Ivan-balvan/iStock via Getty Images

Investment Thesis

National Beverage (NASDAQ:FIZZ) hasn’t been performing well in the past few quarters, yet it is trading at a high price. Because of macro issues, consumers spending money on National Beverage products, which affected its financials overall. The company is also trading higher than its peers, which is not an ideal sign when looking to invest in a company. I am not convinced that the company will outperform the market in the near future, leading me to rate the stock as a Hold.

The Fizzling Performance

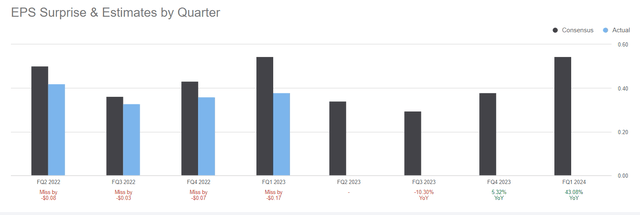

Seeking Alpha – National Beverage Earnings

National Beverage hasn’t been performing well for the past few quarters, caused by less consumer power. Starting with earnings, the company has been missing earning estimates for four quarters in a row now. As mentioned in National Beverage’s recent press release:

LaCroix was impacted by the volume declines of the category and the apparent trading down by consumers.

– National Beverage Q1’23 Press Release

This means that sales were slowed down due to inflationary pressures. I believe that part of the reason why sales have been impacted during the pandemic is that consumers have opted for familiar beverages such as Coke products from The Coca-Cola Company (KO), and PepsiCo, Inc. (PEP). Additionally, something about National Beverage’s recent earnings report lacks a ton of detail which I don’t really like that much since investors aren’t given much context, leading to people guessing what the specifics of the company’s performance were in the quarter and worrying investors. The company also claimed “Grass Turning Greener”, which I don’t think is true based on the company’s sluggish performance and high price.

Moreover, National Beverage mentioned in its latest press release that they are committed to strengthening its focus to create long-term brand equity by upholding marketplace price discipline while managing margins and cash flows.

Is this achievable? Yes, but for how long? That I do not know. The thing I notice with beverage companies is that although you’ve been doing good for the past decade or so, if you don’t win the hearts of the consumers, then you’re probably not going to last long. In a market where new entry is easy, having loyal consumers is what matters.

Think about Coke and Pepsi, sure they’ve released new products now and then, but the main sales driver is the loyalty of its consumers. National Beverage already has a consumer base. To expand the company’s consumer base, they have to invest more in marketing efforts so that the company can acquire more customers in the long term.

National Beverage Financial Analysis

National Beverage’s financials aren’t looking too pretty, and the high price just makes the stock unattractive. The accompanied volatility (unstable consumer power), and earnings miss just make the stock unappealing at what it’s priced at.

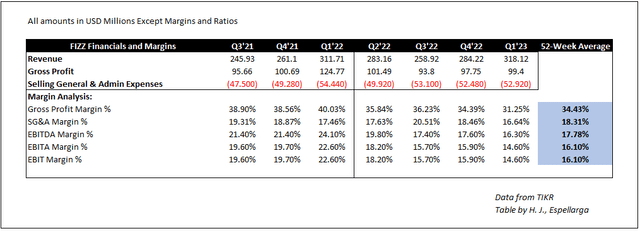

National Beverage – Financials and Margins – Source: FIZZ Financials

National Beverage had $318 million in revenues on its Q1’23 results, a 2.10% year-over-year growth which is not good, considering the sector median’s year-over-year growth is 11.29%. The company generated $99.4 million in gross profit, which is a 20.30% year-over-year decline, compared to the company’s $124.77 million in gross profits, in the company’s Q1’22 results. Although gross profits are declining, I think that one of the major factors that affected its gross profit is the increasing prices of products.

Think about it, with high inflation rates, the cost to make beverages would typically increase and with little-to-no growth in sales, profits are bound to decrease. However, what’s interesting is that the company still holds its gross margins of 31.25%, which isn’t that far from the margins around its 52-week average of 34%. Considering economical issues such as rising costs of raw materials and lesser consumer power during the pandemic, the company still managed to maintain its high double-digit profit margins, despite macro situation.

National Beverage is still keeping its EBITDA, EBITA, and EBIT margins which is around -1% lower than its 52-week average which I think is okay, but given that there’s a decrease in gross profits, I think it still affects the company’s reputation on being profitable on the short term.

Overall, my outlook on the company’s growth and the outlook remains the same in my previous article, National Beverage: Winning An Award Isn’t Enough, I stated:

I think FIZZ has much potential in the long run if the economic situation is much better. The company received an award for one of its products, but I don’t think it’s enough to say it’s worth investing in.

– National Beverage: Winning An Award Isn’t Enough

This means that I still believe that the company could be profitable and can grow larger in the future when macro issues subside, and the post-pandemic economy would return to normal, otherwise, I don’t think the current valuation of the company is worth the investment.

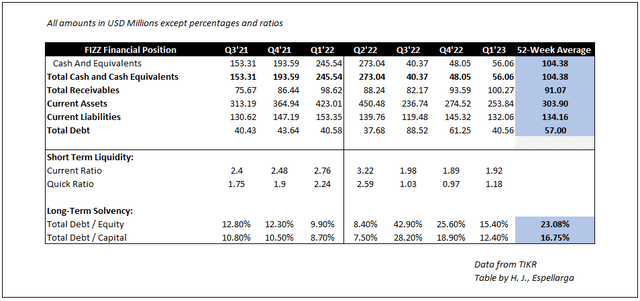

National Beverage – Financial Position – Source: FIZZ Financials

On the balance sheet, the company’s cash and equivalents in the first quarter of the fiscal year 2023 is $56 million, it grew by 16.67% or $8.01 million. The company had huge debt in the company’s third quarter, which slowly has been paid, as we can see the company’s total debt decreased in the first quarter of 2023.

National Beverage doesn’t seem to have short-term liquidity issues, since the company had $253.84 million in current assets in its first quarter in 2023, and with $132.06 million in current liabilities, we get a current ratio of 1.92 (Current Assets/Current Liabilities), which means that National Beverage has enough current assets to pay off its current liabilities.

I also did an acid test/quick ratio on the company and found out that its recent quarter performance is doing better than the 2 previous quarters of 1.03, and 0.97 in Q3’22 and Q4’22 respectively. Since the company has $56 million in cash and equivalents and $100.27 million in accounts receivable, we add that and get $156.27 million (Cash + Receivables), divide it by $132 million, its current liabilities, we get a 1.18 quick ratio. A quick ratio higher than 1 is ideal, because of the company’s ability to use its cash and receivables to meet its current liabilities.

With all those ratios, we can conclude that short-term liquidity isn’t a problem for National Beverage, well how about the company’s long-term solvency? As previously mentioned, the company has been paying down its debts, which resulted in lower debt levels in the company’s Q1’23 results. As you can see, the company had very high debt levels in its Q3’22 and Q4’22 performance, so I think it’s good that the company has low debt levels in Q1’23, or a 15.50% debt/equity ratio.

Overall, National Beverage has mixed financials, and judging by its recent performance, I don’t think the company’s justifying its price right now. The company’s growth is lagging and with macro issues, the COGS could affect its profit margins. The company paid off much of its debt, so I think that’s a plus for National Beverage.

Valuation And Peer Comparison

The earnings report lack detail and the company’s mixed financials don’t justify the price at that National Beverage is currently trading. With macro issues like higher costs of raw materials, weak consumer power, and high inflation rates, I don’t think that the company should be valued this highly, with the consideration that their growth isn’t that impressive.

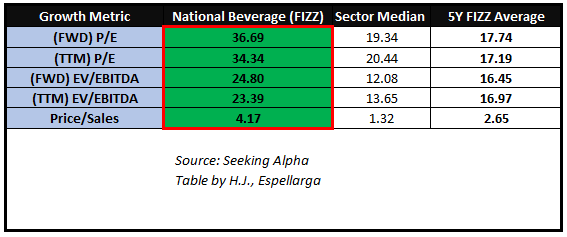

When comparing National Beverage to its sector median, the company is heavily overvalued. Despite the company missing earnings estimates for a few quarters, it’s still trading at a relatively high price. So for the valuation, I compared National Beverage to its sector median, and some of its related peers recommended by Seeking Alpha’s charting system, to get a better grasp on how highly valued the company is.

National Beverage Performance vs Sector Median – Source: Seeking Alpha

National Beverage has a forward price-to-earnings ratio of 36.69 which is high above the sector median’s 19.34 and its five-year average of 17.74, we use the P/E ratio to determine if the price we’re paying for a company is worth the price. It’s relatively showing the same signs with its TTM P/E ratio of 34.34, which is higher than its sector median of 20.44 and 17.19, not a great sign so far.

Its forward EV/EBITDA multiple is showing the same signs too. Trading at a 24.80 EV/EBITDA, the company almost doubles the sector median of 12/08, which is not ideal. We use the EV to EBITDA ratio so that we can factor both cash and debt when determining an ideal price for the company, and so far, I don’t think National Beverage is trading at the “ideal price”.

To me, the ideal price would either be in-line with its sector median, below its sector median or slightly above its sector median (which is okay if it’s backed up by fundamentals and strong growth drivers, which National Beverage currently doesn’t have). The company also has a relatively high price-to-sales ratio, which isn’t very ideal since generally, you’d like to pay a lower price for every dollar the company makes. With that said, the company has a 4.17 price-to-sales ratio, which is triple its sector median, and almost double its five-year average, this screams to me that the price isn’t right for the stock.

By comparing these numbers to its sector median, we can get a good idea of how the stock should be priced at. National Beverage seems to be expensive when compared to its sector median, which leads me to rate the stock as a Hold because I believe the stock to be overpriced.

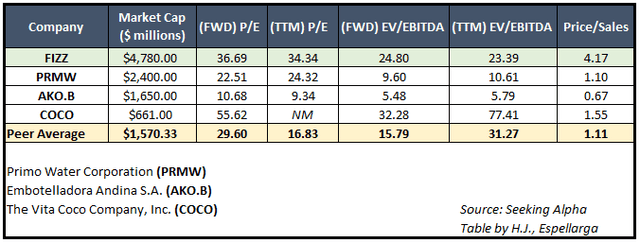

National Beverage Peer Comparison – Source: Seeking Alpha & Table by Author

Other than comparing the company to its sector median, I also compared National Beverage on a peer-to-peer basis. As seen in the table above, when compared to Primo Water Corporation (PRMW), Embotelladora Andina S.A. (AKO.B), and The Vita Coco Company, Inc. (COCO), National Beverage looks overpriced. Although the peer average has been affected by COCO also trading at higher multiples, but still, I think this goes to show that the company is overvalued and trading at an unjustifiable price.

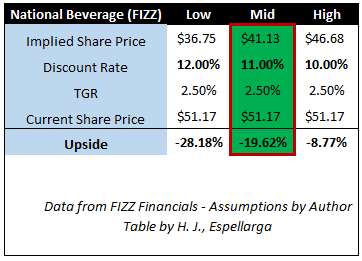

National Beverage DCF – Source: FIZZ Financials & Assumptions by Author

Moving on to my valuation of National Beverage, the “high price” currently sits at $46.68, which is 8.77% below the price it is currently trading at today. My DCF model is very simple and the varying factors between low, mid, and high is the discount rate. Assuming that National Beverage’s revenue grows at an 8.5% average in the next five years once macro issues subside, EBIT margins (around 18%) are maintained, D&A and CapEx being 2.00% and 2.00-3.00% of sales respectively, the stock has a Mid implied share price of $41.13 which is near the consensus median target of $42.

Overall, with the sector median comparison, peer-to-peer comparison, and DCF valuation, I think that National Beverage is overpriced. The financials don’t add up, there’s little-to-no growth in the short term, and the lack of detail in its earnings report doesn’t convince me to rate the stock as a Buy. Although it can have some potential, considering that it has been in the market for quite some time, we are yet to see this “potential” in the following years when there are no economic complications and macro issues.

National Beverage Risks

Although I think that National Beverage is currently in a tough spot, these risks will make matters worse for the company. The risks I’ll mention may already have affected the company in some way, shape, or form, these risks can even be a bigger problem and can affect National Beverage’s growth as a company in the long term.

Lack of Innovation – National Beverage is known for its constant innovation of new products and flavors through LaCroix, so if the company is unable to innovate new drinks and flavors, it misses the opportunity to ride on new beverage trends that could help the company capture broader consumer markets, which can affect the company’s consumer base. A low consumer base typically means lesser sales.

Existing Competitors and Threat of New Entry – Although it’s a bit hard to enter the beverage industry since all of the products have to go to food approvals and the cost to start such companies is very high, I still think that the number of existing beverage companies can affect the company’s sales. Think about it, if National Beverage stays in the shadows of other companies, big or small, it really can’t find much growth if it stays that way. That means that National Beverage has to find ways to acquire new customers or it’s not going to end well for the company.

Weak Consumer Power – The consumer base is important and can be a determining factor in discovering the demand their products produce. So having weak consumer power essentially means that there’s no one buying their products, and if there’s no one buying their products, this means that the company isn’t growing. Additionally, the macro issues affected the company’s profits since consumers are more likely to buy comfort drinks such as Coke and Pepsi, other than buying other brands of beverages such as National Beverage.

These are the risks that can affect the company both in the short and long term. Although the company does have potential (if they find growth and momentum when creating new flavors and drinks), I still don’t think the financials justify the current price.

Final Thoughts On National Beverage

Overall, I think National Beverage is overvalued and expensive. The company missed earnings a few quarters, growth has been lagging, and it’s currently trading higher than its sector median and peers. There are also no strong growth drivers and catalysts that can drive the price higher in the short term, leading me to rate the stock as a Hold. Unless the company shows great financials and introduces new mouth-watering products, the company remains a Hold until further notice.

Be the first to comment