kokkai

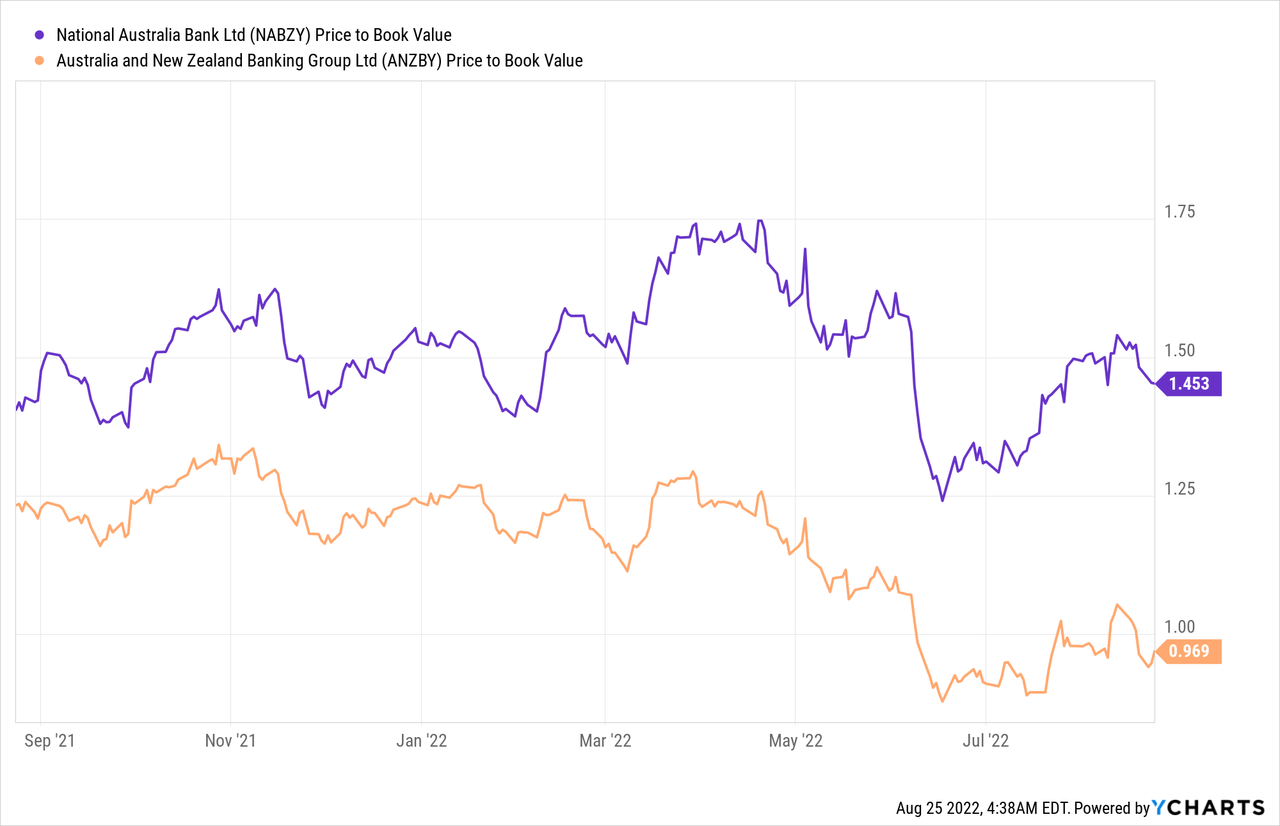

National Australia Bank (OTCPK:NABZY), the leading business bank in Australia with a market-leading presence across the small/medium enterprises and agribusiness segments, recently posted a trading update that appeared below-par at first glance. That said, the underlying picture is not quite as bad as the headline numbers suggest, given the back-end-loaded timing of Reserve Bank of Australia (RBA) rate hikes. With Q4 2022 set to benefit from full-quarter contributions from the Citi acquisition as well as net interest margin tailwinds from the current rate environment, NAB is on track for a stronger upcoming quarter, in my view. Over the mid to long-term, NAB should also see gains from improving volumes and cost management initiatives. Following the price rally since June, however, expectations are high, and the market could be disappointed with this weaker-than-expected quarter’s profit update. With NAB also falling well short of ANZ’s (OTCPK:ANZBY) Q3 trading update (~6bp underlying net interest margin (NIM) uplift and ~5% revenue growth), the stock offers limited relative value at the current P/Book valuation premium.

Disappointing Headline Numbers But There are Silver Linings

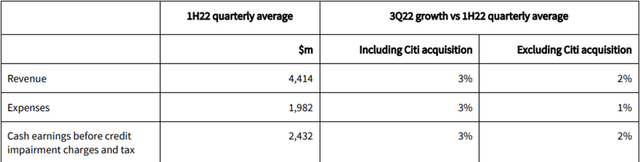

NAB’s latest trading update saw its headline revenue growth reach +2% and cost growth of +1% – excluding the Citi acquisition, this would imply a positive jaws ratio (i.e., income growth vs. expense growth rate) for the quarter. The revenue numbers were still short of consensus expectations, though, so bears might point to signs of a slowdown. On the flip side, I would point out the outsized influence of a weaker Markets & Treasury (M&T) quarter despite improved customer activity – excluding this, revenue growth would have been closer to ~3%. Of note, momentum was also solid in lending and deposit at +2% and 4%, respectively, over the June quarter (excluding the Citi acquisition). With the RBA set to ratchet cash rates higher in the coming months, though, revenue growth expectations are on the rise. Key peer ANZ also posted an impressive ~5% growth this time around, so NAB’s underlying revenue growth of ~2% was disappointing in this context.

In contrast with revenue, cost growth was well controlled at +1%, reflecting additional full-time hiring as well as higher leave costs, partially offset by productivity gains. As a result, NAB had a slightly higher NIM this time around (excluding the M&T impact and the Citi acquisition). Of note, the YoY delta in the underlying NIM profile was attributed to rising interest rates, with partial offset from higher wholesale funding costs and increased competition in home lending. Thus far, the Citi acquisition has already delivered a +1bp contribution to the headline NIM as well, so expect further tailwinds in the coming quarters. Finally, the back-end loaded cash rate hikes in Q3 2022 are worth a mention as well, as the timing likely weighed on this quarter’s numbers but should benefit the P&L in Q4.

A Brighter Near-Term Outlook

Going forward, the margin trajectory looks to be positive as the benefits from RBA rate hikes continue to flow through to the P&L. Plus, a full quarter contribution from the Citi acquisition (effective June) will be a nice tailwind, even if it makes like-for-like comparisons more challenging. This quarter, for instance, included one month’s contribution, without which results would still have been below expectations. On the cost side, NAB management also highlighted targeted productivity benefits of >A$400m in 2022, although the expense run rate has moved higher to 3-4% (excluding Citi) vs. 2-3% previously. While the higher full-year cost guidance is a negative, these projections include a A$60-100m impact from payroll top-ups and customer-related remediation provisions. Adjusted for this, underlying cost growth appears intact, in my view. All in all, assuming NAB executes as planned, expect a much stronger financial performance in Q4 2022, with a faster pace of rate hikes presenting incremental upside from here.

Improving Capital Position and Asset Quality Amid Favorable Backdrop

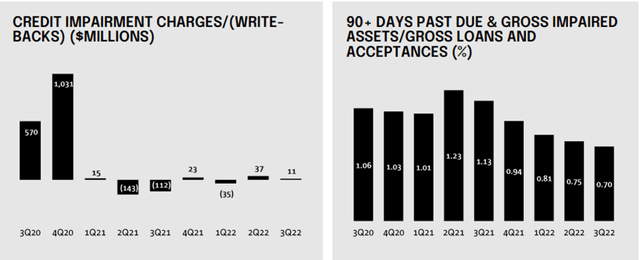

While NAB’s balance sheet growth will inevitably entail higher levels of wholesale funding (and higher funding costs), the state of its provision charges will come as a relief to investors. This quarter saw NAB report a lower than expected A$11m loan loss provisioning reflecting no impact from changes to assumptions used in the Economic Adjustment/Forward-Looking Adjustments. In tandem, total provision coverage also declined by ~1bp but remained at an elevated 1.30% of Capital-To-Risk Weighted Assets. The reduction in the ratio of 90 days past due (for the fifth consecutive quarter) was another key highlight, along with the reduced gross impaired assets at 0.7% of gross lending assets. More broadly, the improved asset quality reflects the quality of the NAB book. The improving state of the Australian home loan portfolio is particularly impressive, with ~70% of customer home loan repayments ahead of schedule. Meanwhile, the business lending portfolio is also seeing limited impairments despite the recent rate hikes – a testament to the benign lending environment at present.

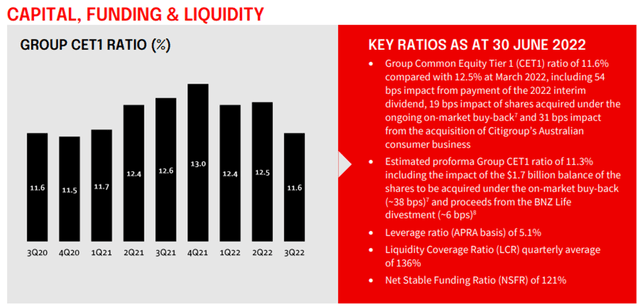

Similarly, the capital position is solid – NAB’s CET1 ratio is tracking well against expectations at 11.6%, even if it did benefit from some deductions movements this quarter. On a pro forma basis, NAB’s CET1 ratio would still have been a strong 11.3% after accounting for the ~$1.7bn balance under the on-market stock buyback program as well as proceeds from the BNZ Life divestment. Heading into Q4 2022, the impact of RBA cash rate increases could result in some refinement of bad and doubtful debt charges (BDDs), though, as impairments begin to normalize over time.

Falling Short of Lofty Expectations

NAB’s underlying profit disappointment this quarter was mainly treasury/markets-driven, but Q4 2022 looks set to be much stronger as the full-quarter contribution from the Citi acquisition flows through to the P&L alongside NIM benefits from the RBA rate hikes. NAB’s raised full-year cost guidance at 3-4% YoY growth was also mostly driven by provisions for customer remediation and payroll-related expenses, leaving underlying cost growth very much intact. The hurdle is the valuation – while the result was not entirely bad, expectations are high following NAB’s post-June rally and widening book value premium (reflecting NAB’s status as a consensus long in this market). With ANZ’s Q3 trading update (5% revenue growth vs. ~3% adjusted growth for NAB) also coming in well ahead of NAB, I am concerned about the relative valuation at these levels.

Be the first to comment