VeselovaElena/iStock via Getty Images

Investment Thesis

Nathan’s Famous (NASDAQ:NATH) has seen slow and uneven revenue growth over the past few years, and the company’s costs have risen alongside it due to pre-Covid inflationary pressures on meats as well as additional inflationary pressures post-Covid, again impacting beef as well as wages. In addition to these operational impacts, the company has exposed itself to a large amount of debt and as a consequence, the company pays out a third of its EBITDA in interest expense alone. Despite these factors, the company has diversified and overall growing revenue streams and appears slightly undervalued and should make for a decent investment.

Brief Company Overview

Nathan’s Famous started as a nickel hot dog stand in 1916 and has grown from a single location on Coney Island to distributing to 79,000 different locations selling a myriad of related food products, and the company has grown to ~$115 million in total revenue in its most recent fiscal year. While still a small cap stock even after over 100 years, Nathan’s growth since its humble beginnings is nonetheless incredibly impressive. The longevity of the company is a testament to the branding of Nathan’s and maybe even more so it is a testament to the longevity of the popularity of the hot dog in America.

In addition to running company-owned restaurant locations, Nathan’s has expanded its revenue sources into franchising, licensing agreements for the sale of the products with various grocery stores and supermarkets, as well as wholesaling to distributors to resell. In fiscal year 2021, Nathan’s also opened its first virtual kitchen, which are existing kitchens with no Nathan’s Famous branded presence, but instead the location is used to fill online orders.

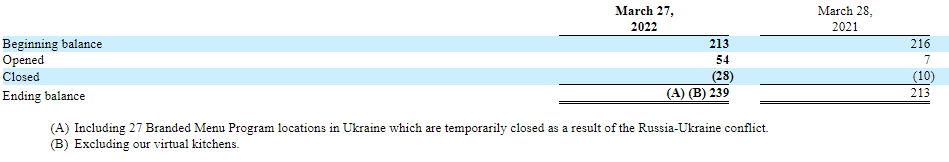

Number of Franchise Locations:

Nathan’s Famous Franchises (SEC)

Nathan’s has Surprisingly Diversified and Resilient Revenue Streams

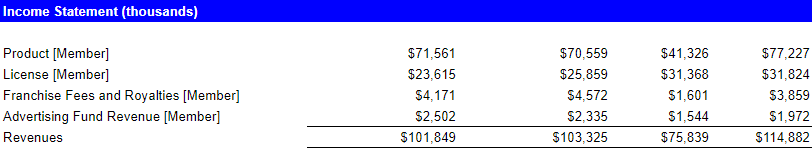

Revenue for Nathan’s Product lines are difficult to analyze over the past few years given Covid’s impact in fiscal year ending Mar 31, 2021. Nathan’s major revenue stream, Branded Products, took a 41% hit in y/y revenue reduction in fiscal year 2021. However, over the past four fiscal years, the Product lines revenues expanded at a CAGR of 2%. It’s hard to tell if the CAGR would have been significantly higher if Covid had never been a consideration, but we can see what management says about this and see if we can extract any useful information.

Lines of Revenue (Author’s Model)

Source: Author’s Model

Additionally, the COVID-19 pandemic has disrupted operations within our Branded Product Program. Operations at many of our Branded Product Program accounts have been hampered as many of our customers operate in venues that are closed or venues operating at reduced traffic levels, such as professional sports arenas, amusement parks, shopping malls, and movie theaters. Such closures and disruptions have impacted sales and operating income within our Branded Product Program.

During the fiscal 2021 period, royalties from our license agreements were significantly higher than during the fiscal 2020 period, due to significantly higher sales of consumer-packaged goods through grocery channels as consumers elected to ‘shelter at home’ as a result of the COVID-19 pandemic.

As mentioned, the Branded Products line took a major hit during that fiscal year, and then rebounded hard the following year. The licensing revenue grew an impressive 21% due to more people staying at home, and then grew a modest 1% the year following. Overall, despite the hiccups from Covid impacting Nathan’s operations, revenue appears to still be modestly growing in its largest revenue lines, however it should come as some comfort that the company is insulated through diversified revenue streams. Again, as one revenue stream took a major dive, the second largest revenue stream grew an impressive amount the same year to help make up some of the shortfall.

Cost of Sales Percentage Increasing Steadily is a Worrying Trend

Next, I want to discuss a little about gross margins and what contributes to cost of sales. The main reason I want to focus on this is the inconsistency we see through the last four years. Cost of sales as a percentage of revenue steadily increases year over year and heavily increases in fiscal year 2022 when compared to fiscal year 2020. This can be a worrying trend and I want to see what is making up this amount to help us forecast out.

Cost of Sales (Author’s Model)

Looking at Management’s Discussion and Analysis, we see that the cost of sales is primarily made up of expenses attributable to the Branded Product revenue line. As management explains, cost of sales is rising sharply due to inflationary pressures that the company is struggling to pass on to its consumers.

Beginning in July 2021, the cost of hot dogs has increased significantly due to higher costs for beef and beef trimmings, labor, packaging and transportation, as well as supply chain challenges associated with increased consumer demand as a result of the continued recovery from the COVID-19 pandemic. We did not make any purchase commitments for beef during the fiscal 2022 and 2021 periods. If the cost of beef and beef trimmings increases and we are unable to pass on these higher costs through price increases or otherwise reduce any increase in our costs through the use of purchase commitments, our margins will be adversely impacted.

This explains the sharp rise in cost of sales in fiscal year 2022, but there seems to be more to the story given that the cost of sales as a percentage of revenue was rising steadily pre-Covid as well. For example, cost of sales increased from 74% of Branded Product revenue in fiscal year 2019 to 77% of Branded Product revenue in fiscal year 2020. Given that the fiscal year 2020 would have ended March of 2020, prior to most U.S. Covid-related lockdowns, I think this is a fair timeline to poke around in and see if there are more issues under the hood aside from persistent inflation.

Cost of sales in the Branded Product Program increased by approximately $2,179,000 during the fiscal 2020 period as compared to the fiscal 2019 period, primarily due to the 6.7% increase in the average cost per pound of our hot dogs. We did not make any purchase commitments for beef during the fiscal 2020 and 2019 periods.

From the explanation above, it appears the issue with Nathan’s cost of sales increases is both an overall inflation issue and an industry-specific issue. Nathan’s is facing consistent year over year increases in its cost to produce its hot dogs due to “…high commodity costs of beef.” In addition, the company is struggling to pass on the costs to consumers through higher prices, partly due to high competition in the fast food space as well as grocery shelves.

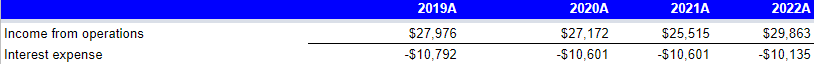

Interest Expense and Debt Load are Unreasonably High

Much has been made of Nathan’s Famous’ debt load, and I am going to be jumping on the discussion as well. Although I’ve seen plenty of investors complain that discussing the debt burden is a moot point given Nathan’s consistent positive free cash flow, it is definitely worth noting two different points about the debt.

Interest Expense (Author’s Model)

First, not only is the debt a large dollar amount, it’s so high that Nathan’s fiscal year 2022 ending stockholders’ deficit was $55 million. Again, this in and of itself is not a make-or-break for an investment, but having such a large deficit for a company consistently posting profits can be a concern and make you question why it wanted to incur the debt to start with. Now, it should be noted that the company did pay down $40 million in fiscal year 2022, but this still leaves a large $108 million balance.

Second, and my main concern, is the massive annual interest expense. For a company averaging ~$10-20 million in net income every year, having interest expense be $10 million annually is fairly jarring. Given the high interest rate of 6.625% for the debt, it does appear the company is on the right track in using its free cash flow to pay down the debt faster, but the amount of free cash flow that the company throws off means it will still take quite a number of years until the debt is completely paid down, hampering much in the way of growth efforts for the time being.

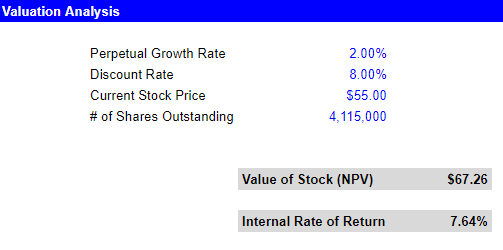

Valuation Analysis

I’ve discussed what I think are the biggest factors impacting Nathan’s Famous’ financials, so now we can look at how these boil down into the valuation. For revenue growth rate, given the fluctuating amounts over the last few years the only reasonable CAGR I could come up with was continuing to use the 2% into the five year forecast period. Cost of sales shot up to 84% of Branded Product revenues in fiscal year 2022 and given persistent inflation and specifically its impact on the beef market, I felt it only made sense to keep this high into the forecast period and keep it consistent at 85%. As for interest expense, the notes are dated for 2025, although the company can pay this earlier. Given the history involved, we kept the interest rate consistent with prior years and the amount of debt consistent, given that the company could choose to refinance with another note after the terms of the current notes.

Nathan’s Famous Valuation Analysis (Author’s Model)

The result of these assumptions is that the company is slightly undervalued, with a net present value of the company’s stock at ~$67 compared to the actual stock price of ~$55, coupled with a rate of return of 7.6%. These results are fairly impressive considering we essentially went with a worst-case scenario for the operational results: persistent high interest rate with no paydown of debt, very little revenue growth, and compressed gross margins. We encourage you to test your own assumptions in the model here: NATH_Analysis.xlsx.

Conclusion

Nathan’s Famous’ admirable free cash flow should allow the company to continue operating indefinitely, or as long as people continue eating hot dogs. Despite slow revenue growth rate, inflation eating into the company’s gross margins and the inability of the company to pass off the increased costs in the way of higher prices, as well as a seemingly unnecessarily large debt balance and corresponding annual interest expense, it would appear the company is fairly undervalued and should lead to continuing investment gains.

Be the first to comment