DenKuvaiev/iStock via Getty Images

Investment Thesis

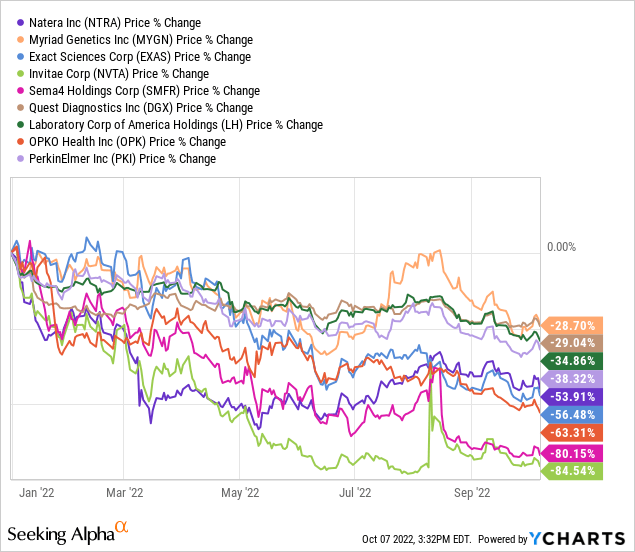

It has been a wild ride for Natera (NASDAQ:NTRA) shareholders over the last few months as stock swung dramatically in response to changing corporate news and analyst commentary. The company has been on a tear since its initial public offering (IPO) in 2015, growing at an incredible pace but failing to turn any form of profit. The resurfacing of allegations concerning abusive sales practices and the marketing of dubious testing led to multiple scandals over the past few quarters, eroding investor confidence in the stock and sending it tumbling. Rising capital costs only served to exacerbate these dynamics.

Nonetheless, the contrarian buy rating mirrored in this piece reflects my modestly optimistic view on the company’s ability to implement its corporate strategy successfully (2024 cash-breakeven target), a strategy influenced by the challenges and opportunities created by a changing regulatory and technological environment but also takes into account the barrage of negative publicity exacerbating the impact of certain risks on the company’s market position and outlook (e.g., Event Risk from various litigations, including IP), affecting the share price that now seem attractively valued, offering investors a discounted exposure to the growing genetic testing industry.

Revenue Trends

NTRA’s predicament can be better understood by looking back at the regulatory and technological dynamics that shaped (and continue to define) its revenue and profitability trends. A good place to start is anomalously last week’s Lasker Foundation award to Chinese University of Hong Kong professor Dennis Yuk Ming Lo for developing the cell-free fetal DNA (cffDNA) test. This breakthrough significantly expanded the scope of genetic testing by enabling the detection of genetic diseases before conception, giving birth to the Non-Invasive Prenatal Screening “NIPS” market ten years ago. In the span of a decade, the nascent industry has exploded into a multi-billion dollar business. Over the same period, the US clinical laboratory industry has also undergone significant change thanks to a renewed regulatory focus on preventive care in the aftermath of the Affordable Care Act, which laid the foundation of expanded preventive care coverage, albeit it fell short of specifically mandating prenatal genetic screening, given that at the time, the NIPS cffDNA technology wasn’t commercialized yet. Nonetheless, the policy direction was clear, focusing on expanding preventive prenatal care.

Under the ACA, most private health insurers must provide coverage of women’s preventive health care such as mammograms, screenings for cervical cancer, prenatal care, and other services –with no cost-sharing. Health Resources and Services Administration Website.

Gradually, NTRA, along with its peers, succeeded in establishing reimbursement pathways to various genetic screening tests under the “not-so-perfect” new healthcare system, validating the clinical efficacy of their product offerings through clinical trials (such as the Trifecta Kidney Transplant trial, which showed high efficacy of Prospera™ test last week) and sponsoring peer-reviewed research (including last month’s Gynecologic Oncology Journal’s paper validating Signatera™ test for Ovarian Cancer) helping in influencing opinion leaders and professional associations into incorporating gene testing in the standard of care guidelines, securing multiple wins from private and public healthcare payors culminated by Medicare’s recent decision to expand coverage for Signatera™ Muscle Invasive Bladder Cancer Test in July, and UnitedHealth’s (UNH) decision to expand insurance coverage of NIPS for medium-risk pregnancies, which came into effect January 2021, helping in creating robust growth for NTRA and the industry in general.

One can’t ignore Illumina’s (ILMN) role in democratizing gene testing by lowering the costs of gene sequencing. If this wasn’t enough to attract Wall Street’s attention, a 2013 supreme court hearing; Myriad vs. US Supreme Court, rendered human DNA unpatentable, bringing down Myriad Genetics’ (MYGN) monopoly in the Hereditary cancer screening market where NTRA now participates through its Empower™test kit.

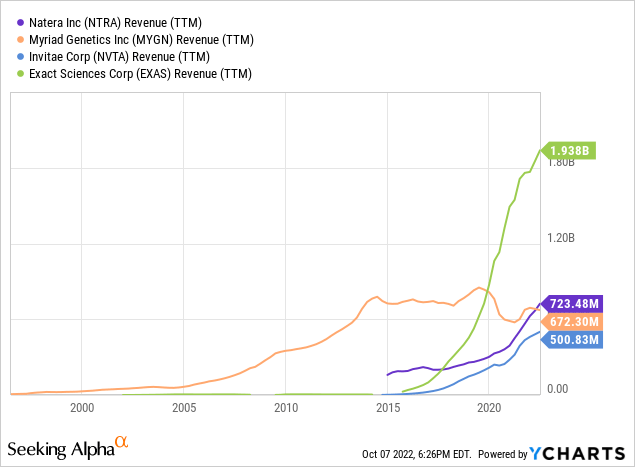

These developments led to explosive growth in gene testing volumes, as shown in the graph below, showing revenue trends for NTRA and its peers (except Myriad, after losing its market monopoly, as mentioned above).

This rosy picture is muddied by multiple challenges, some of which are misplaced (forming the foundation of my modest optimism and buy rating). Still, others are valid concerns casting a shadow over the company’s outlook, as discussed in more detail below.

ESG Concerns

Many women whose prenatal tests looked similar to mine are counseled by medical professionals to pursue further diagnostic testing and, with a confirmation of Down syndrome, to consider abortion. Every day, I’m glad I didn’t. Amy Julia Becker, The New York Times.

NTRA released its 2025 ESG mandate last week, which remarkably failed to address the public concerns around its operations, starting with the negative publicity around its aggressive billing practices, which resurfaced by the short-selling firm Hindenburg Research. These allegations are far from new and have been around for years, as Morningstar analyst Alex Zhao notes in an article here on Seeking Alpha dated back in 2016.

Natera runs a business that performs the services first, with no certainty of when and how much of the bills will be collected. Its business model can be best summarized as “sell first, bill later and collection unsure.” Alex Zhao

The report doesn’t also mention how the company plans to address educational and awareness issues regarding gene testing, especially given the inaccuracy of the results, namely its microdeletion offerings, as mentioned in the New York Times article earlier this year, on account of the dramatic consequences of misrepresenting a positive test result. The brunt of the blame certainly falls on providers, who are required to make available a Genetic Counselor to interpret the results, but also NTRA bears some responsibility, given its active marketing campaigns targeting these Gene Counselors to push sales, not to mention CILA’s requirements for gene testing to clearly explain the limitations of the test in the results report.

Ensuring that test results and their implications can be interpreted for an individual patient or family and that the limitations of the test are defined and reported. The Clinical Laboratory Improvement Amendments Act Framework

There also comes the issue of abortion and how the company’s offering fits into the national discussion around the subject matter. Let’s face it, whether abortion is right or wrong, the benefits of a gene test are severely limited if abortion is not an option and many would reconsider given the $300 co-insurance test costs, which could reach a few thousand dollars for the uninsured or insured patients who haven’t reached their deductible limits.

I decided to forgo genetic testing because I knew I did not want an abortion, either way. Tamasin Partridge, El Cerrito, California

Finally, there comes the issue of the healthcare community’s discussion around differently-abled persons and the acceptance of neurodiversity. Obviously, these issues are not for NTRA’s management to bear on its own; however, with a $23 million 2021 compensation package for its CEO, one rightly would expect some leadership in matters that go beyond day-to-day operations. The dangers of ignoring such issues could lead to detrimental sequences. Facebook (META) and Google (GOOG) (GOOGL) ignored the public’s concerns around privacy for years, and so did previous administrations (Apple started rolling out the iPhone in 2008.) Now all parties are facing the music of their inaction, which is also true for many other sectors, including chemicals, energy, and mining.

Testing rests on an assumption that desirable children conform to a norm of development, alongside a corresponding thought that undesirable children deviate from that norm cognitively or physically. You can see the result of these assumptions in the high abortion rates for fetuses with Down syndrome […]

We need to change our approach to prenatal testing by ensuring that pregnant women who receive prenatal diagnoses get accurate information about what it’s like to raise a child with a disability and expanding the awareness of our collective responsibility to welcome and support diverse lives. Amy Julia Becker, The New York Times

The FDA Is Upset

These ESG issues have an impact on the NTRA’s reputation, and addressing them before festering in on news media and the public’s psyche could save hundreds of millions of dollars for its shareholders, as many learned the hard way this year. The company’s actions, or lack thereof, amplified by negative media publicity, attracted criticism from professional bodies, the public, and perhaps some members of its supply chain (UNH issued a white paper reminding its provider network of the proper use of NIPS test last week.) The company now faces multiple class action lawsuits related to testing inaccuracies, misleading statements, and aggressive billings by patients and investors.

These issues also prompted the FDA to reevaluate its self-regulatory stance on LDT this year. It is currently working with congress to expand its regulatory powers over the market after issuing a warning over the dangers of misinterpreting the NIPS tests in April.

The FDA’s quest to regulate the market saw small setbacks after congress failed to pass the Verifying Accurate Leading-edge IVCT Development (VALID) Act a few weeks ago, which would have filled in the gaps in the FDA’s oversight over LDTs. However, all is not lost, and given the bipartisan support for the IVCT act, there is a chance it will be attached to pending legislation in the coming quarters. We discuss what this means to NTRA in the following section.

The Contrarian Bullish Thesis

Some investors might find the constantly shifting regulatory and legal landscape reason enough to stay away from the ticker. However, a deeper look reveals that beyond Event Risk related to some of these dynamics, I believe that the impact on revenue remains contained, as discussed in more detail below.

Most of the negative publicity mentioned above revolves around NTRA’s Panorama test for microdeletions as opposed to more established prenatal tests for Down syndrome, Patau’s syndrome, and Edwards’ syndrome. Four out of five microdeletion tests have been found to produce high levels of false positive results. The bearish thesis of short-selling firms revolves around its impact on profitability in light of the FDA’s expected involvement in the industry and the public’s criticism of aggressive billing practices.

Between 75%-80% of providers request or forget to opt out of a microdeletion test when ordering NIPS for their patients. However, the collection rate for these tests is around 5%. Thus, the impact on revenue in case of any regulatory disruptions would be limited, assuming a worst-case scenario where the FDA bans these tests, which I believe is unlikely, even with ones with high false positives or sensitivity.

Percent paid rates on microdels are in that kind of single-digit percentage […] range – Michael Brophy, CFO, Q3 2021 Earnings Call

All NIPS tests have various degrees of false positives. Thus, they are not diagnostic tests but rather screening tools to minimize the use of invasive diagnostics, which carry a slight risk of miscarriage. This also creates a weak point for plaintiffs in five out of seven litigations (beyond several IP lawsuits.) I believe a significant part of the blame falls on physicians and improper communication from Gene Counselors rather than gene testing companies. In other words, patients who have made life-altering decisions based on gene testing, as dramatically laid out by media, are victims of lousy physician advice, given that the NIPS test is not a diagnostic test and must be followed by a confirmatory such as chorionic villus sampling or amniocentesis.

In summary, given the limited impact of potential FDA regulatory extension on Panorama (NTRA’s main source of income), the bearish thesis suffers a critical flaw.

Intellectual Property Dispute

IP disputes are an ordinary course of business in any tech-centered business, whether risks of infringing others’ patents by mistake or risks that peers copy, infringe, or find workarounds in a company’s patent portfolio.

Ravgen won its first infringement case against Labcorp last month for infringing a patented method to prevent cell lysis, which in turn enhanced cffDNA analysis, where it was awarded $270 million ($100 per test) performed by LabCorp. Natera is also on the list of companies awaiting trial for the same accusation by Ravgen, along with Quest (DGX), ILMN, and Ariosa Diagnostics, “part of Roche (OTCQX:RHHBY).” If NTRA is found guilty, I believe the infringement would have likely been on purpose, given that in 2015, NTRA expressed its interest in acquiring the patent portfolio of Ravgen. Nonetheless, I don’t think that NTRA’s leading market position rests on the two patents under dispute, the 7,727,720 and 7,332,277 patents that describe methods of cell lysis prevention. One proof is that Lapcorp used this method but still had far less market share in the NIPS market than NTRA, which controls 50% of the market. In my view, NTRA’s market position is protected by its robust patent portfolio, namely in the NIPS market, rather than one particular technique. Moreover, cell lysis prevention technology is a dynamic field, as mirrored in the new discoveries continuously coming to the market.

Summary

A significant part of Natera’s troubles are blown out of proportion, and it’s easy to see why. The short-seller report, which contributed to a 33% stock decline in March, is full of inaccuracies and highlights old news covered here on Seeking Alpha since 2016. The media reports around its inaccuracies, which prompted a wide response from the public, carry a critical flaw in logic. Panorama and most gene tests are marketed to healthcare providers as screening tests rather than diagnostic tools and require further investigation in case of positive results using FDA-approved diagnostic measures.

Not many can deny the value that gene tests bring to the table, especially within the scope of the current political emphasis on preventive care. Gene tests are, in many cases, less expensive than diagnostic tests, and while some might have high false positives, they also, in many cases, have high sensitivity, making them ideal for early detection screening for genetic mutations. Thus, even though the FDA is preparing to extend its regulatory arm to LDT, I believe that its impact on NTRA’s revenue will be limited.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today

Be the first to comment