Nudphon Phuengsuwan/iStock via Getty Images

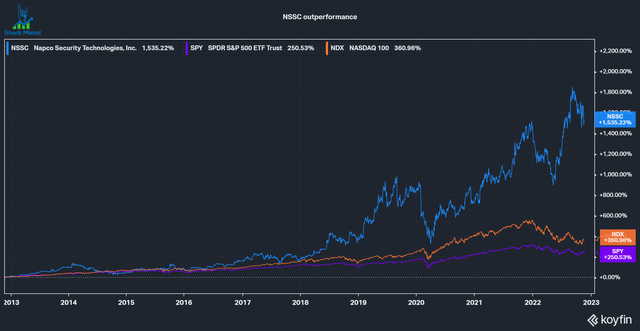

Napco’s (NASDAQ:NSSC) CEO and Founder Richard Soloway sold 3% worth of shares of the company last week. Still, Napco outperformed all indexes over the previous decade by a wide margin, especially in the last five years. The company is transforming its business into a recurring revenue powerhouse and is looking to gain market share in a large addressable market. Let’s see if the stock offers an opportunity for continued outperformance going forward.

Industry

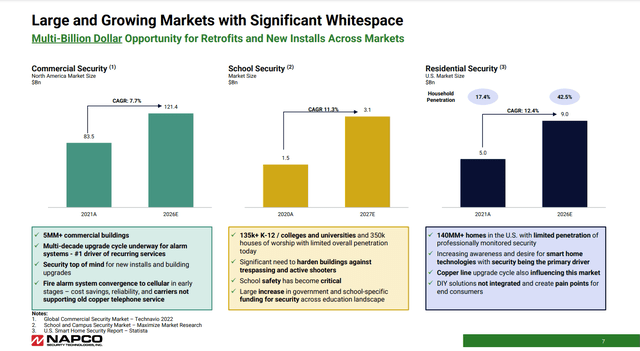

Napco operates in the security market and offers hardware and services for Alarms & Connectivity, Locking and Access Control. The company calls itself a market leader in three large markets:

- Commercial Security (NA) – expected to grow to $121.4 billion by 2026, a 7.7% CAGR

- School Security – expected to grow to $3.1 billion in 2027, an 11.3% CAGR

- Residential Security (US) – expected to grow to $9 billion in 2026, a 12.4% CAGR

I find it hard to see Napco as a leader in this space, with total revenue of $152 million in the last 12 months. Let’s look at two of their markets: According to Market Research Future, the wireless Fire detection system market is expected to reach $4.2 billion by 2030 (9.2% CAGR) and includes global conglomerates as its big players. The report mentions Bosch, Siemens (OTCPK:SIEGY), Honeywell (HON), Tyco International, and EMS Security Group, but no mention of Napco.

According to another report, the Intrusion Alarm System market is expected to grow to $3.7 billion in 2032 (5.1% CAGR global, 5.3% North America). Yet again, this is a highly competitive market with many of the same but also different competitors like United Technologies Corporation or Cognitec Systems. Again, Napco is not mentioned in the profile of the market.

Generally, the market leaves a lot of whitespaces open to gain market share. It has tailwinds like the transition from wired to wireless devices, which Napco estimates as a multi-decade upgrade cycle and a primary driver for its recurring services. No matter what Napco calls itself, they are currently a tiny fish in a big pond and not the market leader.

TAM according to Napco (Napco Corporate Presentation)

An ecosystem play

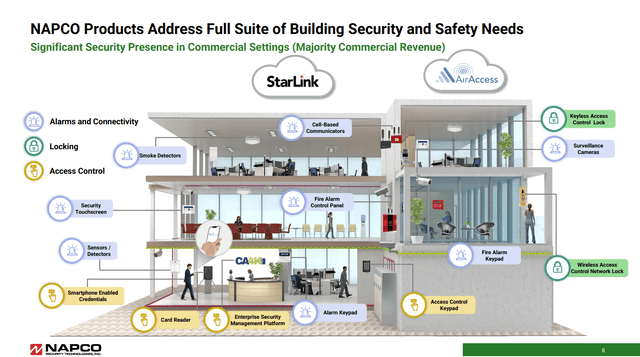

Napco primarily targets the commercial security opportunity, represented in its sales mix with around 80% of sales and the remaining 20% in the residential market. Napco’s value proposition is a full suite of services to cover the full suite of building security applications connected via Cloud services. This should set them apart from the point solutions for the different parts of building security. The company distributes its products via three different channels:

- Over 2000 independent Integrators

- Over 200 Distributors in the US

- Over 10000 independent Dealers

Napco product suite (Napco Corporate Presentation)

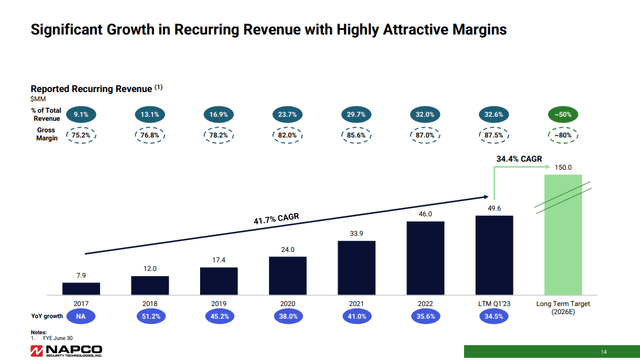

Recurring revenues

Napco has pivoted to a recurring revenue strategy and has managed to grow its share from 9% of revenues in 2017 to 32% in 2022. The goal is to expand recurring revenues to 50% in 2026. The hardware business acts as an installed base, which then operates in combination with Cloud services to generate recurring revenues. With 88% gross margins, recurring revenues are significantly more attractive than the 23% hardware gross margins. The strategy has been working so far, with hardware growing at a 13.3% CAGR versus the 37.9% CAGR of services over the last three years.

Over the long term, the company aims to grow and drive adjusted EBITDA margins up to 50% from the current 17% level by leveraging the high-margin recurring services and significantly increasing product margins from 20% to 50%.

Track record of driving recurring revenues (Napco Corporate Presentation)

What I’m worried about

There are a few things I’m a little worried about regarding Napco:

The CEO sold 1.2 million shares

CEO and Founder Richard Soloway owned 20% of the company last week. On the 15th of November, he sold a substantial 1.2 million shares, bringing his stake in the company down to 17%. This is after he already sold over 2 million shares in 2020. I’m not a big fan of insiders selling significant amounts of their stake, but at least he still owns a substantial part of the company.

A very vague Proxy Statement

Napco’s proxy statement left me disappointed. Everything is very vague, and no clear metrics are discussed. Most of the compensation seems to be discussed on the fly. I prefer a long-term incentive based on operational metrics like a mix between FCF growth, ROIC/ROCE, and revenue growth.

Napco proxy statement (Napco proxy statement)

Production concentration

The company outsourced its manufacturing to the Dominican Republic, benefiting from a tax-advantaged location, low tariffs, and around 1/10th of the labor cost in the US (according to the latest 10-K). Although this is a cost-efficient way to produce products, it leaves a very high concentration in just one location. The company would lose almost all its supply if something happened to this facility.

Our manufacturing facility located in the Dominican Republic (“D.R.”) manufactures over 90% of our products.

Valuation

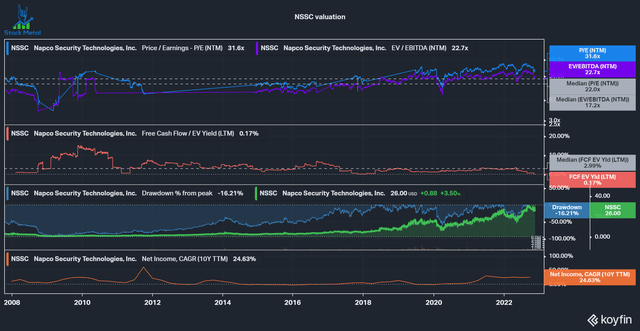

Over the last decade, Napco saw a significant margin expansion from a teen’s PE to low 30s. I think the margin expansion is justified by the move to recurring revenues and a strong 10-year net income CAGR of 24%. The company also periodically repurchased shares and did not dilute shareholders a lot.

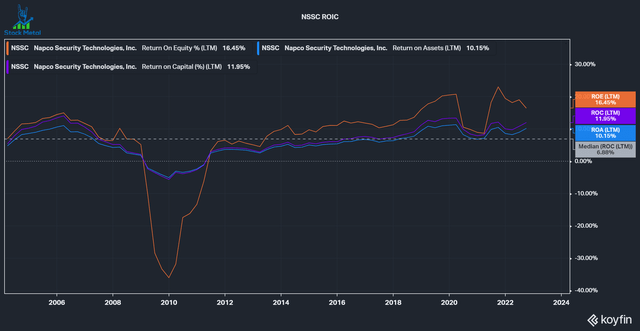

Through all this time, the company managed to generate positive and growing returns on capital, excluding the Great Financial Crisis in 2009. The company has ambitious goals (34% recurring revenues CAGR, adjusted EBITDA margin expansion from 17% to 50%) and is operating in a highly competitive market. Furthermore, I am worried about the concentration in manufacturing, with 90% manufactured in one Dominican Republic facility. Insider selling is not a considerable risk, in my opinion. The CEO and founder still owns a significant stake in the company.

To conclude, Napco offers an excellent opportunity for outperformance if they can execute their ambitions. Due to the risks I mentioned, I am not comfortable opening a position now. I will, however, put Napco on my watchlist and rate it as a buy if you are looking for a more speculative stock.

Be the first to comment