Kanizphoto/iStock via Getty Images

Recommendation

I recommend buying N-able (NYSE:NABL). As SMEs increasingly invest in and rely on IT, the importance of IT availability and functionality to their businesses is rising. NABL helps MSPs keep tabs on their clients’ infrastructure, manage their data, and secure their networks, providing comprehensive, proactive support.

Business

Globally, NABL is a provider of cloud-based software solutions for Managed Service Providers [MSP], empowering them to aid SMEs in their digital transformation and expansion. With NABL, MSPs can more easily keep tabs on their clients’ infrastructure, manage their data, and secure their networks. To help MSPs succeed at scale while continuing to provide exceptional value, NABL provides them with comprehensive, proactive support.

More SMEs are optimizing their businesses through digitalization, but face many complexity

Businesses of all sizes and from all sectors and regions are continuing to put money into cutting-edge cloud and digital technology in order to transform their operations and remain competitive. This is especially true for SMEs, which are increasingly turning to digital tools to improve efficiency in areas like monitoring, managing, and operating productivity, as well as interacting with customers.

Digital solution implementation is not as easy as it may seem at first glance. Many SMEs are used to using legacy solutions, and when they go online to find something new, they get overwhelmed by the sheer number of options. As the SME sector increasingly invests in and relies on IT, the importance of IT availability and functionality to the sector’s businesses rises accordingly. Many SMEs rely on reputable MSPs because they lack the capital, personnel, and expertise to implement, manage, and secure their IT environments on their own in the face of the complexity posed by digital transformation.

Furthermore, the number of cyberthreats is increasing. SMEs typically lack a strong balance sheet to weather acute liquidity risks, making cybercrime protection crucial. Even more problematic is the fact that the number of interconnected nodes is at an all-time high today. According to NABL S-1, it is expected that by 2023, there will be 29.3 billion networked devices worldwide, a CAGR of 10 percent (from 2018). I believe that with a growing number of interconnected, geographically dispersed, and functionally varied endpoints, it is becoming increasingly difficult for small and medium-sized enterprises to manage, provision, and secure them across cloud, on-premises, and hybrid cloud infrastructures.

Emergence of MSP to help SMEs adapt to the digital world is a win-win-win scenario

Each and every one of the world’s problems has a workable answer. For SMEs, the emergence of MSP is a solution to aid in their digital transformation. SMBs are increasingly relying on IT service providers to oversee issues like availability, performance, and security as they make greater technological investments and raise their expectations in these areas. In my opinion, MSPs are an integral part of the value chain because of the assistance they provide to SMEs in the areas of technology procurement, deployment, and management, as well as security. Co-managed models, in which MSPs collaborate with in-house IT departments at SMEs to provide specialized services and divide responsibilities, are also possible. Overall, I believe MSPs boost the value of the value chain by increasing sales for solution providers as a result of increased adoption of digital solutions by SMEs.

NABL solution is designed to fit the needs of MSP

By definition, an MSP works in close conjunction with its underlying clients (in this case, SMEs), and to do this effectively, it needs to be able to connect with a large number of clients remotely. This is yet another way in which NABL stands apart. Through their remote monitoring and management features, MSPs can keep track of the uptime and functionality of a wide variety of systems, network infrastructure, and devices from a single location. With that, MSP technicians save time by narrowing in on the source of specific IT problems using NABL’s role-based access control.

When working with clients from different industries over the internet, compliance can become an issue. Using NABL solutions, MSPs can aid their SME clients in strengthening the security infrastructure of their IT environments and in conforming to industry and government regulations. In addition, MSP’s data protection and security services aim to keep SME’s safe from cybercriminals.

In general, NABL’s solutions span cloud, on-premises, and hybrid-cloud IT infrastructures to accommodate the diverse requirements of MSP partners and the SMEs they serve. In my opinion, these are all tangible benefits that MSPs and SMEs would appreciate having.

Bespoke sales strategy to gain share

In my opinion, NABL’s approach to the market is founded on a bespoke land and expand strategy. With this business model and its alignment with MSP partners, NABL is in a position to serve the SME market and generate the sales volume necessary to do so. The best part about this business model, in my opinion, is that NABL is able to expand right along with MSPs as their clientele grows, as they roll out new services enabled by NABL’s technologies, and as their end-users acquire more gadgets and subscriptions. In addition, the NABL partner success initiatives enable MSP partners to increase revenue, broaden their customer base, and use NABL’s platform to access and consume solutions.

In contrast, NABL’s strategy for expanding its network of MSP partners is to engage in a low-touch, high-velocity internal sales cycle. This sales strategy is based on selling a standardized product or service over the phone or online to managed service providers of varying sizes and locations. This model’s brilliance lies in the fact that it can easily be adapted to new circumstances, is data- and analytics-driven, and is geared toward efficiently generating digital traffic and high-quality opportunities. I think this low-barrier sales and marketing model will also enable potential MSP partners to try out the full versions of NABL’s solutions, which is often the first step toward wider adoption.

Latest earnings review

NABL reported an increase in its top-line guidance and matched the consensus earnings estimate of $0.07, falling just short of the estimate of $0.08. But thanks to wise cost cutting, NABL has lowered its FY revenue guidance by $1.5 million. The introduction of new products, expenditures on data centers, and currency fluctuations all contributed to a 290-basis-point decline in gross margins for the fourth consecutive quarter. Reductions in public company expenses following the finalization of the spin off and decreased spending on low return on investment investments within S&M led to an increase in operating and EBITDA margins.

The fact that NABL was able to surpass revenue guidance once again is encouraging, as it demonstrates that the company is proceeding according to plan and that projections made by management are accurate. I also think NABL’s new offerings will help them stand out in the market more. Some examples include N-Sight RMM, the Cloud User Hub for M365 administration, and the Private Portal.

However, I was disappointed by the earnings because of the lowered guidance, which suggests that growth isn’t as robust as management had predicted. Despite the positive results of the second quarter, NABL lowered its full-year forecast by $1.5 million after cutting its top-line guidance. This quarter’s EBITDA increase of $2.15 million over last quarter’s guidance led to an increase in full-year EBITDA guidance of $111.25 million at the midpoint, an increase of $1.1 million. In addition, the number of MSPs reporting ARR of more than $50,000 decreased sequentially for the first time, from 1,818 in Q2 to 1,786.

I still think NABL is executing well, which is crucial because the TAM is big enough for it to take a sizable chunk of the market and grow.

Valuation & model

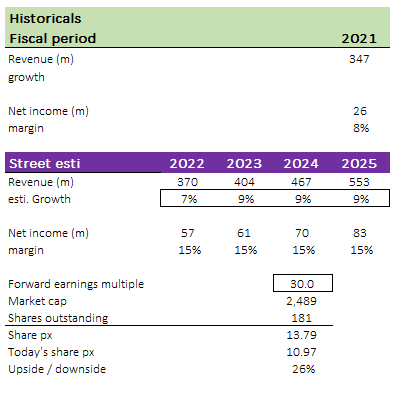

My model suggests that NABL is undervalued. I expect NABL to continue growing in the high single digits moving forward, which is aligned with management guidance and historical growth rates. Underlying that assumption is the fact that NABL continues to ride the secular trend of digitization.

NABL currently trades at 36x forward income. I think this multiple is too high above its average; hence, I expect it to trade back down to 30x. I do note that this multiple seems high on an absolute basis, so investors need to take note.

Author’s own calculations

Risks

NABL is not able to control how fast MSPs acquire customers

NABL expands due to two main factors: the number of MSPs on board and the number of SMEs aboard each MSP. NABL can control the first through its customized sales approach, but it has no control over the latter. This makes forecasting future growth difficult because it is heavily dependent on the quality of MSPs on board and how quickly they grow.

SMEs have high churn rates

Dealing with SMEs is difficult due to their high churn rates. A recession or any other event that has a significant negative impact on SMEs would reduce the number of MSPs in the market, which would have a direct impact on NABL’s growth and business.

Summary

To conclude, I believe NABL is undervalued. NABL is a provider of cloud-based software solutions for MSPs that help them support SMEs in their digital transformation and expansion. NABL provides MSPs with tools to monitor their clients’ infrastructure, manage their data, and secure their networks. More importantly, NABL’s solutions are designed to fit the needs of MSPs and their SME clients, providing remote monitoring and management, role-based access control, and assistance with compliance and security.

Be the first to comment