Blue Planet Studio

When I first covered BlackBerry Limited (NYSE:BB) on Seeking Alpha just over a year ago, I thought BlackBerry stock had hardly been that investable in years as the company seemed well-positioned to revive earnings growth. That being said, I still decided to wait on the sidelines as I thought BlackBerry will face an uphill battle to improve its operating efficiency while maintaining investments at an elevated level to support future growth from the cybersecurity front. I thought BlackBerry’s QNX software will face intense competition that would make it difficult for the company to gain market share as well. A year later, BlackBerry is still struggling to make meaningful inroads into the cybersecurity sector but the company recently unveiled an ambitious plan to hit revenue of $1.2 billion+ in fiscal 2027, which implies annual revenue growth of around 13%. The company also plans to become non-GAAP profitable by fiscal 2025. In this article, I will evaluate these long-term growth expectations of the company to determine whether BB stock deserves a re-rating in the market.

QNX’s strength alone will not help BlackBerry reach its targets

BlackBerry’s QNX software continues to lead the safety-critical embedded automotive software market. QNX royalty revenue backlog increased 14% YoY in Q1 FY2023 to $560 million while the number of vehicles in which QNX software is embedded grew from 195 million a year ago to 215 million. Amid macroeconomic challenges such as surging inflation, supply-chain issues, rising interest rates, lockdowns in China, and geopolitical tensions, BlackBerry still reported an 18.6% YoY growth in the IoT business aided by historical design wins with key potential customers. BlackBerry’s QNX is used by leading automakers in the world such as Toyota Motor Corporation (TM), Mercedes-Benz (OTCPK:DMLRY), and BMW (OTCPK:BMWYY) and the company has also secured wins with 24 of the top 25 EV OEMs.

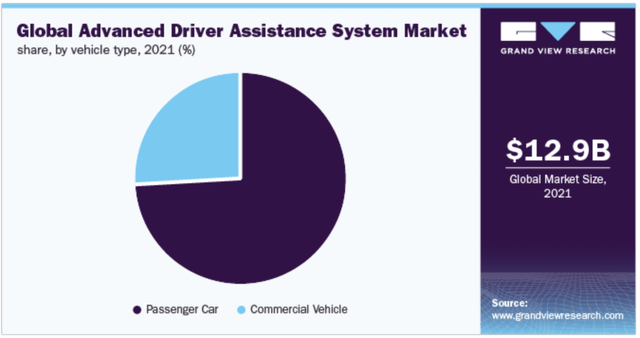

BlackBerry has guided for 20% annual growth in IoT revenue through 2027 to $443 million, which I believe is attainable with the help of design wins the company has secured with leading automakers in the world. In addition to its strength in the automotive business, BlackBerry is penetrating the global medical device market as well, and the company’s software products are now used by 8 of the top 10 medical device OEMs in the world. The global advanced driver assistance system market was valued at $12.9 billion in 2021 and Grand View Research predicts this market will grow at a CAGR of 18.2% through 2030. As illustrated below, passenger cars accounted for the bulk of this market in 2021.

Exhibit 1: Global advanced driver assistance system market share by vehicle type (2021)

The growing demand for safety features in passenger cars, the rising adoption of advanced camera systems in vehicles, and the expected increase in autonomous vehicle usage will keep the demand for advanced driver assistance systems elevated through 2030. BlackBerry’s design wins with tier 1 automakers and the leading OEMs in the world, in my opinion, will help the company make the most of this projected growth for advanced driver assistance systems in the next few years.

So far, so good.

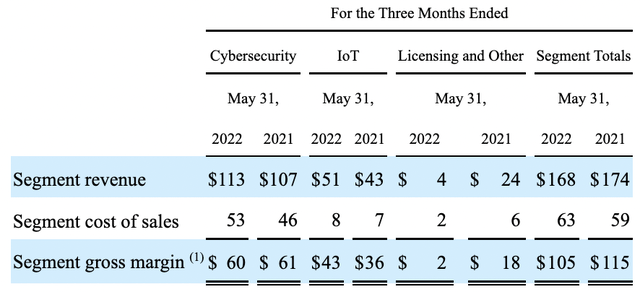

The challenges come to light when we consider BlackBerry’s expectations for the cybersecurity sector. In Q1 FY2023, BlackBerry reported a meager 5.6% YoY revenue growth for the cybersecurity sector, which the company expects to grow at a CAGR of 10% through 2027.

Exhibit 2: Q1 FY2023 revenue breakdown by business segment

When it comes to the cybersecurity solutions offered by BlackBerry which focus on combining unified endpoint management with endpoint protection, the company seems to be struggling to gain market share despite securing deals with the U.S. Airforce and the U.S. Navy. One would have thought that deal wins with top-tier security agencies in the U.S. would accelerate the company’s cybersecurity segment growth, only to be disappointed. One reason behind the lackluster growth seen from this segment could be the company’s narrow focus on certain business sectors that view cybersecurity as mission-critical. In an era where cybersecurity is increasingly becoming a necessity to companies of every scale and size, BlackBerry is likely to see better growth opportunities with a focus on the mass market opportunity.

For this to happen, the company will have to aggressively market their products while investing in improving the technology used in its products. Also, BlackBerry faces intense competition in the fragmented cybersecurity market from larger peers who are enjoying some competitive advantages, so penetrating this market is easier said than done. Even if BlackBerry were to gain market share successfully, I believe such gains will come on the back of a notable increase in costs, which is likely to threaten BlackBerry’s ability to become non-GAAP profitable in FY2025.

Two unmet conditions serve as a warning sign

In my first article on BlackBerry published in May 2021, I wrote that I will be waiting for two signs before investing in the company. Here’s a recap.

- Strong revenue and earnings growth following the reopening of the economy, which would confirm BlackBerry’s ability to thrive with its new business model. In other words, I’m looking for signs of acceptable organic growth.

- A notable improvement in return on invested capital, which would signal BlackBerry is coping with the challenging competitive landscape in an acceptable manner.

None of these conditions have been satisfied so far, which serves as a warning sign that BlackBerry is still not out of the woods completely. There is no doubt that BlackBerry is in a much better position today compared to a few years ago when everything seemed to be falling apart, but that is not a good enough reason to invest in the company.

In one positive move, I believe BlackBerry will focus more on organic growth in the coming years to meet the long-term financial targets announced by the company management recently. BlackBerry, in my opinion, is yet to make the most of its design wins with automakers and the strength of its core technology portfolio. A focus on organic growth could help the company unlock value in the coming years. This, however, is yet to be seen.

Takeaway

I am not confident of BlackBerry meeting its ambitious financial goals for FY2027. The company still needs to go a long way to achieve these goals, and I believe a lot could still go wrong given that the management has historically been not as effective as I would expect when it comes to executing plans to meet targets. Despite the positives that we are seeing today, I am forced to remain on the sidelines because of the many unquantifiable uncertainties surrounding the company’s business.

Be the first to comment