Lemon_tm/iStock via Getty Images

Dividend growth [DG] investors like to invest in companies with long dividend growth streaks. Such companies often have strong business models and shareholder-friendly policies. The dividend growth streak is a point of pride for these companies, so there’s a strong likelihood that they’ll continue to pay and increase their dividends.

Of course, a strong likelihood is not a guarantee, as we saw when Ross Stores (ROST) suspended its dividend shortly after becoming a Dividend Aristocrat. In fact, in the pandemic-induced recession of 2020, many companies cut or suspended their dividends.

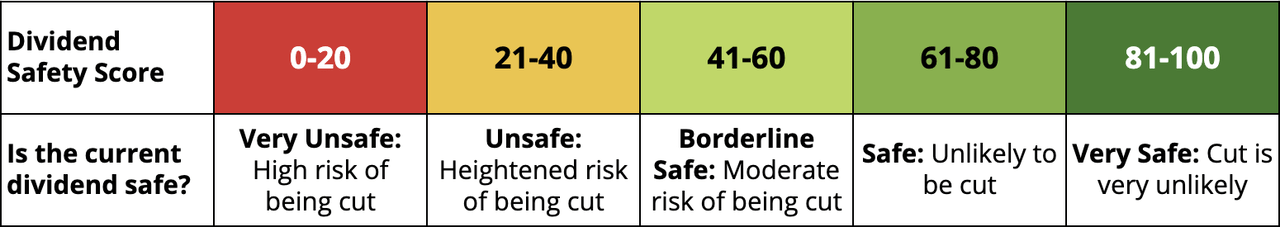

I use the Dividend Safety Scores of Simply Safe Dividends to analyze DG stocks. The scoring system predicts dividend risk over a full economic cycle by analyzing the most important metrics for dividends, including payout ratios, debt levels, coverage metrics, recession performance, dividend longevity, industry cyclicality, free cash flow generation, and forward-looking analyst estimates.

Simply Safe Dividends

Dividend Safety Scores have avoided 98% of dividend cuts and excelled during the pandemic. While 51% of stocks with Very Unsafe and Unsafe ratings at the start of 2020 went on to cut their dividends, only 10% and 4% of Safe and Very Safe-rated companies cut their dividends, respectively.

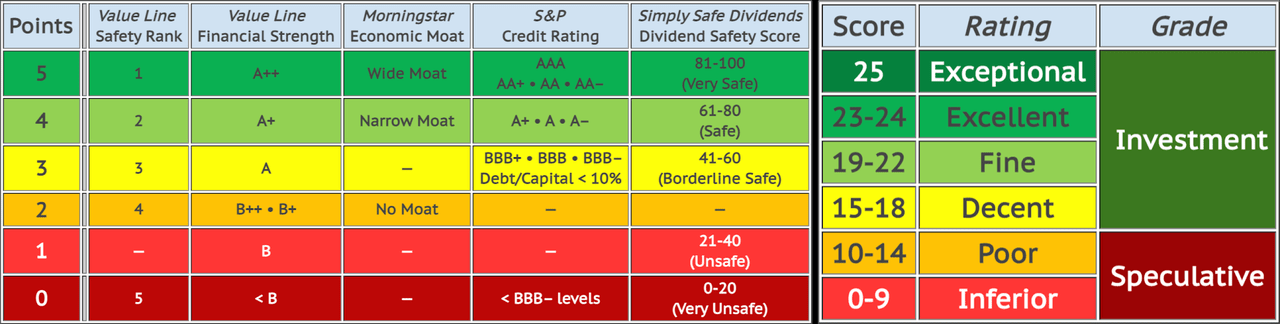

Dividend Safety Scores is one of five quality indicators referenced in DVK Quality Snapshots to assess the quality of DG stocks. Proposed by David Van Knapp, the system assigns 0-5 points to each quality indicator for a maximum of 25 points.

For this article, I focused on DG stocks in Dividend Radar with Safe and Very Safe dividends. Additionally, I screened for stocks trading below my fair value estimate and stocks with strong income and growth prospects. I’ll explain these screens in more detail below.

The article presents my top dividend growth pick in each of the GICS sectors. I provide quality indicators, key metrics, and my risk-adjusted Buy Below prices for each stock.

Assessing Quality

Here are the quality indicators of DVK Quality Snapshots:

- Value Line’s Safety Rank

- Value Line’s Financial Strength ratings

- Morningstar’s Economic Moat

- S&P Capital’s Credit Ratings

- Simply Safe Dividends’ Dividend Safety Scores

DVK Quality Snapshots use data from Value Line, Morningstar, S&P Capital, and Simply Safe Dividends

My rating system is simply a mapping of different quality score ranges. Ratings are Exceptional (25), Excellent (23-24), Fine (19-22), Decent (15-18), Poor (10-14), and Inferior (0-9).

To rank stocks, I sort them in descending order by quality scores and use the following tie-breaking metrics, in turn:

- Dividend Safety Scores

- S&P Credit Ratings

- Dividend Yield

When two stocks with the same quality score have the same Dividend Safety Score, I next compare their S&P Credit Ratings, ranking the one with the better Credit Rating higher. I rarely need to break ties with Dividend Yield.

Stock Valuation

Stock valuation is a method of determining the intrinsic value of a stock. There are several sophisticated stock valuation methods, including the Dividend Discount Model [DDM], which assumes a company’s fair value equals the present value of future dividends. In the past, I used an elaborate three-stage DDM but found that even minor adjustments to the inputs produced wildly varying results.

Now I prefer a survey approach, collecting fair value estimates and target prices from several reliable online sources, including CFRA, Finbox, Morningstar, Portfolio Insight, and Simply Wall St. With as many as 11 available estimates, I ignore the lowest and highest, then average the mean and median of the remaining values to arrive at my fair value [FV] estimate. Averaging the mean (average) and median (middle value) helps adjust skewness in the surveyed estimates.

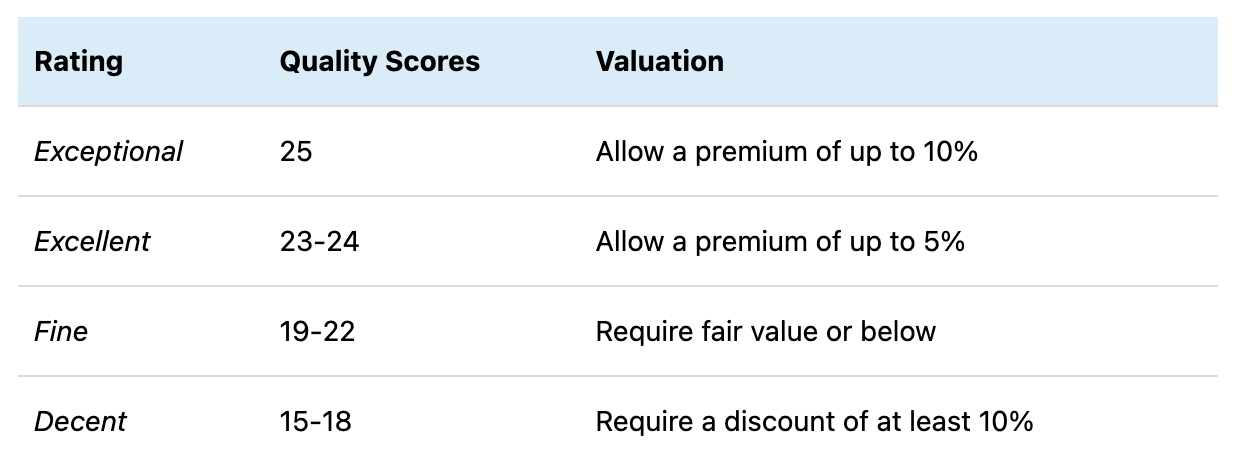

While I prefer to buy at discounted valuations, I’ve found that the highest-quality dividend growth stocks rarely trade at discounted valuations! For this reason, I’m willing to pay a premium price for the highest-quality stocks. In contrast, I require discounted valuations for lower-quality stocks:

Created by the author to illustrate how to calculate risk-adjusted Buy Below prices

Growth And Income Prospects

The Chowder Number [C#] sums up a stock’s forward yield and its 5-year dividend growth rate. It is a growth-oriented metric measuring the likelihood that a DG stock will deliver annualized returns of 8% or more. In my tables of key metrics and valuations, I color-code the C# column green for DG stocks likely to deliver annualized returns of 8%, yellow for DG stocks somewhat likely to deliver annualized returns of 8%, and red for DG stocks unlikely to deliver annualized returns of 8%.

For this article, I considered only DG stocks likely to deliver annualized returns of 8%.

The 5-year Yield on Cost [YOC] is an income-oriented metric indicating what your YOC would be after buying a stock and holding it for five years, assuming the current 5-year dividend growth rate [DGR] is maintained. I color-code the 5-year YOC column as follows: red < 2.50% ≤ yellow < 4.00% ≤ green.

To calculate the 5-year YoC is easy:

5-year YOC = Forward Yield × (1 + 5-year DGR)^5

Here, ^5 means to the 5th power.

For this article, I considered only DG stocks likely to have high 5-year YOCs after five years of ownership (5-year YOC ≥ 4.00%).

My Top DG Pick In Each GICS Sector

The Global Industry Classification Standard (GICS) is an industry taxonomy developed by MSCI and S&P Global Ratings for the global financial community. The GICS structure identifies 11 sectors into which all major public companies have been categorized.

I thought it would be interesting to pick one DG stock in each GICS sector for further analysis and possible investment. Investors looking to diversify their portfolios across different sectors might find this selection of interest.

To recap, the stocks are discounted to my FV estimates and have Very Safe or Save dividends, according to Simply Safe Dividends. Furthermore, the picks offer strong income and growth prospects.

| # | Company (Ticker) | Sector | Supersector |

| 1 | Texas Instruments (TXN) | Information Technology | Sensitive |

| 2 | Union Pacific (UNP) | Industrials | Sensitive |

| 3 | Home Depot (HD) | Consumer Discretionary | Cyclical |

| 4 | BlackRock (BLK) | Financials | Cyclical |

| 5 | Comcast (CMCSA) | Communication Services | Sensitive |

| 6 | Amgen (AMGN) | Health Care | Defensive |

| 7 | EOG Resources (EOG) | Energy | Sensitive |

| 8 | Pinnacle West Capital (PNW) | Utilities | Defensive |

| 9 | Packaging Corp. of America (PKG) | Materials | Cyclical |

| 10 | Crown Castle International (CCI) | Real Estate | Cyclical |

| 11 | Tyson Foods (TSN) | Consumer Staples | Defensive |

The following company descriptions are the author’s summary of company descriptions sourced from finviz.com.

1. Texas Instruments (TXN)

TXN designs, manufactures, and sells semiconductors to electronics designers and manufacturers globally. The company operates in two segments, Analog and Embedded Processing. It markets and sells semiconductor products through a direct sales force and through distributors, as well as through its website. TXN was founded in 1930 and is headquartered in Dallas, Texas.

2. Union Pacific (UNP)

Omaha, Nebraska-based UNP operates the largest public railroad in North America, with 32,000 miles of track linking 23 states in the western two-thirds of the United States. UNP hauls coal, industrial products, intermodal containers, agricultural goods, chemicals, and automotive products. UNP owns a quarter of the Mexican railroad Ferromex. The company was founded in 1862.

3. Home Depot (HD)

Founded in 1978 and based in Atlanta, Georgia, HD is a home improvement retailer that sells an assortment of building materials, home improvement products, and lawn and garden products. HD provides installation, home maintenance, and professional service programs to do-it-yourself, do-it-for-me, and professional customers.

4. BlackRock (BLK)

BLK is an investment management company that provides a range of investment and risk management services to institutional and retail clients across the world. The company’s offerings include single and multi-asset class portfolios investing in equities, fixed income, alternatives, and money market instruments. BLK was founded in 1988 and is based in New York City.

5. Comcast (CMCSA)

Founded in 1963 and headquartered in Philadelphia, Pennsylvania, CMCSA is a global media and technology company. The company operates through Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Sky segments. CMCSA delivers broadband, wireless, and video connectivity; creates, distributes, and streams entertainment, sports, and news; and operates theme parks and resorts.

6. Amgen (AMGN)

Based in Thousand Oaks, California, AMGN is a biotechnology company. The company discovers, develops, manufactures, and delivers human therapeutics worldwide. It offers products for the treatment of serious illnesses in the areas of oncology/hematology, cardiovascular disease, inflammation, bone health, nephrology, and neuroscience. AMGN was founded in 1980.

7. EOG Resources (EOG)

EOG, together with its subsidiaries, explores for, develops, produces, and markets crude oil, natural gas, and natural gas liquids. Its principal producing areas are in New Mexico and Texas in the United States and the Republic of Trinidad and Tobago. The company was formerly known as Enron Oil & Gas Company. EOG was incorporated in 1985 and is headquartered in Houston, Texas.

8. Pinnacle West Capital (PNW)

PNW is a holding company that provides retail and wholesale electric services primarily in the state of Arizona. Its subsidiary, Arizona Public Service Company, is a vertically integrated electric company that generates, transmits, and distributes electricity using coal, nuclear, gas, oil, and solar resources. PNW was founded in 1920 and is headquartered in Phoenix, Arizona.

9. Packaging Corp. of America (PKG)

PKG manufactures and sells containerboard and corrugated packaging products in North America and Europe. The company provides various corrugated packaging products, honeycomb protective packaging, and packaging for meat, fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products. PKG was founded in 1867 and is headquartered in Lake Forest, Illinois.

10. Crown Castle International (CCI)

Crown Castle owns, operates, and leases more than 40,000 cell towers and approximately 80,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service, bringing information, ideas, and innovations to the people and businesses that need them.

11. Tyson Foods (TSN)

TSN is a worldwide food company that operates through four segments: Chicken, Beef, Pork, and Prepared Foods. The company offers its products under various brands, including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Sara Lee, Chef Pierre, and Golden Island brands. TSN was founded in 1935 and is headquartered in Springdale, Arkansas.

Key Metrics And Fair Value Estimates

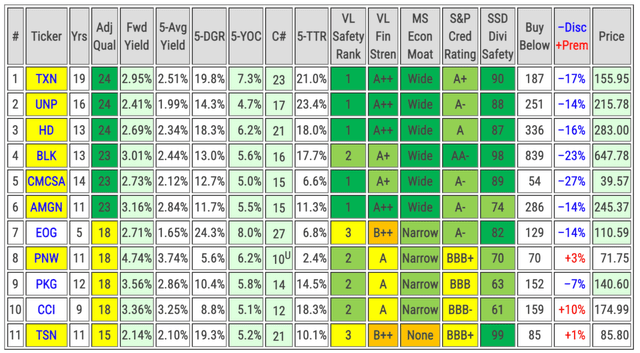

Below, I present a table with key metrics and valuations of interest to dividend growth investors.

|

The table presents the following metrics and indicators:

|

|

Color-coding

|

Created by the author with data from Portfolio Insight and using DVK Quality Snapshots

Note that CCI, PNW, and TSN are trading above my risk-adjusted Buy Below prices because I require a discounted valuation of at least 10% for stocks rated Decent.

My FV estimates for CCI, PNW, and TSN are $177, $77, and $95, respectively.

Commentary

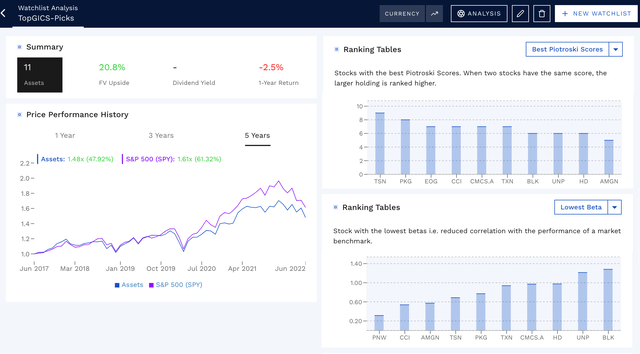

Here’s a comparative analysis of an equal-weighted portfolio of these stocks, courtesy of Finbox.com:

From a price-performance perspective, the portfolio would have underperformed the S&P 500 over the last five years, returning 48% versus 61% of the S&P 500 (SPY).

It is noteworthy that these stocks did not rise as fast in late February/early March 2020, nor drop as much year-to-date, as the broader market. This indicates that the group has a low beta, which is confirmed in the Beta ranking table on the right. In fact, only two of the stocks (BLK and UNP) have Betas above 1.00.

I included a ranking table based on Piotroski scores, which is useful in identifying value stocks. Scores of 9 (TSN) and 8 (PKG) offer the best value, while scores of 7 (EOG, CCI, CMCSA, and TXN) and 6 (BLK, UNP, an HD) offer average value. Based on its Piotroski score, AMGN offer little or no value.

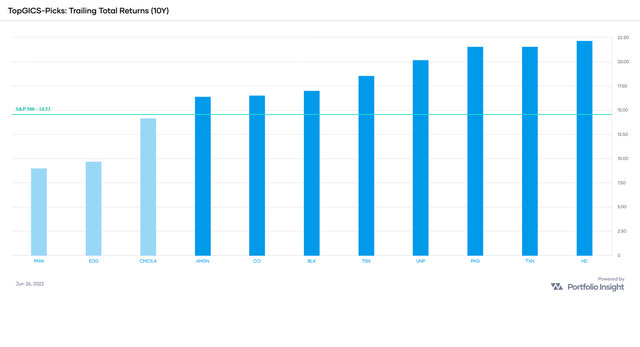

While the portfolio would have underperformed the S&P 500 over the last five years on a price-performance basis, it outperformed the S&P 500 (SPY) over the past ten years on a total return basis:

Only CMCSA, EOG, and PNW underperformed the S&P 500 (SPY) over this period.

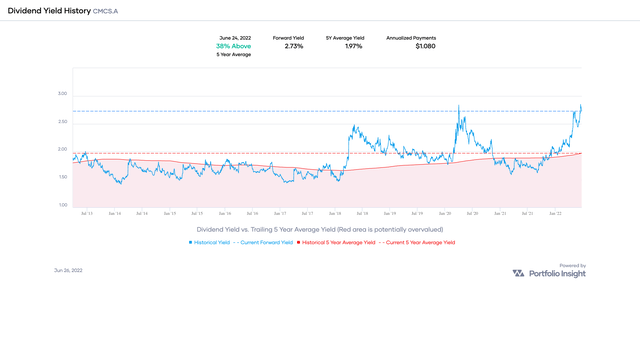

CMCSA and BLK are discounted most to my risk-adjusted Buy Below.

Below is a Dividend Yield History chart of CMCSA, courtesy of Portfolio Insight. The chart shows that CMCSA’s forward yield is 38% above its 5-year average yield, suggesting that the stock is significantly undervalued relative to historical yields. In fact, in may be one of the best times to invest in CMCSA!

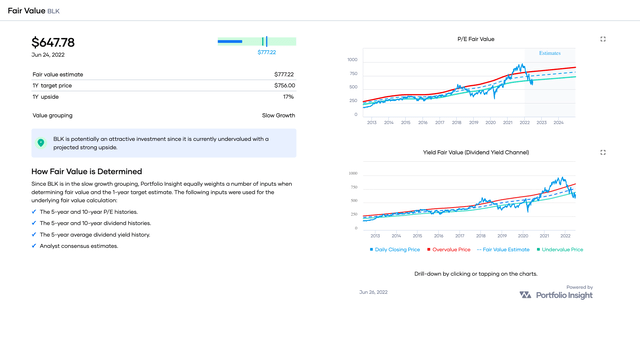

Likewise, BLK is undervalued, as shown in the following Fair Value charts from Portfolio Insight:

On the right, both the P/E Fair Value chart and the Dividend Yield Channel chart indicate that BLK is undervalued. Moreover, Portfolio Insight believes a 1-year upside of 17% is possible for BLK.

Depending on your investment style, you may want to focus on the following stocks first:

- For income investors (highest yields): CCI, PKG, PNW

- For dividend growth-oriented investors (highest 5-DGR): EOG, HD, TSN, TXN

- For very safe dividends (Dividend Safety Score ≥ 90): BLK, TSN, TXN

- For value investors (most discounted): BLK, CMCSA

As always, I encourage readers to do their due diligence before buying any stocks I cover.

Concluding Remarks

In this article, I presented my top DG pick in each of the GICS sectors. The stocks are discounted to my FV estimates, have Very Save or Safe dividends according to Simply Safe Dividends, and offer strong income and growth prospects.

Thanks for reading, and happy investing everybody!

Be the first to comment