Tinpixels/iStock via Getty Images

Investment Thesis

In the following, I will list different characteristics that companies should fulfil to be part of my top 5 dividend growth stocks for an investment portfolio for retirement. A company should fulfil these requirements in order to be able to increase its dividend significantly over the next 30 years:

- Strong Brand Image

- Strong Competitive Advantages Over its Competitors

- High Economic Moat

- High Market Capitalization

- Low Dividend Payout Ratio

- Relatively High Dividend Growth Rate Over the Last 5 Years

- High Financial Strength

- High Profitability

These are my Top 5 dividend growth stocks for a retirement-portfolio:

Visa

In one of my previous articles about Visa, I mentioned why I think it should be part of an investment portfolio for retirement: the company has a wide economic moat and its dividend growth rate of the last 5 years has been 17.91%. Furthermore, the company has a dividend payout ratio of only 21.54%. This low dividend payout ratio shows that there is plenty of room for future dividend enhancements.

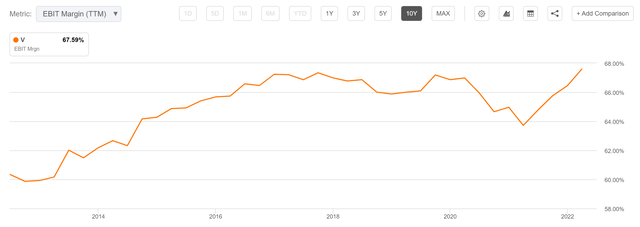

The company has an extremely high EBIT margin of 67.59%, which proves the excellent market position that Visa has within its business industry. Due to Visa’s competitive advantages (such as its payments network, its technological knowledge and its strong brand image), I expect the company to further increase its EBIT margins in the future. In the graphic below you can see that Visa has managed to continuously increase its EBIT margin over the last 10 years.

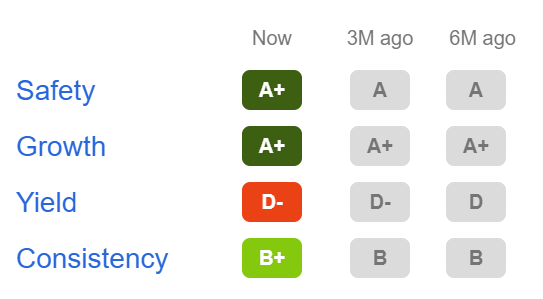

Seeking Alpha’s Dividend Grades of A+ in terms of Dividend Safety and Dividend Growth, confirm the strong rating of Visa’s dividend. Below, you can see the full Seeking Alpha Dividend Grades for Visa:

Visa According to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

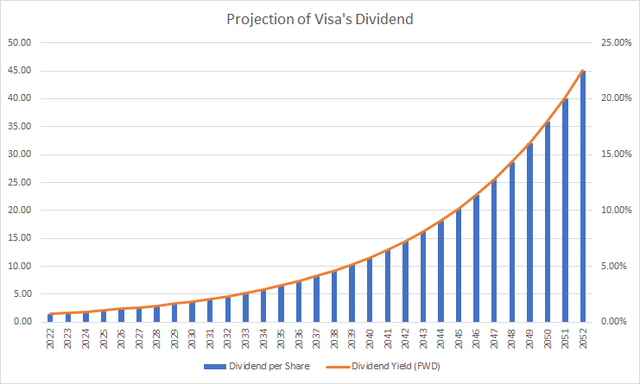

Projection of Visa’s Dividend

Due to Visa’s low dividend payout ratio in combination with its strong competitive advantages, I assume that the company will be able to continue increasing its dividend significantly in the future. Such as mentioned before, Visa’s dividend growth rate of the last 5 years has been 17.91%. I will make more conservative assumptions and assume a dividend growth rate of 12% per year for the company. In the graphic below you can find a projection of Visa’s dividend for the next 30 years assuming its dividend would increase by 12% per year:

Mastercard

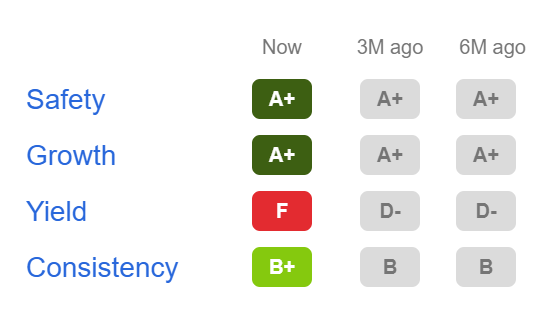

Similar to its competitor Visa, Mastercard has a high EBIT Margin of 55.56%, indicating the excellent market position the company has within the payment industry. Mastercard has shown a dividend growth rate of 17.80% on average over the last five years. Due to the strong competitive advantages of the company in combination with its low dividend payout ratio of only 19.72%, I expect Mastercard to continue significantly increasing its dividend in the upcoming years. Furthermore, the company shows high financial strength, which is underlined by its credit rating of A1 by Moody’s. The strong safety and growth rates of Mastercard’s dividend are underlined by Seeking Alpha’s Dividend Grades of A+ in terms of Dividend Safety and Dividend Growth, as well as B+ in terms of Dividend Consistency.

Mastercard according to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

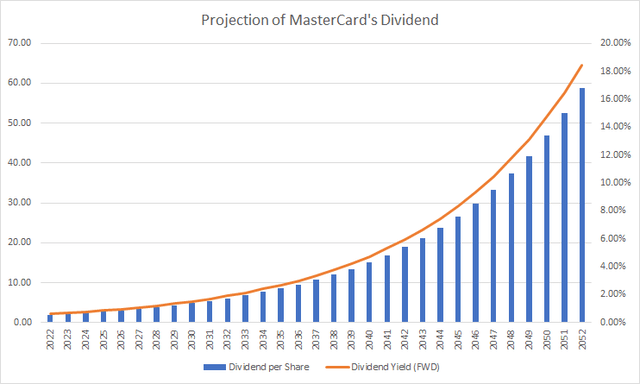

Projection of Mastercard’s Dividend

Similar to Visa, I also expect Mastercard to significantly increase its dividend in the upcoming years. Assuming a dividend growth of 12% for Mastercard (while taking into consideration its dividend growth rate of the last 5 years of 17.8% and making more conservative assumptions), we would get the following dividend projection for the next 30 years:

Apple

Due to Apple’s strong brand image, the brand loyalty of its customers as well as the ecosystem the company has managed to establish, Apple has strong competitive advantages overs its competitors (here you can find my detailed analysis on Apple). The average growth rate of Apple’s dividend of the last five years has been 8.75%. Due to its low dividend payout ratio of only 14.29% and the company’s strong competitive advantages, as mentioned above, I expect Apple to continue raising its dividend in the upcoming years.

As I wrote previously:

“When taking into account Apple’s free cash flow per share of $5.57 in 2021 as well as its current price per share of $133.35, it demonstrates that the company generates a free cash flow yield of around 4.17%. This puts Apple in a position where the company could theoretically be able to pay a dividend of 4.17%. However, instead of paying a higher dividend, Apple uses part of its free cash flow for its repurchase program. In the fiscal year 2021, Apple spent $85.5 billion to repurchase its shares. As a result, investors also benefit from Apple’s relatively high free cash flow yield, which enables Apple to buy back its own shares.”

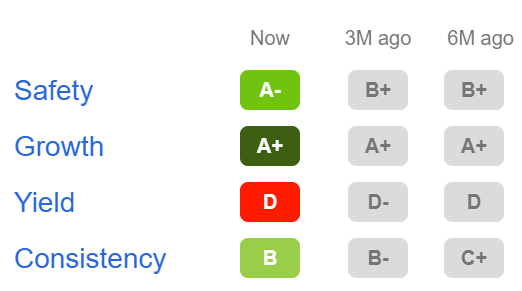

Below you can find the Seeking Alpha Dividend Grades for Apple. The company gets an A- for Dividend Safety, an A+ for Growth and a B for Consistency. The Seeking Alpha Dividend Grates reinforce my belief, that Apple can be considered as an excellent pick as a dividend growth stock to be part of an investment portfolio for retirement.

Apple according to the Seeking Alpha Dividend Grades

Source: Seeking Alpha

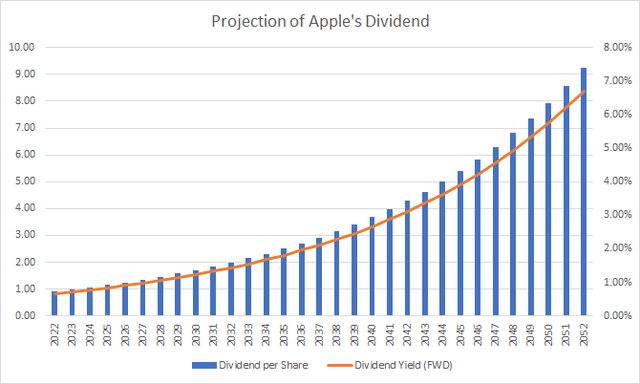

Projection of Apple’s Dividend

For Apple, I have assumed a dividend growth rate of 8% on average for the next 30 years. This is based on its dividend growth rate of 8.75% of the last five years. Due to the company’s strong competitive advantages as well as the low dividend payout ratio, I expect Apple to be able to raise its dividend by about 8% on average in the future.

Nike

Two months ago, I wrote an article about the contribution of the Jordan brand to my buy rating on the Nike stock. In my opinion, Nike is an excellent company to be part of a dividend growth portfolio for retirement. The company has managed to become one of the most well-known brands in the world. Its strong brand image in combination with the endorsements it has with the most valuable sports teams and athletes in the world provide the company with a wide economic moat.

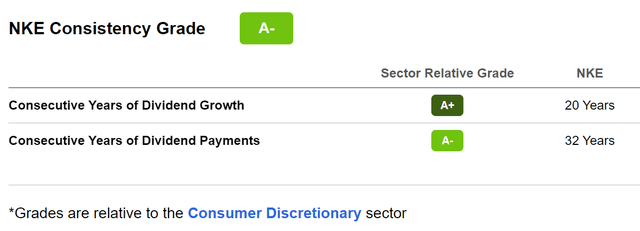

Nike’s dividend growth rate of the last 5 years is 11.20%. Furthermore, the company has a low dividend payout ratio of just 30.61%. This low dividend payout ratio, the company’s dividend growth rate of the last 5 years and its steady revenue growth are strong indicators for possible future dividend enhancements. Additionally, Nike has consistently managed to increase its dividend over the past 20 years, which strengthens my belief that the company will be able to do so in the future. Below you can find the valuation of Nike’s dividend in terms of the Seeking Alpha Consistency Grade.

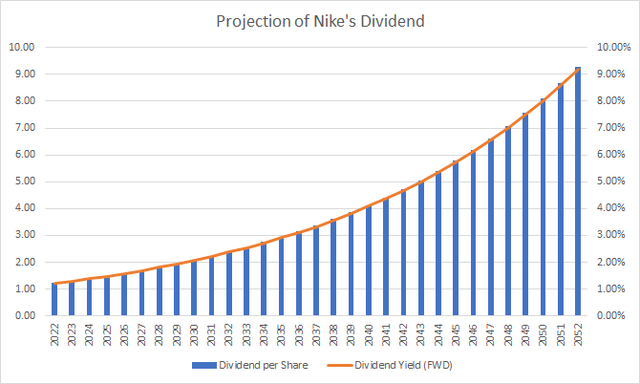

Projection of Nike’s Dividend

As mentioned before, Nike has raised its dividend by 11.20% on average over the last five years. I have made more conservative assumptions by assuming an average dividend growth rate of 7% for the next 30 years:

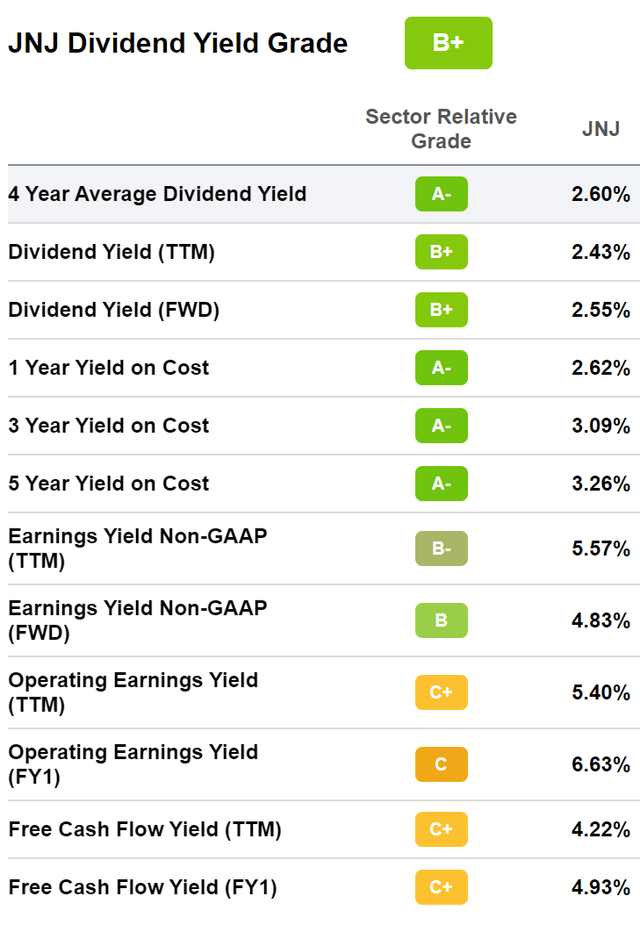

Johnson & Johnson

Johnson & Johnson is a holding company which operates in the business segments of consumer products, pharmaceutical products and medical devices. Johnson & Johnson consists of 260 operating companies and has a product portfolio of 26 brands that each create a revenue of more than $1 billion. Johnson & Johnson has an Aaa credit rating by Moody’s, which demonstrates the enormous financial strength of the U.S. healthcare giant. The company has a dividend payout ratio of only 42.91% and an average dividend growth rate of 5.87% of the last 5 years.

Although it’s true that we cannot expect very high future dividend growth rates from Johnson & Johnson (due to the company’s enormous size and its stable but low revenue growth rates), the company is still a great fit to enhance the stability of our dividend growth portfolio. Proof of this comes from the company’s low Beta of 0.66, its high diversification (by operating in three different business segments) and the fact it has continuously grown its dividend over the past 59 years.

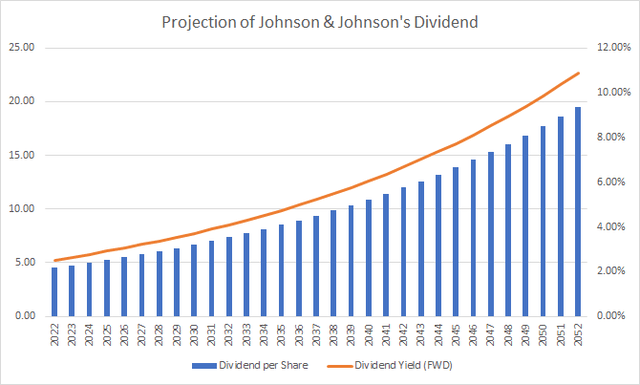

Projection of Johnson & Johnson’s Dividend

For Johnson & Johnson, I have assumed that the company will be able to raise its dividend by about 5% on average. Based on the company’s dividend growth rate of 5.87% in the last 5 years and its low dividend payout ratio, I expect Johnson & Johnson to increase its dividend by about 5% per year over the next 30 years:

Overview of the Top 5 Dividend Growth Stocks for a Retirement-Portfolio

|

Visa |

MasterCard |

Apple |

Nike |

Johnson & Johnson |

|

|

Market Cap. |

$415.59B |

$313.77B |

$2.22T |

$161.75B |

$465.60B |

|

Dividend Payout Ratio |

21.54% |

19.72% |

14.29% |

30.86% |

42.91% |

|

5 Year Average Dividend Growth Rate |

17.87% |

17.80% |

8.75% |

11.2% |

5.87% |

|

Dividend Yield (FWD) |

0.76% |

0.62% |

0.67% |

1.19% |

2.55% |

|

Years of Dividend Growth |

13 |

11 |

9 |

20 |

59 |

|

Moody’s credit rating |

Aa3 |

A1 |

Aaa |

A1 |

Aaa |

|

EBIT Margin |

67.59% |

55.56% |

30.93% |

14.29% |

26.50% |

Source: Seeking Alpha, Moody’s

Conclusion

All 5 companies have characteristics in common: they have strong competitive advantages over their competitors (such as a strong brand image, which helps them to increase prices in times of high inflation), they have a low dividend payout ratio (which allows them to significantly increase dividends in the future) and they have a relatively high dividend growth rate over the last five years. Additionally, they have a high market capitalization, strong financials and they are highly profitable. In my opinion, all of these factors contribute to the fact that each company will be able to significantly increase its dividend in the future.

Which companies would be your top 5 dividend growth stocks for retirement when assuming an investment-horizon of 30 years?

Author’s Note:

Thank you for reading! If you have any questions regarding this article, you can leave a comment below. You can also reach me via the direct message function. If you liked this article, I would appreciate it if you could hit the “Like” button. In case you are interested in reading more of my analysis, you can hit the “Follow” button to get a notification when I next publish an analysis!

Be the first to comment