Natali_Mis

September is over and it is yet another month to quickly forget when it comes to stock returns. After a relatively good performance during the summer and a relatively decent August, stock returns in September were like the first half of this year. With the US technically in a recession, this does not come as a surprise (a recession is most of the time defined as two quarters of negative growth, although there is no official definition). With the Fed still hawkish, I don’t have high hopes for a reversal anytime soon, but as it is very hard to time the market, I’d rather stay invested. I do change to higher quality companies and for that reason, I decided to sell two of my stocks this month. In total I had 7 transactions this month, which is close to my monthly average.

For the people that have not read my previous articles: I am a 25-year-old investor from the Netherlands who is trying to start early so that I will have the option to retire early or at least earlier (the current retirement age is 67 in NL and is trending upwards). If you are interested in previous updates on my portfolio, you can find them here:

September Update

September was a month that we can quickly forget about. The indexes all ended the month in the red and inflation remained high in both the United States and Europe. In the Netherlands, inflation reached 17.1% based on the European Harmonized Index of Consumer prices. In contrast to the US where the Fed has been hiking rates rapidly (3%), the ECB has only hiked its interest rates by 1.25% so far. The reason for this is that it is a lot harder for the ECB to hike the rates as the economies of the members differ a lot. As a result, the ECB has been unable to lower inflation and the Euro has depreciated significantly against other currencies such as the USD (further adding fuel to the fire). Due to the decline, I limit my new purchases in USD as it is hard to predict the future movements in the FX rate. Nevertheless, this month I increased my position in two US stocks. Besides this, I replaced two stocks and added capital to one of my real estate stocks.

The replacements I made were based on my analysis of the European small cap sector. After collecting data on revenue growth, FCF growth, debt ratios etc. of approximately 10 stocks and reading through the annual reports of these companies, I found two companies that were significantly stronger than the companies that I had a position in. By replacing these stocks I hope to improve the strength of my portfolio and increase future returns. I will try to do this for other sectors but at the moment I am time-constrained and unable to put as much effort into this as I’d like.

Transactions

Rules

|

Core |

Value |

Small-cap growth |

|

|

Buy |

|

||

|

Reconsider |

|

|

|

|

Sell |

|

Beginning of September

Vonovia (OTCPK:VONOY) – Bought 10 shares for €26.35 each:

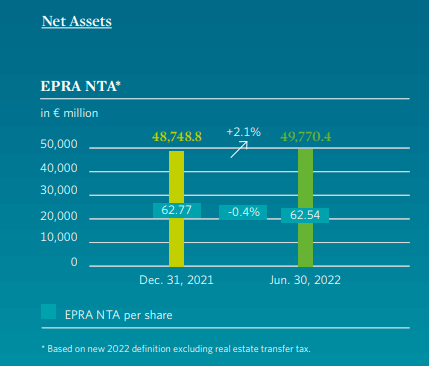

I have been accumulating shares in all my European real estate companies over the past few months. In my opinion, the entire sector is grossly undervalued and the increase in interest rates, in combination with weak economic sentiment does not warrant the current discounts of over 60% on the estimated NTA per share. Keep in mind that Vonovia is the largest listed residential landlord in Germany, owns properties in the largest cities in the country, and has a relatively low LTV of 43.3% (vs 45.3% at the end of 2021). One could argue that this ratio can get worse very quickly if the value of the real estate depreciates very quickly. Even though this is true, we are talking about apartment units in a country where there is a shortage of living space. What is also in favor of Vonovia is that Germany has one of the lowest homeownership rates in Europe with only 50.5% of people owning their home. Therefore, I remain confident that the share price of Vonovia will revert back to the NTA per share value.

Vonovia NTA and NTA per share (H1 report 2022 Vonovia)

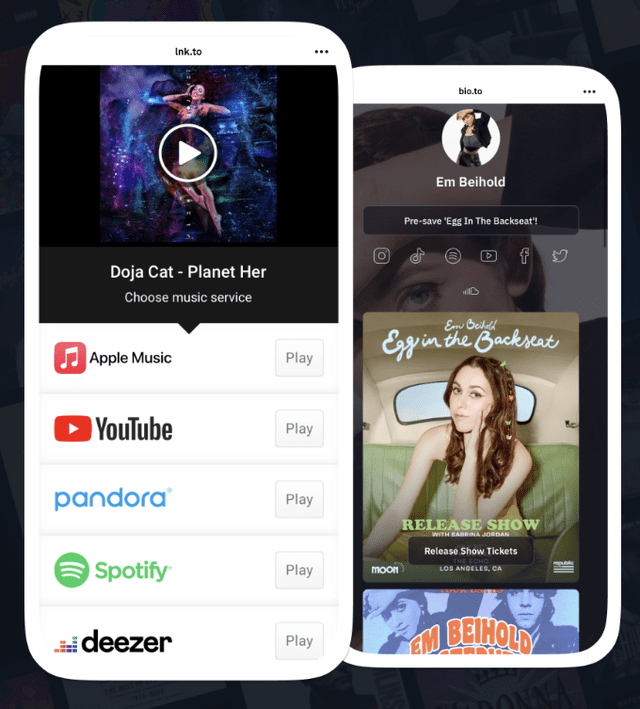

Linkfire – Sold 1,121 shares for 2.505 SEK each:

Approximately a year ago I started a position in Linkfire, a small start-up that is active in the technology sector. The company provides artists with smart links that they can use to direct their fans to their music on the right platform. The company is a market leader in this sector and has had a revenue CAGR of approximately 40% over the past two years. What made me decide to sell is that the company is not expecting to become EBITDA positive soon, if you combine that with the increase in interest rates and the shaky economic environment, the risk outweighs the reward for me.

The Italian Sea Group – Bought 83 shares for €4.82 each:

As I still believe in small firms, I decided to buy a company that has been on my watch list for a couple of months. The Italian Sea group is a manufacturer of yachts for ultra-high net worth individuals. The fact that the company’s customers consist of the ultra-rich and most yachts take a few years to complete, makes the company less risky than other manufacturers of luxury products. The company is working together with some big brands such as Lamborghini and Giorgio Armani, to provide the most luxurious experience for its customers. Talking about Giorgio Armani, the founder, and CEO of Giorgio Armani is also a shareholder in The Italian Sea Group and he owns approximately 5% of the shares outstanding, while Giovanni Costantino, the founder, and CEO of TISG owns over 60% of the shares outstanding.

Technomar for Lamborghini Yacht (Technomar)

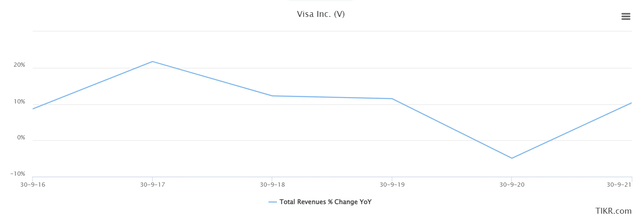

Visa (V) – Bought 1.35 shares for $200.45 each:

Visa is one of the largest payment providers in the world and its industry has a high barrier to entry. For that reason, Visa tends to trade at a premium to its fair value (at least according to my estimations). Taking into consideration the shaky economic environment and the potential increase in competition, if this bill introduced by members of both parties gets through the house, it makes it hard to predict future earnings for Visa. It is hard to say if the bill goes through and/or what the effect on Visa would be. Nevertheless, Visa is a company that has been able to grow its revenue at a CAGR of approximately 10%, and has been buying up smaller companies to get into more sectors of the market such as cryptocurrencies. Therefore, I remain confident in the future of the company and add to my position below my estimated fair value of $226.98.

Visa revenue growth rate (Tikr.com)

Mid/End of September

THG Plc (OTCPK:THGHY) – Sold 179 shares for 0.4002 GBP each:

One of my worst investments ever… I bought THG when it was trading at approximately 5 GBP and have bought all the way down to approximately 1.4 GBP. There are multiple reasons why the stock has fallen which include problems with its governance, unclarity about its exact business model, as well as the reputation of the CEO. Given that the company’s recent performance did not instill new confidence, I decided to take my losses and close this position.

THG’s share price performance (Tikr.com)

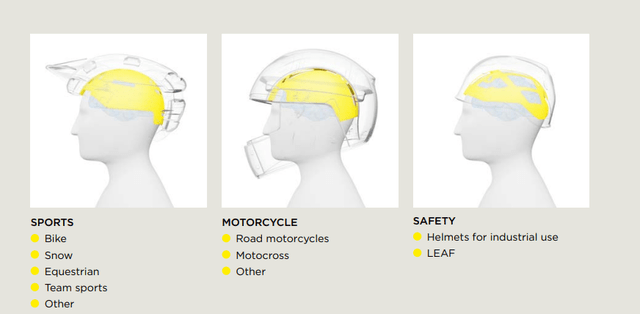

MIPS AB (OTC:MPZAF) (OTCPK:MPZAY) – Bought 8 shares for 339.50 SEK each:

As small firms are, in general, riskier than large firms I decided to replace THG instead of using the proceeds to increase my position in TISG. To replace THG, I started a position in MIPS, which is a market leader in helmet safety and brain protection. The company provides helmet manufacturers with its safety technology which should limit the impact of rotational motion. What it comes down to is that they provide a layer that can be installed in the helmet (such as bike helmets, skiing helmets, and safety helmets). The company is an ingredient brand and outsources the production to helmet manufacturers, lowering costs and increasing its rates of returns. As most people do not want to save money on their safety, the company is relatively defensive and in combination with a low debt rate, made me pull the trigger.

Mips solutions overview (MIPS Annual report 2021)

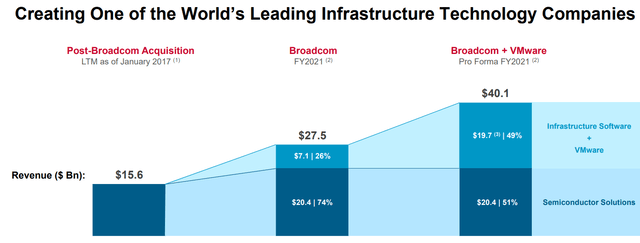

Broadcom (AVGO) – Bought 0.5 shares for $493.96 each:

Broadcom remains one of my smaller DGI positions as it has been trading above my estimated fair value. As investor sentiment is currently weak, the stock has come down from its highs. This gives me the possibility to add more capital to the company. What I like about the company is that it has been growing revenue very fast. The company has done this by making acquisitions at the right time and realizing synergies, while also diversifying its business mix. Using this strategy has been very successful for the company as shown by its revenue CAGR of 15.6% over the past 5 years. If the upcoming acquisition of VMware (VMW) goes through and the company is able to integrate it successfully, I expect the company to continue its rapid growth. If the company is unable to pull off the acquisition, then the upcoming semiconductor boom will still increase the company’s revenue albeit at a slower growth rate. Therefore, I will continue to add to my position below my estimated fair value of $507.25.

Avgo + Broadcom revenue (AVGO investor presentation)

|

Company |

Shares |

Total price |

Effects on dividend pre-tax |

|

Vonovia |

10 |

€263.50 ($257.92) |

€16.40 ($16.05) |

|

Linkfire |

-1,121 |

2808.11 SEK ($252.40) |

$0 |

|

The Italian Sea Group |

83 |

€400.06 ($391.58) |

$0 |

|

Visa |

1.35 |

$270.61 |

$2 |

|

The Hut Group |

-179 |

71.64 GBP ($80.06) |

$0 |

|

Mips AB |

8 |

2,716 SEK ($244.12) |

40 SEK ($3.60) |

|

Broadcom |

0.5 |

$246.98 |

$8.20 |

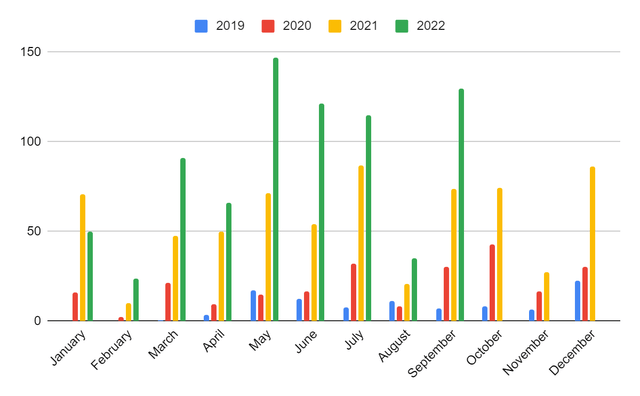

Dividends

In September I received $152.70 in dividends before tax, which is an increase of $66.28 compared to last year (+43.4%). This is the second highest amount I have received in one month and this was partly due to the semi-annual payments of Ahold and CTP. The main reason for the increase compared to last year is the addition of new capital, which will have a more muted impact as the portfolio grows.

|

Company |

Dividend 2021 |

Dividend 2022 |

Difference |

|

Unilever (UN) |

€5.98 ($6.93) |

$0 |

-$6.93 |

|

Reinsurance Group of America (RGA) |

$7.30 |

$0 |

-$7.30 |

|

Visa (V) |

$1.60 |

$3.12 |

$1.52 |

|

Intel (INTC) |

$3.82 |

$7.41 |

$3.59 |

|

Enbridge (ENB) |

$13.50 |

$35.73 |

$22.23 |

|

Interactive Brokers (IBKR) |

$0.11 |

$0.36 |

$0.25 |

|

Prudential Financial (PRU) |

$12.42 |

$25.14 |

$12.72 |

|

Ahold Delhaize (OTCQX:ADRNY) |

€14.19 ($16.45) |

€28.98 ($28.39) |

€14.79 ($11.94) |

|

TJ Maxx (TJX) |

$4.16 |

$7.43 |

$3.27 |

|

3M (MMM) |

$7.40 |

$0 |

-$7.40 |

|

CBOE Global (CBOE) |

$3.84 |

$7.80 |

$3.96 |

|

NETSTREIT (NTST) |

$2.60 |

$14.68 |

$12.08 |

|

L3Harris (LHX) |

$4.08 |

$8.81 |

$4.73 |

|

Brookfield Asset Management (BAM) |

$2.21 |

$5.26 |

$3.05 |

|

CTPNV |

$0 |

€1.98 ($1.94) |

€1.98 ($1.94) |

|

Prosus (OTCPK:PROSY) |

$0 |

€2.38 ($2.33) |

€2.38 ($2.33) |

|

Broadcom |

$0 |

$4.30 |

$4.30 |

|

Total |

$86.42 |

$152.70 |

$66.28 |

In September VICI Properties (VICI) announced that it would raise its dividends by approximately 8%. Vici is my largest position and thus an 8% raise is very nice. My new forward dividend is €1,084.32 ($1082.10) compared to last month my dividend is up slightly over $25, while compared to last year it is up approximately $303 or 40%.

|

Company |

Increase in dividend quarterly |

Dividend per share pre-raise |

Dividend per share post-raise |

|

Vici Properties |

$0.03 |

$0.36 |

$0.39 |

Sector Overview

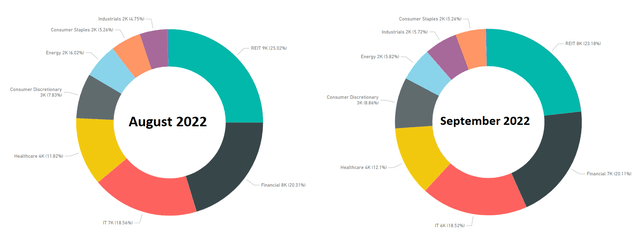

Sector allocation (Author)

Compared to last month we see an increase in industrials and consumer discretionary. The increase was driven by the replacement of THG and Linkfire (replaced with TISG and Mips). What is interesting to see is that even though these companies were classified under IT, the allocation to the sector has been stable, which implies that the IT sector in my portfolio has outperformed the other sectors.

The increase in industrials, and consumer discretionary led to a decrease in my REIT allocation, which was mainly driven by the horrible performance compared to other stocks in my portfolio. I am currently not worried about this as inflation is beneficial to landlords and the recent hikes in interest rates are not enough to offset this It could become a problem in the future but most rental agreements have a clause to hike rates every year, if the rent is adjusted by CPI, real estate companies should profit. Additionally, as mentioned before, there is also a huge shortage in some real estate sectors, which improves the position of the landlord.

Current Holdings

|

Symbol |

Qty Held |

Portfolio % |

Days Since Latest Buy |

|

VICI Properties |

73 |

6.27% |

234 |

|

AbbVie (ABBV) |

16 |

6.01% |

314 |

|

Enbridge |

55 |

5.82% |

327 |

|

Ahold |

72 |

5.26% |

40 |

|

CBOE |

16 |

5.25% |

243 |

|

Prudential Financial |

21 |

5.15% |

65 |

|

Visa |

10 |

4.92% |

25 |

|

L3harris |

8 |

4.69% |

248 |

|

Morgan Stanley (MS) |

20 |

4.62% |

62 |

|

TJX |

25 |

4.49% |

171 |

|

Brookfield Asset Management |

38 |

4.41% |

62 |

|

Vonovia |

65 |

4.04% |

31 |

|

CTPNV |

134 |

3.96% |

76 |

|

Broadcom |

3 |

3.88% |

12 |

|

Netstreit |

73 |

3.75% |

67 |

|

Inditex (OTCPK:IDEXY)(OTCPK:IDEXF) |

62 |

3.69% |

62 |

|

CVS Health (CVS) |

13 |

3.64% |

249 |

|

Prosus |

23 |

3.47% |

139 |

|

Aroundtown (OTCPK:AANNF) |

458 |

2.89% |

93 |

|

Armada Hoffler (AHH) |

86 |

2.56% |

68 |

|

Fresenius&CO KGAA (OTCPK:FSNUF) |

40 |

2.45% |

184 |

|

CoreCard (CCRD) |

29 |

1.78% |

184 |

|

CareCloud (MTBC) |

126 |

1.51% |

139 |

|

Intel Corporation |

20 |

1.50% |

248 |

|

StoneCo (STNE) |

53 |

1.44% |

79 |

|

TISG |

83 |

1.04% |

27 |

|

Mips AB |

8 |

0.68% |

12 |

|

Interactive brokers |

4 |

0.67% |

138 |

|

Tezos (XTZ-USD) |

50 |

0.20% |

584 |

|

Hedera Hashgraph (HBAR-USD) |

680 |

0.11% |

556 |

|

Bitcoin (BTC-USD) |

0 |

0.08% |

556 |

|

Binance (BNB-USD) |

0 |

0.02% |

584 |

Going Forward

During October I expect to add another €1,000 to my portfolio, which is in line with my average this year. I expect to add approximately 50% of the cash to European stocks and 50% to US stocks. However, the second highly depends on the development of the EURUSD FX rate. The stocks/sectors I am looking to add to are the following:

European real estate

I could basically write the same as last month. Companies in the European real estate sector are currently trading at a considerable discount to NAV and even though the economic environment is shaky, this does not warrant companies trading at 1/3rd of NTA. The companies that I invest in (Aroundtown, CTPNV, Vonovia) are relatively strong compared to some other companies in the sector.

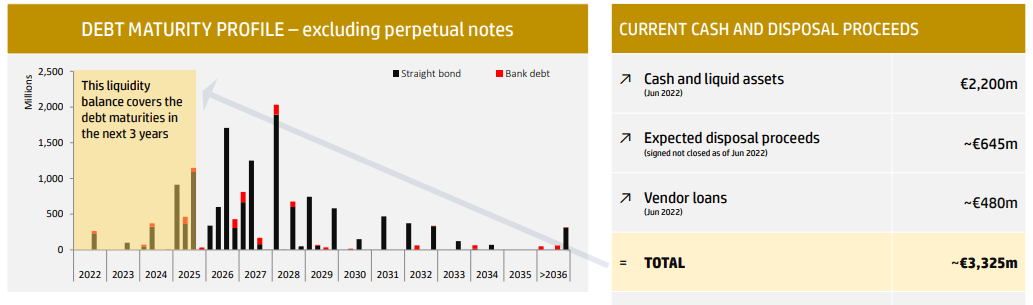

Aroundtown is a differentiated real estate owner that owns both residential and commercial properties. The company is trading at almost 25% of its NTA estimate. The company is still selling non-core properties above book value, can cover debt maturities with its current liquidity till 2025, and has been buying back shares. I recently wrote a more in-depth article about the company that you can find here.

Debt coverage Aroundtown (H1 2022 report)

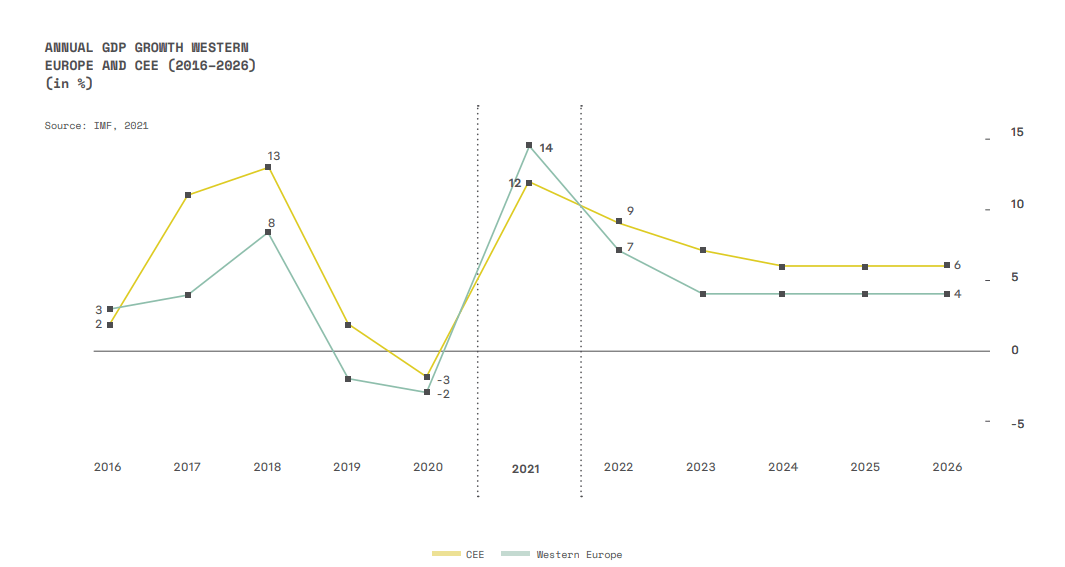

CTPNV is the largest logistics real estate owner in the CEE (Central Eastern Europe) region. The company’s largest markets are Romania and Poland, but it has properties in most major countries from the Black Sea to the North Sea. Even though this region is slightly riskier, the growth forecasts are also better than for Western Europe.

GDP growth rates Western Europe vs CEE (IMF)

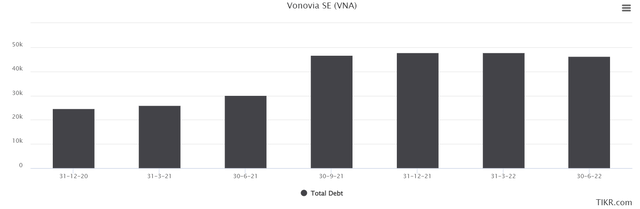

Vonovia is the largest residential landlord in Europe and owns properties in Germany, Sweden, and Austria. As mentioned before Germany has one of the lowest homeownership rates in the European Union and also has a huge shortage. This gives Vonovia a strong position. Nevertheless, the company trades at approximately 1/3rd of its fair value, while it has been focusing on decreasing its debt by selling new developments.

Vonovia’s total debt, note that the increase in debt during Q3 of 2021 is due to the acquisition of Deutsche Wohnen (Tikr.com)

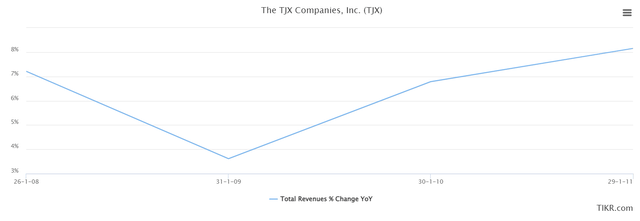

TJX

As prices rise, consumers are left with a lower disposable income. One way to lower your costs is to do your shopping at discount stores such as TJX. The company offers brand products at bargain-basement prices. This does not mean that TJX will do well in the current environment. The company’s products aren’t necessities by any means, but it will do well compared to the overall sector. What strengthens my conviction is that the company was also able to increase its revenue during the great financial crisis. Therefore, if I am able to buy shares around or below my estimated fair value of $66.48 I will add to my position.

Revenue growth during GFC (Tikr.com)

L3Harris

L3Harris is a company that I also expect to do well in the coming years. The war between Ukraine and Russia continues and even if the countries come to some sort of peace agreement, I expect an increase in spending on defense in the coming years as NATO members have increased their pledges since the invasion. The war between Ukraine and Russia has shown to a lot of nations that it is important to have a good defense system in place because you can never fully predict the actions of other countries/governments. Additionally, the company’s valuation has come down considerably over the past few weeks and that means it is trading below my estimated fair value of $230.68.

Growth defense expenditures NATO (NATO)

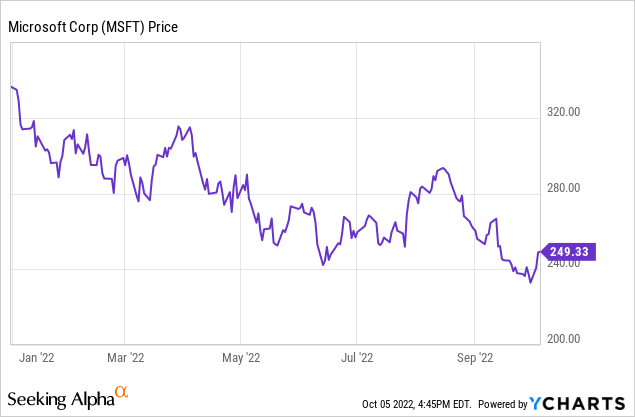

Microsoft (MSFT)

A company that I currently have no position in but that is very interesting to me is Microsoft. The company is one of the largest technology companies in the world, is still growing its revenue, and continues to find new segments to prolong its stellar growth. The subsequent growth in free cash flow is partly returned to its shareholders, while the remainder is being reinvested in the business at an ROIC of 26.09%. With the share price down over 25% YTD, the company has finally come close to my buy territory. If the company does hit my buy below price I will initiate a position and most likely build it out over the coming months.

Conclusion

In September the bear market continued, and with a shaky economic environment and a hawkish Fed I don’t expect this to change any time soon. As I find it hard to time the market I’d rather stay invested and regularly add to my positions.

In September I received approximately $150 in dividends, which was up approximately $65 compared to last year. My forward dividend at the end of August was $1,080, which is up over $400 compared to last year’s September.

I hope you enjoyed the update about my progress, and I would love to hear your thoughts on my portfolio and what you would like to see in future updates.

Be the first to comment