Andy Andrews/DigitalVision via Getty Images

As I write this over Thanksgiving weekend, I can’t help but count dividend growth investing amongst my many blessings. You see, I spent a decade floundering around without a strategy that really hit home. Like many during the dotcom era, I was up big on paper, only to lose it all in the crash. And then, just when I thought I was getting ahead in 2008, along came the Great Recession. Investing appeared to be one giant cycle of two steps forward and one step back.

But, out of my failures, I learned what I really wanted to get out of investing. The concept of building a portfolio up to some arbitrary number never really resonated with me. What I truly wanted was to replace my income from work with investment income. I had no idea what dollar value I would need to save to retire, but I did know the number it costs me to live. My goal became about generating enough income from my investments to cover my expenses.

One of the most motivating pieces of dividend growth investing is being able to measure how I am doing at any given time. Unlike planning to sell shares to generate income, dividends are consistent and not tied to the portfolio value. On any day, I know the exact income my portfolio generates.

The second very appealing aspect of dividend growth investing is the fantastic consistency of income growth. With reasonable certainty, my income will grow by 10% yearly as long as I invest in solid companies with long histories of dividend growth. I demonstrated this fact in this article, which still holds today. I can’t imagine trying to generate income from selling shares into a down market.

Today, I sleep well at night, knowing my income is consistently growing and I am on my way to meeting my goals. I am excited to see what the upcoming year is going to bring!

How is 2022 Finishing up?

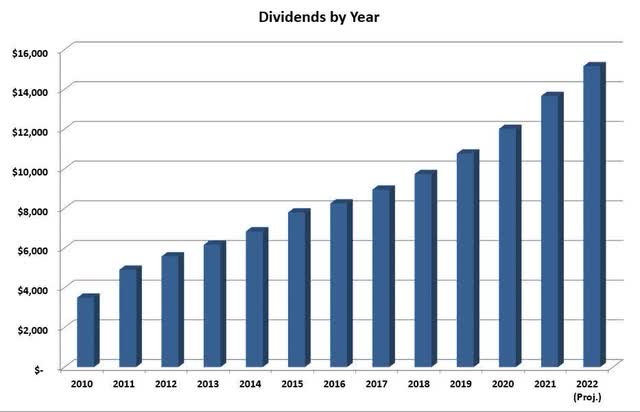

This year is looking to be a massive one for dividend growth. My current estimate is $15,545 in income, an increase of 13.8% over last year. This smashes my goal of 10% income growth. In fact, the fourth quarter is looking to be the first quarter exceeding $4,000 in income. It’s always nice to see round numbers fall. Below is a chart of the distributions collected by year. It’s important to know that this portfolio has been closed to new capital since 2016, so all income growth is organic.

While I don’t have any goals around total return, I know many readers are interested. Through the end of November, the portfolio’s total return is -1.4%, crushing the total return of the S&P 500.

November’s Dividend Increases

- Last month’s report came out a little later than usual, and the increases were all announced early in the month. For this reason, last month’s report included November’s raises. So, I will briefly recap them here:

- On November 7th, Aflac (AFL) announced a 5% increase in the dividend. While this is well below the last two raises of 21% and 18%, it wasn’t unexpected.

- Automatic Data Processing (ADP) announced a whopping 20% increase on November 9th! This was well ahead of my double-digit projection and above its 5-yr and 10-yr growth rates of about 10%.

- Early in the month, Snap-on (SNA) announced a 14% increase, nearly matching its 3, 5, and 10-year growth rates. This surprised me as I expected a more conservative number following the cratering of Stanley Black & Decker’s (SWK) earnings.

- Diamond Hill Investment Group (DHIL) announced its annual special dividend at $4 a share. A bit disappointing but not unexpected. As an asset manager, their earnings move with the market. This is a micro, speculative position in the portfolio.

December’s Expected Increases

Increases at the end of the year largely take effect in the first quarter of the following year. The one exception to this (in this portfolio) is Broadcom (AVGO). It was just 2020 when I was waiting for the AVGO announcement to see if I would break $12,000 in income for the year. Unfortunately, no such milestones are on the line this year.

Broadcom

Broadcom is an average size position at 2.5% and accounts for a proportionate amount of income at about 2.6%. This company has been a dividend growth superstar, having 5-year and 10-year dividend growth rates above 40%. However, this has primarily come by massively increasing the payout ratio.

The payout ratio has expanded from the high teens in 2016 to the mid-forties today. This payout growth rate isn’t sustainable, and in recent years, they have begun matching the dividend increases to earnings growth. This year very easily could be a mid-teens increase; however, given the expectations for the chip sector, they may opt to look ahead and be conservative. So far, we have seen very few companies take the conservative route.

CVS Health (CVS)

Last year, after a multi-year hiatus, CVS began raising the dividend again. I was glad to see the increases start again, but I was equally pleased they had frozen the distribution to pay down debt. Something I wish more companies would do.

Last year, CVS rewarded shareholders with a 10% raise. They could easily afford to do this again this year, but I expect only half that at 5%. CVS has been in the portfolio since 2018 and is a small position at about 1%.

Fortune Brands Home & Security (FBHS)

Fortune Brands entered the portfolio late this year as part of a basket of companies purchased to replace the Apple (AAPL) shares that were called away. FBHS was the weakest of the replacement positions but significantly undervalued.

The company has a ten-year dividend growth history and a 5-year dividend growth rate of about 10%. Notably, the company has maintained a payout ratio of under 25%, which has been falling in recent years. I think a 10% raise is likely this year, although the spin-off of the cabinet division could muddy things.

CME Group (CME) Special Dividend

Another company that I added along with FBHS was CME Group. In addition to its twelve years of dividend growth, the company also pays an annual special dividend. Over the past ten years, the special dividend has ranged from $1.30 to $3.50 per share. Last year came in at $3.25. An off-the-cuff projection puts the distribution between $2 and $3 this year.

Along with DHIL, CME becomes the second company paying a regular special dividend to the portfolio. I am still deciding how to incorporate these into my forward projections. Most likely, I will just use a conservative number.

Sales in November

This year has been an unusual one for sales. Before this year, there had been twenty-six sales over twelve years. Of these twenty-six sales, only two were due to acquisitions. This year, there have been five sales, two of which were to acquisitions.

The volatility in the market this year has offered an opportunity to evaluate positions closely for better alternatives, although two of the sales were due to acquisitions. Both Preferred Apartments and STORE Capital (STOR) were acquired. (Or in the process of being acquired for STOR.) Annaly Capital (NLY) was sold in March as part of a regular review as it is an income destroyer, meaning the longer you hold it, the less income you collect. Apple was trimmed in August as I had sold covered calls on its relative overvaluation. And finally, this last month, I closed my Healthcare Services Group (HCSG) position.

Healthcare Services Group

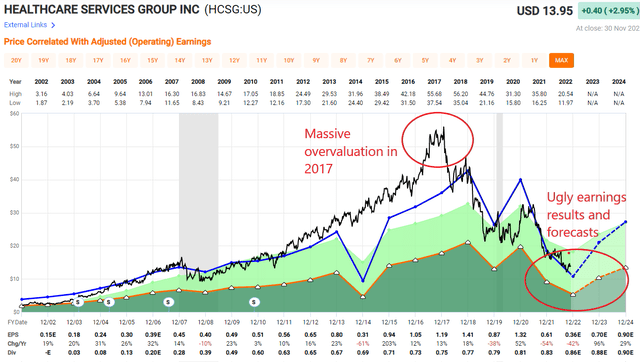

HCSG has been in the portfolio since 2011. The company is unique in that it raises the dividend every quarter, albeit by a fraction of a penny. In 2017, I sold a third of this position based on overvaluation. In hindsight, I should have closed the position then, as it has fallen from an all-time high of nearly $55 to about $14 today. In fact, the shares sold in November were at a slight loss to the original purchase price in 2011, which is incredible considering the huge run in the stock market since then.

I reviewed HCSG in early 2021 as a potential sale. I cited its strong cash flow growth, cash position, and low debt as reasons for keeping the company. While it still has essentially no debt, its earnings have been abysmal, the cash position has weakened, and the company still looks to have a while to recover to 2020 profit levels. These factors, coupled with the meager dividend growth and being a micro position, made selling the right choice. Below is a Fastgraph of the company, showing its massive run-up in price and earnings collapse in recent years.

fastgraphs.com w/comments from Wyo Investments

Purchases in November

I make two types of purchases: Regular purchases, which are reinvested dividends, and purchases to replace sold shares. I emphasize bargain purchases with reinvested dividends, whereas replacement purchases are more about replacing the income with higher quality and better dividend growth. Currently, the portfolio is at the highest cash position it has been since entering 2020.

Replacement Purchases

During the month, I fully reinvested the proceeds from the HCSG sale. Nearly any company in the dividend growth universe would offer similar to better quality than HCSG at a higher dividend growth rate.

Most of the HCSG funds were invested in Simon Property Group (SPG). SPG is a high-yield position in the portfolio and makes up slightly more than 1% of the portfolio. I had the misfortune of adding SPG right before the pandemic and am still underwater on my shares. While the company cut its distribution during the pandemic, it has raised the dividend multiple times since and is a solid company.

The remaining funds from the sale were placed into a basket of Realty Income (O), National Retail Properties (NNN), and Enterprise Products Partners (EPD). These are high-yield positions in the portfolio but offer better dividend growth than HCSG.

Regular Purchases

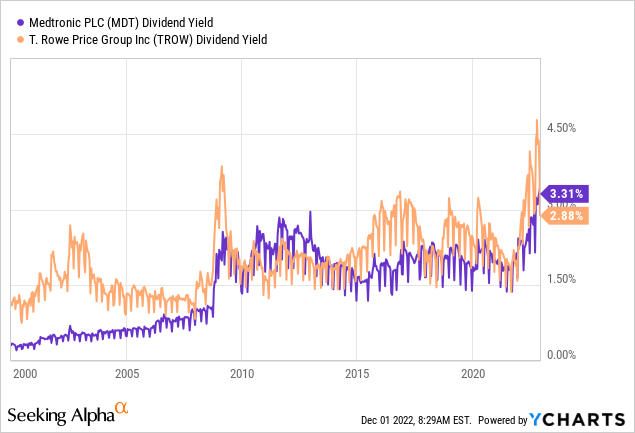

The market took off at the end of October and continued shooting higher in November. Many dividend growth stocks are closer to their 2021 prices than the lows of October. I am mostly content to collect dividends for the moment and watch what happens. I made a single purchase last month of one share of Medtronic as it made new lows at $77.53.

What Else Am I Watching?

Since this is a closed portfolio, I can only buy some of the companies that look interesting. I use this section to cover what I purchase and consider in my other portfolios. My other portfolios have different goals and rules but are also dividend growth portfolios.

It’s hard to get excited about anything in the market right now. Companies have bounced hard off the October lows. However, there are still many buys in a historical context. I am not buying anything but my small daily purchases of Schwab U.S. Dividend Equity ETF (SCHD) at this time, but below are some areas that are still showing up on my radar.

Verizon (VZ), Comcast (CMCSA), and Nexstar (NXST) continue to offer yields at the higher end of their historical averages. While these companies are not precisely in the same industries, they rhyme. Most companies in these areas are decent bargains right now.

Many specialty retailers like Tractor Supply Company (TSCO), Best Buy (BBY), and Lowe’s (LOW) are still coming up as bargains based on yield. However, if you believe we are heading towards a recession, specialty retailers should offer better starting yields in the future.

Semis have bounced hard in the last month. However, the two I mainly follow, Broadcom and Texas Instruments (TXN), still offer great starting yields.

Based on deviance from historical norms, Medtronic (MDT) and T. Rowe Price (TROW) still show up as the best available bargains from the companies I follow. With their extremely long dividend growth histories and low debt, a long-term investor can hold through a couple of weak years.

On the low-end side of the yield spectrum, Visa has rarely offered a 0.7% yield, so its yield today of 0.85% is well in the bargain area. Mostly this is because of its massive dividend increase last month. However, it is trading close to its average PE ratio of 27. In a recession, we could see a much better price. From 2010 to 2014, the company regularly commanded a PE of 15-20 while growing faster than today.

Final Thoughts

Even as this portfolio approaches breakeven for the year, I can’t help but feel the strong market is an illusion. There are too many warning signs in the economy and the world. However, I also know that the economy isn’t the market. But, given the yield on treasuries today, the yield on stocks seems way too low.

I’m not sold on the market right now. However, I remember feeling the same way in 2011, 2012, and 2013; compared to the market lows of 2009, everything looked expensive. In hindsight, those years were absolute bargains!

On the other hand, I am confident that I have systems that better identify bargains in the market today. And, while some decent prices are available, no great deals are screaming for me to buy them.

I have decided to be patient. After all, even when the market is at record highs, relative bargains are always found. Something will come along that gets my attention. That is one of the truths of dividend growth investing; you don’t have to be perfect to succeed.

Next month, I will be skipping the December update and instead will be doing a 2022 recap. This will be followed up by a 2023 preview, where I will cover more details of the portfolio including changes over the years, breakdown by sectors, and what I am targeting for the upcoming year. Happy holidays everyone!

Be the first to comment