buzbuzzer

The following segment was excerpted from this fund letter.

Murphy USA, Inc. (NYSE:MUSA)

We currently hold an approximately 3.5% position in Murphy USA, Inc., and wanted to tell you more about this portfolio holding. This section was written by our intern Tin Nguyen, who is a junior at the University of Texas at Austin, with light edits by me.

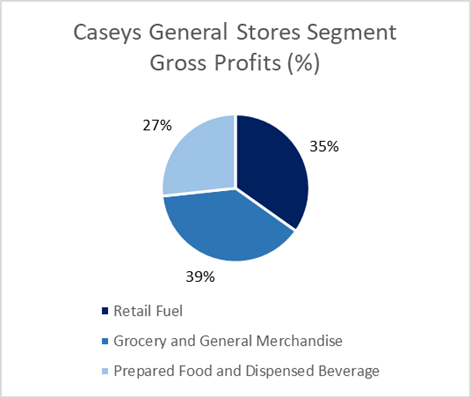

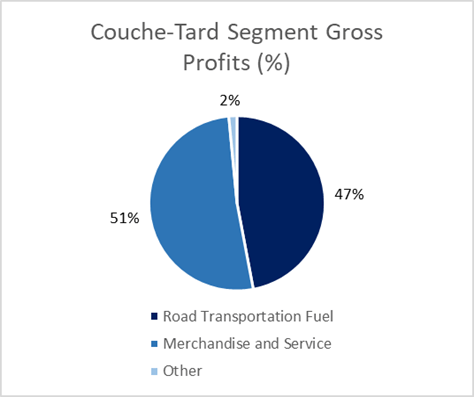

Murphy USA is a fuel marketer, operating both gas stations and wholesale fuel distribution. The company also has a merchandise business segment where they sell typical convenience store items such as tobacco, energy drinks, and snacks. However, unlike many convenience stores, or C-Stores, the bulk of their gross profit comes from their retail fuel segment. In FY 2021, Murphy USA’s fuel contribution made up 62% of their gross profit while only 38% came from their merchandise contribution1. By comparison, competitors such as CASY and Couche-Tard (OTCPK:ANCUF, Circle K, pictured on the right) derive roughly 65% and 51% of their gross profit from convenience store sales and only 35 % and 47% from fuel, respectively.2,3

Murphy USA became public in 2013 after Murphy Oil spun off its downstream energy business. The company primarily operates a kiosk model, or a C-store with low square footage dedicated to the store, many times only having 400 square feet of store area. By comparison, a typical Casey Store is 2,450 sq ft. for their larger store designs and 1,350 sq ft. for the rest of their smaller store designs4. Historically, Murphy USA has had a partnership with Walmart (WMT) where the majority of their Murphy USA branded stores are located in Walmart parking lots, with Murphy USA owning the underlying real estate.

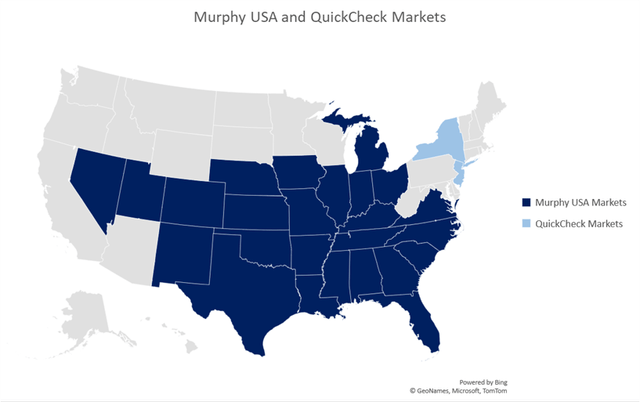

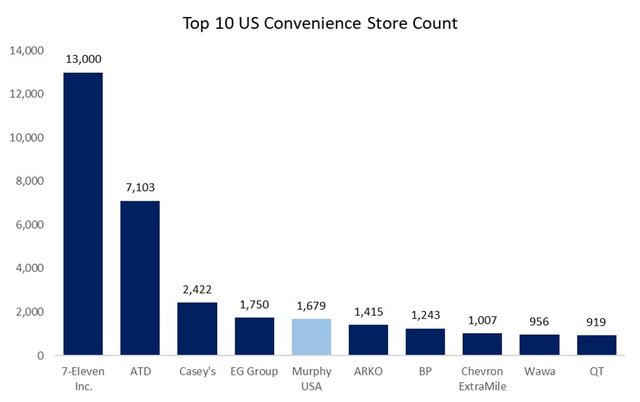

The company operates primarily in the Southeast, Southwest, and Midwest of the United States, and is one of the largest C-store chains by store count in the US.

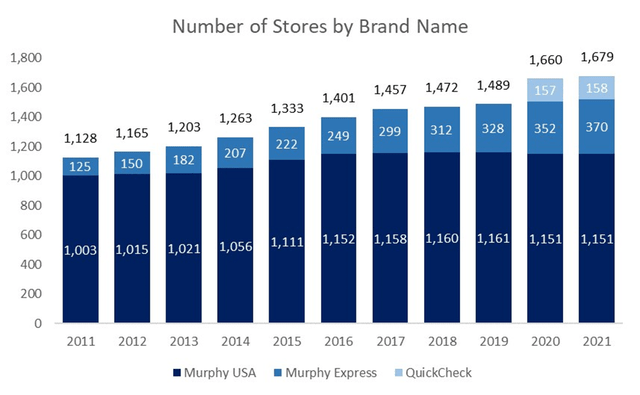

As of December 31, 2021, Murphy USA had 1,679 stores, which were split into three different brand names: Murphy USA with 1,151 stores, Murphy Express with 370 stores, and QuickChek with 158 stores. The Murphy USA brand has the most store locations and is nearly all located near Walmart stores as mentioned. Murphy Express refers to its independent standalone stores. They also operate more traditional, larger C- stores with a fuel retail segment under the brand name QuickChek, which they acquired in early 2021, and which are located in New Jersey and New York.

Murphy USA operates a low-margin, high-volume retail model rather than focusing on the merchandise segment like many C-Stores. Their unique business strategy has led them to great success in many different economic environments.

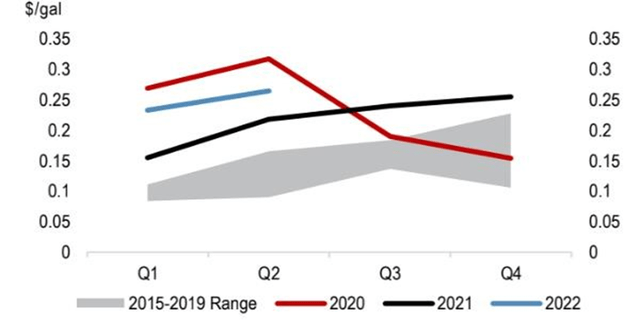

MUSA Retail Fuel Margin

For example, during the COVID pandemic, fuel volumes across the industry dropped sharply. MUSA was able to offset this drop in volumes through gains in its fuel margins, which increased to ~23c/gal up from ~14c/gal from 2017-2019. This heightened level of fuel margins has remained higher than in previous years even as fuel volumes recovered. We expect retail fuel margins to remain high in the United States due to tight refining capacity, some of which gets captured by the retailers. Given the hostility of the current US administration to the oil & gas industry, we do not expect large amounts of new investment in the oil & gas sector in the near term. This in turn should keep margins high for incumbents.

From before the pandemic, during the pandemic, and even in today’s environment of high inflation and uncertainty, Murphy USA has been able to grow free cash flows despite rising fixed costs in the industry and volatile crude oil prices. We see Murphy USA as a strong long-term investment, with a management team dedicated to returning capital to shareholders, diversified growth opportunities, and proven resilience in the face of uncertain economic conditions.

The C-Store and Retail Fuel Industry

The convenience store, or C-store, and retail fuel industry in the United States is fragmented, consisting of a large number of companies that each control a small portion of the total market. According to the National Association of Convenience Stores, or NACS, in the United States in 2022, there were 148,026 C-stores, of which, 116,641 sell fuel. And of this number, about 95% of them are owned by independent companies rather than large, major oil companies. However, in more recent years, the industry has been consolidating as the number of single-store operators continues to drop. In 2021, about 55% of the C-stores that sell fuel are single-store operators, which has declined from about 63% of single-store operators in 2017.7

While the major oil companies only own a small portion of the number of US C-stores, about half of the fueling sites in the US carry a major oil company’s brand, such as Chevron (CVX), Exxon (XOM), or Shell (SHEL). Usually, single-store operators have fuel supply agreements and licenses with refiners or distributors that market fuel from major oil companies. The rest of the outlets solely carry unbranded fuel. The main difference between unbranded fuel and branded fuel is that branded fuel contains additives such as antioxidants and detergents. All fuels sold to consumers, however, must meet federal and state regulations, so it already has a set number of additives added, but just not an additional number of additives like branded products. For this reason, branded fuel products usually sell at a small premium to stores of about 5 to 15 cents per gallon compared to unbranded products. Murphy USA gets both branded fuel and unbranded supply from numerous sources, including almost all major oil companies that operate in the US, independent refiners, and other marketers.

There is an overlap between fuel distributor companies and C-store chains, though not always. Many companies that do business within the C-store industry also have operations in fuel distribution too, and Murphy USA is no different. The company sells fuel to retail customers at their C-stores and sells fuel to other dealers. These companies act as marketers for fuel products from upstream sources including major branded fuel from large companies like Chevron and Shell or from independent refiners. They transport fuel from terminal locations, where the fuel is temporarily stored, to the final location where it is then dealt to retail customers. And as C-store operators, they operate within the physical store.

There are multiple types and combinations of C-store ownership and operation structures within the industry, but the details of these structures are more important for companies that deal more with wholesale fuel distribution. Murphy USA operates all their locations, so the only factor left to analyze is the company’s real estate ownership, where they can choose to either rent the property or purchase the real estate. Rent expense is usually a large part of a company’s operating expenses, and built-in lease modifiers can vary the amount of rent a company pays on the lease as interest rates change. However, Murphy USA is able to avoid most of the complications that come with this since a large proportion of the company’s total stores are Company-owned. As of December 31, 2021, 77% of Murphy USA’s stores are Company-owned, meaning they do not incur any rent expense on these properties.8

Competitive Landscape and Consolidation

By nature of the business, most of the costs are variable, like gasoline and the physical merchandise within the store. As mentioned before, the C-store industry is highly fragmented. Of the roughly 150k C-stores in the US, the top 10 largest C-store companies by count make up only about 31,000 stores or about 20% of the total market share. The C-store business does not have high barriers to entry, but we believe it has a high barrier to success and consistent profitability. If an individual wanted to, they could rent a C-store site and set up a fuel supply agreement with a distributor, and simply operate the inside for not much upfront cost if they rent. This is why 55% of C-stores in the United States are single-store owners.

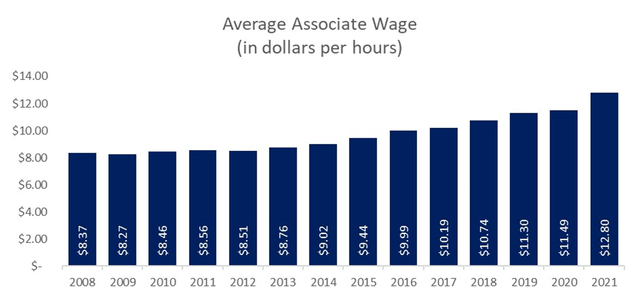

Despite high variable costs and low upfront costs, however, the industry has been consolidating for years now, as large companies are better able to handle what has generally been a trend of rising fixed costs. Companies with large operations can do much better than independent store owners due to economies of scale. We believe that the larger the business, the more negotiating power they have over fuel prices from suppliers, and they have an option to offer a loyalty program to increase customer loyalty. Single-store operators could never have that option. Furthermore, we believe that as the fixed costs of operating in the industry continue to rise (primarily rent and labor expenses), industry consolidation will continue.

Revenue Sources – Marketing and Merchandise

There are two main sources of revenue for C-stores in general: fuel sales and in-store sales, also known as “inside sales”. Or using Murphy USA’s terminology: marketing and merchandise. Starting off with Murphy USA’s marketing segment, they split their petroleum sales into retail petroleum sales and wholesale petroleum sales, the former making the majority of their total marketing segment sales. The retail segment refers to the direct selling of fuel to retail customers at the pump. They also market to other fuel dealers through their wholesale segment, where they distribute them through a combination of Company-owned and third-party terminals.

General C-store inside products includes items such as ice, beverages, tobacco products, prepared foods, and snacks that all yield much higher margins than fuel. For this reason, the majority of C-stores use their fuel retail segment as a means to attract customers into the store, where they can reap much higher margins when the customers go inside. Contrary to the typical convenience stores that look to have small fuel profit margins but strong inside profit margins, Murphy USA does not make as much profit from this segment as their marketing segment. In FY 2021, their merchandise sales made up only 21% of their total sales, however, like other C-stores, merchandise still had a much higher margin at 19% compared to petroleum’s margin of only 6.5%.11

The largest driver of C-store inside sales are cigarettes and other tobacco products. These products are sold overwhelmingly at C-stores. Around 88% of all cigarettes and 95% of all other tobacco products sold in the United States are sold through the C-store channel.12 Unsurprisingly, Murphy USA’s largest merchandise segment sales were tobacco and other tobacco product sales.

Proximity to Walmart and Murphy Drive Rewards

One of Murphy USA’s greatest strengths is its proximity to Walmart stores which allows them to bring consistent, high-volume traffic indirectly to Murphy USA locations. They are also on Walmart+’s discounted fuel program, which includes a fuel discount on gas stations including Murphy USA and Murphy Express locations. The Company also offers Murphy Drive Rewards, a loyalty program that offers a discounted price on fuel and occasional deals on snacks and drinks based on how many gallons of gas the customer buys. They have about 100,000 customers who are a part of their Murphy Drive Rewards program.

Inflation and Volatility Pressures

In the current economic environment, there has been broad inflation across all parts of the economy. Wages have increased, oil prices are volatile, and in an attempt to control inflation, the Federal Reserve has conducted several interest rates hikes that are expected to last until the end of the current year. With higher interest rates, leases can become more costly. All of these rising cost pressures put heavy costs on C-stores that have a high number of employees, and those that lease their property. Murphy USA mitigates the rising cost pressures well compared to other C-stores because the company owns the majority of its stores and operates primarily smaller store formats which require less staff.

Consumers are very sensitive to price changes on the upside and less so when prices are comparatively lower. As noted by Andrew Clyde, Murphy USA’s CEO during their 2022 2nd quarter earnings call: “consumers just aren’t as price-sensitive on the margin when prices get lower. As long as we’re in a higher price environment and their paychecks are impacted by inflation across everything that they buy, it’s a great environment to gain those customers and create stickiness.”13 Because of Murphy USA’s unique business model, during high price environments and volatility, Murphy USA is able to sell their fuel at lower prices than their competitors, which has a greater effect when customers get more price conscious.

The current economic environment is uncertain, with many feeling like a recession is imminent, but there is historical evidence of Murphy USA’s success during such uncertain conditions. Throughout fiscal years 2019, 2020, and 2021, Murphy USA has increased gross profit and net income in all three years despite taking a significant hit on top-line volumes due to the pandemic when people drove much less.

The company’s kiosk model, a high proportion of store ownership, and reliable customer traffic all allow Murphy USA to reduce operating costs and mitigate the threat of macroeconomic conditions like higher interest rates or recessions, and ultimately offer lower gas prices compared to competitors. During times of uncertainty, high gas prices, and higher consumer price elasticity, Murphy USA is able to offer comparatively cheap fuel without needing to widen margins as much as single-store operators on fuel since they have such high volume. This being said, the Company was still able to increase fuel margins to much higher levels than before COVID and bring in record profits on their fuel segment.

Murphy USA’s performance during the pandemic is a strong indicator of the robustness of the company’s business model.

QuickChek

On January 29, 2021, the Company acquired QuickChek, a New Jersey gas station chain with 156 stores, as a means to expand its operations into the Northeast. QuickChek operates with a more traditional C-store model with larger stores than the rest of Murphy USA. QuickChek offers traditional C-store inside products with higher margins like food and beverages. QuickChek’s stores are much larger than Murphy USA and Murphy Express branded stores, where the “New-to-Industry” (NTI) locations average between 5,000 to 7,000 square feet in size. This has been Murphy USA’s only acquisition since it was spun-off from Murphy Oil in 2013.

Debt Levels and Sale Leasebacks

Murphy USA has kept a stable level of debt. Their Total Debt / LTM EBITDA ratio was around 2.2, which is a healthy level. For comparison, competitors had a slightly lower ratio: Couche Tard has a ratio around 1.8 and Casy’s ratio is about 2.0.15 But what isn’t reflected on MUSA’s balance sheets is the current valuation of the land they own. As mentioned before, as of December 31, 2021, The Company owns about 77% of their stores, a significant amount. A lot of these properties were purchased long ago for prices much cheaper than what they are worth today. There is significant value in their land and potential possibility for Murphy USA to conduct several sale-leasebacks to unlock significant amounts of cash to buy back shares.

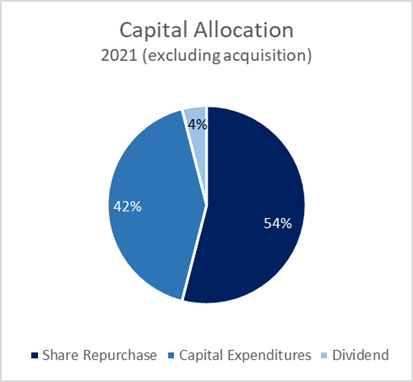

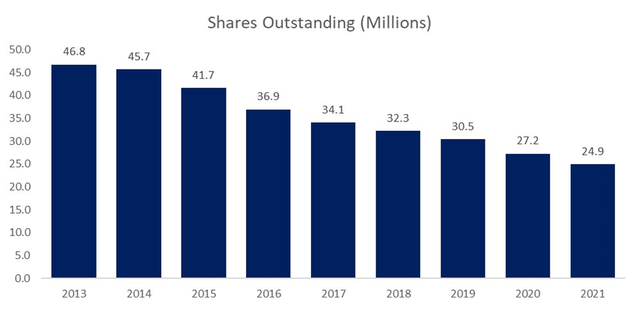

Capital Allocation16

Capital investments within their marketing segment are largely devoted to acquiring land and the construction of new stores. A small amount of their total capital expenditures is put toward sustaining their current stores. Outside of capex, Murphy USA spends a significant amount of capital on share buybacks. Excluding the acquisition of QuickChek, in FY 2021, they spent more than half of their capital on share buybacks. And this pattern extends to past years too. Since going public in 2013, they have repurchased 23.4 million shares out of its 46.7 million issued. In their latest earning call, Andrew Clyde stated that “share repurchase continues to be [their] preferred use of free cash flow”, and management is clear that they want to continue buying back shares rather than most M&A opportunities that they view as inferior to their existing network given the premium, they would have to pay to acquire them.17

Tobacco Legislation Risk

There is a potential risk of future legislation against the tobacco industry. There has already been legislation in the past in 2019 when the government raised the federal minimum age for the sale of tobacco products for people aged 18 to 21 years. And more recently too in June, the FDA stopped Juul from selling and distributing its products. Tobacco makes a significant portion of C-stores’ inside sales, and Murphy USA is no exception even if they have a smaller merchandise segment.

Future Industry Outlook & EV Adoption

A threat to the C-store industry is the gradual adoption of mainly electric vehicles rather than gas vehicles. In general, cars are becoming more efficient, and electric vehicles have become more and more popular. However, we believe that the transition to electric vehicles on a substantial scale is much further away than many believe. For widespread adoption, the prices and insurance costs for EVs need to decline substantially, something that appears very far on the horizon especially given the recent dramatic increases in the price of lithium.

Today, the leading country for electric vehicle adoption is Norway. In 2020, there were 81 EVs per 1,000 people in Norway, more than twice as much as the following country, Iceland, with only 37 EVs per 1,000 people.19 But this widespread adoption within the country has not been a result of pure free market forces. The country has reached this level largely due to numerous government initiatives put in place to reduce the cost and increase the convenience of owning an electric vehicle. The Norwegian government placed a goal that all new cars sold by 2025 will be zero emission vehicles (either battery electric or hydrogen). Initiatives for EVs such as higher taxes for high emission cars and lower taxes for EVs, no charges on toll roads, access to bus lanes, and free municipal parking have given drivers high incentives to switch to EVs. Norway has also invested in building a charging infrastructure across the country. For quicker widespread adoption, more countries would need to implement legislation as aggressive as Norway’s incentives, something we do not see as likely.

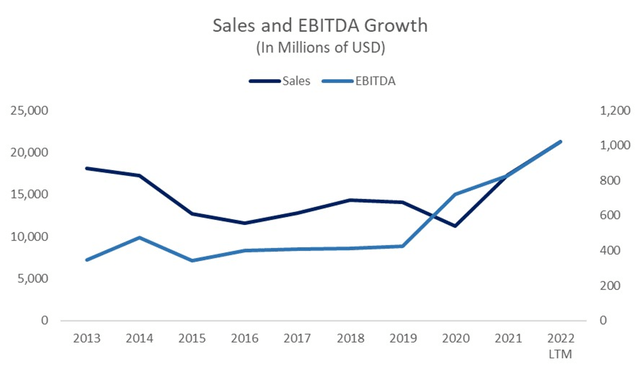

Sales and EBITDA Growth

Murphy USA’s revenue has fluctuated since the Company went public, growing only at a 1.8% CAGR over the last 9 years. In comparison, the Company’s EBITDA has substantially increased, growing at a 12.8% CAGR from $347 million to $1.02 billion in the last twelve months ending in June 2022. Long term fuel margins remain the key driver to the company’s profitability, and we expect them to stay elevated in the years ahead.

Conclusion

In a landscape where new businesses in emerging industries are constantly pushed to innovate, invent, and change themselves in order to survive, the gas station business has innovated in its own ways too, but the fundamental operations have remained simple. Likewise, value in investing doesn’t necessarily come from the companies with the most growth potential in the most exciting industries. Even within a “declining” or flat industry, value can still be found. Retail fuel has played and will continue to play a critical role in maintaining the integrity of the transportation ecosystem. We see Murphy USA as a particularly strong long-term investment within the retail fuel industry. With a management team dedicated to returning capital to shareholders, diversified growth opportunities through its acquisitions, and tested resilience in the face of uncertain economic conditions, Murphy USA remains one of our favorite investments.

Disclaimer and Contact InformationLRT Capital Management, LLC is an Exempt Reporting Adviser with the Texas State Securities Board, CRD #290260. Past returns are no guarantee of future results. Results are net of a hypothetical 1% annual management fee (charged quarterly) and 20% annual performance fee. Individual account returns may vary based on the timing of investments and individual fee structure. This memorandum and the information included herein is confidential and is intended solely for the information and exclusive use of the person to whom it has been provided. It is not to be reproduced or transmitted, in whole or in part, to any other person. Each recipient of this memorandum agrees to treat the memorandum and the information included herein as confidential and further agrees not to transmit, reproduce, or make available to anyone, in whole or in part, any of the information included herein. Each person who receives a copy of this memorandum is deemed to have agreed to return this memorandum to the General Partner upon request. Investment in the Fund involves significant risks, including but not limited to the risks that the indices within the Fund perform unfavorably, there are disruption of the orderly markets of the securities traded in the Fund, trading errors occur, and the computer software and hardware on which the General Partner relies experiences technical issues. All investing involves risk of loss, including the possible loss of all amounts invested. Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly herein will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing herein should be construed as guaranteeing any investment performance. We do not provide tax, accounting, or legal advice to our clients, and all investors are advised to consult with their tax, accounting, or legal advisers regarding any potential investment. For a more detailed explanation of risks relating to an investment, please review the Fund’s Private Placement Memorandum, Limited Partnership Agreement, and Subscription Documents (Offering Documents). This report is for informational purposes only and does not constitute an offer to sell, solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Any offer to sell is done exclusively through the Fund’s Private Placement Memorandum. All persons interested in subscribing to the Fund should first review the Fund’s Offering Documents, copies of which are available upon request. The information contained herein has been prepared by the General Partner and is current as of the date of transmission. Such information is subject to change. Any statements or facts contained herein derived from third-party sources are believed to be reliable but are not guaranteed as to their accuracy or completeness. Investment in the Fund is permitted only by “accredited investors” as defined in the Securities Act of 1933, as amended. These requirements are set forth in detail in the Offering Documents. |

Footnotes1 MUSA FY 2021 10-K 2 CASY FY 2021 10-K 3 ATD 2022 Annual Report 4 CASY SEC Filings, 2015-2022 5 MUSA SEC Filings, 2015-2022 6 J.P. Morgan Convenience Stores/Fuel Retail & Distribution Equity Research 7 NACS, 2022 8 MUSA FY 2021 10-K 9 CSP Top 202 Convenience Stores 2021 10 NACS State of the Industry Report 2021 11 MUSA FY 2021 10-K 12 Alimentation Couche-Tard 2022 Investor Presentation 13 MUSA FQ2 2022 Earnings Call 14 MUSA SEC Filings, 2015-2022 15 SEC Filings, 2015-2022 16 March 2022 Raymond James Institutional Investor Conference 17 MUSA FQ2 2022 Earnings Call 18 MUSA SEC Filings, 2015-2022 19 Statista, Oct 20th 2022 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment