CloudVisual

Valaris Limited (NYSE:VAL) recently announced that it was rated the number one offshore driller in the customer satisfaction survey of 2022 by EnergyPoint Research covering offshore contract drillers. Global oil companies are injecting a lot of money into offshore drilling, a move seen to reverse a long decline in expenditures with projects lined in the U.S and Atlantic Coast of Canada. The investments have been encouraged by surging oil prices as well as the increase in energy demand from Europe due to the ongoing Ukraine-Russia war. Despite being more expensive than onshore shale, offshore production sites can turn profits at lower prices than other production sites.

Thesis

Less than 1.5 years after emerging from Chapter 11 bankruptcy protection, Valaris’ partnership with ARO Drilling has started paying off including partial early repayment of its shareholder notes. The company is looking forward to new contracts and extension awards that will support its growth initiatives into 2023. However, the company is expected to increase its spending levels as it reactivates rigs as compared to 2021. The increase will coincide with higher labor and material costs, and spare depletion from its initial reactivations projects.

I believe that VAL’s price return has gained⁓ 52% (YoY) boosted by a significant value in ARO Drilling and the company’s drive to build its contract backlog.

It has reactivated its high-quality stack rigs to ensure it gets long-term contracts at good rates.

ARO Drilling and Jackup engagements

Valaris Limited announced that it had received a $40 million partial payment from its joint venture ARO Drilling, of its shareholder notes receivable. This payment means the shareholder notes receivable attributable to Valaris stand at $403 million, with $225 million due in October 2027 and about $178 million due in October 2028.

The relationship between Valaris and ARO (a 50-50 joint venture between Saudi Aramco (ARMCO) – the world’s largest oil and Gas Company) took shape in 2017 and 2018 when Valaris contributed cash to ARO in exchange for a 10-year shareholder notes receivable with interest. After adjusting the notes to fair value, a discount was recorded from the effective date to the principal amount of $442.7 million. The reprieve for Valaris is that this agreement with Saudi Aramco- in the creation of ARO Drilling, prohibits the sale or transfer of shareholder notes to a third party. By inference, Valaris is entitled to 50% of ARO’s net earnings due to this venture agreement.

The partial early repayment also demonstrates that neither Valaris nor Saudi Aramco will be required to provide additional financing to ARO for the new build project expected in H1 2023. Saudi Aramco owns and operates jack-up drilling rigs in Saudi Arabia, which is arguably the largest market for jack-up rigs in the world. Saudi Aramco- a state-owned oil company is expected to charter 26 new jackups in 2022 expected from ADES which is owned by Saudi Arabia’s Public Investment Fund (PIF). Overall, Aramco’s total fleet of offshore rigs (on contract) in the Saudi Arabian Kingdom will rise to 78 jackups. The year 2023 may likely see the number of rigs rise to the range of 10 to 14 depending on market demand. In the past decade, Aramco has overseen an average of 45 jackups.

Back in Q1 2022, Valaris signed new deals with Saudi Aramco that saw Valaris 250 (a jackup for the heavy-duty harsh environment), Valaris 116 (a heavy-duty modern jackup) and Valaris 143 & 146 (standard-duty modern jackups) commence 3-year extensions of their charter agreements with ARO Drilling after completion of their existing agreements in December 2021.

There was an increase in revenues from jackup rigs in Q2 2022 attributed to more operating days for Valaris 249 after VAL kicked off a New Zealand offshore contract in Q1 2022. However, contract drilling expenses gained 9.4% (QoQ) to $361.8 million from $331.3 million. Total revenues in the quarter soared 29.8% to $413.3 million while gross profit inched up⁓ 500%.

Notable also are the new contracts and contract extensions, with an associated contract backlog of $95 million announced by the company as of September 1, 2022. As it stands, VAL’s jackup rigs are securing more work, especially coming just a month after the rig owner added $149 million yet again to its contract backlog.

Post-bankruptcy growth valuation

Valaris emerged from Chapter 11 bankruptcy at the beginning of Q2 2021 when it finished its financial restructuring and eliminated $7.1 billion of debt. The company had incurred an expense of $3.6 billion concerning the Chapter 11 case but later recorded an income of $158 million in the 6 months ending on June 30, 2022. In the same period, Valaris also realized a $137.6 million increase in the sale of property. The growing income levels indicate increasing customer confidence post-bankruptcy.

VAL’s cash balance in the quarter also declined 9.07% (QoQ) to $553.5 million indicating that the company was using part of its cash to fund operations and support rig reactivations. However, the company has sustained its tranche of debt above $550 million since June 2021 with its senior secured notes (as of June 30, 2022) due in 2028. The management did well to exclude any new build capital commitments into Q3 2022 as it indicated payment of an annual interest expense of $45 million.

Still, on the financial side, VAL recorded $2.3 billion worth of contract backlog as of July 28, 2022, up more than 437% from $428 million worth of contract backlog recorded as of May 2, 2022. ARO Drilling owns 7 jackup rigs that operate under contracts with Saudi Aramco with a contract backlog of $935 million as of July 28, 2022.

Both ARO and VAL are hoping to capitalize on incremental EBITDA at market multiples. In 2021, ARO’s EBITDA stood at $91 million with its cash balance at $91 million as of June 30, 2022. The joint venture also announced a 20-rig new-build program into 2023 consisting of guaranteed contracts.

In its Q2 2022 earnings call, Valaris CEO, Anton Dibowitz stated,

“Recently, we were awarded a 4-year contract with Renishaw Petroleum for the VALARIS 115 which represents the largest backlog award for a benign environment jackup outside of the Middle East this year. We’ve also been awarded a 1-year extension with BP Offshore, Indonesia for VALARIS 106 and several shorter-term contracts for VALARIS 107 offshore Australia and VALARIS 144 in the U.S. Gulf, demonstrating the global nature of the recent pickup in activity.”

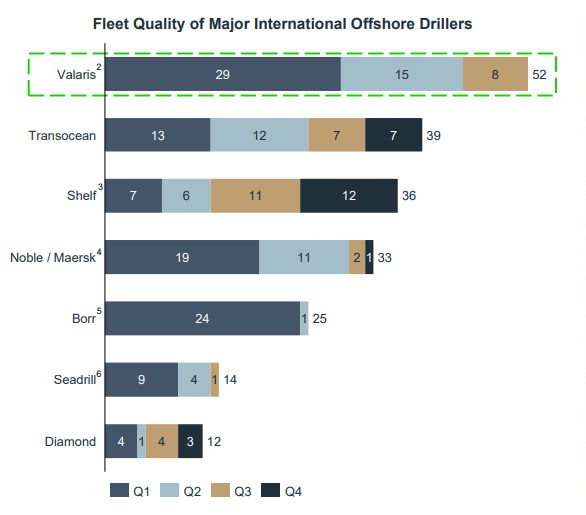

Valaris owns up to 52 rigs from a global jackup rig count of 388, and a global floating rig count of 141, Valaris recorded 8 active floaters by the end of 2021, indicating that it controls 5.67% of the floaters market. Of these 52 rigs, 11 are drill ships. 5 are semisubmersibles and 36 are jackups. The company also boasts of a high-quality modern fleet with a gross asset value (GAV) above $7 billion.

Valaris has been facing an increase in shareholder losses pre-bankruptcy and it reached its peak in December 2020 at $4.18 billion. In Q2 2021 (post-bankruptcy) VAL’s accumulated loss slowed down to $6.2 million. Retained losses further increased to $71.6 million in the quarter ending on March 31, 2022, before it hit profitability and gained 155.9% to stand at $40 million in Q2 2022.

Risks to the Downside

Despite having 52 rigs, Valaris has not outlined the number of rigs to be used in Q4 2022 for offshore drilling as is the case with Transocean (RIG), Shelf (OTCPK:SHLLF), Maersk, or even Diamond (DO).

Valaris Q2 2022 Earnings Report

Valaris has 8 active floaters lined up for Q3 2022 down from 10 a year ago and 25 jackups. From a total of 39 rigs, Transocean has 7 rigs set for use in Q4 2022.

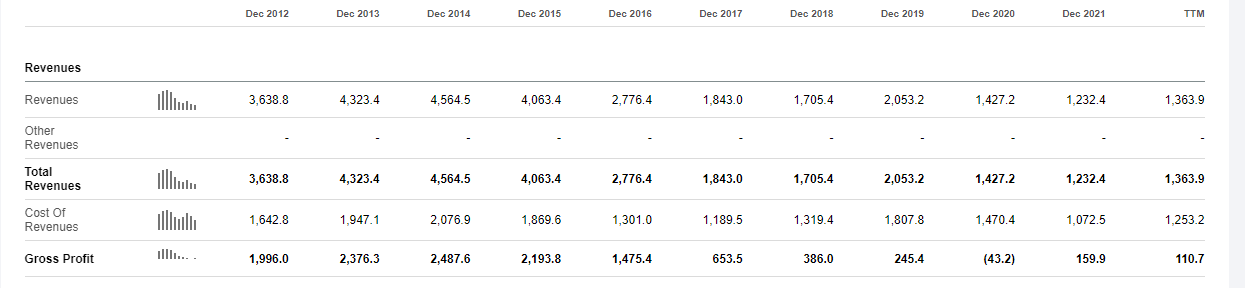

The full year 2022 revenue guidance for Valaris is expected to be $1.57 to $1.6 billion. The company has not attained this level since the year ending in December 2019 when it stood at $2.053 billion.

Seeking Alpha

These revenues are high but not entirely impossible considering the pending contractual agreements, especially for jackups. On the flip side, Valaris has not announced many longer contractual agreements for floaters especially for the Fiscal Year 2022/ 2023. As it stands there is a higher demand for deep-water jackups than floaters. Nonetheless, Brazil stands out with an expected 22% increased level of demand over the next 5 years. Other key areas include U.S and Mexico at 19%, West Africa at 11%, and Australia at 3%. The other share is predominantly held by jackups with areas like the Middle East having as high as 43% demand level over the next 5 years.

OPEC is also expected to cut oil production by up to 2 million barrels per day, a move is seen to likely drive the oil price higher. A decline in production could affect drilling thus impacting revenues for companies such as Valaris Limited.

Bottom Line

Valaris Limited has come out of bankruptcy and in less than 2 years has proven its ability to win contracts and reactivate its stacked assets. The company is operating on scale with rigs that it claims are well suited for attractive opportunities in the market. It set its full-year revenue guidance for 2022 at a high of $1.6 billion. The company also expects to reap from its 50/50 ARO Drilling joint venture with Saudi Aramco. Still, the company is facing lower production due to OPEC’s call to decrease production (to ostensibly increase oil price), a move that may lower the production guidance. In my view, while the company has not placed enough emphasis on floaters as opposed to jackups it is still operating on leverage of a fluid market. For these reasons, we have raised our rating of the stock to hold from sell.

Be the first to comment