mikkelwilliam

Main Thesis & Background

The purpose of this article is to discuss the state of the municipal (muni) bond market, both tax-exempt and taxable. This is a sector I have long favored within the IG credit markets, often owning it exclusively and holding no IG corporate debt (I do have some high yield corporate exposure). However, I saw a heightened level of interest rate risk back in 2021 for this sector in particular, and began to fade on my outlook. In hindsight, this was certainly vindicated, the problem was I saw the sell-off in the first half of 2022 as a buying opportunity and that has had limited success. The sector continues to see intense pressure, with investors bailing on leveraged CEFs that are a popular way to play the space. Net result, my muni positions are in the red for the year (so far).

With this perspective, it could seem unwise to add mine to my positions at this juncture. But the bottom-line is I just see too much value not to. Discounts have widened considerably, credit risk remains extremely low, and I believe the Fed only has a few more rate hikes left, some of which could be baked in at current prices. (I personally see .75 – 1.50 basis points from the Fed before a pause is required). With this view, I am hunting for value across the muni landscape, and will present the support for this outlook below.

Taxable Munis Are One Source Of Value

To start, I want to touch on the taxable muni sector and why I see some buy opportunities there. This is an area that unlike its tax-exempt peers, doesn’t have the same tax advantages that muni investors have come to expect. But it remains a higher yielding sector compared to other taxable alternatives and its size and importance has grown over the past five years (especially post 2017 tax reform).

For me personally, I see merit to owning this sector for diversification from both equities and also within the muni sector itself. Because it lacks the tax-exempt status, I am generally less reluctant to add to this sector but when I do I find it useful in a tax-deferred account (i.e. an IRA). At this juncture, I do see merit to buying in at these levels for a couple of key reasons.

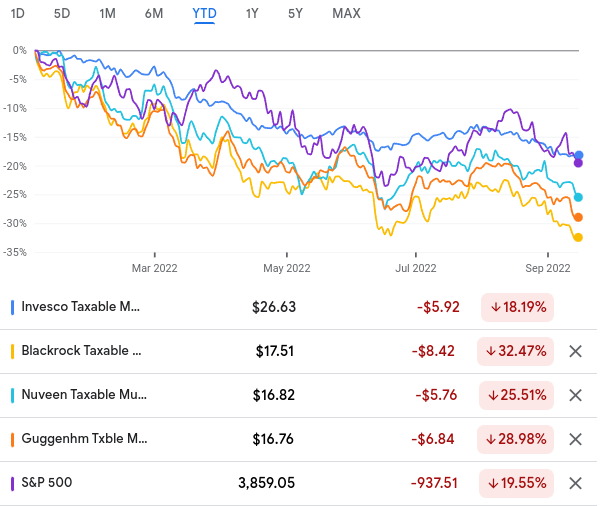

One, this has been as hard hit a sector as any in credit markets this year. While that is not exactly comforting, it does indicate a bit of a contrarian play. It can often be a smart thing to buy into an unloved sector – whether this is equities of fixed-income – and taxable munis are certainly that. For perspective, let us consider this sector is dominated by three CEFs: the BlackRock Taxable Municipal Bond Trust (BBN), the Nuveen Taxable Municipal Income Fund (NBB), and the Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust (GBAB). There is also a non-leveraged, passive ETF that is quite popular, the Invesco Building America Bond Portfolio ETF (BAB) that I cover from time to time. All of these options have been hammered year-to-date, as shown below:

YTD Performance (Google Finance)

As you can see, 2022 has not been kind to taxable munis. The sector is supposed to provide an equity hedge, yet the CEFs have all dropped substantially more than the S&P 500. BAB, as a non-leveraged option, has held up better, which makes sense given rising interest rates are key to this under-performance. Yet, an 18% drop (not accounting for distributions) is really not that comforting either.

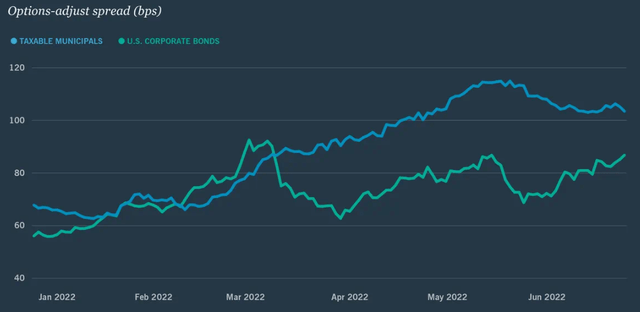

This begs the question – where is the opportunity? Seeing such large losses can often signal a buying opportunity, but it certainly doesn’t provide a lot of short-term comfort either. That said, I would look to some relative signals that support why positions now could make sense. For example, when we compare to yields offered in the taxable muni space compared to taxable yields in the corporate debt sector, we see a sizable advantage:

Relative Yield Spreads (Taxable Sectors) (Nuveen)

This says to me that if one wants to buy taxable fixed-income right now, munis have the advantage over corporate bonds (in terms of yield). Personally, I see limited credit risk in both IG corporates and IG munis, so that is not much of a differentiator. Duration risk is also similarly high. So I view the yield advantage as a big winner when comparing these two spaces.

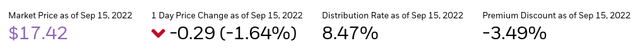

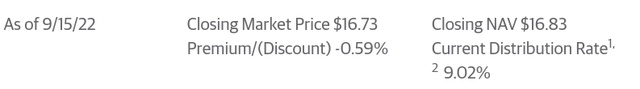

Looking into the options for this sector then, I think BBN in particular is the most attractive move. The fund has a discount to NAV over 3%, which compares favorably against NBB and GBAB, as shown below, respectively:

BBN Metrics (BlackRock) NBB Metrics (Nuveen) GBAB Metrics (Guggenheim)

I simply see this sector as ripe for a recovery. Credit quality supports this, as the sharp drawdown in share price means that a lot of the downside risk is probably already baked in. While there still remains plenty of interest rate risk to contend with (I will expand more on that later), I believe this is a place that will offer positive returns in Q4 and in early 2023.

**My personal holdings include BBN. I continue to view this as a reasonable option against its two peers, but I also believe BAB offers a good value at these levels for a more risk-averse investor. Since it is a non-leveraged ETF, if the sector sees a continued downtrend, BAB should fare better.

Why I Believe Credit Quality Is Strong

My next point looks at the muni sector more broadly. This is relevant for both the tax-exempt and taxable sector. As I have stated, I see limited credit risk going forward. I want to focus primarily on IG debt, and this is an area that I believe investors can sleep pretty well at night. While other risks (i.e. duration risk) remain, I do believe municipalities are going to make good on their debt obligations. This supports a generally healthy backdrop for muni-backed debt.

To understand why, let us consider a few key aspects of this sector. The credit quality and overall health of state and local governments depends largely on tax receipts. This was an area that faced a tremendous headwind when the Covid-19 pandemic got underway. There were fears of a widespread economic collapse, loss of sales tax revenues, and a substantial drop in income taxes resulting from job losses.

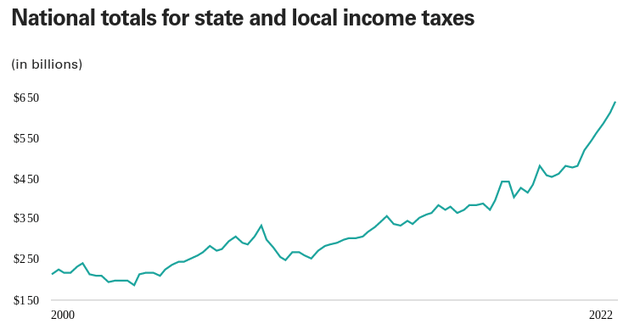

In hindsight, these issues did not really come to pass. Consumers continued to spend, white-collar work shifted to a remote environment (maintaining income tax levels), and the economy recovered fairly quickly given how bleak the outlook was at the onset of the crisis. The net result was that state and local government tax collection was very resilient. In fact, collections are currently well above where they were pre-pandemic:

Tax Collections (US Bureau of Economic Analysis)

The conclusion I draw here is that default risk remains very low. State and local governments are sitting on historically high levels of tax collections. In addition, these same governments have gotten a lot of federal aid from Covid-19 pandemic relief funds. The end result is that state and local municipalities really have no excuse for not making timely interest payments on their debt. This bodes well for muni investors across the board.

Defaults Remain Concentrated And Rare

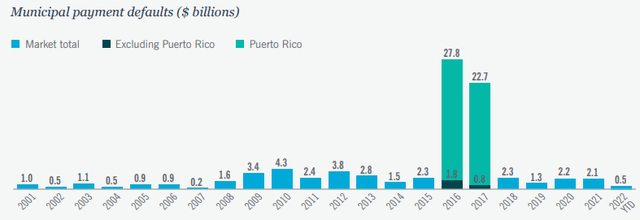

Expanding on the previous topic, my outlook for limited defaults has to do with historical performance as well. Even in times when state and local governments are not flush with cash (as they are now), defaults within munis tend to be uncommon. There was an uptick in 2020, but overall delinquent debt was still minor. That held steady in 2021 and this calendar year is on pace to have lower levels of payment defaults than both those years. This is an encouraging trend:

Muni Defaults (By Calendar Year) (Bank of America)

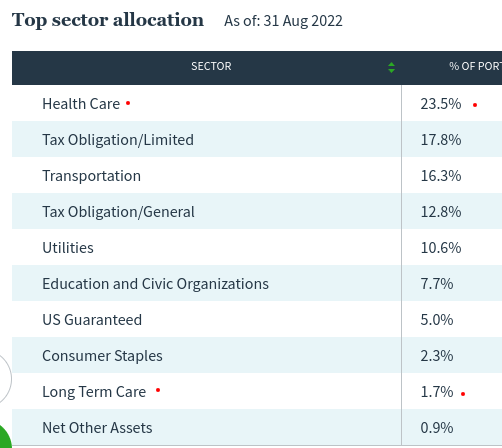

This is an across the board theme impacting even some of the more “at risk” jurisdictions, such as Illinois. Defaults are still uncommon, and are concentrated primarily in the health care sector. But even then we need to be more discerning. Hospital systems would be lumped into this sector, but those are areas that rarely default as they get quite a bit of state aid. Since the pandemic started, they are getting a lot of federal aid as well. So when I see “Health Care” listed in the portfolio, I am not overly concerned, as with my primary muni holding, the Nuveen AMT-Free Quality Municipal Income Fund (NEA):

NEA’s Sector Breakdown (Nuveen)

The reason is that muni defaults have primarily been in private assisted living facilities, or other private health care practices. There have also been defaults in private school systems, such as off campus student housing developments. These are areas I would continue to avoid, but as you can see from the graphic above, NEA does not have any education exposure and long term care facilities make up less than 2% of total assets.

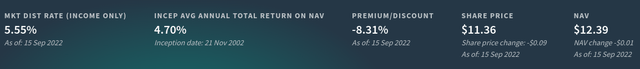

In any event, this is just one fund to consider. I personally favor it because as a North Carolina resident, this fund offers more in-state munis than the average national muni CEF. That is because the fund absorbed a North Carolina-specific muni CEF from Nuveen a few years back. I have held it since that time. The fund also attempts to shield investors from the alternative minimum tax and, at current levels, sits with a discount wider than 8%:

Clearly, I like NEA, and I see no problem with recommending it as a candidate to consider.

But that is just one option of many. I would suggest readers look for funds with similar characteristics in terms of well supported sectors, strong distribution coverage, and attractive valuations. For those who live in California and New York, two high-tax states that issue a lot of muni debt, there are a number of options. I see value in the Eaton Vance California Municipal Income Trust (CEV), the BlackRock MuniHoldings California Quality Fund (MUC), and the Nuveen California Quality Municipal Income Fund (NAC). For New York, I similarly like the PIMCO New York Municipal Income Fund II (PNI) and the Nuveen New York AMT-Free Municipal Income Fund (NRK).

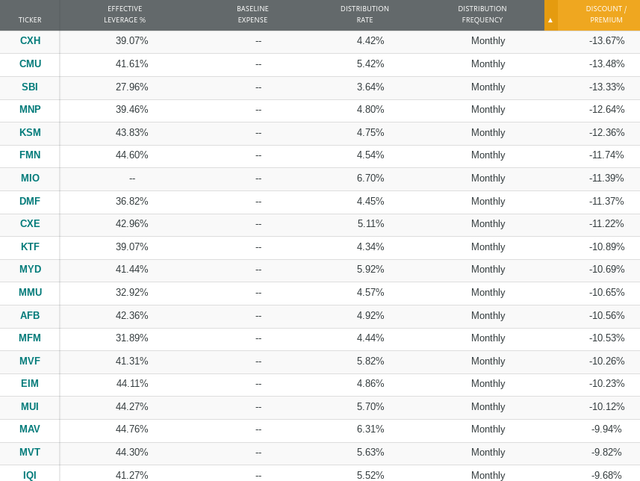

For those with a more national focus, like myself, I see value across the spectrum. A host of national muni CEFs have discount in the double-digit range, and there are too many good candidates here to select just one or two.

National Muni Funds With Discounts To NAV > 10% (CEF Screener)

Even those that are a bit pricier, in the 5-9% discount range, there are over a dozen to choose from. Investors will want to determine what type of sector exposure they want – I would lean more towards GO bonds, utility sectors, hospital systems, and also transportation for stability and opportunity.

**I personally hold NEA and have added to my position on Friday (9/16).

A Fundamental Risk Remains That Needs To Be Considered

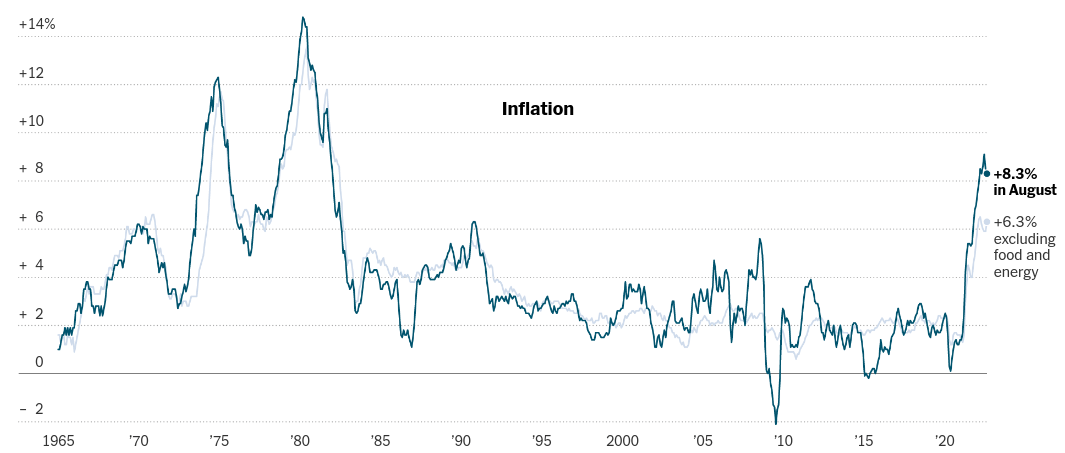

Through this review I have painted a fairly positive brush over the muni sector. I find patience has been rewarded here, and now is indeed a buy opportunity to put any available cash to work. I stand by this assessment, but I would suggest that this is not a risk-free strategy. The muni market, despite its idiosyncratic nature, is influenced substantially by U.S. Treasury yields. The performance in 2022 is driven primarily by Federal Reserve officials hiking rates, and this could very well continue to be the trend for the next 6-12 months. If so, there is the potential for more downside to come. In fact, August’s inflation report has made continued Fed rate hiking almost a foregone conclusion when they meet again later this month:

CPI Figures (US Bureau of Labor Statistics)

The takeaway here is that the major pain point for munis remains in place. While interest rate increases are the headwind, those increases are being drive by inflation. The two go hand-in-hand, so investors need to monitor both and gauge how that will impact their muni positions. We have seen in 2022 that the impact is fierce, so this risk should be managed going forward. Know your own risk tolerance, outlook for inflation and the Fed, and whether now is a good time for you to buy individually. Current positioning (size and overall portfolio diversification should all be considered).

For now, the muni sector is unloved. That speaks to me as a contrarian buy opportunity. But it is entirely possible that the market will continue to price in more interest rate hikes and investor outflows could continue. This suggests going “all in” right now is probably not wise either. Yet, the market can have a habit of front-running actual events. When the Fed finally stop hiking rates it may be too late to get the “best” price in this sector because investors will already be looking ahead to stable or declining treasury yields. This would boost muni share prices. Knowing when (and “if”) these scenarios will occur is a guessing game at this point. So my advice is patience, add opportunistically, and be realistic about what short-term returns are going to be.

Bottom-Line

The story behind muni performance in 2022 has not been a good one. The bond market has been disproportionately impacted by an aggressive Fed rate-hiking campaign, and that headwind does remain in place to this day. This limits the opportunity in the near term.

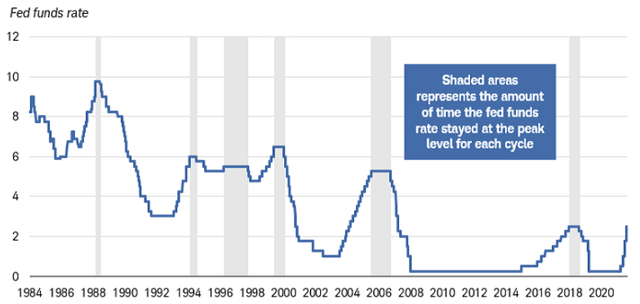

However, we have to consider that muni debt is still very solid in terms of credit quality, after-tax yield, and valuations. These attributes all support buying positions now. Further, while there is uncertainty around Fed policy in 2023, we should recognize the Fed often begins a rate cutting cycle fairly soon after it stops a rate hiking cycle. For support, consider the historical trend reflecting this in the graphic below:

History of Fed Rate Movements (Charles Schwab)

I conclude from this that if the Fed is near an end to its rate hiking cycle, that means better times are almost certainly ahead. Buyers will get interested again in munis, which could create a technical tailwind in the form of buyer demand for higher prices in the next few quarters. While the future of Fed movements is currently unknown, I do believe a lot of the downside to the muni sector has already materialized. As a result, I am re-buying in this space, and I suggest readers give the thesis some thought at this time.

Be the first to comment