Author’s Note: This is a reduced version of an article published on iREIT on Alpha on the 22nd of March.

Jerome Maurice/iStock via Getty Images

It’s not that only pure-play Reinsurance businesses offer reinsurance. Many normal insurance businesses offer this as well. However, Munich Re (OTCPK:MURGY) is the largest reinsurance business on the entire planet, and this definitely tells us something.

In this article, we’ll deconstruct the company and look at what makes it tick. We’ll go into results, forecasts, and conservative expectations, to see what exactly we can and should expect from the company.

Munich Re – Looking at the company

The company Munich Re was founded in 1880 by a German national (then the Kingdom of Bavaria). This was following the relatively recent founding of Allianz (OTCPK:ALIZY) in Berlin. The founder of Munich Re would be the head of the business unit in 1921, with the co-founder serving as head of the supervisory board until the mid-1920s.

The company became famous after the San Francisco Earthquake in 1906, as it was the only insurer that remained fully solvent after paying out all claims, around 15.5M marks at the time. The company, unfortunately, was a net beneficiary of antisemitic persecution during WW2 as Jewish customers were forced to cancel their life insurance policies as well as sell property. Munich Re was involved with Allianz, with the SS during the time, and also reinsured contracts for several concentration camps. In addition, supervisory board members joined the Nazi Party and the SS and even had political postings during the war.

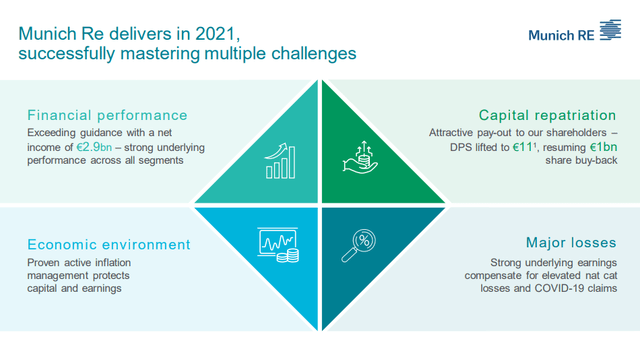

Munich Re Results (Munich Re IR)

Today, it’s obviously a different company. Warren Buffett is a prominent shareholder of Munich Re. It was once his biggest holding, and now he owns around 3% of the business.

As mentioned, the company is the biggest in reinsurance, and it’s also the largest primary insurer in all of Germany. Both Allianz and Munich Re are located in München – even on the same street – and are often considered to be sister companies. The two businesses have had a cross-25% shareholding in their various businesses and operate with extensive connections, common subsidiaries, and operations that have been slowly unwound over the past decade or so.

It can be said that the company to gain its independence from others has been Allianz. This has freed Munich Re up to build up its own primary insurance businesses, which were bundled together under the ERGO brand since around 1997. Initially, profitability was bad, but it became a good contributor in later days.

Munich Re Goals (Munich Re IR)

Operations today come in three areas – Life, Non-life, and Reinsurance. Reinsurance is the largest at over 70% of sales revenues, with life at about 10% of revenues and non-life at around 6%. All said and done, Munich Re is still a reinsurance major, not a primary insurance major, at over 80% of annual revenues.

Munich Re has made a history of performing well when competitors have been down or posted losses, thanks to titanium-clad underwriting standards and safeties. It’s what allowed them to post a near €3B net profit during the financial crisis. Most European peers, including Swiss Re (OTCPK:SSREY) and Hannover Re (OTCPK:HVRRY), posted losses in 2008. The company repeated this feat during COVID-19, posting a €1B net profit during a time when most reinsurance companies were suffering massively due to a global pandemic.

On a high level, Munich Re is perhaps the most conservative, traditionally German-led reinsurance business on the entire planet. And this has, and is paying off in spades during crises. It’s also fair to consider the worldwide and especially European reinsurance markets to be quasi-oligopolies. Small players have no room in this business area. You need insane amounts of capital backing to even start considering a reinsurance business.

In terms of net profit, reinsurance is the primary contributor here. More than 60% of Munich Re’s annual profit levels are from reinsurance – though, as you may see, insurance is a better-margin operation. Reinsurance operations also suffer from cyclical characteristics, doing well from 2012 to 2017 because of no major losses, but tend to be worse performers during world events.

And unless you’ve been in a cave for the past 2+ years, you’ll know we’ve been through quite a few of these during the last few years. It began with hurricane claims in late 2017, followed then by COVID-19 and other events, leading to calls of higher sector discipline. Prices for reinsurance increased in 2018 and have increased more or less since that point.

So on a high level, reinsurance operations are both local and macro-oriented. Sets of hurricanes can cause local or national claims, while macro events such as COVID-19 of course massive, global sets of claims which drive up costs for reinsurance contracts.

Munich Re has written, like its peers, more new business with higher margins in the 2021 renewals, and the company expects that the market conditions will continue to improve in the remaining renewal rounds in 2022, too. Munich Re said that prices were up by 0.7% risk-adjusted overall for reinsurance treaty renewals on January 1st, 2022.

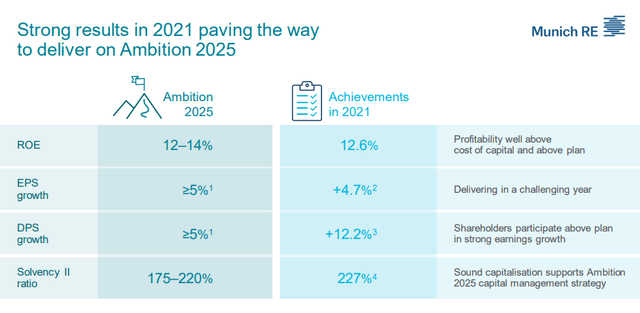

Its ambition-2025 targets include:

• Return on equity to increase to 12-14% by 2025

• Earnings per share to increase annually by 5% on average by 2025

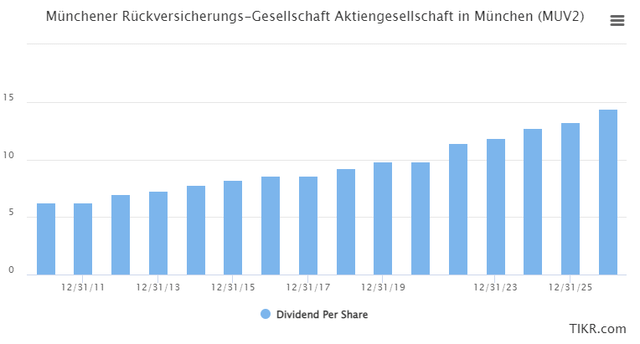

• Dividend per share to increase annually by 5% on average

• Solvency ratio to remain in the ideal corridor of 175-220%

• Extensive decarbonization strategy: shifting away from coal, oil, and natgas/LNG.

The company targets increased property/casualty reinsurance premium growth to almost €32B by the end of 2025 and a 4% annual premium growth in life reinsurance. The targeted combined ratio for Munich Re is 95% until 2025, and Munich Re wants ERGO to contribute an RoE of 12-14%, with a premium increase of 2.5% per year, and a combined target of 90% for Germany, 91% for international.

Munich Re is among the highest-rated reinsurance shops on the planet. It has a AA- S&P credit rating, with equal ratings from Fitch/Moody’s. The company has around 2% debt, 75% of which is subordinated. The likelihood of the company facing imminent fundamental danger to its operation due to capital limitations Is close to zero. 10% of company assets are funded by equity, most of the rest by insurance reserves.

The company has dividend stability that’s the envy of many other insurance businesses and certainly most European companies. Here are the historical and current forecasts. The worst that happened during COVID-19 was a dividend freeze.

Recent figures have come in very well, with a good 2021, a dividend increase to a massive €11/share up from €9.8, which puts the company’s yield at 4.7%, on par with most higher-yielding American insurance play and actually above many of them.

Net profit was up 142%, premiums up 8.5% YoY, and despite lower investment results and slightly lower RoI, and increased expenses, the overall picture is positive. The company announced a new profit target of €3.3B for the 2022 period, in addition to ongoing share buyback programs of up to €1B. The company reported 0.7% risk-adjusted price increases for its renewals, and business volume written on the 1st of January was up 15%. The company also remains positive for all of 1Q22.

All segments showed improvements for 2021, with p&c reinsurance up almost quadruple YoY. The costliest disaster in 2021 was Hurricane Ida, which was a loss of around €1.2B for the company, with the German flooding at around €500M for the entire event. The company released reserves of around €1B for basic losses, but this was less than 4% of the company’s net earned premiums.

Munich Re said it still aims to set the number of provisions for newly emerging claims at the very top end of the suitable estimate range so that profits from the release of a portion of these reserves are possible at a later stage.

Overall, this is a solid, conservative business in the reinsurance industry. Its fundamentals are top-notch, over 60% of profits are from reinsurance, and the company also has alternative revenue/profit streams.

Risks to the company

No company is without its risks. Munich Re operates in the volatile reinsurance segment, and we need only look at profit numbers to realize that when “the world” goes down, Munich Re goes down along with it. Profits turned very low during crisis years, and even though peace years bring years of smooth sailing when that turn does come, little can change its course.

Munich Re is also the only reinsurance business is cover that doesn’t just reinsure but also has primary insurance operations. The profitability of these operations (ERGO), despite its improvements, has still lagged some of its peers, and it’s hard to justify running primary insurance when you can’t even somewhat beat your peers, as I see it.

I’ve also spoken about how very conservative Munich Re is. It’s by far the most conservative reinsurance shop on the planet, in terms of its underwriting, history, and fundamentals. No national or international peers come close. Such approaches are of course preferable for conservative investors, but they may also limit business for the company, given that Munich Re passes on contracts that might be more profitable.

In short, expect lower margins/returns from this business – but safer ones.

Some analysts consider COVID-19 a continued risk impact – I don’t share this view to any extensive degree. It’s a minor risk at €250-€400M, which is relatively small given the current macro and geopolitical scope.

Beyond these, I consider Munich Re too conservatively capitalized and operated to have any sort of outsized or major risk that’s company-specific. We could discuss macro risks all day long, such as climate events, world events, pandemics, and the like – but the fact is that these events are not Munich-specific, they’re systemic.

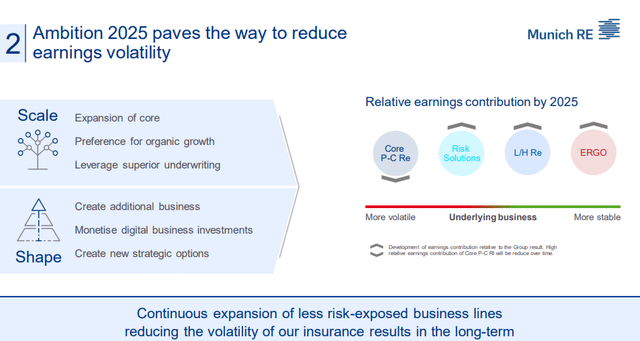

The company seeks to reduce its EPS and cash volatility through the expansion of its core and focus on non-reinsurance business lines. This is what makes Munich Re relatively unique in its segment.

Munich Re Goals (Munich Re IR)

Munich Re valuation

Munich Re operates at the second-highest total shareholder return numbers in the entire sector. At a 4-year TSR of almost 71.6%, the company drives sector-leading profitability and growth, and its outlook for 2022 includes over €60B of gross premiums and a net result of €3.3B. The company’s capitalization is extremely solid at a 227% Solvency II ratio. The company has a relatively low sensitivity here, where each 0.5% interest rate increase corresponds to +/- 7 bps solvency. As an example of a massive impact, we have an Atlantic-type Hurricane, a 200-year event, which could drive the company’s solvency down around 27 basis points, if one were to strike. This still leaves Munich Re well-capitalized.

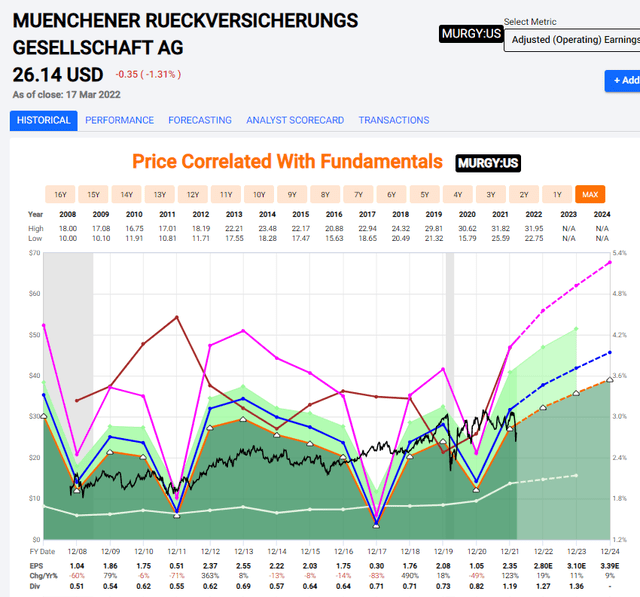

The appeal I see in the company is that even in the event of a global catastrophe unless we’re talking doomsday-scenario, the company’s trends are relatively easy to forecast. Both in terms of earnings, but also in terms of stock development.

We can see what global events do to Munich Re.

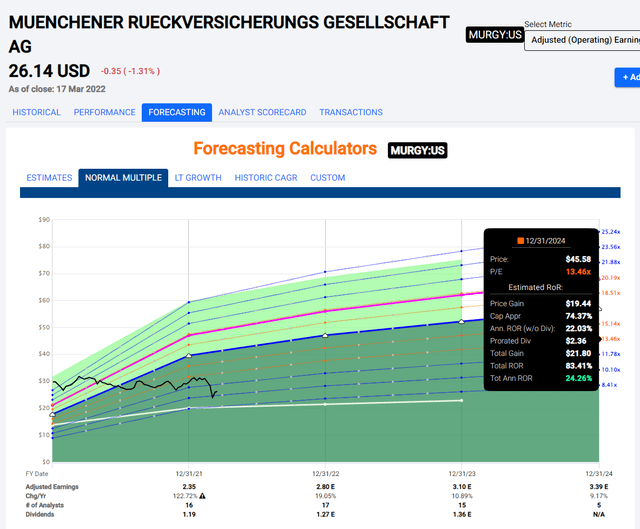

Munich Re Valuation (F.A.S.T graphs)

But we also see what happens after a downturn. The company is “predictably volatile”, as I would characterize it, with extreme EPS growth variances that haven’t, historically, trickled down to returns or dividends.

This makes it what I view as a good investment. Munich Re follows a “safety and profitability before growth”-approach, which I’m very into. It’s conservative and extremely risk-averse, and they’ve paid off for 140 years. Based on the company’s valuation, I’m prepared to say that Munich Re is, as of writing this article, undervalued in every single relevant metric.

Peers include Allianz, Swiss Re, Hannover Rueck (OTCPK:HVRRY), and French business Scor. On peer-based comparison, the average valuation here is just south of 10-11.5X P/E, making the company’s current P/E valuation of 11.2X somewhat undervalued. Businesses such as this tend to trade at conservative book multiples, and Munich Re is no different, coming to around 1.03X to the average of 1.1X. The company’s yield of 4.7% is mostly on par with the average, with Allianz over 5%, Scor at 7.3% (but far riskier), and Hannover Rueck at the lowest with around 4%. When investing in an insurance business, I want 4% or more – that’s a bit of a ground-rule. On a peer-based average, I do view Munich Re as undervalued here, if slightly.

Moving over to embedded value, we use a WACC of 9.04% with a cost of debt of 2.73%. I don’t use DCF for insurance business, I use a calculation called embedded value, which is the value of a block of business that includes the solvency and financial requirements on an insurance company in non-US geography, estimating the consolidated value of shareholder interest in the company. It’s done by adding the PV of future profits to the NAV of the capital + surplus and is also known as the MCEV, or market-consistent embedded value. We use a calculation of projection of future profits from in-force policies.

Based on a demand range of required return of 6-8%, I’m getting an EV/share of around €235-€260/share, which is either somewhat, or very undervalued, depending on what you look at in terms of the average overall return. In terms of the DCF proxy, Munich Re is undervalued as well.

For NAV/SOTP, I’m using straight-line P/E valuation of below-market average multiples to discount for world events. I value ERGO at 100% NAV, and use a 7.5X-9X P/E range for the remaining sectors of Primary and reinsurance. This comes to a net cash/debt position of around €40-€41B, which at 137M shares net of treasury comes to at least €290/share, and a high of €300/share. Given how far I’ve already discounted these ranges here, I consider these to be quite indicative for the long term.

We can put it together by looking at the S&P Global targets. These mostly line up with my own estimates. There’s a low-end range target of €223 and a high end of €330, based on 20 S&P Global analysts. The difference in this target is how you value some of these assets and how you expect the company to grow. Some of the analysts likely use up to a market-equal 10-12X P/E for some of the company’s SOTP valuations, some use a higher growth rate, ending at 13 analysts having either a “BUY” or “outperform” rating for Munich Re here.

I end at a conservatively-adjusted PT of €280, below the average of €290/share that S&P Global has, and below equity analysts like Alpha value, which gives the company €283, though not by much. In the end, it comes down to how analysts fine-tune some of these assumptions and how we weigh the different methods.

As always though, I consider the low range target to be needlessly conservative, and the high end to be needlessly positive. I believe the truth to be somewhere in between these. The main point here being that yes, I believe that Munich Re, at this valuation, is an undervalued business with an upside for the conservative investor.

Let’s look at a thesis.

Thesis

Munich Re is an undervalued company in the insurance/reinsurance space. It’s relatively unique in the sense that it carries the revenue mix of reinsurance and primary insurance. It’s the largest in the world, and one of the best-rated in the world.

It has an ADR – MURGY, which is a 0.1X ADR, meaning every receipt is a tenth of an ordinary share. This ADR is relatively liquid and mirrors the native fairly well, though the yield estimates lag the native quite strongly.

However, the relative upside expected here is similar.

From an 11-13X forward P/E, the company has an upside of at last 15% annually, and upwards of as much as 25%.

Munich Re Upside (F.A.S.T graphs)

I would argue the native should trade around 11-12X P/E, which should mirror this upside or a similar one. From today’s undervaluation, I do believe that the company’s upside here is close to overall double digits.

The turnaround we’ve been waiting for a long time has been coming since 2018, with renewals up and volume growth up as well. The macro situation is now driving prices up, which as odd as it may sound, is actually good news for reinsurers like Munich Re.

It’s my favorite reinsurer because of its relentless conservativeness in its operation, and I consider it to be a “BUY” at an undervaluation of above 15%.

Be the first to comment