Melpomenem

People will pay any price for motion. They will even work for it. Look at bicycles.”― William Faulkner

Today, we take our first look at another small cap SaaS concern that’s sporting more reasonable valuations as the air has come out of that bubble over the past year. Is it cheap enough to be in the “buy zone” yet? An analysis on this Busted IPO follows below.

Seeking Alpha

Company Overview:

Momentive Global Inc. (NASDAQ:MNTV) is a San Mateo, California-based provider of SaaS based survey solutions for more than individuals and organizations with more than 909,000 paying customers and a user base of 13 million strong throughout the world. Its questionnaires are designed to create market and brand insights, as well as feedback from customers and employees. The company was founded in 1999 as Survey Monkey and went public as SVMK Inc. in 2018, raising net proceeds of $225.3 million at $12 per share. It subsequently rebranded to its current moniker in June 2021. A casualty of the risk-off trade, Momentive is now a busted IPO, trading near $8.00 a share, translating to a market cap of $1.3 billion.

Offerings

The company derives a preponderance of its revenue from subscriptions to one or more of its services – 64% from self-serve customers. Its product suite includes three offerings (Surveys; Customer Experience, and Market Research) across five categories: Market Insights; Brand Insights; Product Experience; Customer Experience; and Employee Experience.

Surveys include software products that allow individual and companies to conduct their own surveys, branded under SurveyMonkey. Momentive’s basic survey plan for do-it-yourself individuals is offered at no cost. The company charges for subscription services based on functionality, with its most advanced enterprise package including managed user accounts, customized branding, collaboration capabilities, security, and deep integration features, which is sold through its business and enterprise sales teams, (a.k.a. the “sales-assisted” channel).

Customer Experience captures in-the-moment customer feedback across multiple (primarily) digital channels and integrates it with clients’ customer relationship management data to construct a deeper and broader profile of their customers. Clients can then integrate this data into Salesforce (CRM) so they can take even more effective action on this feedback. This product offering came via two 2019 acquisitions (Usabilla and GetFeedback CX) and is sold through Momentive’s sales-assisted channel.

Market Research includes software powering the collection and analysis of insights from target audiences, which can be provided by Momentive. The modules provide scorecards with statistical testing, analysis, configurable dashboards, and longitudinal data visualizations, among other features. The software allows clients to test the effectiveness of an ad campaign, product packaging, logo designs, etc. This offering encompasses the Market Insights, Brand Insights, and Product Experience categories, and unlike Surveys and Customer Experience, it technically generates its revenue on a transactional basis, with clients preloading market research credits that can be used to pay for Market Research projects over the subsequent 12 months.

Owing to its SaaS or SaaS-like offerings, gross margin was 81% in 1H22.

Approach

To a certain extent, the company’s business model revolves around attracting clients to its website for its self-service offerings and then upselling those accounts. With more than 900,000 paying customers (of which approximately one-in-three are self-serve using a business package), ~345,000 organizations (including 95% of the Fortune 500) as clients (of which 40,000-plus have more than 1,000 full-time employees), and 94% of its ~15,685 sales-assisted accounts using only one of its products, Momentive believes that its client base is ripe for upselling. First, it can transition more self-serve clients into sales-assisted ones, which typically results in a 4x revenue uplift. Second, it can push its product offerings deeper into organizations – into more departments – meaning additional use cases. Third, it can expand its relationships with its sales-assisted clients beyond one product offering. In theory, successfully executing on these initiatives should drive profitable growth. Within its existing customer base, management believes these tactics represent a $2 billion opportunity – fairly heady for a company that generated revenue of $443.8 million in FY21.

The total market opportunity is estimated at ~$84 billion, consisting of $64 billion for market, brand, and product insights and $10 billion each for customer and employee experience. Momentive competes with Qualtrics (XM), Alchemer, Typeform, Google (GOOG) (GOOGL), and Microsoft (MSFT) in Surveys; Medallia, InMoment, and Salesforce Surveys in Customer Experience, and Nielson (NLSN), Kantar and YouGov (OTCPK:YUGVF) in Market Research. It also competes with the in-house efforts of many enterprise-level concerns.

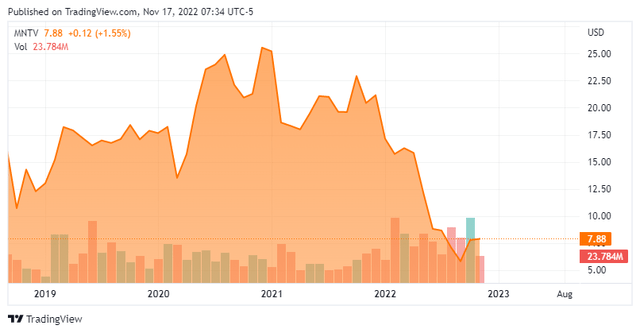

Share Price Performance

Since going public, Momentive had consistently grown revenue each year in the 16% to 22% range, although it has lost money every year on a GAAP and non-GAAP basis and generated only $12.7 million of total free cash flow over the same period (FY18 – FY21). That said, with the term “SaaS” associated with Momentive, its stock was bid up to 9.1 times FY21 revenue in February 2021 ($28.12 per share), eventually attracting the interest of CRM firm Zendesk in October 2021. Shares of MNTV closed the trading session prior to the official all-stock merger announcement – the deal had been rumored for approximately three weeks – at $24.92.

However, Zendesk shareholders were not happy with the fact that it was using its stock to buy a company that was losing money (-$0.01 a share (non-GAAP) in both FY20 and FY21) and growing revenue at a slower pace than its profitable (non-GAAP) acquirer (18% vs 30% in FY21). The market protested, selling shares of ZEN lower, dragging the tethered shares of MNTV with it. In February 2022, Zendesk shareholders voted down the acquisition, sending its shares higher, while Momentive stock, already down 35% since the deal’s announcement, didn’t really react, rather continuing its trend lower, hitting an all-time low of $5.14 a share on Oct. 13, 2022. The shares have made a nice rebound since

2Q22 Earnings and Outlook

It addition to a nosebleed valuation trapped in a viscous market environment, Momentive’s stock is down because its growth is slowing and it’s still not profitable, a trait on display when it reported 2Q22 financials on Aug. 4, 2022. The company broke even (non-GAAP) on revenue of $120.2 million vs. a loss of $0.01 a share on revenue of $109.4 million in 2Q21, representing only a 10% improvement at the top line. These metrics fell slightly short of Street expectations by $0.01 and $1.2 million (respectively) as a weak top-of-the-funnel self-service business and forex headwinds – ~35% of its business is international – were blamed.

Management also was compelled to lower its revenue outlook for 3Q22 and FY22, the latter of which is now $482 million vs. its prior view of $497 million (based on range midpoints). The new top-line projection reflects only 9% growth FY22 vs FY21. Free cash flow for the year is now expected to be $4 million, down from management’s previous estimate of $27.5 million.

Trying to put a positive spin on the quarter, Momentive noted that its sales-assisted channel revenue improved 30% year-over-year, with the number of clients in that category increasing 60% over the same period. Additionally, the number of clients employing more than one of its offerings had nearly doubled in the past 18 months.

Those developments have yet to result in overall revenue growth acceleration or profitability and were overshadowed by the departures of Momentive’s Head of Sales and CFO. Not surprisingly, on the back of this news, shares of MNTV continued their decline, selling off 11% in the subsequent session to $7.64.

Third Quarter Results:

Third quarter numbers that came out on Nov. 3 were inline to expectations. The company had a non-GAAP profit of four cents a share as revenues rose just over six percent on a year-over-year basis to $121.8 million. Both paying users (897,500) and average revenue per user ($533) or ARPU were up two percent from the same period a year ago. Elsewhere, deferred revenue was $213.5 million, an increase of 8% from 3Q2021 year-over-year while remaining performance obligations were $244.5 million, an increase of 10% year-over-year.

Balance Sheet and Analyst Commentary:

That said, the company is decent financial stead with cash and equivalents of $193.1 million against debt of $185.3 million as of September 30th, 2022. Momentive’s board authorized a $200 million share repurchase program in February 2022 and had spent $83.5 million within this program by the end of 3Q22. The company’s cash balance was reduced by just over $16 million in third quarter, almost all the drain was due to these stock repurchases.

Since third quarter earnings were posted, three analyst firms including Needham have reissued Buy/Outperform ratings on MNTV. Price targets proffered range from $11 to $15 a share. Both Credit Suisse ($13 price target) and Stifel Nicolaus ($7 price target) have maintained Hold ratings on the shares.

On average, they expect the company to turn into the black during 2H22, earning $0.14 a share (non-GAAP) on revenue of $480.4 million in FY22, followed by $0.32 a share (non-GAAP) on revenue of $522.9 million in FY23. Approximately 6% of the shares outstanding are currently held short.

Verdict:

As part of the company’s investor day presentation (Aug. 5, 2022), management spoke of the Rule of 40+, a standard measure for SaaS companies defined as revenue growth and profitability margin adding to at least 40, as its long-term objective. With revenue growth pegged at 9% in an environment where the company is having macro-induced challenges attracting new clients to the top of its funnel and free cash flow margin projected at ~1% in FY22, that objective does not appear remotely doable anytime in the next two years.

That said, its stock currently trades at 2.5 times FY23E sales and nearly 25 times FY23E EPS. Neither metric is outrageously overvalued, but neither is outrageously attractive. For its stock to become more attractive, prospects for Momentive or the global economy have to improve significantly. As such, investment is not currently recommended.

A rolling stone gathers no moss ……but it sure gathers momentum…”― Ankala Subbarao

Be the first to comment