designer491/iStock via Getty Images

Introduction

I own 22 dividend growth stocks in my long-term portfolio. You can see them in my Seeking Alpha bio, but I will also highlight them in this article. When I buy dividend growth stocks, I try to buy stocks that I will “never” have to sell. Not worrying about selling makes life easier as it prevents me from selling during dips, corrections, or worse. After all, time in the market beats timing the market. This is a very general role as there are big differences between a stock like Walmart (WMT), and a hot tech stock that everyone is recommending you to buy. In this article, I will show you an ETF that I would buy if I had no time to monitor my single-stock portfolio or if I had no interest in analyzing a single company, after all, that’s where a lot of the risk lies. The ETF I have found is the iShares Core Dividend Growth ETF (NYSEARCA:DGRO).

Dividend Growth Is The Place To Be

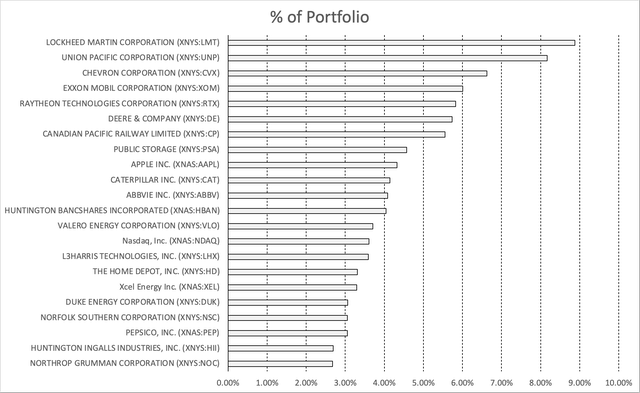

Most of the stocks that I own are dividend growth stocks. I did own a few high-yield stocks like Exxon Mobil (XOM), Chevron (CVX), Huntington Bancshares (HBAN), Valero Energy (VLO), AbbVie (ABBV), and Duke Energy (DUK). I would argue that most other stocks are mainly dividend growth instead of high yield.

I decided to buy some high yield because of tax reasons, and because I got most of them at really attractive prices when the yields were even higher.

The beautiful thing about a dividend growth stock with a long history of consistent dividend growth is that there’s a solid business backing shareholder payout. No company can sustain long-term dividend growth (sometimes with buybacks) without relying on its business model.

In general, dividend growth investors avoid mistakes like high-growth tech stocks without net income that got punished in 2021/2022, or investments that are unable to pay a dividend because of a risky business. I believe that avoiding mistakes is at least 50% of long-term investing.

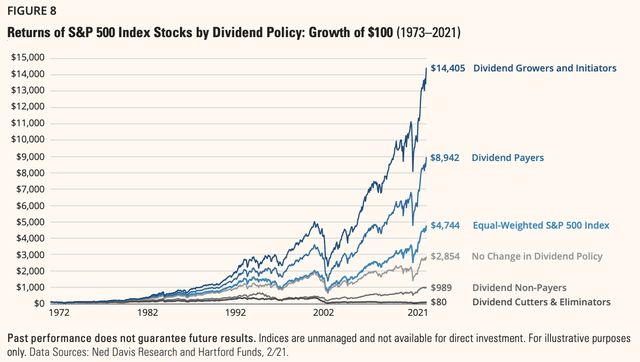

The good news is that I have data to back this up. Between 1973 and 2021, the equal-weight S&P 500 has turned $100 into $4,744. That’s neat! However, S&P 500 holdings that can be considered dividend growers and initiators turned $100 into $14,405. Companies with no change in their dividend policy returned $2K less than the EW S&P 500. Companies that do not pay dividends were extremely disappointing. Companies that cut their dividends lost money over a 50-year time span!

Bear in mind that the abysmal performance of dividend cutters is a big reason to go with an ETF. After all, it significantly lowers the chance that people are overweight divided cutters.

Also, people tend to be biased when it comes to investing. I’ve spoken to people who had 50% energy exposure, 60% consumer staples, 40% banks, and you name it.

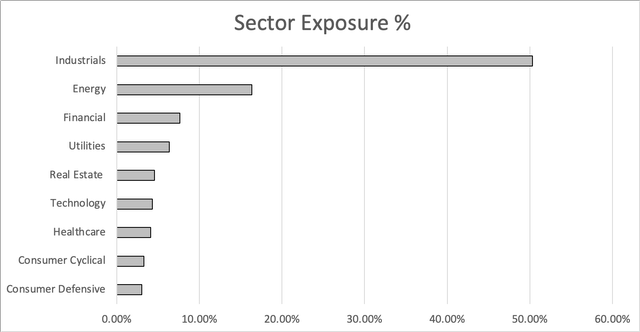

I’m guilty of that as well as my sector exposure below shows. I have almost a quarter of my money in defense and a lot in railroads in addition to a rather large (relatively speaking) Deere & Company (DE) position. This causes industrial exposure to hover close to 50%.

However, as I explained in prior articles, all of these companies are rock-solid dividend stocks. So what if they are in the same sector?

And, it may sound a bit arrogant – I don’t mean it that way – but I believe that I know the companies that I buy very well. And I try to communicate that to readers to limit risk-taking.

However, and this is the point of this article, I get very often asked by people who are not on Seeking Alpha what they should buy. I’m not recommending single stocks to any of them as they:

- Often lack the knowledge to research what they own.

- Are sometimes eager to sell when a stock goes up or panic-sell close to the lows.

So, now unto DGRO!

DGRO – Great Stocks In A Single ETF

According to BlackRock (BLK), the owner of iShares, the investment objective is as follows:

The iShares Core Dividend Growth ETF seeks to track the investment results of an index composed of U.S. equities with a history of consistently growing dividends.

Founded in 2014, the ETF has close to $23.7 billion in net assets. The benchmark index is the Morningstar US Dividend Growth Index. The expense ratio is just 0.08%, which is very fair.

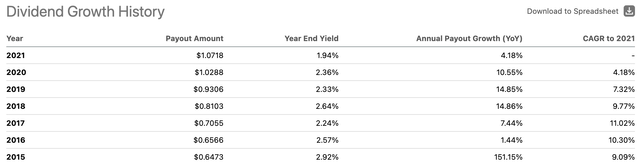

The ETF has 418 holdings and a 2.0% dividend yield. The table below is provided by Seeking Alpha. It shows dividend growth per year since its inception. Since 2016, dividend growth has been 10.3% per year, which is a very decent number. More recently it slowed due to economic headwinds (pandemic and supply chains), but I have little doubt that long-term growth will be double digits, or really close to 10% depending on the development of the economy going forward.

With that said, the ETF is not prone to the “ESG-crowd’s ” criticism, ESG means environment, social, and governance. The company has zero tobacco exposure, and no investments in thermal coal and oil sands. Controversial weapons have 1.39% exposure. Nuclear weapons have 0.78% exposure.

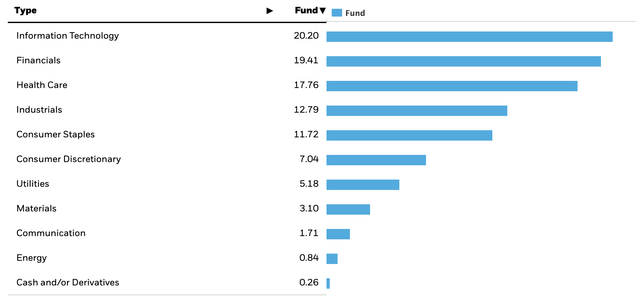

This is what the ETF’s sector exposure looks like. Energy, communications, materials, and utilities have a rather low weighting due to low dividend growth – in general.

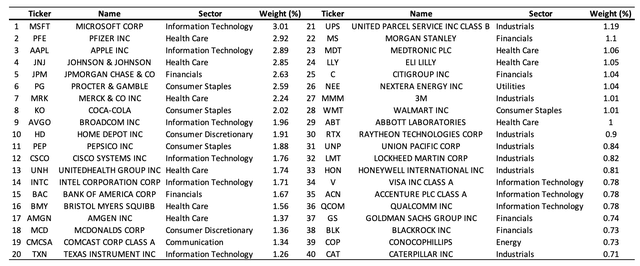

The Excel screenshot below shows the ETF’s 40 biggest holdings. As the data shows, there’s no front-heavy top 10 as we’re dealing with a well-diversified ETF. Even the 40th-largest holding still has a 0.7% weighting.

So, what about the performance?

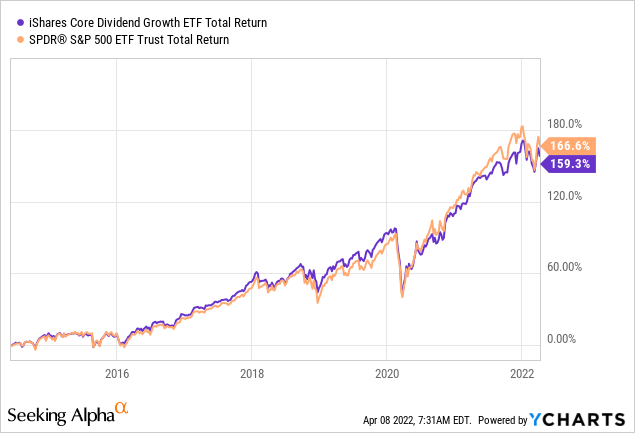

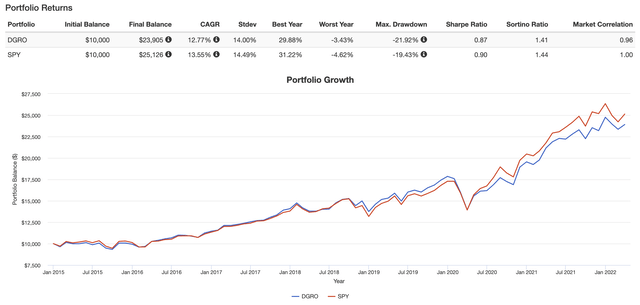

Since the ETF’s initiation, it has returned 160% including dividends (total return). The S&P 500 returned 167%. In this case, the ETF had a hard time outperforming post the 2020 COVID sell-off due to the S&P 500’s massive exposure to high-flying growth stocks.

It resulted in a very close underperformance as the data below shows and a slightly less beneficial Sharpe Ratio.

So, with that said, here’s my takeaway.

Takeaway

The market is flooded with ETFs. There’s an ETF for every sector, major stock index, and niches – as well as a lot of actively traded ETFs that are often expensive.

I try to avoid ETFs as much as possible because I like to do the work myself and because I’m not a big fan of big asset managers becoming bigger and bigger.

However, ETFs are simply the best tool for a lot of investors. In this case, I prefer the DGRO ETF as it has a 2.0% yield and a historic dividend growth rate of 10% which I believe is sustainable on a long-term basis.

The ETF has kept up nicely with the S&P 500 since its inception and I believe that DGRO will outperform the market going forward.

Long story short, if you’re looking for quality long-term exposure, look no further.

(Dis)agree? Let me know in the comments!

Be the first to comment