Black_Kira

At the right part of the Seeking Alpha screen, I constantly see the ticker — MULN that recently seems to be often in green. When I googled it, a nostalgic feeling seized me. Winter 2020. It’s freezing cold. But you don’t feel the cold because your mind was preoccupied with GameStop (GME) setting a new share price record every day. It seemed that gold was here; you just needed to reach out a hand to touch it. After such a severe market selloff, there is an impression that a new golden bull is found: an automotive company called Mullen (NASDAQ:MULN). Many bloggers believe that Mullen can become the GameStop of 2022 and the recent share price drop from 13 USD in November 2021 to 0.5 USD presents a strong buying opportunity. As my subscribers already know, I love thinking critically and looking into these kinds of stories. Therefore, my team and I spent plenty of days researching the name. Unfortunately, the bulls won’t like what we have found. I am sure that even the most convinced bulls will turn into bears upon reading this article to the end.

Mullens’s communication with investors is very nontransparent. The big news is often announced without any details. It seems that the CEO passes his messages exclusively onto retail investors to stimulate the hype around the stock. Although Mullen claims that it’s very advanced in the development of the solid-state battery, there is little credibility in the company’s announcements. The recent press release about expansion to Europe and recent acquisitions have made us even more alarmed. I don’t see how the company could raise money to deliver on its strategy. Certainly, you should do your own due diligence before making investment decisions, but if I were you, I wouldn’t touch the stock. Otherwise, your fingers will bleed.

Vans or no vans?

Mullen is a small automobile player that aims to produce innovative EVs for the American market. In its 2021 annual report, Mullen claimed that it was targeting to produce Mullen Five, an SUV with 325 miles at 55,000-75,000 USD. Product validation was expected to begin in the 4th quarter of 2023, with sales in late 2024.

No other vehicle production was mentioned in the annual report. But in the separate press release in January 2022, you can read that Mullen was also working on Cargo Vans that were promised to deliver in Q2 2022. A couple of months later, Mullen’s CEO, David Michery, proudly hinted that Mullen was about to manufacture 2 models of electric vans within months for a “major, major Fortune 500 customer.” The news caused the stock’s 35% increase intraday. However, no details were provided to investors, leaving them to wonder who the mysterious customer was. A few months later in June 2022, the company announced the purchase order for 600 Mullen Class 2 Electric Cargo Vans by DelPack Logistics, LLC. The order was planned to be completed over the next 18 months, with the first vans to be delivered by November. Is it the company from the Fortune 500 announcement? Apparently not. So investors are still waiting for details of the big customer.

Unfortunately, Mullen’s communication is very opaque and it’s almost impossible to track when the company started working on the van and how it progressed. As you can see, they have not even mentioned the van in its SEC-compliant reporting Annual Report 2021. It was only announced in separate press releases. In contrast to the usual market practice, Mullen also does not set up earnings calls. The entire communication goes through press releases or the CEO’s interviews with various YouTube bloggers. Trust me, there are really a lot of interviews. I guess it’s easier to speak with show moderators than with investment analysts who ask tricky questions.

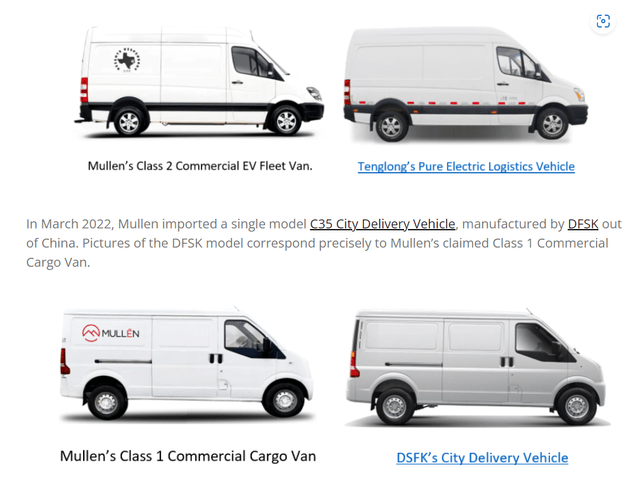

Recent research by the Hindenburg Research group claims that Mullen does not produce vehicles at all. Instead, it modifies Chinese ones to US standards. Given such poor communication by Mullen I tend to believe the report. The following months will tell us if Mullen resells or manufactures vehicles. We just need to wait for the first financial metrics, gross margin in particular. If it’s negative, then Mullen manufactures the vehicles itself. Before production is fully ramped up, the gross margins are negative due to low factory utilization and high fixed costs. This is even the case with Tesla. If the gross margin is slightly positive, then it would be a sign that Mullen should resell the autos. The issue is that a manufacturing company can increase profits when it works at scale, but trading companies can’t, and their profits will remain marginal.

Source: Hindenburg Research

A miracle or an empty wrapper?

The main bullish argument for Mullen’s future success is its advanced development of solid-state battery technology. Let us first start with the basics and find out how the battery works and what technologies using them are the most prevalent today.

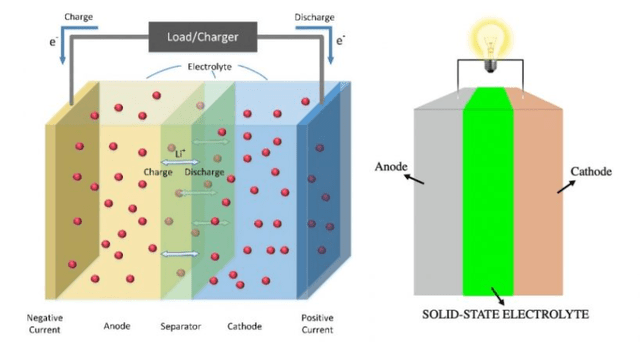

Batteries have a positive electrode (cathode) and a negative electrode (anode) made out of metal. The space between them is filled with a substance (electrolyte) that conducts electricity carried by charged particles (IONs). When the battery does not work, the anode and cathode store ions. When energy is released, ions travel between the electrodes through the electrolyte. But what is the difference between lithium-ion and solid-state cells, and why is the latter considered the industry’s holy grail nowadays?

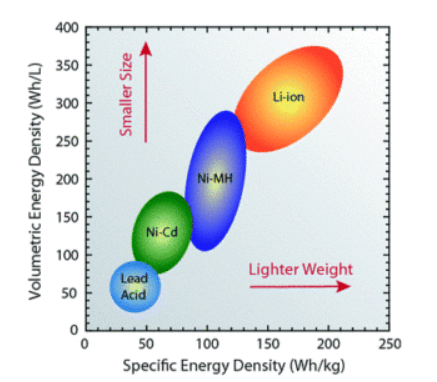

Lithium-ion batteries involve lithium used for its cathode and carbon as its anode. Among current technologies, these batteries have the highest energy density of any technology today (but not tomorrow) and are used almost everywhere, from the EVs that you drive to the mobile phones you use to connect.

If you are confused about what energy density is, let me briefly cite the paragraph from my earlier article on Electrovaya (OTCQB:EFLVF):

Energy density measures the energy a battery contains in proportion to its weight. High energy density is what allows for batteries thin enough to power the phone in your hand. Further technologic advances can expand the vehicle’s range and open new markets for electrification where the battery weight plays a crucial role. I can already imagine taking a zero-emission transatlantic flight.

In the chart below, you can see a comparison of Lithium-ion batteries with widespread technologies (excluding solid-state). We can see that its energy density significantly outpaces peer technologies.

Source:epectec.com

However, there are crucial drawbacks of the technology that can be separated into ecological and safety concerns.

Lithium extraction requires a lot of water, approximately 500,000 gallons per metric ton of lithium. This process could have a significant effect on local rural communities. For example, in Chile’s Salar de Atacama, mining activities consumed 65 percent of the region’s water, forcing local farmers and even entire communities to have to get water elsewhere.

Another issue is that only a small fraction of batteries are recycled. For example, only two percent of the country’s 3,300 metric tons of lithium-ion waste is recycled. It’s estimated that between 2021 and 2030, about 12.85 million tons of EV lithium ion batteries will go offline worldwide. So progress on more efficient recycling is integral.

Another problem is that lithium-ion batteries are flammable and pose a threat to drivers. While longer-lasting batteries are more desirable, it means nothing if they can’t assure the safety of the drivers.

To address these risks, a new technology appeared on the horizon: a solid-state battery. It involves the replacement of the liquid electrolyte in lithium-ion cells with a solid-state electrolyte. This change would make the batteries more ecologically friendly, safer, and increase their energy density even further.

Source: thenextweb.com

The first positive of this new technology is the solid electrolyte’s applicability. The change from the liquid to solid state electrolyte gives producers a wider variety of manufacturing abilities, as plenty of materials can be used as a solid electrolyte.

Solid state batteries are also more environmentally friendly. They could cut emissions by up to 39%. They will still need lithium but don’t require cobalt and, thanks to a higher energy density, can be much smaller. Therefore, producers would need fewer materials per the same number of MWh. The increased stability that solid electrolytes offer means that solid-state batteries can hold up to 50% more energy than their lithium-ion counterparts. They even charge much faster, with the ability to reach a whopping 80% charge within 12 minutes.

The main disadvantage of the battery is its cost. The solid-state technology is estimated to have high cost varying in the range of ~$800/kWh (kilowatts per hour) to ~$400 per kWh by the year 2026. It’s significantly higher compared with lithium-ion batteries, which cost about $100 per kWh. Besides, the cell degrades faster, which limits its recharging cycles.

Since the technology promises to change the EV landscape drastically, many companies rushed to join the technological race. Mullen was no exception. It announced a very promising battery prototype with exceptional test results. The miracle was that both technology tests undertaken in 2020 and 2022 showed almost similar results: previously reached results of 300 Ah (ampere-hour) at 3.7 volts and current 343 Ah at 4.3 volts. These results are impressive, especially compared to more developed and experienced players’ efforts. For instance, BMW (OTCPK:BMWYY) managed to produce prototype solid-state batteries up to 20 Ah capacity in partnership with Solid Power or, looking at a smaller scale, component manufacturer Murata managed to develop 25 mAh solid-state batteries. The battery’s charging time was also significantly shorter than competitors’ ones.

I am really surprised by the figures claimed by the CEO. Mullen presented not only very impressive KPIs but also a very ambitious timeframe to market. No other company awaits the results in less than 2-4 years. For example, Nissan, Renault SA (OTCPK:RNSDF), and Mitsubishi (OTCPK:MSBHF) only plan mass production of all-solid-state batteries by mid-2028. QuantumScape Corporation (QS), the company that develops and commercializes solid-state cells, backed by Volkswagen (OTCPK:VWAGY), Bill Gates, and SAIC Motors, targets prototype batteries deliveries in 2022, with the mass production of cells expected between 2024 and 2025.

Obviously, these are leading companies, investing billions of dollars into technology development. Can Mullen really produce such a technological breakthrough even though it doesn’t have a track record in the field? We need to remember that the CEO previously worked in the entertainment industry and in a couple of car startups that didn’t reach scale. The enterprise’s outlook seems far-fetched since the whole industry is working on the technology and craving to see the results at least in 4 years, while a newcomer company decides to win this competition in only 12 months.

But another interesting thing to consider is recent research by the Hindenburg Research group that analyzed the company’s operations. It appears that nothing is as clear as it seems to be. The researchers point out the lack of documents verifying Mullen’s business deals in relation to battery materials purchases. They said that after contacting the senior executive that had detailed knowledge about the joint venture that supplied Mullen with battery components, it appeared that the JV was a “nonstarter” and “didn’t exist.”

“It didn’t exist at all [the joint venture]. Not a single piece of paper. And he proudly goes and shows the Tweet—and about that time was when [the Nextmetals representatives] did get up and walk out. And [they] said, you know, ‘you’re nothing but a hustler. You have no substance’[…]”

What’s more, covering the topic of cell test results, the CEO of EV Grid, the independent laboratory used by Mullen for testing, claimed that he has never verified that the company’s battery could allow vehicles to travel 600 miles distance as announced at Mullen’s press release. And the timing of tests also raises questions. Let me quote his commentary on this point:

“No, we would never have said that. We never did say it and certainly wouldn’t have said it based on the results of testing that battery…but the timing is a little off. EV Grid more or less ceased operations by June or July of 2020, and for the first half of the year it was basically shut down and I was moving out, storing stuff in a warehouse because I had this other job at Indi EV. So that makes me think that whatever testing we did probably was in 2019 or even 2018. That’s my timeline as I recall it.”

It’s your choice whether to believe the research or not. However, even if Mullen is on track with their development, we remain skeptical, as there is too little data available.

One acquisition is never enough

Recently, Mullen announced that it secured exclusive distribution rights in Europe for I-Go. Usually, when you have a press release, you then have a short description of two partners. In this case, there is only a description of Mullen and no single word about I-Go. It looks like this:

Source: Mullen’s press release, SA

When we googled I-Go, we couldn’t find anything meaningful either.

Another development worth mentioning is Mullen’s recent acquisition of the ELMS manufacturing facility. The purchase included the factory in Mishawaka, which can provide Mullen with a capacity of 50,000 vehicles per year. Earlier, Mullen announced acquiring a 60% controlling interest in EV truck manufacturer Bollinger Motors for $148.2M USD in cash and stock.

Mullen’s CEO has a solid track record in acquiring bankrupt companies, so I believe he managed to conclude solid transactions. But he would need money to ramp up these facilities. Money needed for van roll-out, SUV, and solid-state battery development would massively dilute the company’s current market capitalisation of 200M USD. Besides, to get back to their use of solid-state cells, even if Mullen managed to create a prototype, they would need huge investments. As of June, Mullen had about $60M USD in cash. It is definitely not enough for technology development. But instead of raising money and focusing on the solid-state battery, Mullen attracted new cash and spent it on acquisitions.

I believe that the recent announcements were made almost at once to create positive momentum for the stock and raise further capital from investors. A successful equity raise would help the company continue its business but would bring a lot of pain to current investors due to equity dilution.

Bullish outlook

Many investors claim that Mullen is capable of rapid development. The excitement about the contract with DelPack Logistics, European expansion, and recent acquisitions only strengthens this belief. But the main incentive for shareholders remains the development of a solid-state battery. If the company manages to introduce its cells to the market despite scarce manufacturing facilities and a tarnished reputation due to Hindenburg Research, its share price will rise.

Investors’ Takeaway and Valuation

It’s almost impossible to value a company like Mullen, considering there are so many uncertainties. It isn’t clear if Mullen manufactures the vehicles itself or just resells them. Even more so, it’s puzzling how Mullen can produce the solid-state battery so quickly while the entire multi-billion industry can only do it only by the end of the decade. And finally, it’s confusing how Mullen can execute its expansion plans in Europe and how it can efficiently integrate recent acquisitions.

With all this in mind, I don’t deem any valuation reasonable at the current stage. I wouldn’t invest in the stock and wouldn’t be surprised if Mullen doesn’t deliver on its plans, as we have seen no serious execution track record so far.

Be the first to comment