Sean Gallup

Investment Thesis

Garmin (NYSE:GRMN) recently reported mediocre third quarter results. I think that the company’s diversified portfolio is efficiently offsetting the large drawdown in its fitness segment. But what I’m most concerned about is Garmin’s elevated inventory position and its free cash flow issues. Furthermore, I think that the valuation is too expensive considering the risks.

Garmin’s Q3 Earnings

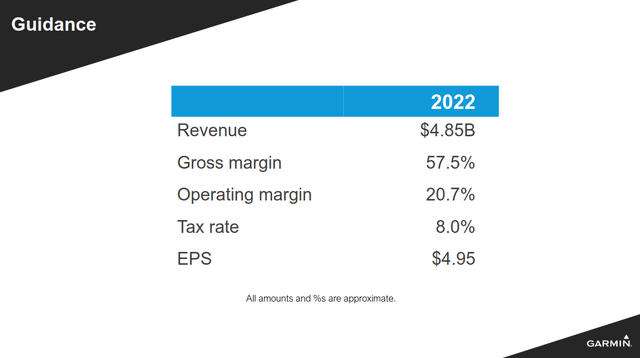

Garmin reported a mixed Q3. The company slightly missed revenue expectations but beat earnings estimates. It tweaked its EPS guidance from $4.90 to $4.95. This is still down from the business’s initial estimate of $5.90 in EPS. This would be the company’s worst result since 2018.

Garmin Q3 2022 Earnings Slides

Garmin has a relatively diversified electronics portfolio. The business produces a variety of electronic devices for fitness, outdoors, autos, aviation, and marine markets. But sales have fallen off dramatically in a few segments. As revenue falls off, operating expenses have continued to tick higher. This is hurting the company’s profitability and free cash flow.

Garmin Q3 2022 Earnings Slides

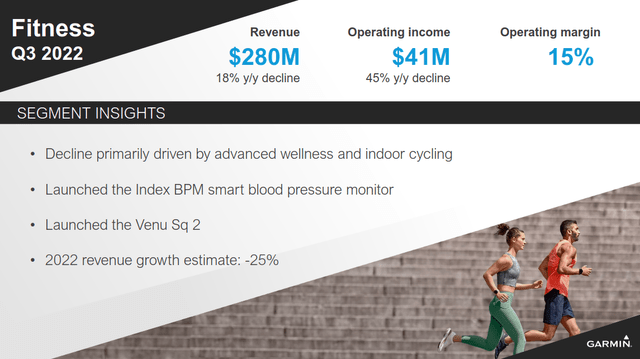

I’m most concerned about Garmin’s fitness segment. The segment is usually the largest revenue generator for the company. But sales have fallen off drastically in the last few quarters. Demand is declining, and consumer electronics have been hit hard. Fitness revenues dropped by 18% compared to last year. Operating profit cratered by 45%. Management expects the situation to get worse. They predict a 25% total decline this year.

Garmin Q3 2022 Earnings Slides

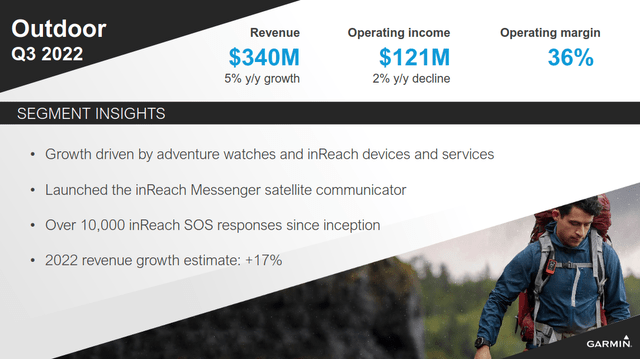

But I am impressed by Garmin’s outdoor segment. Even as the broader environment deteriorates, it has boosted sales 5% year over year. Management expects 4% growth in the fourth quarter. I think that this is strong performance in the current market.

The performance for Garmin’s other segments has been relatively flat. Collectively, the business’s autos, aviation, and marine segments have declined 1% since last year. The former two segments are generating revenue at 2019 levels. I think that this is solid performance, and these segments act as a stabilizer for Garmin’s portfolio.

Overall, this is mixed performance. Garmin’s fitness segment is clearly struggling. But the business’s diversified portfolio of products is offsetting this. I think that Garmin’s fitness and outdoor segments are going to be the most important drivers in the short term.

Balance Sheet And Inventory

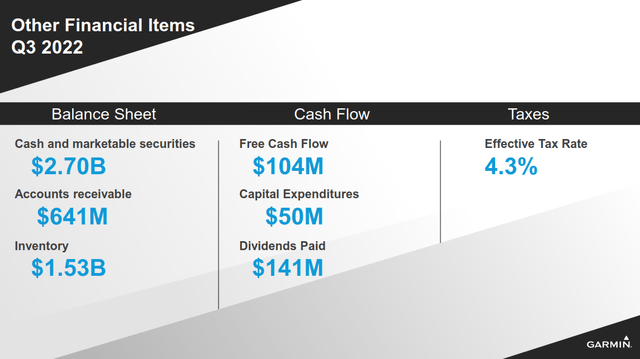

I think that Garmin has a solid balance sheet and decent liquidity. The business has $1.45 billion in cash and short-term investments. It has no debt and only a few major liabilities. Garmin’s cash balance alone could pay off 84% of its total liabilities.

Garmin Q3 2022 Earnings Slides

However, I want to discuss Garmin’s concerning levels of inventory. At the end of Q3, the business had $1.5 billion in inventory on its balance sheet, or 294 inventory days. This is up from about $520 million five years ago, a 105% increase in inventory days.

This concerns me. I want to point out that tech inventory ages quickly. Garmin has to regularly update and roll out new products. Stale inventory may have to be sold at discounted prices. I feel that Garmin is at higher risk than businesses with long lasting products. Management discussed its inventory on their earnings call.

As you’ve noticed, our inventory has been increasing year-over-year and did increase here in Q3. As we look at year-end, we would expect that our full — our end of year inventory will be lower on a sequential basis compared to Q3, maybe by around 10% or so and that would mean that our year-end inventory would probably be up over the comparable period in 2021 by mid-teens or so. So there will be — and last year, comparing that to it, you saw in 2021, actually inventory increase from Q3 to Q4 about 10%…

Yeah. Right now, I would say that we feel like channel inventory is mostly at reasonable levels. The one exception to that has been the indoor cycling trainers, which the channel is full of trainers from all manufacturers, not just a garment specific thing because of the shift from indoor cycling training during the pandemic to more outdoor cycling training. So that’s the one area that the market is continuing to work through. But in general, we feel like the levels are mostly good.

The one thing that is a factor out there, as we look forward and really kind of difficult to predict how it will go. But retailers generally have inventory of lots of different things right now. So as they move into Q4, many have signaled that they’re promoting. And so as we look at Q4 we’ll be looking for signals around open-to-buy dollars and promotions that they’re willing to do given their overall inventory picture.

This is a slightly upbeat outlook, but I still feel that consumer demand is very unclear. I still see a major risk that a drop in demand could push the company to liquidate inventory. This could put its profitability at risk. Garmin’s profit dropped by 40% in the 2008 recession. The company spent years struggling to recover. I’m not confident that Garmin is well positioned to deal with those sorts of headwinds.

Valuation

Garmin’s shares are trading at a P/E of 17 times. As I mentioned, the business has $1.45 billion of cash on its balance sheet and no long-term debt. Adjusting for this cash, the company has a forward EV/EBIT of 15 times. I think that this is a slightly expensive valuation for a business with this profile. The company seems stable, but I think that this is fairly valued at best.

I also found that Garmin is struggling with its free cash flow. In the last five years, the business has only converted 60% of its net income into free cash flow. The business is currently trading at a forward P/FCF of 36 times. This seems high, and I don’t think that Garmin’s fundamentals are strong enough to justify this valuation.

Shareholder Returns

Garmin is returning a solid amount of money to shareholders. The company pays out a regular dividend at a 3.4% yield. It also recently authorized a $300 million share repurchase.

But I don’t think that these returns are enough to justify the price. For one, Garmin’s dividend isn’t well covered by the company’s cash flow. The regular payouts cost the company $560 million per year at the current run rate. This is even higher than Garmin’s current $450 million free cash flow guidance. The company spent more money on shareholders than it generated in each of the last four quarters.

Garmin’s GAAP payout ratio is also high, at 59%. I don’t think the company has much room to raise its payout. Any buybacks right now are being paid out of the business’s cash balance. Overall, I don’t think that the company is positioned to boost shareholder returns in the near term.

Final Verdict

I think that Garmin has decent fundamentals. Its outdoor segment is continuing to report strong results. This is impressive performance as consumer electronics headwinds continue to increase. The company’s marine, aviation, and auto segments are still performing decently.

But overall, I don’t believe that the valuation is compelling. The business has free cash flow issues and is unlikely to increase its payout. Inventory headwinds add to this risk. Overall, I recommend avoiding Garmin’s stock at the current price.

Be the first to comment