imaginima

The iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) covers various elements of the oil landscape, both companies that are long on the oil price and those that in some respects aren’t. In other words, the ETF has refiners and E&P companies in it. We think that while the demand question for oil will depend on macroeconomic factors, strategic and geopolitical supply factors will support the price regardless. The same cannot be said for product spreads, especially if crude does indeed stay relatively firm. The signs of refinery issues are already coming to light, and this will affect about 20% of the ETF. On balance, the PE is too high considering these headwinds and uncertainty around commodities generally.

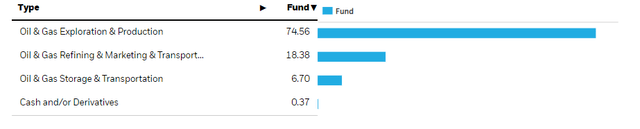

Breakdown Of IEO

The key figures are definitely those concerning the sectoral exposures. Let’s have a look.

Sector Breakdown (iShares.com)

We are seeing the allocations towards E&P at 75%, and these companies are long on the oil price with great operating leverage. Below are the refinery and logistics companies, which together account for the last 25%. 20% is exposed to product margins, which are the price of product minus the price of crude.

OPEC is cutting supply. This isn’t a big surprise. Firstly, oil-controlling countries are in the driver’s seat right now, and they are flexing their advantage. US companies that used to fill the shortfall from global producers have been more conservative on stranded asset complaints with Biden, and the fact that they’d prefer capital return with buybacks and dividends. Moreover, there is a credible argument that the oil production is hamstrung globally. There isn’t an obscene amount of excess supply. Supply cuts are not crazy nor malicious from OPEC, save for Russia’s influence on the decision.

This is to the credit of 75% of IEO. They are long oil and those prices look to be quite firm. On the other hand, this is bad for refiners. Refiners convert crude into product. Crude prices staying firm while macro hits, in part instigated by continued high prices in oil and demand destruction, are a mean cocktail for refiners. We already began to see some run cuts from refiners when we late covered IEO. It looks like run cuts by crude-based producers have done enough to maintain margins, as seen in Shell’s (SHEL) recent results from the petrochemical business.

Remarks

Some of the logistics and midstream elements aren’t commodity exposed at all, and depend purely on volume, but easily 20% do depend on product spread. While margins may be safe in the 75% of the IEO, volumes may slow down a little, and earnings growth isn’t exactly the narrative. Recession in refinery businesses is absolutely a possibility.

The IEO currently trades at a 14.8x PE and hasn’t really seen pronounced declines lately. We don’t think this average multiple well reflects the situation. While being long on oil in 75% of its exposures is good, we are still talking about a commodity with a volatile future. A lower multiple is reasonable for oil exposures right now, especially with the demand side of the question easily capable of tanking oil, thinking back to just a week ago where oil did fall on renewed macro concerns. Where forward earnings are questionable, we’d say that a single-digit multiple would be appropriate for refiners. On balance, the ETF looks a little expensive.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldRephraseRephrase current sentenceEdit in Ginger×

Be the first to comment