Suchat longthara

Water is one of the most vital resources on this planet. Although it’s everywhere, it’s truly necessary in order for the world to survive. And between pollution, climate change, and a continually growing population, that fact will become truer every day. One company that operates in the space as a producer and marketer of valves that are used not only for water, but also gas systems, as well as a producer of wet barrel fire hydrants, water metering technologies, water leak detection and pipe condition assessment products, and so much more, is Mueller Water Products (NYSE:MWA). Most recently, the company has demonstrated continued growth on its top line. But profitability has taken a slight step back. Despite these concerns though, management seems optimistic about the near term and, as a result, shares look quite affordable at this time. Even if financial performance does not match what management is pushing for, the stock does not look to be so pricey as to warrant anything short of a soft ‘buy’ rating at this time.

Recent performance has been mixed

Back in early September of this year, I wrote a bullish article covering Mueller Water Products. At that time, I talked about how the company was looking rather sound from an operational perspective even though some of its cash flow data was disappointing. But shares were cheap enough at that time to make me believe that the stock could outperform the broader market for the foreseeable future. And that, in turn, led me to rate the company a ‘buy’. Since then, shares of the firm have delivered on the call that I made, generating a return of 3.7% compared to the 0.9% experienced by the S&P 500.

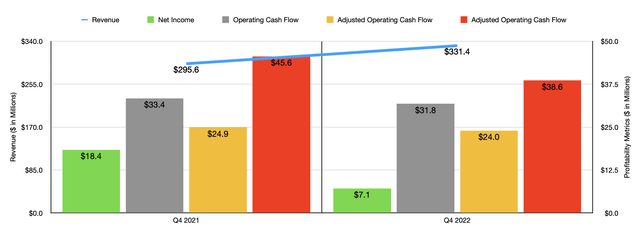

In order to truly evaluate why this return disparity exists, it would be helpful to cover data from the fourth quarter of the company’s 2022 fiscal year. This is the only quarter for which data is now available that was not available when I last wrote about the enterprise. During that quarter, sales came in strong at $331.4 million. That’s 12.1% higher than the $295.6 million reported for the fourth quarter of the 2021 fiscal year. This increase, according to management, was driven mostly by higher pricing across the company’s product lines. The firm did see a decrease in volumes associated with its service brass products thanks to this higher pricing. But clearly, that was not enough to prevent sales from climbing.

Although the company benefited from increased sales, that benefit did not extend to bottom line results. Net income in the final quarter of the year came in at $7.1 million. That’s 61.4% lower than the $18.4 million reported the same time last year. Although the company benefited from higher pricing on its offerings, this pricing was more than offset by higher costs caused by inflation, unfavorable manufacturing performance, an increase in certain other operational expenses, and other related factors. Part of this also included $3.6 million associated with strategic reorganization activities and $6.8 million involving non-cash impairment charges. Other profitability metrics for the company were a bit weak as well. For instance, operating cash flow dipped modestly from $33.4 million to $31.8 million. If we adjust for changes in working capital, the metric would have fallen from $24.9 million to $24 million. Also on the decline was EBITDA, with the metric dipping from $45.6 million to $38.6 million.

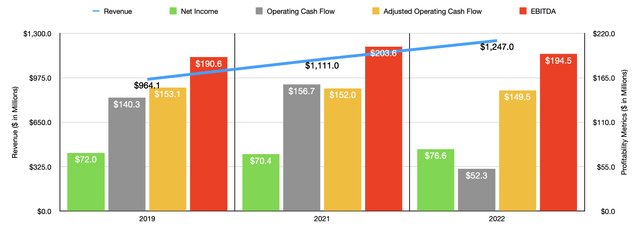

The results you experienced during the fourth quarter of the year were largely in line with what the company achieved in 2022 as a whole. During the year, revenue of $1.25 billion came in 12.2% higher than the $1.11 billion reported in 2021. Net income also improved, climbing from $70.4 million to $76.6 million. But outside of that, the rest of the news was rather depressing. As an example, operating cash flow plunged from $156.7 million in 2021 to $52.3 million in 2022. Even if we adjust for changes in working capital, we would have seen a decline from $152 million to $149.5 million. And over that same window of time, EBITDA for the company worsened from $203.6 million to $194.5 million.

While Mueller Water Products did have something of a mixed year, management seems to be optimistic about the near-term picture. At present, they are forecasting EBITDA this year to be higher than it was last year by between 10% and 14%. At the midpoint, that would translate to a reading of $217.8 million. Unfortunately, the company has not provided any real guidance when it comes to other profitability metrics. But if we assume that they would change at the same rate that EBITDA is forecasted to, we would expect net income of $85.8 million and adjusted operating cash flow of $167.4 million.

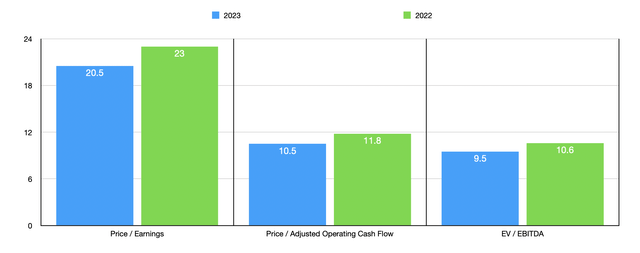

If these estimates come to fruition, it would mean that the company is trading at a forward price to earnings multiple of 20.5, at a forward price to adjusted operating cash flow multiple of 10.5, and at a forward EV to EBITDA multiple of 9.5. By comparison, using the data from 2022, these multiples would be slightly higher at 23, 11.8, and 10.6, respectively. Although these numbers might seem a bit lofty to some investors, they really aren’t that bad. On top of that, they also mean that the company is trading near the low end of the scale relative to similar firms. Five similar companies I looked at had price-to-earnings multiples ranging from 16.3 to 764. In this scenario, only two of the five companies were cheaper than Mueller Water Products. Using the price to operating cash flow approach, the range was from 14.3 to 28.8. In this case, our prospect was the cheapest of the group. And finally, using the EV to EBITDA approach, the range was from 7.9 to 31.2. In this scenario, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mueller Water Products | 23.0 | 11.8 | 10.6 |

| Helios Technologies (HLIO) | 18.2 | 18.0 | 11.7 |

| Barnes Group (B) | 78.5 | 24.0 | 16.0 |

| Hillman Solutions (HLMN) | 764.0 | 25.4 | 14.0 |

| Kennametal (KMT) | 16.3 | 14.3 | 7.9 |

| Enerpac Tool Group Corp (EPAC) | 85.8 | 28.8 | 31.2 |

Takeaway

At first glance, investors who are evaluating Mueller Water Products might be concerned about the weakening results in the final quarter of 2022. Having said that, management seems optimistic about future profitability. Obviously, there is always a chance that they could be wrong. But absent that, shares look fairly attractive moving forward. I wouldn’t exactly call this a strong prospect by any means. But for those who like this space and who want an enterprise that could have a bit of upside potential to it, Mueller Water Products seems to be worthy of consideration.

Be the first to comment