wellesenterprises

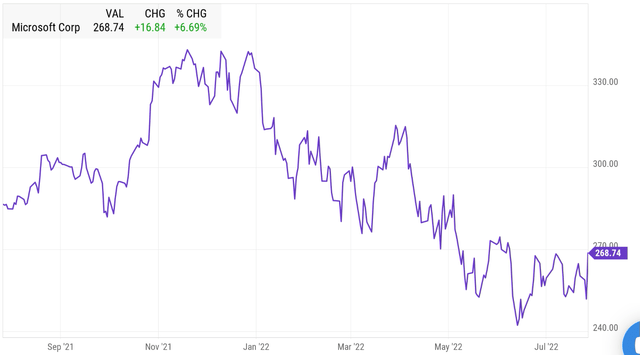

Previously, I wrote a post on Microsoft Corporation (NASDAQ:MSFT), which I called an “Undervalued Tech Titan with Roaring Revenue.” The story hasn’t really changed, but the company’s recent financial results indicate short-term headwinds from foreign exchange, PC shipment declines, and higher operating expenses. However, Microsoft reiterated strong guidance for the full year 2023 and believe they can “Take market share” in the cloud workload space. Microsoft’s Cloud segment (Azure) was up a blistering 40% year-over-year, and the trend of digital transformation is not slowing down. The market also agrees, and the stock price has popped by ~7% on the “poor” earnings report. Microsoft stock is still undervalued intrinsically, so let’s dive into the latest earnings report in greater detail, its diverse business model, and valuation.

Microsoft share price (YCharts)

Tepid Earnings, Strong Guidance

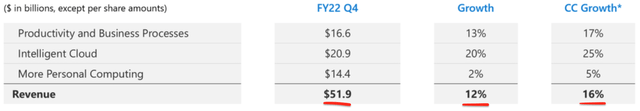

Microsoft announced its financial results for what they call the Q422. Revenue was an enormous $51.9 billion, up 12% year-over-year or 16% on a constant currency basis. Overall, revenue missed analyst expectations by $493 million. This was mainly due to “unfavorable” exchange rate movement due to a strong dollar, which impacted revenue by an eye watering -$595 million. The production shutdowns in China, along with a weak PC market, impacted Windows revenue by -$300 million. In addition, increased economic uncertainty have caused advertisers to pull ad spend, which negatively impacted LinkedIn and Search revenue. Advertising giant Google (Alphabet) (GOOG) (GOOGL) also highlighted a similar issue in their recent earnings report.

Microsoft Q423 (Investor Earnings Report)

To reiterate my thoughts from the introduction, the majority of the aforementioned issues are short-term macroeconomic factors and don’t substantially change the Microsoft story long term. For example, in five years’ time will we still be talking about FX headwinds or advertisers pulling spend for a quarter… I doubt it.

Let’s dive into each segment independently to review the recent positives and negatives.

1. Productivity And Business Processes

The Productivity and Businesses Processes segment grew revenue by 13% (17% constant currency) year-over-year, driven by Microsoft 365 and LinkedIn.

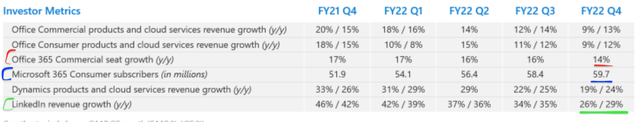

The Microsoft 365 platform, includes the Microsoft Office suite (Word, PowerPoint, etc.) and Teams. The pandemic accelerated the need for employers to offer a fast and secure remote working solution, and MS 365 was there to fill the gap. Although Microsoft hasn’t reported the exact number of paid seats this quarter, sources report they had 345 million paid seats as of April 2022, which was up a meteoric 72% since 2020, due to the aforementioned lockdowns. In the most recent quarter, commercial seat growth popped by 14%, which was a couple of points slower than the last quarter but still strong.

This partially drove Office 365 commercial revenue growth higher by 15% (19% cc) (not shown on table). In addition, the company “expanded” its accounts and grew Average Revenue Per User (ARPU).

Productivity Unit (MS Earnings Report Q422)

The increase in ARPU was driven by higher demand for Microsoft 365’s E5 license, which has been called the “Cadillac of Licenses” and makes up 12% of the Office 365 installed base.

The E5 license gives an enterprise all the productivity apps in the Microsoft office suite but includes Voice via Teams, Compliance and Security. It has proven to be extremely popular and paid seats increased by a blistering 60% year over year.

Teams (Video conferencing) has announced “deep integrations” with multiple software vendors including Adobe and Workday. In addition, Teams now acts as a “platform” where third party apps can be built on top. The number of these apps increased by 40% year over year, according to CEO Satya Nadella in the Q422 earnings call. The platform is also the market leader in both VOIP (Voice over IP) and PSTN calling. PSTN (Public Switched Telephone network) users nearly doubled year over year to 12 million.

A key element of Microsoft’s strategy is to increase the “feeling of presence” in hybrid working environments. “Teams Rooms” allows employees both virtually and onsite to get a seat at the table. The solution offers AI powered cameras, Intelligent Microphones and even an “intelligent capture” whiteboard which fades out the writer so even remote employees can see clearly what is happening. The platform is immensely popular and is being used by over 60% of the Fortune 500.

Teams Rooms (Microsoft Website)

Security As A Secret Weapon

Microsoft’s mission is to “empower every organization on the planet to achieve more.” One of the ways they accomplish this is by identifying where organizations have a real pain point and solving it. Security has been a hot topic recently, as the hybrid work environment has widened the attack surface and introduced new security threats.

Microsoft provides a suite of solutions across over 50 categories and has recently seen strong growth in the security segment, with revenue increasing by a blistering 40% year over year. According to CEO Satya Nadella, in the Q422 earnings call:

“We are the only cloud provider with protection for the top three cloud platforms, and we are seeing more and more customers turn to us to protect their multi-cloud, multi-platform infrastructure.”

Hybrid cloud is a common enterprise structure as companies start to digitally transform from on premises to the cloud. Microsoft recently announced the “Entra product family” which includes tools for Identity verification and permissions. The company even secures the world’s largest hedge fund Bridgewater Associates, founded by Ray Dalio. The cybersecurity industry was valued at $139.8 billion in 2021 and is forecasted to grow at a 13.4% CAGR up until 2029. Thus, this is a huge opportunity for Microsoft to attack, and even tech giant Google is aggressively moving into the space, with a recent acquisition of Cybersecurity firm Mandiant for $5.4 billion.

On the consumer side, Consumer Products and Cloud Services revenue grew by 9% (12% cc). This was driven by increased Microsoft 365 subscriptions, which grew by 15% year-over-year to 59.7 million.

Dynamics Revenue showed strong growth of 19% (24% cc), driven by rapid Dynamics 365 growth of 31% (36% cc). Microsoft Dynamics 365 includes Enterprise Applications such as its CRM and ERP software.

LinkedIn Is Growing Rapidly

LinkedIn is the world’s most popular professional social network and has over 310 million monthly active users. I personally see LinkedIn as a much more stable and valued social network, when compared to platforms such as Facebook, TikTok and Instagram. LinkedIn benefits from strong network effects like the aforementioned platforms, but doesn’t face the intense competition like those do. In Q422, Revenue increased by 26% (29% cc) which was slightly slower than the 34% growth in the last quarter, but that was driven by a very strong job market. In addition, economic uncertainty has caused advertisers to reduce ad spend, and thus LinkedIn “Marketing Solutions” saw slower growth. Talent solutions was also impacted by fewer job posts, as many companies such as Meta (META), Google (GOOG, GOOGL), and even Microsoft (MSFT) have begun to slow down hiring. The good news is the macroeconomic environment is cyclical, just like the advertising and job market, thus what goes around comes around.

2. Cloud Is The Growth Engine

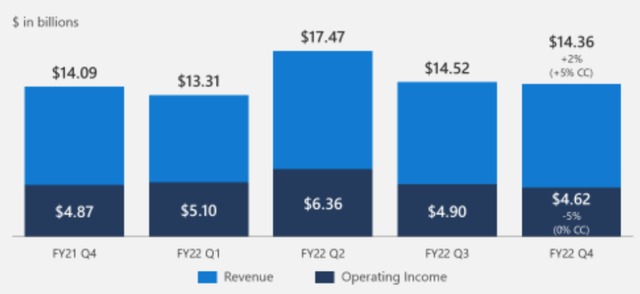

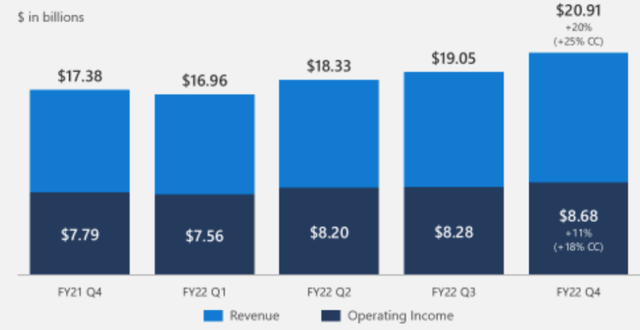

Microsoft’s “Intelligent Cloud” segment saw revenue growth of 20% (25% cc basis) to $20.91 billion, driven by strong growth of 40% (46% cc) in Microsoft Azure, which is the second largest cloud provider globally. Despite the rapid growth in Azure, it was approximately 3% less than analyst expectations and 1% less than managements own guidance. This was driven by Azure’s consumption-based model and organizations going through a period of “optimization” due to economic uncertainty.

Server products revenue declined by 2% (1% cc) due to a strong prior-year figure and more multiyear agreements. Overall, operating expenses for the intelligent cloud segment grew by a substantial 20% as the company increased investment into Azure and the recently acquired Nuance, which is a conversational AI company.

3. More Personal Computing

The “More Personal Computing” segment grew revenue by just 2% (5% cc) year over year to $14.36 billion. This was driven by a 2% decline in Windows OEM due to China factory shutdowns. In addition, the company saw a 6% decline in Xbox services revenue and a substantial 11% drop in Xbox hardware sales. At first glance, this may seem very bad, but let’s take a step back to get some perspective. Gaming saw a huge boost in 2020, as the lockdowns forced people to stay at home, thus a correction in demand would make sense. In addition, Yahoo Finance technology editor Daniel Howley stated in a recent interview that “Many of the people who wanted to buy Xbox’s have already bought one,” in addition, “there weren’t a lot of first party titles from Microsoft this quarter.” These are both good points.

Personal Computing (Microsoft earnings report)

Strong Guidance

Despite the relatively poor quarter, management issued confident guidance and double-digit growth in both revenue and earnings. The company believes the digital transformation tailwinds in Azure are strong and the consumption model will correct itself moving forward.

Microsoft has a fortress balance sheet with $104 billion in cash, equivalents and short-term investments. In addition, it has $47 billion in long-term debt, of which just $2.7 billion is current (due within the next two years).

Advanced Valuation of Microsoft

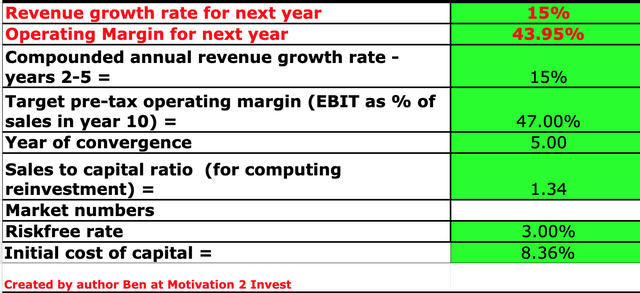

In order to value Microsoft, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 15% revenue growth for next year and 15% for the next 2 to 5 years. This takes into account management’s confident outlook and the rebound in future consumption.

Microsoft Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the currency headwinds to correct in the upcoming years, and the company’s operating margin to increase to ~47%. In addition, I have taken into account Microsoft’s “Effective tax rate” of 19% (forecasted) and capitalized its R&D investments.

Microsoft Stock Valuation 2 (created by author Ben at Motivation 2 Invest)

Given, these factors I get a fair value of $299/share. At the time of writing, the stock is trading at ~$268 and thus is ~11% undervalued.

As an extra data point, Microsoft is trading at a Price to Earnings Ratio (Forward) = 26.4, which is ~9% cheaper than its five-year average.

Risks

Macroeconomic Headwinds

The high inflation rate and rising interest rate environment is increasing input costs for both businesses and consumers. This has led to many analysts forecasting a “shallow but long recession” starting in the next quarter. This may cause enterprises to delay new investments, advertisers to reduce spending, and consumers to cut back on expenses. In addition, the strong dollar is negatively affecting U.S. companies, which earn a significant proportion of revenue from abroad. Microsoft falls into this camp, as they earn approximately 50% of their revenue from international markets and thus are more sensitive to the FX environment. Due to these factors, I expect Microsoft’s revenue and earnings to be volatile in the short term.

Final Thoughts

Microsoft is a technology juggernaut, which continues to innovate and pivot to stay ahead. Moving forward, Microsoft Azure will continue to be a key growth driver as more companies are moving their workloads to the cloud. The company is facing a lot of short-term headwinds from inflation, recession fears, and unfavorable FX exchange rates. However, longer term I believe the company is in a strong position to continue to grow at a sustainable pace. The stock is undervalued intrinsically and relative to historic multiples at the time of writing. Therefore, this recent volatility could be an opportunity for the long-term investor.

Be the first to comment