AlbertPego/iStock via Getty Images

Essential Properties Realty Trust (NYSE:EPRT) is a lesser-known net lease REIT but has shown strong performance since coming public in 2018. While the stock is up materially from COVID-lows, the stock still trades at some discount to peers in spite of a newer portfolio and lower leverage. EPRT should show stronger forward growth than peers, largely due to the lower leverage profile, but that is not yet reflected in the stock price. The 4.7% yield is attractive while investors wait for inevitable multiple expansion.

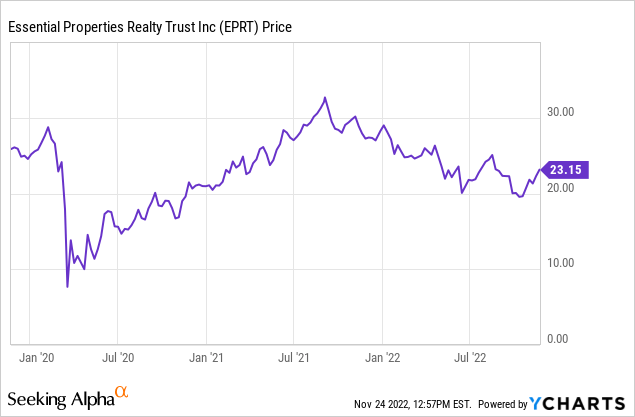

EPRT Stock Price

EPRT came public in 2018 at an IPO price of $14 per share. It recently traded hands just around $23 per share.

I first covered EPRT in April 2020 during a time in which I was heavily overweight equity REITs (recall that REITs had crashed amidst pandemic lockdowns). EPRT has since delivered 145% total returns since then. I most recently covered EPRT in October 2020 where I continued to rate the stock a buy – it is up 34% since then (including dividends). Due to the strong growth, the dividend yield has compressed only slightly from 5% to 4.7% – there’s still more upside to be had here.

EPRT Stock Key Metrics

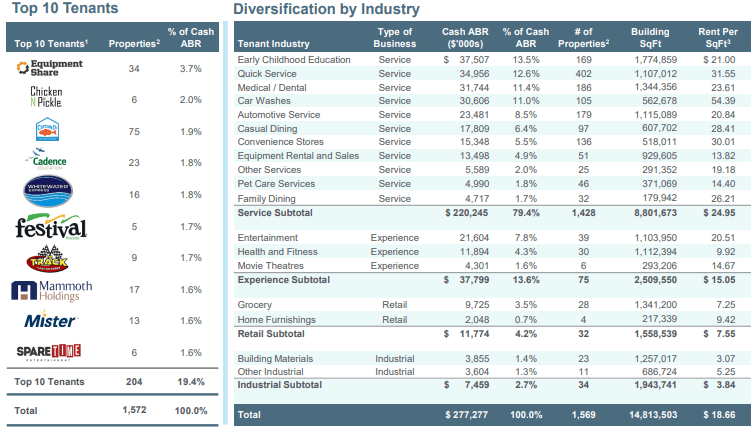

EPRT can be considered a smaller operator in the NNN REIT sector though it does have a well-diversified portfolio with only 19.4% exposure to its top 10 tenants.

November Presentation

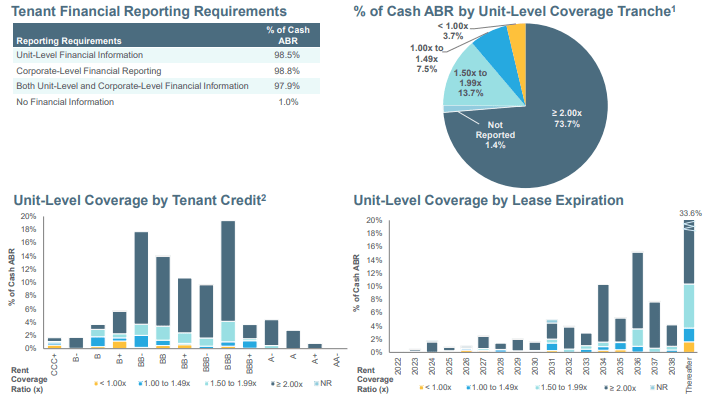

EPRT maintains a high-quality portfolio as evidenced by the 4.2x average unit-level coverage. Only 3.7% of tenants have less than 1x rent coverage.

November Presentation

That unit-level coverage ranks highly among peers, and EPRT also has one of the longer weighted average lease terms in the sector. NNN REITs typically do not derive strong leasing spreads upon lease expiration, so investors should prefer longer lease terms (though it is unclear if they can deliver strong leasing spreads amidst an inflationary environment).

November Presentation

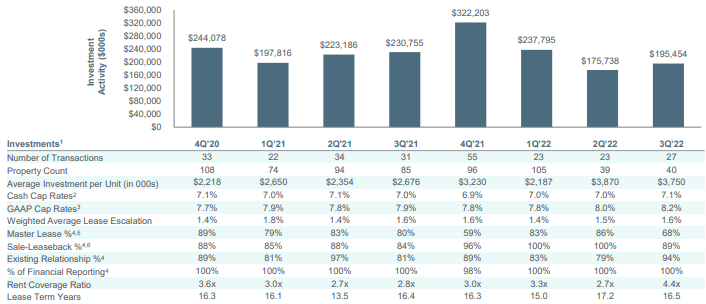

The smaller size and newer profile have not impeded the company’s growth pipeline, as it had acquired around $200 million in properties every quarter. EPRT typically acquires properties at a 7% cap rate with 1.5% annual lease escalators.

November Presentation

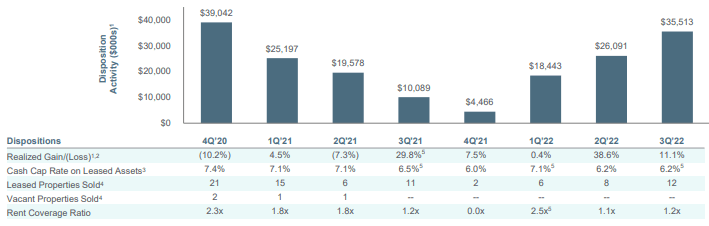

It is worth noting that while disposition activity is rather elevated at 18% of acquisitions as of the latest quarter, all sold properties have been occupied over the past many quarters, with disposition prices at attractive cap rates.

November Presentation

Investors should not expect this trend to continue indefinitely, as the portfolio over time will have underperforming assets that will need to be sold off.

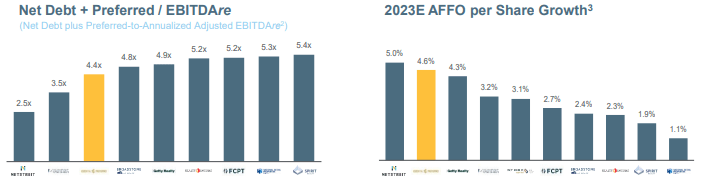

EPRT maintains one of the lower leverage profiles in the sector with debt to EBITDA at only 4.4x – on the conference call management set 4.5x to 5.5x as their long term target profile.

November Presentation

In the latest quarter, EPRT delivered 1.7% same-store rent growth and grew adjusted funds from operations (‘AFFO’) 15% to $0.38 per share.

EPRT guided for up to $1.54 in full-year AFFO per share in 2022, representing 14% YOY growth. EPRT has also given preliminary 2023 guidance for up to $1.64 in AFFO per share, reflecting 6.5% growth. That projected growth rate would still comfortably put it near the top of peers. This is because equity valuations for all NNN REITs have compressed amidst rising interest rates – whereas peers may find it difficult to fund external acquisitions as accretively as they have in the past, EPRT may be able to increase leverage on its balance sheet to continue its growth story.

Is EPRT Stock A Buy, Sell, or Hold?

At recent prices, EPRT is trading at a 4.7% yield, which is at the high end of its limited time as a public company (if one excludes the elevated yields amidst the pandemic crash).

Seeking Alpha

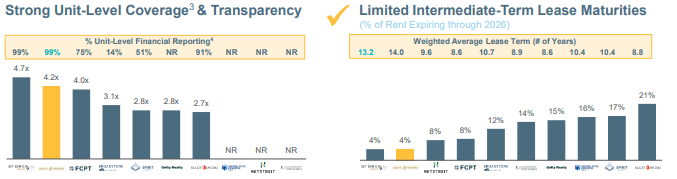

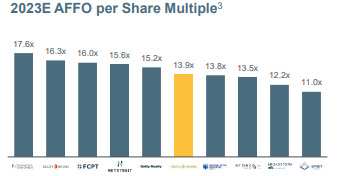

EPRT trades at a notable discount to more well-known peers like Realty Income (O).

November Presentation

Given the stronger forward growth rates, I would have instead expected EPRT to trade at some premium. Something like 18x AFFO already reflects 33% potential total return upside over the next 12 months.

But there are headwinds to consider here.

Given the rising interest rate environment, investors may be wondering if cap rates are expanding. Based on what we’ve seen in the sector, cap rates have not yet expanded and EPRT management actually stated that they may need to slow down their pipeline if sellers do not calibrate their expected cap rates to match theirs. That may disappoint some investors as the rising interest rate environment may prove to be a significant headwind for NNN REITs as they are unable to offset rising costs of capital.

It is also possible that if current difficult conditions continue indefinitely, then EPRT may begin to see tenant weakness. I am doubtful that EPRT would be able to sell off nonperforming properties at attractive cap rates.

What kind of returns can investors expect from here? EPRT yields 4.7% and can probably sustain around 4% growth moving forward. If we assume that multiple expansion takes place gradually, then the stock might deliver double-digit returns. That may be attractive to many investors, especially those looking to incorporate EPRT as a bond-replacement kind of investment. But there are admittedly few catalysts at play here – growth is more likely to disappoint than surprise due to high cost of capital, though I expect growth to be faster than peers considering the lower leverage. There is some possibility that EPRT falls back to COVID lows when the yield soared into the double-digits – in my opinion that wouldn’t be unreasonable considering where tech stocks are trading at today. EPRT makes sense for those looking for a yield-based stock that can beat the market over the long term, but makes less sense for those looking for a lower volatility play. I rate the stock a buy.

Be the first to comment