Michael Warren/E+ via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 31st 2022.

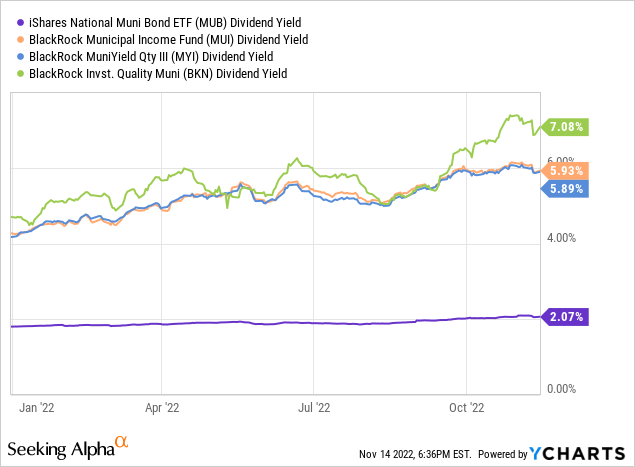

The iShares National Muni Bond ETF (NYSEARCA:MUB) is the largest municipal bond ETF in the market. MUB offers investors diversified exposure to high-quality municipal bonds with low credit risk, and its dividends are tax-exempt. On the other hand, the fund’s 2.1% dividend yield is quite low, and interest rate risk is quite high. MUB’s dividends should grow as interest rates rise, but expected yields remain low regardless.

Although MUB’s value proposition might be attractive for some conservative, long-term investors, there are similar, higher-yielding alternatives out there.

Treasury bills currently yield +3.6%, have significantly lower interest rate risk than MUB, and seem particularly appropriate for more conservative investors. The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) is a simple T-bill ETF, last covered here.

Municipal bond CEFs offer much higher yields, albeit at significantly greater risk and volatility, so seem more appropriate for more aggressive investors. There are many fantastic choices in this space, including a suite of BlackRock muni CEFs. Of these, the Municipal Income Fund (MUI) sports a particularly high 11.3% discount, and yields 4.8%.

MUB- Basics

- Investment Manager: BlackRock

- Underlying Index: ICE AMT-Free US National Municipal Index

- Expense Ratio: 0.07%

- Dividend Yield: 2.06%

- Total Returns CAGR 10Y: 1.52%

MUB – Overview

MUB is a municipal bond index ETF, tracking the ICE AMT-Free US National Municipal Index. It is a relatively simple, broad-based index, including all dollar-denominated, fixed rate, investment grade, tax-exempt bonds meeting a basic set of inclusion criteria. It is a market value weighted fund, comparable to a market-cap weighting scheme but for bonds.

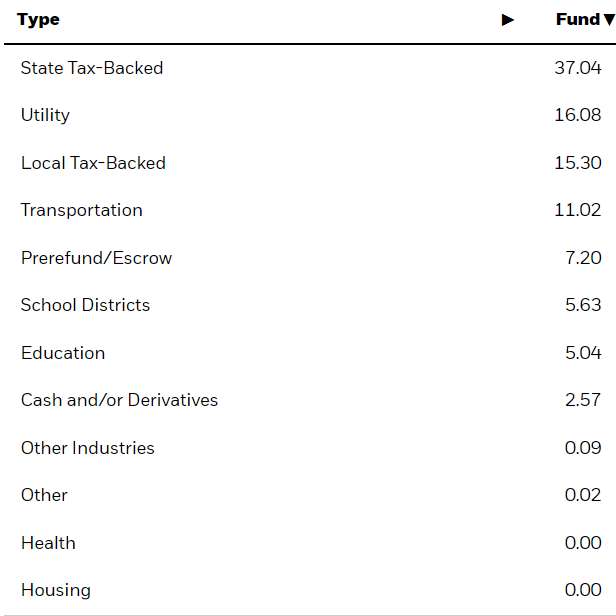

MUB’s underlying index is quite broad, resulting in a very well-diversified fund. MUB invests in over 5,000 securities from all relevant states, and from all relevant market subsegments. As with most municipal bond funds, MUB is overweight state bonds, as well as bonds issued in New York and California.

MUB MUB

MUB’s holdings are quite diversified for a municipal bond fund, but the fund is obviously less diversified than bond funds investing in several bond sub-asset classes. In my opinion, the fund is more than sufficiently diversified for most investors, but those looking for as much diversification as possible should consider broader bond funds.

Besides the above, nothing much else stands out about the fund or its holdings: it is a simple municipal bond index fund. With this in mind, let’s have a look at the fund’s investment thesis.

MUB – Benefits and Investment Thesis

Tax-Exempt Yield

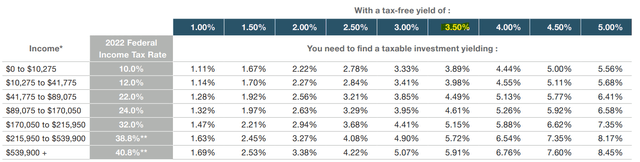

MUB focuses on tax-exempt municipal bonds, which are exempt from federal taxes. This is a significant benefit for the fund and its shareholders, and particularly important for investors in higher tax brackets, who could significantly reduce their tax bill by focusing on MUB or similar alternatives. Tax savings are dependent on dividends received and federal income tax rates, both of which vary.

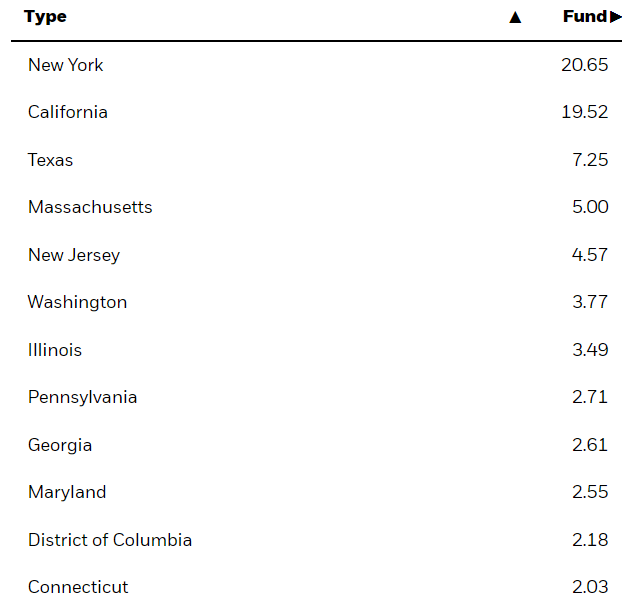

Looking at dividends, the fund currently sports a relatively meager 2.1% dividend yield. On a slightly more positive note, dividends should see very healthy growth due to rising interest rates, courtesy of the Federal Reserve. As per management data, MUB currently sports an SEC yield of 3.7%. SEC yields are a standardized measure of a fund’s short-term generation of income, and explicitly exclude capital gains, return of capital distributions, and the like. MUB is generating quite a bit more in income than it is distributing to shareholders, so there is quite a bit of room for dividend growth. Fund dividends have seen very healthy growth YTD, but further hikes are quite likely, at least under current conditions.

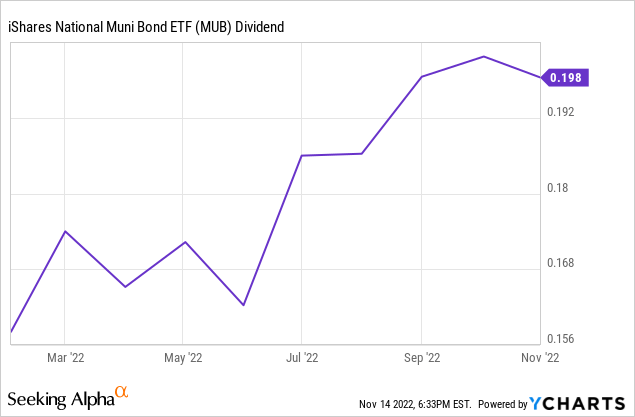

Tax savings depend on an investor’s specific circumstances, especially their federal income tax rate. These specific issues are outside the scope of this article, but I’ll provide a quick table of tax-equivalent yields that might be of use. In simple terms, the table lets you compare tax-free yields with equivalent taxable yields depending on your tax rate. MUB’s 3.7% SEC yield is equivalent to a +4.5% taxable yield for most investors, although figures do vary depending on an investor’s specific circumstances.

Finally, a quick table comparing MUB’s yield to that of some of its peers. It is a competitive yield, especially considering its tax advantages, but pales in comparison to that of leveraged municipal bond CEFs.

Fund Filings – Chart by Author

Low Credit Risk

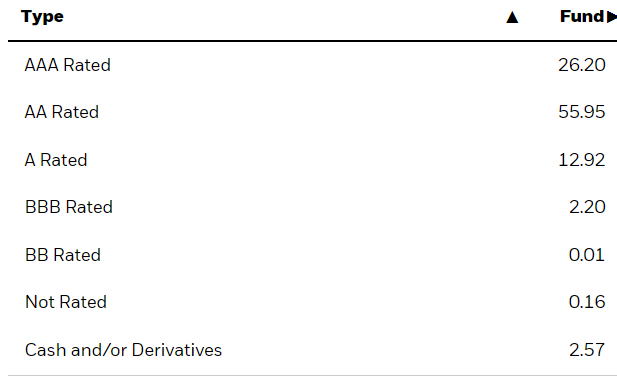

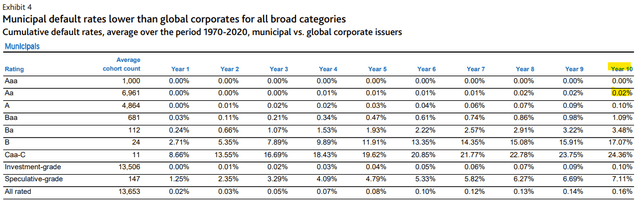

MUB exclusively invests in investment-grade municipal bonds, with strong credit ratings and relatively low default rates. The fund sports an average credit rating of AA, second highest rating available.

MUB

Importantly, credit ratings for municipal bonds are quite strict, and generally indicate a higher level of quality than comparable ratings in other bond sub-asset classes. As per Moody’s, municipal bonds with AA credit ratings have a 10Y cumulative default rate of only 0.02%, almost zero. These are incredibly safe securities, all things considered.

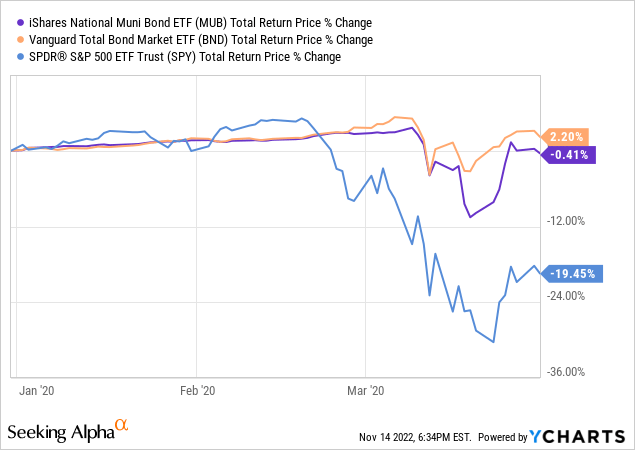

Bonds with strong credit ratings are issued by institutions with strong, proven capacity to pay, even during adverse economic scenarios. As such, these bonds tend to fare relatively well during downturns and recessions, as they are very rarely at real risk of default. Expect the fund to perform relatively well during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

MUB’s safe, high-quality holdings are a significant benefit for the fund and its shareholders, and should prove particularly beneficial for more risk-averse investors.

Although MUB does provide investors with some important benefits, there are significant drawbacks as well. Let’s have a look.

MUB – Risks and Drawbacks

High Interest Rate Risk

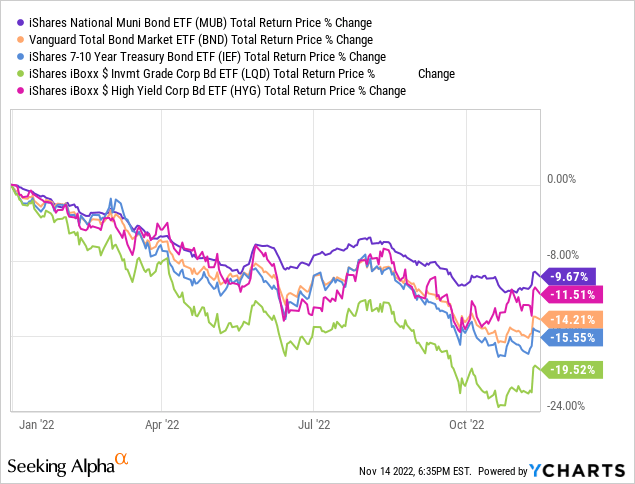

MUB focuses on relatively long-term bonds, with an average maturity of 7.6 years, and an average duration of 6.5 years. Both figures are high on an absolute basis, although somewhat about average for a bond index fund. Expect high, but average, losses when interest rates increase.

MUB has somewhat outperformed expectations these past few months, with the fund slightly outperforming relative to most of its peers, although still suffering high losses. From what I’ve seen, interest rate risk / duration for MUB and its peers was slightly different in prior months, so I don’t expect the fund will continue to outperform if rates continue to increase from here on out.

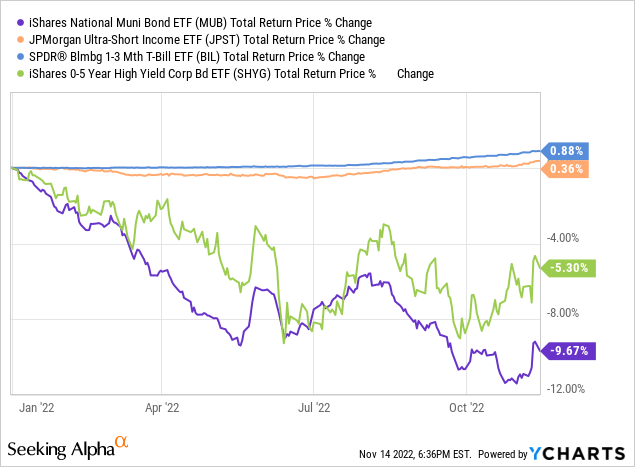

Although MUB’s interest rate risk is about average for a bond fund, it is significantly higher than that of short-term or variable rate bond funds. I’ve included some of the better known of these funds in the graph below.

Although MUB’s interest rate risk is not higher than average, it is relatively high on an absolute basis, higher than that of some specific / niche funds, and somewhat undercuts its investment thesis. MUB’s diversified holdings and low credit risk are particularly important for more risk-averse investors, but these should find the fund’s high interest rate risk off-putting.

Low Dividend Yield

MUB currently yields 2.1%, a relatively meager amount. Dividends should grow until the fund yields around 3.7%, equivalent to its SEC yield, a higher, but still quite low, figure.

MUB’s relatively meager yield is a negative for the fund and its investors, and especially important considering its relatively high interest rate risk. T-Bills currently yield between 3.7% and 4.0%, and have much, much lower interest rate risk than MUB. The fund’s tax advantages might make it better than T-Bills under some circumstances or for some investors, but these are very small benefits compared to a massive increase in interest rate risk. It simply does not seem worth it, in my opinion at least.

MUB’s dividend yield is also significantly lower than that of most leveraged municipal bond CEFs, albeit these are riskier investments too. As mentioned previously, there are many fantastic CEFs in this space, including most BlackRock offerings. Of these, MUI has the highest discount of 11.4%, but most others trade with sizable discounts and yields as well.

For more aggressive investors, these and other CEFs offer much stronger dividend yields and value propositions. In my opinion at least.

Conclusion

MUB offers investors diversified exposure to high-quality municipal bonds with low credit risk, and some tax advantages. On the other hand, the fund’s 2.1% dividend yield is quite low, and interest rate risk is quite high. MUB’s risks and drawbacks seem to outweigh its benefits, so I would not be investing in the fund at the present time.

Be the first to comment