Michael Vi/iStock Editorial via Getty Images

BlackBerry Limited (NYSE:BB) reported fiscal second-quarter earnings yesterday with earnings and revenue coming slightly ahead of Wall Street expectations. More often than not, we associate earnings announcements with wild swings in stock prices although some of these moves seem irrational and unjustifiable. In after-hours trading yesterday, BlackBerry shares hardly moved in one particular direction with the stock pulling back just 2% at one stage only to recoup those losses later. In short, Q2 earnings failed to move the market – at least yesterday – which I believe is a sound reaction given that Q2 earnings offer no catalyst for the stock to break higher or lower. A deeper dive into Q2 earnings reveal the company is still suffering from the same old problems it did over the last few quarters and that the measures taken to overcome these challenges are yielding little to no results today.

More challenges on the cards for BlackBerry

As I pointed out in my previous article on BlackBerry, the company is struggling to grow its cybersecurity business, which is a concern. IoT revenue increased 11% YoY in Q2. In comparison, cybersecurity revenue fell 8% YoY, which is a clear indication of how the company is failing to gain traction with its security products. Business conditions for this sector seem promising although BlackBerry is struggling to establish itself as a reliable security solutions provider.

The strength of the IoT business dominated by the QNX segment has so far negated, to a certain degree, the negative impact resulting from the cybersecurity segment’s struggles. The company announced a design win with Volkswagen AG (OTCPK:VWAGY), which is an important step toward strengthening its footprint in the automobile sector, but this sector could come under pressure in the coming quarters due to the weakness in global economic activity.

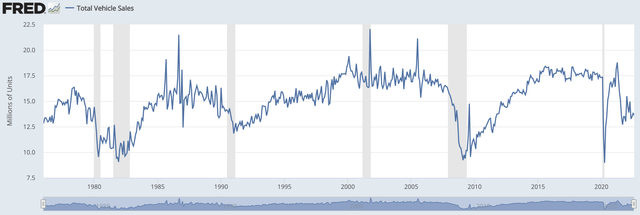

During historic economic downturns, the automobile sector has shown notable weakness. As illustrated below, previous recessions in the U.S. (marked in grey) have led to a downturn in vehicle sales. The impact during the global financial crisis was so severe and could be thought of as a one-off occurrence, but a recession will anyways lead to a cutback on discretionary spending, thereby affecting vehicle sales.

Exhibit 1: Monthly vehicle sales in the U.S.

This time around, the situation might not get worse until a few quarters pass by as there is a shortage of vehicles globally, which is evident from the lack of inventory at dealers. The short supply of vehicles will soften the blow on automakers but persistently low economic activity will eventually catch up with the automobile industry, which may force automakers to slash spending on the production of new vehicles. Automakers could also be forced to call off investments, and this could limit BlackBerry’s potential for striking new partnerships. Knowing that the cybersecurity segment is already struggling, investors are very likely to react negatively to any weakness in the IoT business.

The unclear path to profitability

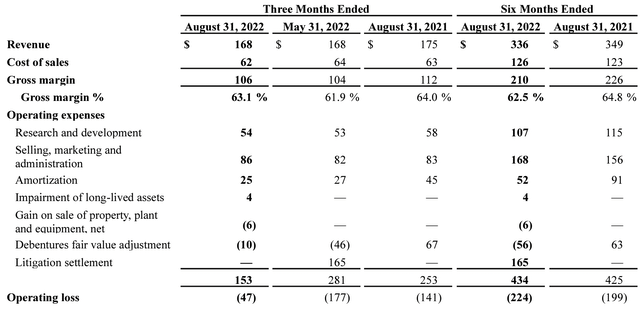

BlackBerry does not enjoy any competitive advantages in the cybersecurity segment, and it would not be unreasonable to claim that a path toward enjoying competitive advantages, in the long run, is also not visible. The unified endpoint management market is highly competitive with the likes of Microsoft Corporation (MSFT) aggressively investing to gain market share. This fragmented nature of the market along with the aggressive plans of Microsoft makes it difficult for BlackBerry to gain market share. The company, therefore, is left with no option but to invest in marketing to build brand equity. The company seems to be going down this path, which is evident from the growth in selling, marketing, and administration expenses in Q2 compared to the previous quarter and the corresponding quarter last year.

Exhibit 2: Excerpt from the Q2 consolidated income statement

The coming quarters will reveal whether BlackBerry’s recent investments in people and marketing are yielding desired results. Nonetheless, it seems reasonable to conclude that BlackBerry will find it difficult to expand profit margins in the foreseeable future because of growing competition in the cybersecurity sector and its investments in marketing.

When it comes to the QNX business, BlackBerry is already pumping money into R&D projects as innovation is key for design wins at a time when Android-based software products are being embraced by automakers. Although these investments are necessary to retain its market share, a deterioration of margins seems unavoidable as a result of these investments.

I do believe that BlackBerry operates in two fast-growing markets, but the company is nowhere near profits, and it would take years for the company to deliver profits, if at all. There are a lot of variables to consider, and a lot could go wrong in the next few years.

Takeaway

BlackBerry Q2 earnings tell the same old story, which could be the major reason behind the muted reaction in the market. There are no visible catalysts that could push BB stock higher in the foreseeable future. In the absence of a clear path to profitability and growth catalysts, investing in BlackBerry stock today does not seem like a prudent move although the company has come a long way in recent years to dismiss the threat of bankruptcy.

Be the first to comment