imaginima

Midstream energy companies are a go-to investment for those looking for high yields that are following the 2020 shock. The sector has performed well over the past two years as the demand and supply of oil and gas recovered following the 2020 shock. The company MPLX LP (NYSE:MPLX) is particularly popular among individual investors due to its high 9% dividend yield and decent earnings quality.

There is a lot to like about the company. It has performed slightly better than its peer group over recent years and has considerably expanded its revenue (but not revenue per share) with the overall U.S. energy landscape. Like most mainstream energy firms, its sales are far more likely to keep up with inflation than many other companies. In my view, this factor makes MPLX and its peer’s robust long-term investment options today since few high-yield investments benefit from inflation.

However, most analysts focus on the company’s backward-looking financial metrics and not on forward-looking data regarding the U.S. energy sector. MPLX has particular economic risk factors today that investors would be wise to consider. The LP is certainly not a “low risk” investment, as seen not only in its historical volatility but in the risks in its core business model. While the company is trading at a reasonably low valuation, energy demand destruction and waning supply growth may upset its profitability over the coming years.

Energy Demand Destruction Grows

Most energy MLPs like MPLX generate earnings from contracts on energy product transportation and processing. MPLX’s segments are divided between gathering and processing (G&P) and logistics and storage (L&S). The firm generates nearly even revenue between each. Its operational profitability depends mainly on the volume of energy products it transports, stores, and processes. Today’s high oil and gas prices are not necessarily beneficial due to growing demand destruction. The company’s recovery largely stemmed from aggressive growth in consumer demand for energy products. Still, prices have risen without an equal increase in production, which has recently signaled a decline in demand.

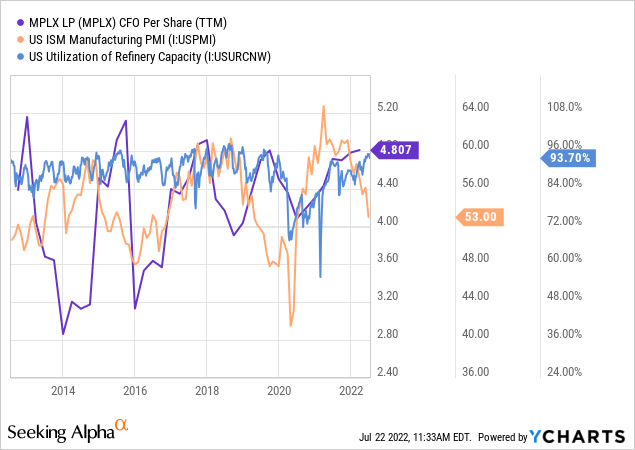

MPLX’s CFO per share generally declines with the U.S. economy, measured by the Manufacturing PMI and refinery utilization capacity. See below:

MPLX’s CFO per share above is a trailing twelve-month total which lags the other metrics. However, historically, when the U.S. manufacturing PMI has declined, MPLX’s trailing CFO per share has slipped over the following year as energy demand has weakened, as well as its client’s pricing power. The recent decline in U.S. refinery capacity was particularly harmful, but MPLX made it through with only a ~$1 reduction in annual operating cash flow.

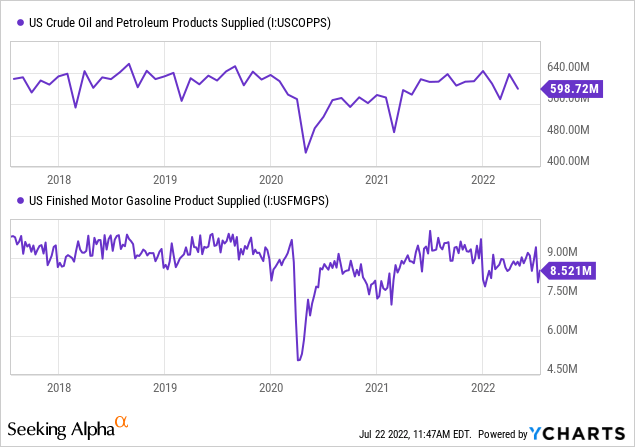

Looking forward, the U.S. manufacturing PMI is declining at a very rapid pace. The chart above does not display the most recent July data, indicating a further decline in U.S. GDP growth. Not all economic slowdowns are necessarily negative for MPLX, but the current downturn relates more explicitly to the energy sector as high prices have caused significant and growing demand destruction. While we are still in the early stages of this trend, there has been some decline in crude oil products supplied and notable recent declines in finished motor gasoline products provided. See below:

Currently, this drop is not likely significant enough to materially impact MPLX’s bottom line due to its long-term contracts and the fact that overall volumes are likely to remain decent. However, in the future, higher energy prices are not necessarily bullish for MPLX and may prove bearish as efforts to reduce consumption grow.

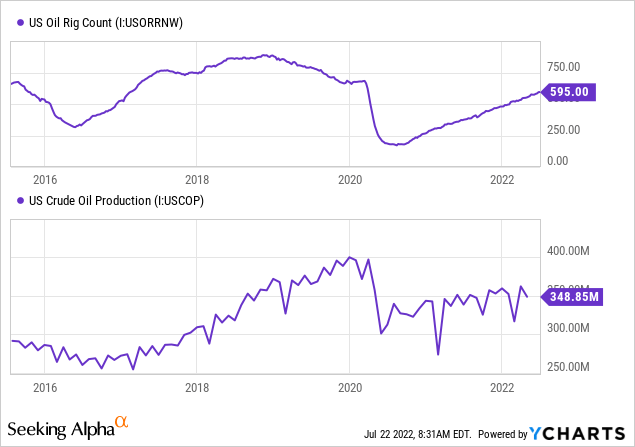

Energy Supply Weak, Particularly in Marcellus

The supply aspect may be more problematic than demand considering the weakness in output growth following 2020. The U.S. has thus far been unable to bring crude oil and natural gas production back to pre-2020 levels. Midstream demand grows, and more oil and gas are being produced and transported across the country. Production growth stems from the rig count, which must be over 500 to create net gain as many new wells replace old wells. The rig count has risen to a level where oil production is likely to increase, but not at a remarkably rapid pace. See below:

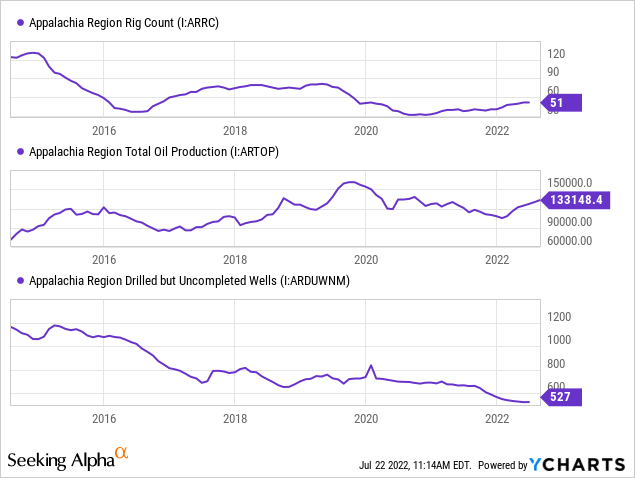

This factor is not necessarily bearish for MPLX today since there are few strong signals of a decline in overall output. However, the bulk of MPLX’s operations is situated in the Marcellus and broader Appalachia region, which is substantially weaker than most others. Over half of its processing and pipeline operations are located in the Appalachia region, while it also focuses on the Permian basin region. The Appalachia region rig count is meager today. See below:

The region’s oil production growth has stemmed mainly from the completion of previously “drilled but uncompleted” oil wells (as opposed to newly drilled wells from rigs). The region’s inventory of drilled but uncompleted wells has dwindled, so its output may decline materially without a sharp rise in rig count (which has stagnated). Over time, MPLX may need to reinvest more outside of this region as there may soon be a notable decline in production without a significant increase in drilling activity.

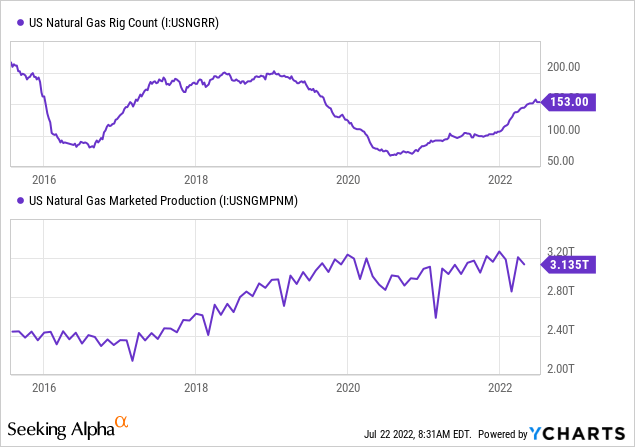

Finally, U.S. natural gas production may be peaking despite high prices and significant LNG demand from Europe. The natural gas rig count has plateaued, and overall production has stopped rising. Natural gas output recovered fully from the 2020 decline, unlike crude oil, but recent data suggest a coming decline in production. See below:

As with the others, this trend is in its infancy, so a large decline in output is not yet guaranteed. However, natural gas production depends on high continued drilling activity as wells deplete relatively quickly. Without a more significant sustained rise in the natural gas rig count, MPLX may see some volume declines in its critical pipelines and processing facilities.

Leverage and Rising Rates Do Not Mix

The operational situation facing MPLX relating to energy product supply and demand creates risk factors that investors should consider. For now, it does not appear the declines in energy product demand nor potential future declines in supply are large enough to substantially negatively impact the company’s cash flow. That said, as the U.S. economy enters a potentially significant recession, MPLX’s economic risk factors may begin to surface.

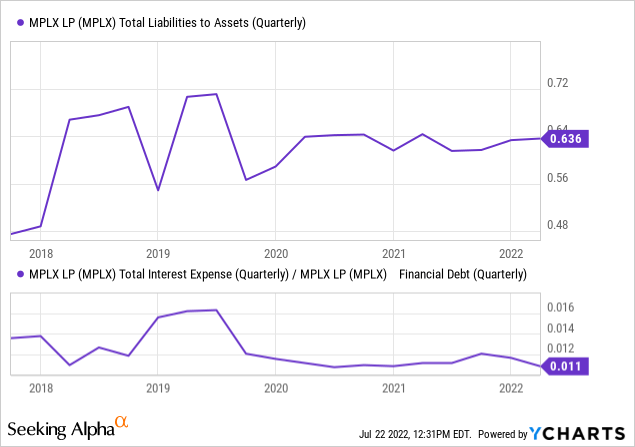

For now, the most significant risk to MPLX is the sharp rise in interest rates. MPLX is a highly leveraged company with total liabilities-to-assets of ~64%. The firm’s total free cash flow and EBITDA have been solid following the 2020 crash, but the sharp rise in interest rates may upset its distributions over the coming years. As you can see below, the firm’s total interest expense to debt is around 1.1% per quarter or 4.4% per year, down from prior years:

MPLX managed to refinance much of its debt during the 2020 ultra-low interest rate period. The company has had a total interest expense of ~$875M over the past year compared to a total operating cash flow of $4.9B, a total income of $3.2B, and total dividends paid of $3.6B. Its interest coverage is strong based on past-looking data, but rates on BB-rated bonds have more than doubled this year. If MPLX were to refinance its debt today, it might need to reduce its dividends by ~$700 to $1B to make up for higher interest costs. Fortunately, most of its debt is not variable, and its fixed rate note maturity dates range from this year to 2058 (10-K pg. 131). However, the firm does have nearly $3B in current liabilities, so there may be some negative pressure on its yield over the coming year.

The Bottom Line

Overall, the risks facing MPLX are not significant enough for me to have a bearish outlook on the company. However, they essentially negate the attractiveness of its high yield, which, in my view, reasonably accounts for its riskier nature. I will keep a close eye on the company and its peers over the coming months as the potential declines in energy product volumes may have a more substantial negative impact on MPLX’s sales. MPLX may see its profitability decline materially if the U.S. economy enters a more significant inflation-driven recession that causes energy demand to decline substantially.

Long-term investors should be aware of the impact of the company’s high leverage on dividends as interest costs increase. The company’s pricing power may be limited because minimal evidence supports a prolonged rise in U.S. energy production, particularly considering growing regulatory burdens and alternative energy efforts. MPLX’s 9% yield is certainly attractive, but with interest rates much higher, investors may soon be able to find such yields in companies with less debt and more growth potential. That said, MPLX does not appear to be overvalued and, for now, has a limited risk of a significant decline in cash flows over the coming year.

Be the first to comment