Editor’s note: Seeking Alpha is proud to welcome Callum Postlethwaite as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

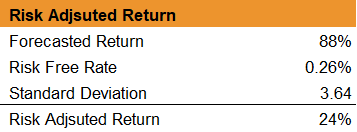

MPLX LP (NYSE: MPLX) has become significantly undervalued based on their objectively strong fundamentals and potential growth outlook. This has created a unique opportunity offering both growth and value potential, accordingly I believe the stock has a 88% upside with an attractive risk adjusted return of 24%.

Company overview

Over the past year, the midstream oil and gas firm, which focuses on logistics and storage (L&S) and gathering and processing (G&P), has seen its share price crumble around 60%.

This has partly been driven by recent macroeconomic trends within the oil sector; US sanctions on top exporters such as Iran and Venezuela have led to a retraction in the oil supply which has weighed on its share price through 2019. In addition to this, the global energy outlook is shifting away from traditional fossil fuel-based energies, which ultimately has had an adverse effect. More recently, fears and uncertainty surrounding coronavirus and the impact it will have on global demand has also been reflected in the share price.

Source: Google

At a company specific level, uncertainty around the parent company’s future plans for the firm have triggered a gradual sell off. The parent company, Marathon Petroleum Corp (NYSE:MPC) is the target of activist investor Paul Singer, where there are fears he may split up MPC, selling a stake of MPLX shares; this could ultimately lead to reduced cash flows and a large cut in future dividends which is unlikely to be well received by investors.

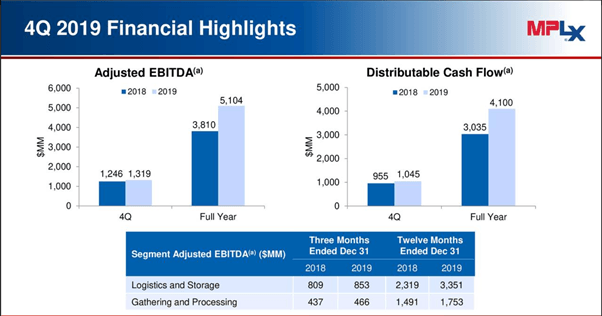

More recently the 2019 Q4 net loss has accelerated this share price drop. But is this an overreaction? By stripping away some of the ‘non-cash’ accounting treatments – notably a $1.2 billion impairment expense, we can see 2019 Q4’s results were far from terrible, with a positive adj. EBITDA and growth year-on-year.

Source: MPLX

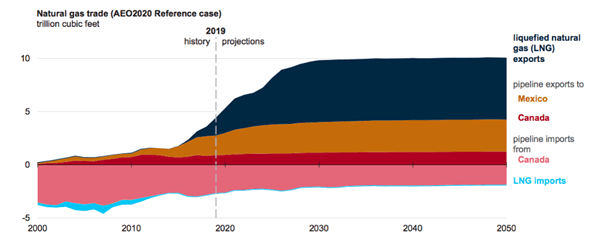

Contrary to the above sentiments there may be opportunities for MPLX which have not been fully factored into its share price. US natural gas exports are forecasted to almost double over the next decade, representing huge growth in one of MPLX’s main industries.

Source: U.S. ENERGY INFORMATION ADMINISTRATION

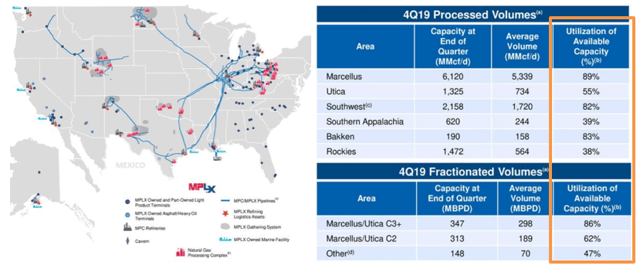

In fact, we can see MPLX is well positioned to capitalise upon this, with coverage across the US and spare capacity from existing infrastructure, not to mention future planned expansions.

Source: MPLX

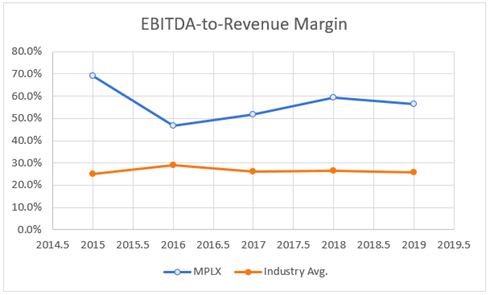

While the share price may have struggled in recent years, MPLX has managed to grow revenues and EBITDA year-on-year while achieving industry leading margins, positioning it as an attractive growth opportunity at an excellent price. These factors are explored in more detail below using a three-factored approach: EBITDA-to-revenue margin, Capex-to-EBITDA and Forward EBITDA.

Growth potential

EBITDA Margin

EBITDA margins that consistently beat the industry average can indicate that management are efficiently allocating capital and controlling costs, freeing up more cash to be reinvested to create growth.

In 2018 MPLX achieved an impressive 59.3% EBITDA-to-revenue margin, over double the industry average of 26.3%. This combined with a substantial EBITDA growth of 47% outlines the stocks historic track record and potential for future growth (FY19Q4).

Going into 2019 the US based oil and gas firm achieved an EBITDA of $5,104m, equating to 34% growth YoY. The corresponding margin was 56.5%, again eclipsing its industry peers who averaged 25.9%. Yet the markets response has been far from reflective, with the share price falling from $35.47 to $25.81 during this same period.

Source: Author/CSIMarket

However, EBITDA growth cannot be solely relied upon. These profits must be allocated wisely and put to good use within the company.

Capex-to-EBITDA

Capital expenditure as a percentage of EBITDA is a powerful tool to help identify possible growth opportunities. High capital expenditure tells us the company is reinvesting in property, plant and equipment which has the potential to translate into growing revenues and profitability.

In 2018, MPLX’s Capex equated to 57% ($2,200m) of EBITDA, showing significant investment of its operating cash flows helping to produce the tremendous growth outlined in the previous paragraph. This is also a testament to management’s ability to effectively allocate capital.

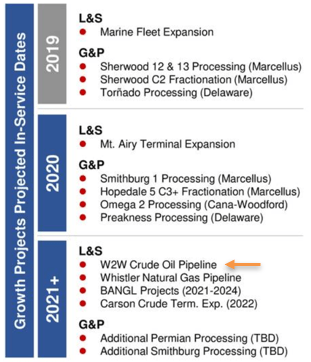

A similar approach was taken during 2019, generating EBITDA growth of 51%, with a focus on long-haul pipelines that add export facilities to meet growing global demands.

Looking forward, MPLX have a range of projects aimed to complete throughout 2020/21 and as such this is when we should see the financial effects. The Wink-to-Webster pipeline being one of the most significant of these; this is a crude oil pipeline connecting the Permian basin to the Texas Gulf Coast. With the planned capacity it will be able to support a large percentage of the Permian’s current output, this pipeline will position MPLX well to tackle the expanding oil export industry in the US.

Source: MPLX

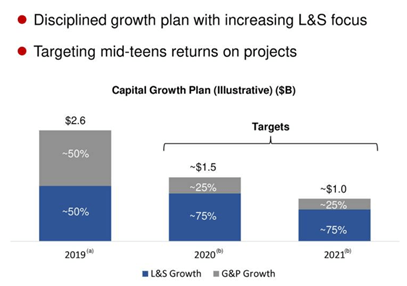

An important observation can be made here. Historically capital expenditure has been allocated equally between the two divisions, new targets set for 2020 and 2021 aim to allocate capital expenditure in the ratio 3:1 in favour of L&S. This is significant because L&S is both the largest and the most profitable (in terms of EBITDA-to-revenue margin) division as of 2019. This strategic shift could ultimately lead to increased growth and profitability going forward.

Source: MPLX

Source: MPLX

Forward EBITDA

Forward EBITDA is arguably the most important factor. It is seen as a good cash proxy and exceptional growth here is often an indication of strong prospects for the company and the share price.

Right now, year-over-year EBITDA growth for MPLX is 34%, which is higher than many of its peers, the industry average being around 25%. Adding confidence to these figures; net cash flows from operating activities have similarly grown at 33% year-on-year.

As previously alluded to, the company’s heavy investment in infrastructure has positioned them well to take advantage of the US’s growing crude oil and natural gas exports.

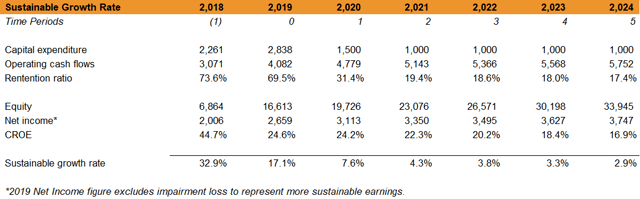

Using a Sustainable Growth Rate (SGR) model, I have forecasted growth for the next financial year to be 17.1% in operating cash flows and EBITDA. This is a reduction on the prior year figure which has been predominantly driven by an increase in shareholder equity from the Andeavor acquisition, meaning ROE is comparatively smaller. There ‘true’ growth relating to MPLX specific growth may be far larger. Please see the following valuation section for further details.

Valuation

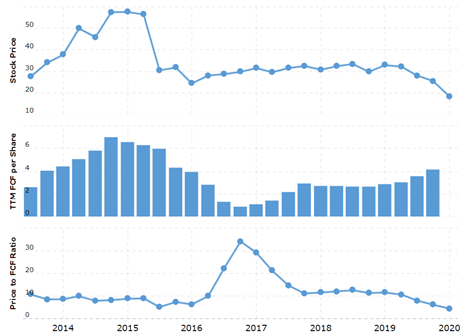

Overall, MPLX appears to be very undervalued, trading at near historic low multiples. This is a result of strong financial performance coupled with an underperforming share price.

Source: Macrotrends

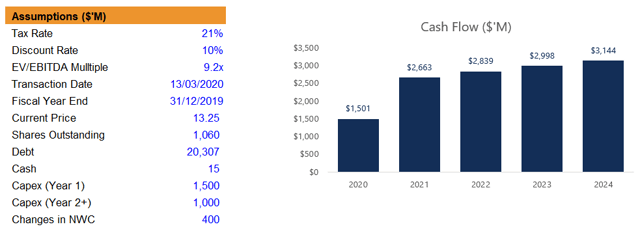

To value this company, I have opted to use a DCF model. In MPLX’s accounts there is currently a disparity between the accounting profits and cash profits, therefore an earnings-based approach would not reflect the true underlying value. Additionally, a discounted cash flow considers the time value of money/required rate of return and allows me to tailor the forecasted capital expenditures and growth rates to give a more accurate valuation.

Source: Author

The model is comprised of the following:

- 2019 operating cash flows form the basis of the model, which are subsequently grown at the calculated growth rate (see below).

- A discount factor of 10%. PV10 is widely used by stock analysts and investors as a measure of an oil and gas company’s market value. A conservative rate considering the companies WACC is around 6%.

- The exit multiple used was 9.17 which is the current overall average for the industry.

- Future capital expenditure figures are based on the company’s own targets, as cited in the company’s Q4 earnings.

- Change in working capital was calculated using the audited 2018 figures, this has been assumed to remain constant at ~$400 million per annum.

A Sustainable Growth Rate (SGR) model has been used for the forecasted growth, calculated by multiplying the Retention Ratio by the Cash Return on Equity (CROE). Again, utilizing cash flows in an attempt to remove accounting bias.

Source: Author

Note, in order to calculate Equity each year Net Income was also required. Using the 2019 net income as a basis, the SGR was also applied to this figure in addition to the operating cash flows.

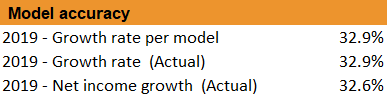

In order to check the accuracy and appropriateness of the calculated SGR I performed a check, comparing the 2019 actual growth to the growth calculated in the model. As can be seen, the model proved to be accurate in 2019 and thus deemed an appropriate rate to be used in the model.

Source: Author

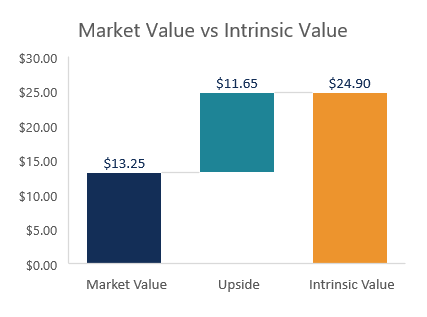

Combining this together, the discounted cash flows would value MPLX at $24.90/share. This represents an upside of 88% based upon current market prices of $13.25. Although I believe a significant portion of this upside will be realized in the short to mid-term as the coronavirus subsides, I recommend a holding period of 1-2 years, this will give enough time for the proposed projects to generate a return.

Source: Author

The project also yields an attractive risk adjusted return, which has partly been driven by historic low returns on 10yr gilts (risk free rate).

Source: Author

Risks

It is always good practice to thoroughly assess the risks relating to any investment. In my view, the biggest company-specific risk facing MPLX is the potential $15 billion asset sale Marathon Petroleum, the parent, is currently exploring.

The potential divestment is seemingly to provide Marathon with a cash boost to help weather the global economic slowdown caused by the covid-19 pandemic and low oil prices exacerbated by the ensuing price war between OPEC and Russia.

Specifically, Marathon is looking to sell the Gathering and Processing (G&P) arm of MPLX in either an asset sale or a spinoff deal. Although, as touched on previously, G&P is not the largest or most profitable revenue stream for MPLX it still represents a significant portion, 34% of FY19 EBITDA. This has the potential to significantly decrease the future expected cash flows and concentrate the company’s reliance of the L&S division, thereby increasing exposure to specific risks relating to that segment of the industry. Both aspects are likely to have an adverse impact on the overall company valuation. On the flip side, the smaller – post spinoff – business does have the potential to become more profitable, with L&S achieving in 2018 a 64% EBITDA-to-revenue margin vs a 45% equivalent margin in G&S.

Adding to this, the signaling effect to investors will be that this is not a planned strategic move, but a forced move given the current economic climate; arguably this situation is being made worse by activist shareholders, including hedge fund Elliott Management, who are applying pressure to spinoff the retail gas station business, Speedway.

Overall, there is uncertainty regarding the future direction of MPLX, and investors feel that any decisions made may not be because of their economic benefits but because of situational pressures from both shareholders and market conditions.

Conclusion

Given the recent share price dip caused by stifled demand from Covid-19, this could be an opportune moment to take a long position in MLPX. While further downside is still a risk from the virus, I believe the longer-term growth potential is where the true value lies.

MPLX has shown consistent, industry beating, year-on-year growth. Generated significant operating cash flows, and effectively invested into growth projects. The US’s natural gas exports are forecasted to double over the next decade and with the projects currently in progress at MPLX, they are well positioned to gain from this.

The next review point will be the 2020 Q1 results, actual performance can be compared against my forecasted figures and positions can be adjusted accordingly.

Remember, if considering a position there are still uncertainties and unknowns surrounding Marathon’s potential $15 billion asset sale, in addition to the more immediate viral outbreak. MPLX shares could get worse before they get better.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MPLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment