OlegAlbinsky/iStock Unreleased via Getty Images

In the fashion and apparel industry, one of the best strategies for companies is to focus on one particular niche and stay there. An example of a hyper-focused player in a very specific niche is Movado Group (NYSE:MOV). This manufacturer of watches and related products has generally performed well in recent years. Despite experiencing pain caused by the COVID-19 pandemic, the firm is larger and healthier now than ever. Naturally, some investors might be worried about the impact that an economic downturn might have on the firm. But even if financial performance drops back to what it was in prior years, it’s difficult to see the company as being any worse than fairly valued. More likely than not, shares are undervalued, especially if current trends persist.

Keeping a beat on Movado

According to the management team at Movado, the company focuses on designing, sourcing, marketing, and distributing a variety of watch brands across the globe. Brand names the company owns include Movado, Concord, Ebel, Olivia Burton, and MVMT. In addition to having its own brands, the company also licenses brands from other major lifestyle and fashion businesses. Examples include, but are not limited to, Calvin Klein, Tommy Hilfiger, Coach, and Scuderia Ferrari.

The watches that Movado produces and sells span the spectrum in terms of quality. At the low end, the company has a variety of moderate and fashion watches that it sells. This category is just above the mass market category that the business does not serve. Pricing for these watches range from $75 to $595. The next step up would be the accessible luxury category, with pricing of between $500 and $3,295. And above that, there is the luxury category. Watches here typically retail for between $1,300 and $9,900. Above this level, you have the exclusive watch category. These are the really high-end options like Rolex, Patek Philippe, Piaget, and others. This is a space that Movado does not play in. In addition to selling the aforementioned watches, the company does also produce and sell other jewelry and accessory products. But on the whole, these comprise just a small portion of the firm’s overall business.

In terms of overall revenue composition, it’s worth mentioning that only 14.5% of the company’s revenue comes from its company stores. The rest comes from the watch and accessory brand sales made outside of those locations. Owned brands that the company sells under the watch and accessory brands category represent 34.1% of revenue, while the licensed brands are surprisingly larger at 50.3%. The company also generates a modest amount of revenue, totaling 1.1% of sales in all, from after-sales service and all other activities.

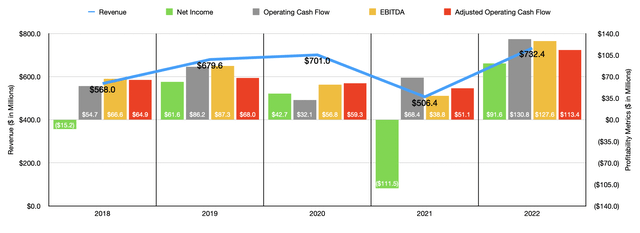

Over the past few years, the general trajectory of the company has been positive. Revenue from its 2018 through 2020 fiscal years increased from $568 million to $701 million. During its 2021 fiscal year, sales dropped to $506.4 million. For those wondering why this drop took place in the 2021 fiscal year as opposed to 2020, it’s because of what management defines as the start and end of each fiscal year. For context, January 31 of 2022 was the end of what management calls its 2022 fiscal year. Despite the pain caused by the pandemic, sales for the company quickly rebounded. Revenue for the 2022 fiscal year came in at $732.4 million. That represented an all-time high for the company and was even 4.5% higher than the $701 million generated two years earlier. Truth be told, management was a bit vague on the cause for this significant recovery. They did say that increased volumes were a contributor. Unfortunately, we do not know how much of the increase was caused by higher pricing. Another contributor to the increase with a 79.8% rise in sales associated with the company’s stores. This was driven in large part by the fact that, during the latest fiscal year, all of its stores were open unlike in the prior year. The company also benefited from a rise in the number of retail locations in operation from 47 last year to 51 this year.

Profitability for the company, as measured by net income, has been all over the place. There really is no clear trend when it comes to this metric. However, we do see some stability when looking at cash flows. Operating cash flow for the company fluctuated between $32.1 million and $86.2 million in the four years ending in 2021. In 2022, operating cash flow spiked to $130.8 million. If we adjust for changes in working capital, the picture looks even better. Cash flow ranged between a low of $51.1 million and a high of $68 million during the aforementioned four-year window. Then, in the 2021 fiscal year, cash flow rose to $113.4 million. Similar to cash flow is EBITDA, ultimately ranging from $38.8 million to $87.3 million before spiking to $127.6 million during the 2022 fiscal year.

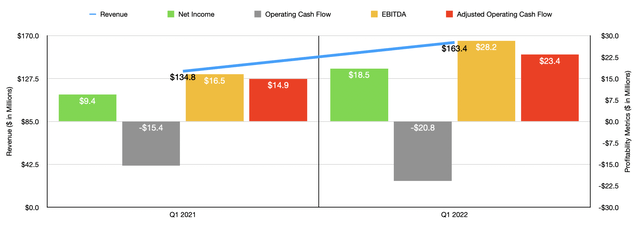

For the 2023 fiscal year, growth for the company continues. Revenue in the first quarter of the year totaled $163.4 million. That’s 21.2% higher than the $134.8 million reported for the first quarter of 2022. Once again, this rise was driven in large part by an increase in volume shipped. Growth was particularly strong in the licensed brands category, with revenue there rising by 31.4% year over year. Profitability has largely followed revenue higher. Net income in the latest quarter was $18.5 million. That’s almost double the $9.4 million seen one year earlier. Operating cash flow did worsen, dropping from a negative $15.4 million to a negative $20.8 million. But if we adjust for changes in working capital, it would have risen from $14.9 million to $23.4 million. Over that same window of time, EBITDA nearly doubled, climbing from $16.5 million to $28.2 million.

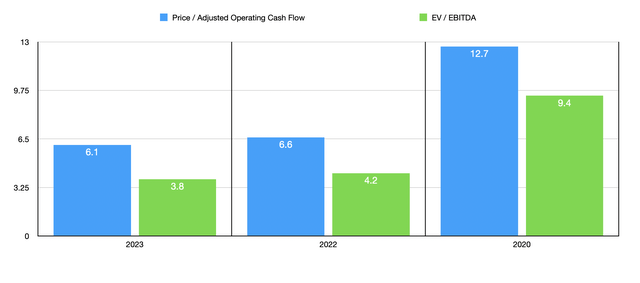

Management has not been as detailed on guidance as I would like. They did say that revenue should come in at between $780 million and $800 million for the year. If this comes to fruition, using midpoint figures, it would imply a year-over-year improvement of 7.9%. On the profitability side, the only guidance management gave was in relation to operating income. This number should be between $125 million and $130 million. This compares to the $117.5 million reported for the 2022 fiscal year. Extrapolating this out, we should end up with adjusted operating cash flow of roughly $123.1 million and EBITDA somewhere around $138.5 million. I do not feel comfortable providing an analysis that’s based on earnings given how volatile earnings have been in recent years. So instead, we will rely on these other metrics to value the business.

At present, Movado is trading at a price to adjusted operating cash flow multiple, using 2022 numbers, of 6.6. This drops to 6.1 if we rely on the 2023 forecast. Meanwhile, the EV to EBITDA multiple should be 4.2. That should decline to 3.8 if the 2023 estimates are accurate. Of course, some investors may be worried about a broader economic downturn. Certainly, a weakening of the economy would lead to accessories and other fashion goods suffering more than most other categories. However, even if financial performance reverts back to what it was before the pandemic, shares are still trading at reasonably attractive levels. The price to operating cash flow multiple would be 12.7, while the EV to EBITDA multiple would be 9.4. To put this all in perspective, I decided to compare the company to five similar firms. I did so with the 2022 figures in mind. On a price to operating cash flow basis, these companies ranged from a low of 2.9 to a high of 26. Two of the five were cheaper than Movado. This number changes to three of the five if we rely on the 2020 fiscal year results. Using the EV to EBITDA approach, the range was from 1.7 to 10.7. In this scenario, three of the five companies were cheaper than our prospect. This number changes to four of the five if we use the 2020 fiscal results.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Movado Group | 6.6 | 4.2 |

| G-III Apparel Group (GIII) | 7.6 | 3.6 |

| Superior Group of Companies (SGC) | 26.0 | 10.7 |

| Delta Apparel (DLA) | 18.5 | 5.7 |

| Vera Bradley (VRA) | 4.4 | 1.9 |

| Signet Jewelers (SIG) | 2.9 | 1.7 |

Takeaway

At this point in time, I must say that I am moderately impressed by how well Movado has done in recent years. Despite the pain associated with the pandemic, the business has weathered the storm nicely and made a full recovery. If current market conditions persist, shares look fairly valued relative to similar firms but are cheap on an absolute basis. If financial performance worsens, shares do become more or less fairly valued. Due to this favorable risk-to-reward prospect, I am slightly bullish on the company right now, leading me to rate it a soft ‘buy’.

Be the first to comment