Mining of potash ore in an underground mine. Ramil Nasibulin/iStock via Getty Images

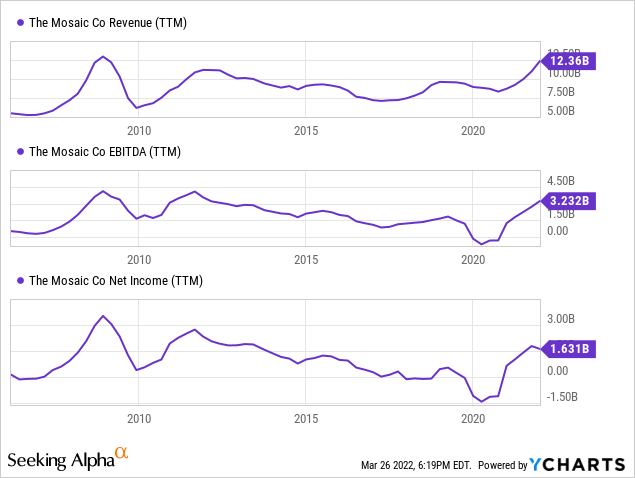

The Mosaic Company (NYSE:MOS) effectively knocked it out of the park with its FY21 operating performance. Total revenue increased to $12.36 billion and net income increased to $1.63 billion, which translates to $4.27 in diluted EPS. Back in 2016, when the entire industry was in disarray, I argued that Mosaic was a buy here and here for a few core reasons:

- “Current valuation disregards the double-digit cyclically adjusted free cash flow yield.”

- “Even though potash and phosphate prices still remain relatively weak, we think stabilization will begin to develop with more substance over the intermediate-term.”

- “We would be much more inclined to accumulate at $20 (or lower) as the risk/reward profile would be pretty solid over a 3-5 year timeframe.”

Back in 2016, analysts were also bearish on Mosaic’s purchase of Vale’s fertilizer unit claiming that Mosaic was overpaying, calling it to only be worth $1 billion. My argument for the purchase was that Mosaic was getting a good deal as the purchase price occurred at a time when fertilizer prices were cyclically weak. While it did take some time to play out, Mosaic did eventually purchase the unit for a valuation of $2.5 billion.

Fast forward to today, Mosaic management updated analysts and investors that the same Brazilian unit was now generating incredibly strong operating performance:

In Brazil, Mosaic Fertilizantes generated adjusted EBITDA of $821 million, up 74% from the prior year as the team capitalized on strong demand, a trend that we expected and drove our decision to acquire Fertilizantes 4 years ago. In 2021, Mosaic Fertilizantes was able to achieve its $200 million transformational EBITDA improvement target over a year ahead of schedule. These results highlight the decisions we have made over the last decade that has strengthened the business.”

In other words, that translated to a 3x EBITDA purchase price based on just this year’s worth of earnings. The unit also represents about 23% of the total annualized adjusted EBITDA that Mosaic generated in FY21. Clearly, this move was an excellent way for Mosaic to geographically diversify its operations, supply chain, and cash flow generation.

In a few words, I’ve always been a huge fan of operators that have the ability to acquire competitors or non-core assets from other companies, especially in the commodities space. While many investors and analysts are often skeptical of these deals, and management’s ability to derive synergies, you have to pay attention to what they say, such as the timeline and degree of synergies to be obtained over time.

In any event, Mosaic has executed successfully to deliver near-record revenue and EBITDA, as well as very strong net earnings:

In the last few years, Mosaic was valued with an average market capitalization of about $8 billion. Mosaic has now surged to a market cap of $26 billion!

According to Prospect.org, Mosaic currently controls 90% of the current supply to U.S. markets, which enables significant pricing power.

Despite rising input costs, Mosaic also enjoys a significant cost advantage over its competitors:

market ammonia is probably in the range of, Jenny, $1,100. So that adds about $200 plus per ton to the cost of making phosphates. Now recognize our costs are significantly lower than that because two-thirds of ours is on a natural gas basis. So for our competitors, call it, $250 per ton. For us, probably more than half of that range would be the right number.

In terms of sulfur, sulfur 40%. So if sulfur price is $300, then your cost in making DAP is probably $120-ish per ton. So you could look at that for our competitors being a total cost of up to $300 extra ton and for us, probably $220 or something, in that range.

That’s pretty impressive to have significant market share and cash cost per tonne advantages over your competition.

Looking Forward

With the Russia-Ukraine war starting in February, Fertilizer prices began to surge. According to Bloomberg’s Green Markets Weekly North America Fertilizer Price Index, which encompasses urea, potash, and DAP, three core agriculture fertilizers, the index has surged by more than 3x. In fact, the index is now running about 36% higher than the peak that occurred in August of 2008. So at least in the near term, we can expect that these record prices and solid production volumes will continue to deliver strong profits.

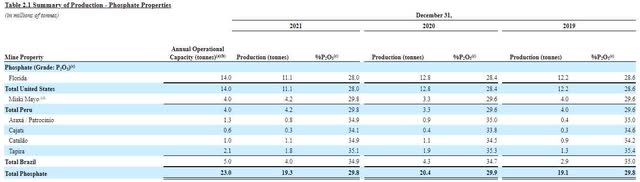

Mosaic has phosphate properties in the United States, Peru, and Brazil:

Mosaic Phosphate Properties (Mosaic FY21 Form 10-K Filing)

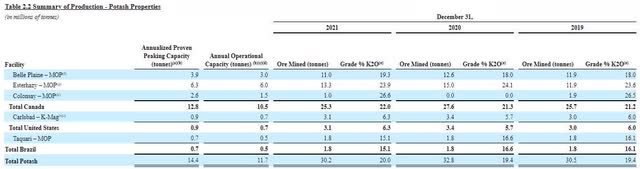

And Potash properties in Canada, the United States, and Brazil:

Mosaic Potash Properties (Mosaic FY21 Form 10-K Filing)

Mosaic management stated in their Q4 2021 conference call that they believe that fertilizer prices will remain strong due to the high demand for agricultural products combined with global industry supply constraints. On the demand side, various institutions estimate that food demand growth is relatively constant at 2% per annum.

Supply chain constraints, however, a more difficult to quantify, but at least over the next year, we can expect them to remain unhinged.

It started around October 2021 when China banned the export of urea, sulfate, and phosphate. This ban is expected to stay in place at least until June 2022.

Russia also instituted a ban on all fertilizer exports at least until August, and the country represents about 13% of global output. As we’ve seen with oil, the marginal supply of commodities, in this case, fertilizers, has a huge impact on prices. Unfortunately, peace talks have been ongoing for about a month with the fifth round of negotiations ending without any apparent progress.

Another factor is that natural gas is a key input for fertilizers, which have shown significant surges globally over the last year, especially in Europe.

One minor kink in the domestic supply chain for the U.S. market comes from the labor dispute with the Canadian Pacific rail strike, where Canada’s largest potash supplier, Nutrien, indicated it may have to temporarily shut down production.

So at least in the near-term, perhaps even over the next two years, this myriad of supply chain disruptions will allow Mosaic to enjoy strong profits and cash flow.

Management even indicated that they anticipate returning approximately 75% of all free cash flow to shareholders through dividends and buybacks, according to its Q4 press release.

However, I think it’s important to note that the outlined capital return showed that $170 million remained on the buyback authorization, which might be completed by now. They did indicate that another $1 billion was authorized to repurchase shares, however, that now only represents 3.8% of the entire market cap. Additionally, the dividend distribution was raised to $0.60 annually, which only equates to a dividend yield of 0.84%. Therefore, the combined capital return will only be 4.64% at the current valuation, which is arguably not a good use of capital at this point. Instead, management should retain this cash for a “rainy day” or identify better opportunities with investments in marketable securities.

The Clock Starts Ticking

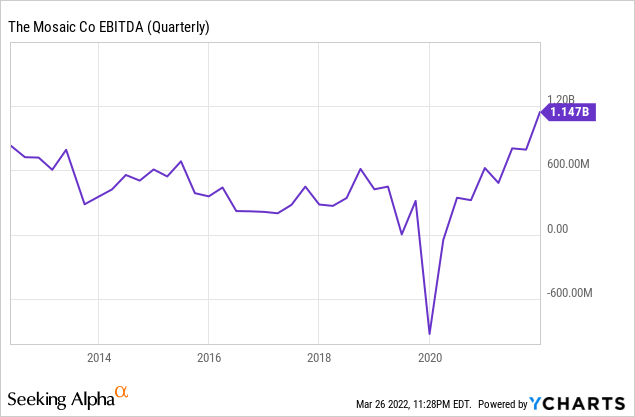

As we all know, commodities are a boom and bust category. With the massive spike in fertilizer prices and stock returns, it’s hard to be confident that purchasing MOS at today’s prices will result in great incremental returns. If we annualize the most recent Q4 EBITDA performance of $1.147 billion,

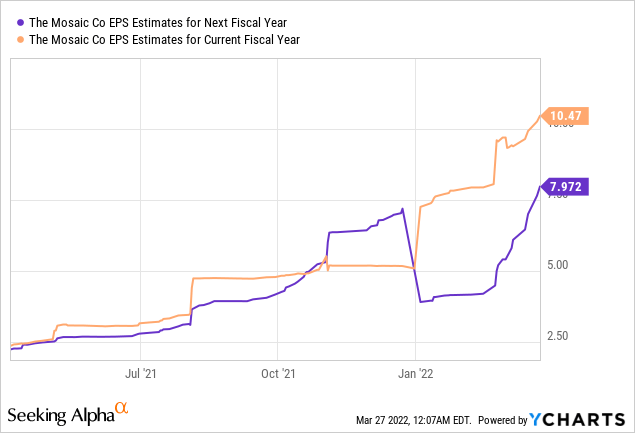

and then take out all of the necessary reinvestment, net interest expenses, and taxes, Mosaic would be producing about $2.32 billion in net profits annually, which equates to $6.20 or 11x earnings. One could argue that EBITDA could be set to improve further too since fertilizer prices have surged heading into March, so if we roughly apply that premium, net profits would be $3 billion, or about $8 EPS and 8.6x earnings. For FY22, analysts have even earmarked $10.47 EPS or 6.8x earnings!

All in all, these are cheap multiples, but something you would want to pay at mid-cycle, and we could be closer to a cycle-high at this point.

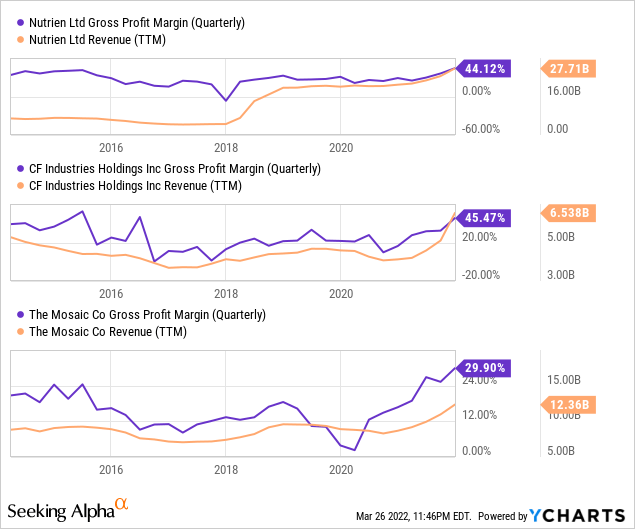

Revenue and gross margins of top industry players are surging, but once that happens, it doesn’t take long for producers to ramp capacity:

Export bans, sanctions, embargos, or whatever else, deals are eventually always made and commodities will flow to the highest bidding market, even if it needs to travel around the world twice to reach its destination. Fertilizer investment and production capacity are beginning to pick up too.

To start, one of the largest aforementioned producers, Nutrien (NTR), is in process of ramping production to a record 15 million tonnes, with total capacity increasing by 20% in the last two years.

Reuters reported that Nigerian billionaire Dangote has already launched a fertilizer plant with plans to deliver shipments to Brazil, the United States, India, and Mexico. Additionally, other fertilizer producers have significant untapped capacity. The report also indicated, for example, that “Singapore-owned Indorama Eleme Petrochemicals Ltd. plans to double its annual output of urea fertilizer to 2.8 million tonnes.”

The largest meat producer in Brazil, JBS, also announced that they will be producing its own organic fertilizers.

And finally, the USDA announced that they plan to invest $250 million to increase domestic fertilizer production as well. Some key statements surrounded increasing competition and price transparency:

to address rising costs, including the impact of Putin’s price hike on farmers, and spur competition. USDA will make available $250 million through a new grant program this summer to support independent, innovative and sustainable American fertilizer production to supply American farmers. Additionally, to address growing competition concerns in the agricultural supply chain, USDA will launch a public inquiry seeking information regarding seeds and agricultural inputs, fertilizer, and retail markets.”

There is so much new investment and untapped capacity, and I think it’s a given that fertilizer production will continue to ramp higher. It’s really just a matter of how quickly it can be done and how fast the shipments can be delivered to end markets. With the proverbial clock already ticking, I’d argue that we could be approaching peak fertilizers prices as early next year contingent upon export bans not being extended, and of course, depending on how natural gas prices adjust and incremental fertilizer production ramps.

Bottom Line

Mosaic is an excellent company in a currently booming industry. I would not be surprised to see the momentum continue on more headlines highlighting fertilizer supply chain problems, natural gas prices, and fear around food supply. Mosaic is already generating near-record earnings and returning tons of cash to shareholders. The fundamental issue, however, is that even if net earnings push to new heights in the next year or two, what comes after that? For those reasons, even though we are only two years into this upcycle, it’s hard to be confident that investors are buying good value here with so much new capacity soon coming online. How do you think MOS will perform? Let me know in the comments section below. As always, thank you for reading.

If you enjoyed this article and want more direct access to my research and ideas as well as the chance to chat with me and review my two model portfolios (dividend and long-only total return stocks) and my overall investing strategy, please note that I am launching a Marketplace Service called Equanimity Research in April. I am very excited to foster a community of like-minded investors. There will be a considerable discount for early annual subscribers. More details coming soon.

Be the first to comment