Ramil Nasibulin

Thesis

The Mosaic Company (NYSE:MOS) has had a tumultuous few weeks as it had to deal with the potential disruptions from Hurricane Ian, which is expected to impact phosphates production through Q4. It also had to deal with market volatility that saw MOS fall more than 25% from its August highs to its recent September lows.

Coupled with the threat of further demand destruction due to high fertilizer prices, we believe investors need to be wary about buying the recent dip.

Mosaic’s revenue and profitability growth is projected to fall further through FY24 as the underlying demand/supply imbalances normalize further. While it’s still expected to be well above its historical average, we believe it could put further pressure on MOS to move much higher from here. Therefore, we assess that MOS will likely find significant selling resistance trying to navigate its way above August highs as its growth continues to normalize.

Notwithstanding, the selloff through September has created a near-term bottom for MOS. As such, investors can consider waiting for price action signals indicating the failure of the current relief rally before cutting exposure further.

Accordingly, we reiterate our Hold rating on MOS.

Don’t Ignore Demand Destruction Due To Unsustainable Prices

Mosaic’s phosphates sales volume was cut further to 1.6M-1.65M tons from its initial Q3 guidance of 1.7M-2M tons due to the recent Hurricane Ian disruption. However, we are less concerned with the transitory impact, as no significant damage was done to Mosaic’s production facilities, and the delayed shipments could be moved to Q4.

But, we are increasingly concerned with whether the market had adequately priced in further demand destruction across all its business segments as the world moves closer to a global recession.

For instance, Bloomberg reported in a recent commentary that “Brazil has so much fertilizer that shipments are getting turned away.” Notably, the high prices in the market have forced farmers to apply lesser phosphate fertilizers to mitigate the impact on their margins. Bloomberg highlighted:

With prices at record levels, farmers decided to reduce applications to protect their margins. Farmers are able to skip [the] application of phosphate fertilizers without compromising yields since the soil can retain this nutrient for more than a year. – Bloomberg

Furthermore, India was also cited as importing less potash as farmers couldn’t cope with the high prices in the market. Therefore, farmers have resorted to using “less of it to grow crops like rice, wheat and sugar.”

Notably, potash consumption is expected to fall to 3M tons through March 2023, compared to 5M tons in the previous year. One of India’s top importers for potash, Indian Potash Limited, highlighted: “Our potash availability is comfortable. The sad part is potash demand has gone down because of high prices.”

Investors Need To Expect Further Normalization

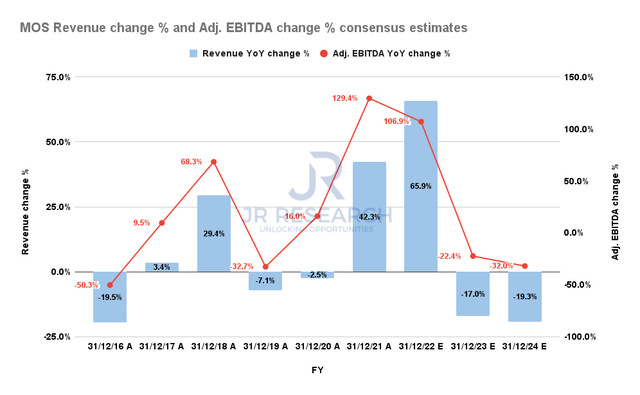

Mosaic Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Therefore, we believe it’s critical for investors to accord higher precedence to the thesis of further demand destruction, which could moderate Mosaic’s growth momentum further.

Even the bullish consensus estimates suggest that Mosaic’s revenue could decline by 22.4% in FY23, followed by another decline of 32% in FY24. Accordingly, we believe these estimates are credible, as Mosaic is unlikely to sustain its current growth cadence with the prospects of further normalization.

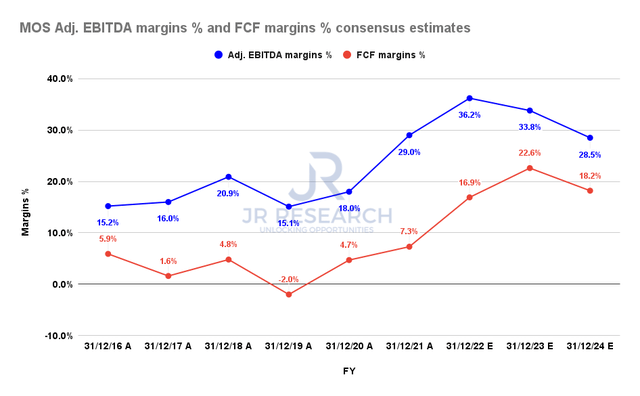

Mosaic Adjusted EBITDA margins % and FCF margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the company is still expected to post robust profitability through FY24, even though its profitability profile is also estimated to moderate further.

Hence, investors need to consider that while Mosaic’s underlying metrics should remain robust, the company could be entering a significant period of growth digestion, which could impede further upward momentum in its stock.

Is MOS Stock A Buy, Sell, Or Hold?

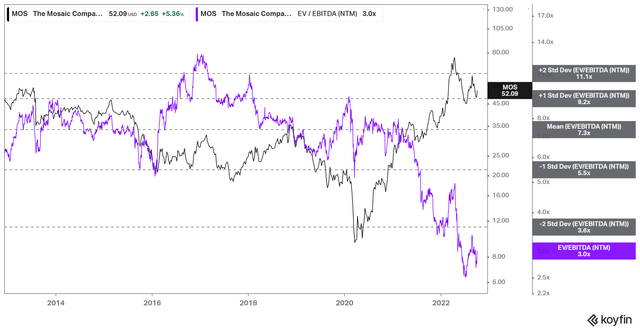

MOS NTM EBITDA multiples valuation trend (koyfin)

MOS last traded at an NTM EBITDA multiple of 3x, well below its 10Y mean, as seen above.

However, the market is not dumb, right? Indeed, there must be a logical reason why it has “refused” to re-rate MOS at such valuations. We postulate the market is looking ahead, expecting demand destruction to impact its earnings profile moving forward.

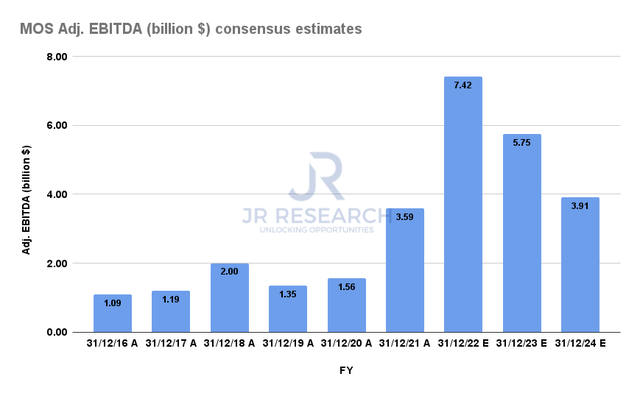

Mosaic Adjusted EBITDA consensus estimates (S&P Cap IQ)

Note that MOS’ NTM EBITDA multiples are based on its NTM adjusted EBITDA of $7.14B. However, that could very well fall to $3.91B (down 45%) through FY24 as its operating performance normalizes.

Therefore, we believe the market is factoring in these assumptions in its valuation of MOS. As such, MOS’ NTM EBITDA multiples are unsustainable at the current levels and should revert higher.

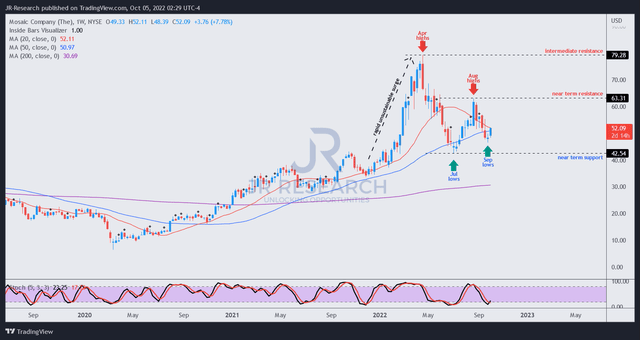

MOS price chart (weekly) (TradingView)

Based on last week’s lows, we gleaned that MOS is likely at a near-term bottom. Therefore, investors who missed cutting exposure at its August highs could wait for another opportunity for a failure in its current relief rally.

Our analysis suggests that MOS would find significant challenges retaking its August highs, as its operating profile is expected to worsen further. It’s corroborated by the examples of demand destruction of unsustainably high prices. Furthermore, the coming global recession could crimp demand further, which would put further pressure on MOS’ bullish bias.

We think the buyers are trying their best to maintain MOS’ medium-term bullish bias by keeping it above the critical 50-week moving average (blue line).

However, its buying cadence looks increasingly exhausted, as buyers couldn’t overcome August’s selling momentum. Another failure at August highs or lower could indicate the medium-term uptrend could be at significant risk, skewing the reward-to-risk profile to the downside. Hence, we encourage investors to cut exposure accordingly at the subsequent resistance failure and rotate.

We reiterate our Hold rating on MOS for now.

Be the first to comment