ipopba

Investment Thesis

In a world of unprofitable growth stocks, wouldn’t it be lovely to see a company worth less than $8 billion, growing revenue at over 30%, and having EBIT margins above 30%?

Well, here comes Doximity, Inc. (NYSE:DOCS) to answer your prayers! This company has built an incredibly strong ecosystem of medical professionals since its inception in 2010, and has seen its revenue skyrocket in recent years. Even better, this founder-led company has an incredibly profitable business model with plenty of room left to grow.

But does that make Doximity a good buy right now? I put it through my investing framework to find out.

Business Overview

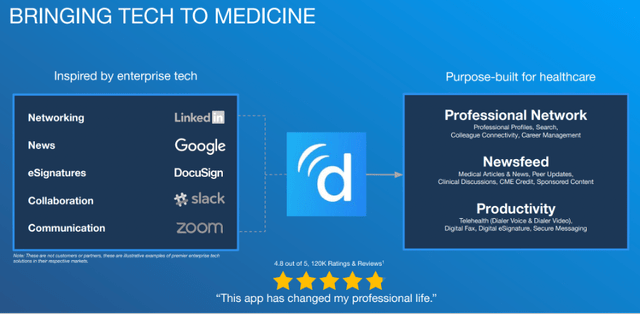

Doximity is the leading digital platform for U.S. medical professionals, with more than 80% of physicians, more than 50% of nurse practitioners and physician assistants, and over 90% of graduating U.S. medical students on the platform. The simplest way to describe Doximity is like a LinkedIn for doctors, although the platform has continually developed more tools and solutions with the aim of achieving its mission: “to help every physician be more productive and provide better care for their patients.”

To get a deeper understanding of the product itself, I would strongly recommend watching the following YouTube video – it is around 5 minutes long, and Doximity Co-Founder and CSO Dr. Nate Gross gives a helpful walkthrough of the product in use.

Doximity Q4’22 Investor Presentation

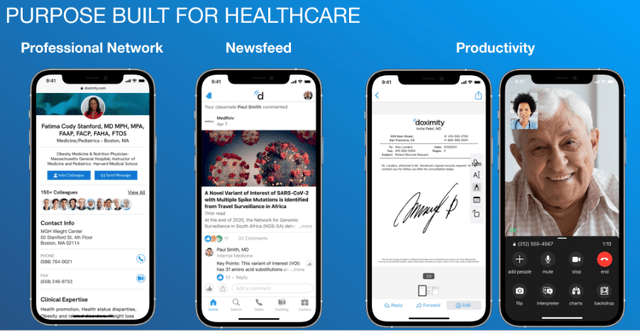

The company has created a LinkedIn-style professional networking platform tailored specifically to the needs to medical professionals. It has the usual features you might expect from such a product: the ability to create a profile with your CV and qualifications, being able to connect with colleagues and search for fellow professionals, and being able to find new career opportunities. But the platform is made by physicians for physicians, and offers the ability to include published research, find specialist physicians at other hospitals that patients can be referred to, as well as the ability for students and residents to discover and compare training programs with the Residency Navigator tool.

There is also a news feed, which is personalized for each member depending on their subspecialty, patient population, and network relationships. The news feed shows content such as medical articles and videos, peer and colleague updates, clinical discussions, and sponsored content. It also automatically tracks the articles read by members and logs CME (Continuing Medical Education) credit for them as they go.

More recently, Doximity has expanded into increasing its suite of HIPAA-compliant productivity solutions. These include the ability to send and receive faxes through the Doximity app or website that can be electronically signed, dated, and customized. It has also dived into telehealth through its Dialer tool, allowing medical professionals to offer either voice- or video-based calls with patients through their smartphone.

Doximity Q4’22 Investor Presentation

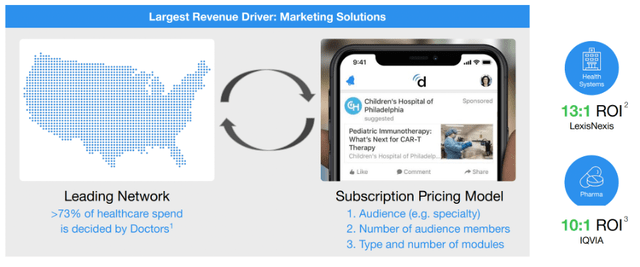

It’s a great business that has swept up medical professionals across the U.S., but how does it make its money? Doximity has three main revenue drivers, with most sales generated as subscriptions:

- Marketing Solutions: Doximity works with pharmaceutical and health system customers to advertise their solutions on Doximity’s platforms. The company boasts high engagement and high value when advertisers use its platform, and counts 20/20 top hospitals, health systems, and pharmaceutical manufacturers as customers. The majority of Doximity’s revenues are currently generated through its Marketing Solutions.

- Hiring Solutions: provides digital recruiting capabilities to health systems and medical recruiting firms.

- Telehealth Solutions: software tools that include the voice and video Dialer, with this tool having powered over 100 million virtual patient visits since its launch in 2020.

Doximity Q4’22 Investor Presentation

Doximity also closed on a deal in April 2022 to acquire the AMiON cloud scheduling platform for health systems, which is likely to become another revenue driver in the near future.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition. Despite its small market cap, I think Doximity has moats in abundance.

The first moat that Doximity benefits from is a powerful network effect. As mentioned, 80% of all US physicians are on the platform as well as the majority of other healthcare professionals. The platform is being utilized more and more by recruiters, as well as healthcare professionals performing tasks, sending documents, and referring patients to specialists. As a result, any medical professional should feel compelled to join this platform for one reason or another (whether for the networking or the tools that are used); this is already playing out, with 90% of graduating U.S. medical students on the platform.

So, the network effect is this: Doximity has the majority of medical professionals using it, so any medical professionals not using the platform would benefit from signing up, which means even more medical professionals would use it, which further incentivizes even more medical professionals to sign up – a powerful network effect.

I believe that there are also high switching costs for Doximity. We’ve already seen that medical professionals have a lot of reasons to be on the platform – and conversely, have few reasons to leave. But having a large network alone does not make for a successful business, and so we have to look at some moats to protect its revenues; thankfully, I think there are switching costs here with the companies that advertise on Doximity’s platform.

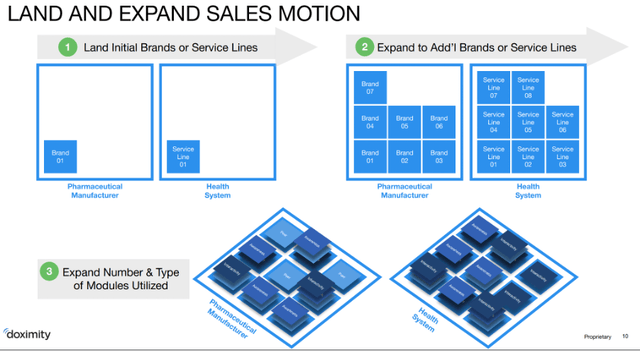

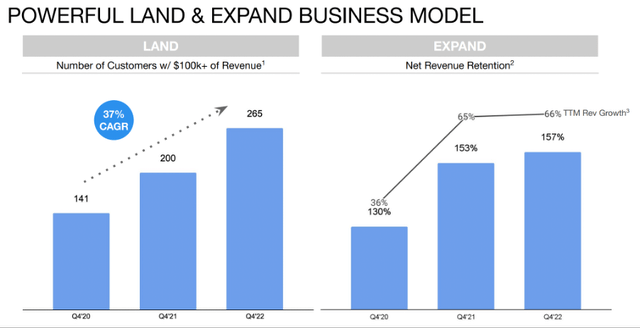

Doximity gives these healthcare companies the ability to specifically target customers that are most likely to respond to their adverts – plus, according to Doximity’s Q4’22 Investor Presentation, more than 73% of healthcare spend is decided by doctors themselves. There really is no other place that advertisers can place these specific, targeted advertisements and see the fantastic results that they have seen. We can see switching costs in play out through Doximity’s incredible 157% net revenue retention rate, as the company adopts a land-and-expand approach with its advertising customers.

Doximity Q4’22 Investor Presentation

Some other weak switching costs relate to the productivity services, albeit this is a smaller contributor to overall revenue. But as Doximity continues to roll out more tools and solutions to healthcare professionals, and becomes more embedded into their day-to-day operations, it becomes more difficult for these professionals to stop using Doximity.

I think this company also benefits from a strong brand within the medical community. I can say this with confidence since over half the medical professionals in the U.S. are on Doximity, and also it receives a stellar 4.8/5 rating in the App Store from over 135k reviews.

Outlook

Investors may see that Doximity has such a huge share of U.S. healthcare professionals on its platform & wonder whether or not there is much growth ahead – I, for one, believe that there is. I do think user growth is somewhat limited, but at the same time there are still a lot of medical professionals not on the platform – plus, Doximity does have a substantial opportunity to expand internationally.

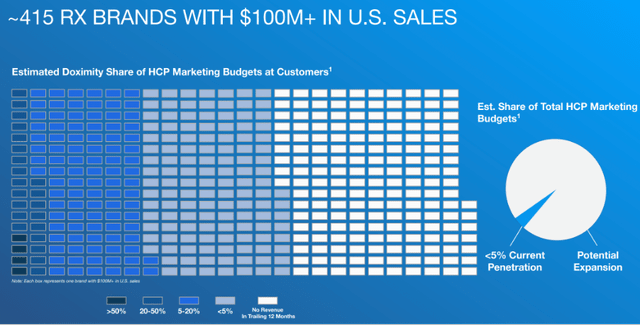

But the main story now for Doximity is being able to use its network of medical professionals to generate more revenue. The company is already doing this by rolling out new productivity tools, and there are still many more advertising customers that it has yet to introduce to its platform. In fact, only 4 of the ~415 top RX brands with over $100m in U.S. sales spend over half their marketing budget on Doximity. As the below graphic shows, the expansion opportunity is huge.

Doximity Q4’22 Investor Presentation

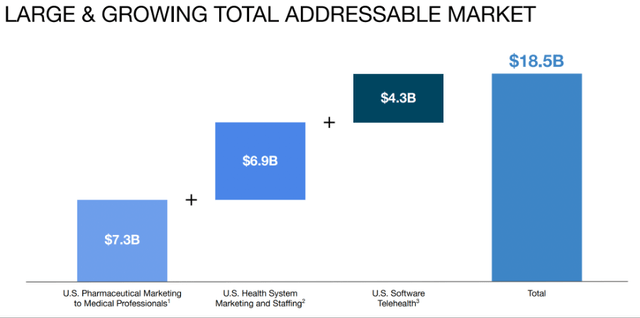

The company has also continually expanded its total addressable market (“TAM”) through the launch of new solutions, and this TAM now sits at $18.5 billion. To put that into perspective, Doximity’s trailing twelve-month revenues account for <2% of this TAM.

Doximity Q4’22 Investor Presentation

Management

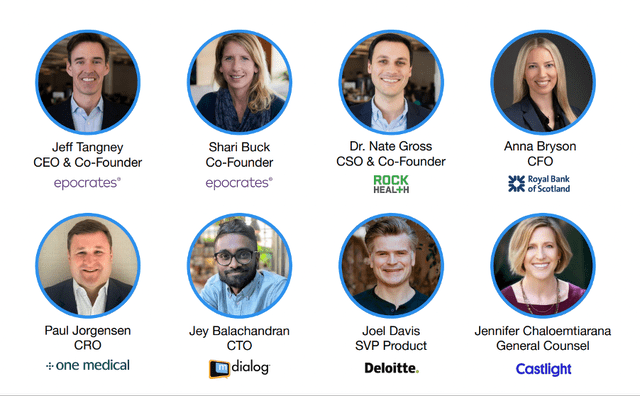

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I’m pleased to say that Doximity ticks this box multiple times over, with its co-founders including CEO Jeff Tangney, CSO Dr Nate Gross, and SVP People & Ops Shari Buck.

Doximity Leadership Team (Doximity Q4’22 Investor Presentation)

I want to invest in companies where leadership has skin-in-the-game, and CEO Jeff Tangney certainly ticks this box, owning almost 28% of all shares in Doximity. This is a huge amount of skin-in-the-game for the Co-Founder CEO, and shareholders can take some comfort in knowing that his incentives are aligned with theirs.

Doximity 2022 Proxy Statement / Excel

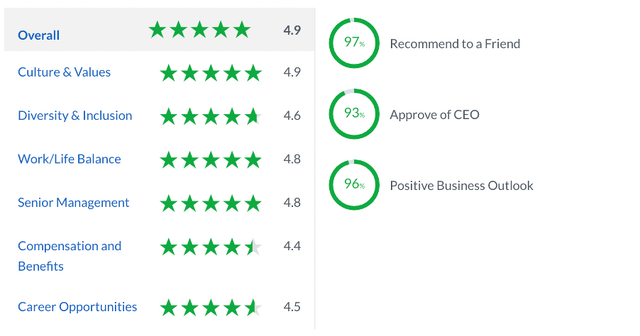

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Doximity gets the best scores I have ever seen from the 106 reviews left by employees. Any score over 4.0 is impressive, and Doximity smashes these ratings in every single category – resulting in an overall score of a whopping 4.9! There is absolutely nothing to fault here; ~100 reviews indicates that this remains a smaller business, so clearly Doximity has been able to nurture its culture and its employees. This looks like an absolutely brilliant place to work.

Financials

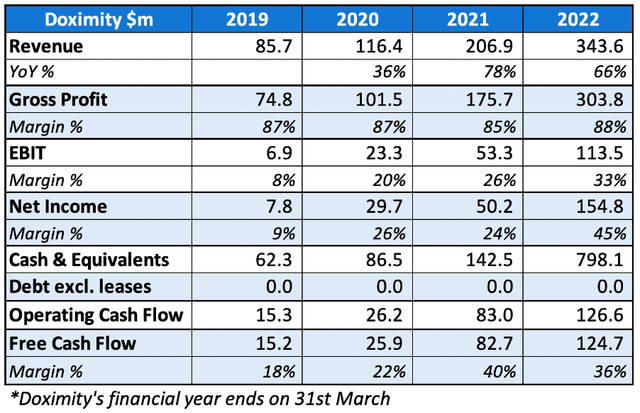

Doximity is one the most financially sound companies that I have analysed to date. I do normally opt for high growth businesses that are reinvesting rather than focusing on profitability, but Doximity is proving that they can do it all.

The company has grown revenues at a 59% CAGR since 2019, with astounding gross margins of 88% in 2022. Not only does it have strong gross margins, but these flow through to both EBIT and net income, as Doximity achieved 33% EBIT margins in 2021 and a 45% net income margin (with the latter being skewed by a one-off tax credit). Make no mistake, this company is raking in the cash.

It also has a stellar balance sheet, with just under $800m in cash and zero debt; I would not be surprised to see the company start making more acquisitions or increase share buybacks, given its substantial cash balance and high cash generation. In fact, the company was authorized to carry out a $70m share repurchase in Q1’23 (aka Q2 of 2022), so this cash is finding its way back to shareholders.

And they aren’t done growing yet, as the company continues to land more big customers who subsequently increase their spend on the platform.

Doximity Q4’22 Investor Presentation

Quite frankly, the financials of Doximity are pristine, and should give investors a lot of confidence going forward.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Doximity is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

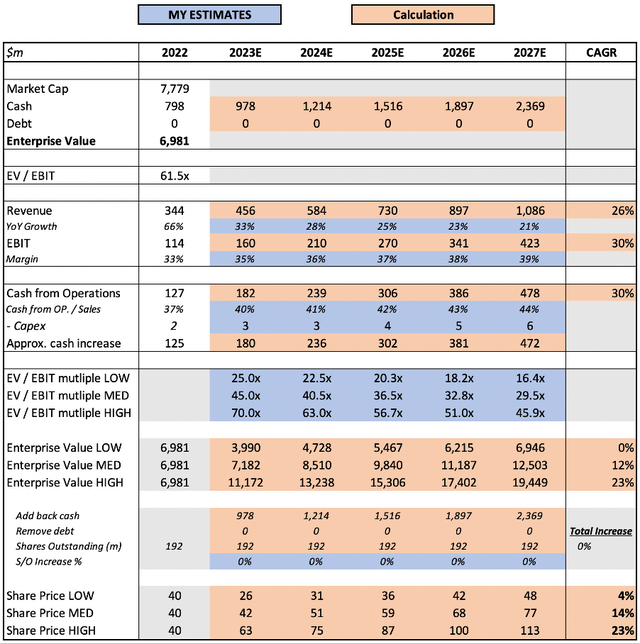

My assumptions on 2023E revenue growth and EBIT are taken from Doximity’s Q4’22 results outlook, with my EBIT based roughly on their adjusted EBITDA guidance. From then onwards, I have conservatively assumed a slowdown in revenue growth through to 2027. I have, however, assumed that EBIT margins will increase and approach 40% – this is a very asset-light business that is extremely profitable, and there is still room for it to boost those margins further as it continues to scale up and add more customers.

I have used a closing EV / EBIT multiple of 29.5x, which I believe would be appropriate for a company that is growing at above 20% with the margin profile that Doximity has. It is difficult to find an appropriate proxy given Doximity’s large growth runway and exquisite financial profile, but a company such as Meta Platforms (META) has had an average EV / EBIT of 36.5x over the past 10 years, ranging from a high of 118.6x to a very recent low of 8.9x. I believe that Meta will have lower multiples than Doximity due to slowing growth, intense government scrutiny, and the multiple controversies & bad PR surrounding the business – but this should give some context.

Put all that together, and I can see Doximity shares achieving a 14% CAGR through to early 2027 based on my mid-range scenario.

Risks

Like most businesses, particularly those who make their money from advertising, Doximity does face the risk of a recession impacting its revenue growth. Yet the companies who use Doximity to advertise are in the recession-resistant medical industry, and any medical professionals who use Doximity and have its tools integrated into day-to-day activities will still require those tools, recession or not. So whilst a recession might cause an issue for a company such as Meta, I think Doximity is pretty safe.

There is also a risk of competition from the likes of LinkedIn on the networking side or Teladoc (TDOC) on the telehealth side. But I think the integrated offering from Doximity stands this company apart from its competitors – medical professionals will be more inclined to use Doximity as a combined, specialized LinkedIn and Teladoc hybrid. Teladoc might provide additional telehealth competition, but I don’t think Doximity will see any meaningful impact on the advertising business which brings in most revenue.

Bottom Line

This is a brilliant business, there’s not really anything else to say. It is founder-led, management have skin-in-the-game, it has consistently rolled out new products to serve its members, it has an enviable margin profile, and it is growing rapidly.

The only reason that I think this stock has been unpopular since it came public is the valuation, as shares have fallen 60% from their 52-week highs. As my conservative valuation model shows, the current share price offers an opportunity to achieve a fairly good CAGR over the next 5 years.

It’s not often I invoke a Warren Buffett quote, but I think it’s appropriate to sign off this article:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Be the first to comment