Nikada

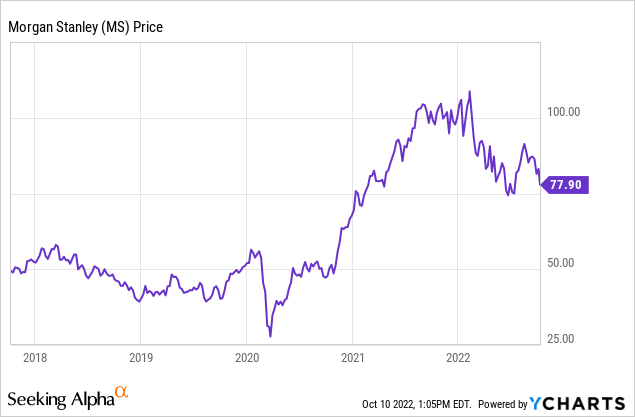

Morgan Stanley (NYSE:MS) is one of the best-run banks in America, passing the Fed’s annual stress test with flying colors this summer and putting through a shareholder-friendly capital return plan. The stock performed strongly earlier in the summer, but investors are selling it off again with fears over QT and the economy. However, at a 2023 P/E ratio of 10.3x and a dividend yield of roughly 4%, MS stock is dirt cheap, even if rates continue to rise and the economy continues to slide, for reasons I’ll get into below. While many companies that trade for PE ratios at or near single digits are value traps, MS stock is far from a value trap – so much so that I’ve compared the stock to Apple (AAPL) in the early 2010s. Morgan Stanley reports earnings on Friday, Oct. 14, giving a fresh update on the company’s plans.

Bears will correctly tell you Morgan Stanley isn’t immune to the cyclical nature of the investment banking business, with IPOs drying up. And by being the lead bank on Elon Musk’s Twitter (TWTR) acquisition, my guess is that the adverse move in interest rates will cost the bank nine figures. They also got fined $125 million for traders texting each other to circumvent compliance.

But beneath the surface and headlines, MS management has made some brilliant deals over the past few years, including the Etrade acquisition, which scored the bank billions of dollars in customer cash paying 0.01% or so, and billions of dollars in margin loans earning 12% or so. Overall, Morgan Stanley had $340 billion in deposits paying an average interest rate of 0.28% as of the last quarterly conference call. That’s mind blowing – if the company simply put that money in Treasuries paying 4%, they could earn $13.6 billion per year in pretax profit without taking any risk. Morgan Stanley’s market cap is only ~$135 billion by comparison. Crazy! With rates continuing to rise and consumers wired after 14 years of interest rate repression to earn nothing in interest, this is an enormous windfall for bank stocks in general and especially for stocks like MS. Competition will eventually start to sap this, but it’s a mind-blowing tailwind. The macro picture remains completely ugly, but I believe MS will be one of the first stocks to bottom and one of the best performing after the bottom of the current recession.

This isn’t 100% true because there are taxes, the company has some SG&A expenses to service the depositors, etc., but my feeling is that you’re basically getting the rest of the business for free at this point with higher rates, and the stock being down YTD. Cutting fat will be an ongoing process for Morgan Stanley, which loaded up on employees in investment banking and via recent acquisitions, but when they slim down the business it’s going to be crazy profitable. As I’ve written before, MS is a structurally profitable operation, and unlike some banks, they aren’t juicing their returns with a lot of leverage. As such, the company’s credit was upgraded to A- from BBB+ by S&P earlier in the year.

Morgan Stanley Business Model Update

As I’ve written before, the story hasn’t really changed much for MS, even though there are a lot of ugly headlines that are ultimately inconsequential to the long-term success of the biz.

Step 1. Find cheap capital. The company acquired a bunch of cheap deposits when the deposit yield curve was super flat, and now rates have surged, making the acquisitions extremely accretive over time. The Etrade acquisition looks incredibly smart in this context.

Step 2. Transition the bank from mostly earning one-time fees to recurring revenue. Even coffee shops are trying to sell monthly subscriptions now (this cracks me up) because recurring revenue makes the business world go round and supports higher valuations. Traditional investment banks are not good at generating recurring revenue, and clients tend to be loyal to dealmakers rather than the bank itself. As such, they were traditionally partnerships. When they came public, the markets weren’t thrilled with the cyclical nature of the business and wouldn’t assign high multiples to the stocks. This is where my Apple comparison comes in because the iPhone maker had a similar problem until they shifted toward recurring revenue with services. Here, the game plan has been to make a bunch of acquisitions in the asset management, retail brokerage, and wealth management areas, which carry recurring revenue that can help stabilize the investment banking profits in down years. They haven’t won every battle here, but I believe they’re making good progress on this front, with the crown jewel here being the bank’s increasing access to cheap deposits as I highlighted above.

Step 3. Return capital to shareholders. If the market isn’t going to initially believe in the game plan even if it’s executed well, then the move is to pay a great dividend and buy back a bunch of shares at 10x earnings (again, Apple famously bought nearly 40% of its shares this way over the last 10 years). The main obstacle to this part of the game plan was the Fed’s stress tests, which demonstrated a high degree of regulatory comfort with Morgan Stanley vs. other banks that have been blocked from returning capital.

As far as I can tell here, the runway is clear for MS to continue to execute. And rising interest rates, which have been the biggest problem for stocks in 2022, are actually a boon to Morgan Stanley’s earnings due to the low cost of deposits they have.

Where Will MS Stock Be in 5 Years?

Let’s sketch a quick, back-of-the-envelope read on MS stock to show the upside potential of the stock. I’ve got crowdsourced analyst estimates out to 2024, and after that, we can extrapolate a bit.

Analysts expect $6.61 in earnings for 2022, $7.68 for 2023, and $8.64 for 2024. Glancing at MS’s income statement, they earned $8.16 in 2021 during the IPO/SPAC boom, so these estimates are considerably lower than the boom in 2021. I think these estimates are too low given how much the company can make just from Etrade and the deposit base. The solution, of course, is to cut overhead, especially highly-paid employees who aren’t bringing in deals anymore. Salaries and benefits expense spiked from about $18.7 billion annually from pre-COVID to a peak of $24.5 billion in 2021 – and it’s only down to about $23.1 billion in the trailing 12 months. Shareholders shouldn’t really have to subsidize investment bankers and others earning huge base salaries, so my guess is that Wall Street in general is about to get rocked with massive layoffs. This gives MS and other banks a ton of room to lower expenses over time.

At ~10x earnings, EPS can grow substantially from buybacks alone here. I’m going to take 2022 and 2023 earnings more or less at face value, but I’m going to assume $10 in earnings in 2024 as the recession clears and the bank emerges leaner. From there, earnings likely can grow to $11 in 2025, $12.2 in 2026, and $13.4 in 2027, again supported by the buyback. If you assume MS’s business plan to become less cyclical continues to be successful, the multiple can expand to perhaps 13-15x, and we have a price target range for the stock of $174 to $201. MS trades for under $79 as of my writing this, so investors can potentially more than double their investment and pocket a 4% dividend along the way. But such is life buying good businesses in a bear market!

It sounds a bit crazy, but consider that bank stocks were really stuck with deflated ROEs during the 10 year-plus period of QE. American banks generally held up better than European banks (which often had ROEs of 5% or lower). MS’s current ROE is 13.6%, which is lower than banks like JPMorgan Chase (JPM) but achieved using far less leverage – MS has a much better underlying return on assets. But with global central banks not doing tons of QE and pulling liquidity out of the system with QT, banks can start to make a lot of money in interest income again, while depositors are slow to remember to stop accepting 0% interest. With interest rates surging but deposit rates still hanging near 0%, the old banking mantra of 3-6-3 (borrow at 3%, lend at 6%, tee time at 3) is replaced with 0-6-3. And Morgan Stanley’s headcount is still a bit bloated from the pandemic boom, there are some very talented people at the bank who will stay and continue to make a lot of money both for the bank and themselves. On a back-of-the-envelope calculation, shareholders are getting them nearly for free.

Bottom Line

Morgan Stanley stock is still dirt cheap. Its management will update investors on the overall game plan on Friday. Those who can look past the drama of the current quarter to the tailwinds of the next five years have the potential to more than double their money and earn a ~4% dividend yield along the way.

Be the first to comment