Nikada/iStock Unreleased via Getty Images

Introduction

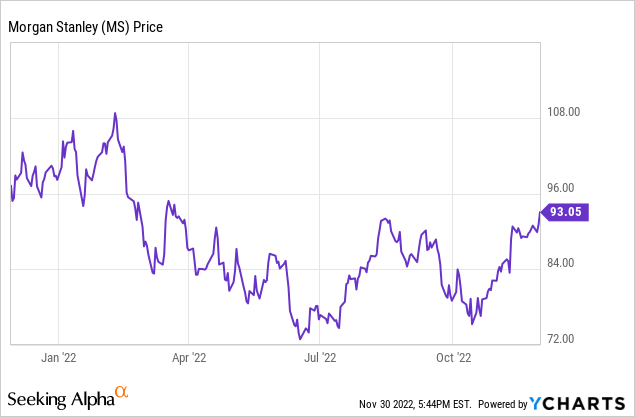

Morgan Stanley (NYSE:MS) likely doesn’t need an introduction at all. As one of the largest financial services firms in the United States with a worldwide brand name recognition, the company focusing on Investment Management, Wealth Management, and Institutional Securities is a well-respected name in the sector. The current market capitalization of Morgan Stanley exceeds $150B, but rather than focusing on the common shares, I wanted to check up on how well the preferred dividends are covered as the interest rate increases on the financial markets have put pressure on the prices of the preferred shares.

A strong set of results also makes the common shares attractive

As I’m mainly interested in the preferred shares, I will only discuss the recent quarterly financial results of Morgan Stanley from a relatively high-level perspective before applying these results to the preferred equity.

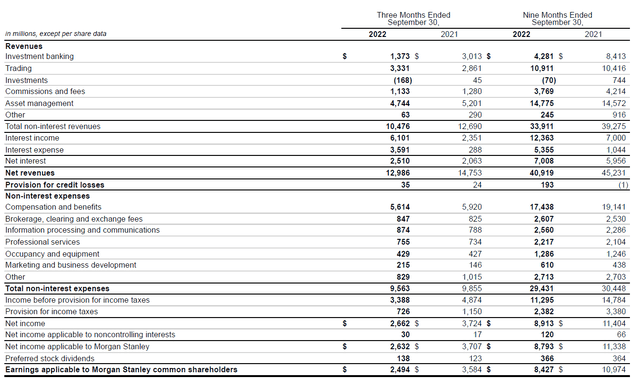

During the third quarter, the company reported a total revenue of just under $13B, mainly fueled by the asset management fees (which tend to be pretty sticky) while the investment banking and commission and fee income were pretty stable as well. Morgan Stanley also generated about $3.3B in trading revenue, which is slightly lower than in the previous few quarters, but this was mitigated by lower expenses as well.

Morgan Stanley Investor Relations

As you can see in the image above, the total amount of compensation and benefits paid by MS decreased both on a YoY basis as well as compared to the previous few quarters. Taking everything into consideration, the total expenses came in at just under $9.6B, resulting in a pre-tax income of $3.39B (which also includes a $35M credit loss provision).

The net income came in at $2.66B, but from this amount, we still need to deduct the $30M in net profit attributable to non-controlling interests as well as the $138M in preferred dividends. This means the net income attributable to the common shareholders of Morgan Stanley was approximately $2.5B, resulting in an EPS of $1.49 (and a non-GAAP EPS of $1.53) based on the average share count of 1.67 billion shares outstanding during the quarter.

The EPS for the first nine months of this year was $4.95 and Morgan Stanley will likely report an EPS fin excess of $6.25 for the entire financial year and I wouldn’t be surprised to see an EPS in excess of $7 in 2023. And although that’s pretty attractive, I’m mainly interested in the fixed income opportunities presented by the preferred shares of Morgan Stanley.

The newly-issued preferred shares are interesting for income investors

I have been keeping an eye on Morgan Stanley because I’m quite interested in its new issue of preferred shares. The P-series were issued this summer and have a fixed preferred dividend of 6.5% based on the $25 principal value of the security. The P-Series preferred shares (which are trading with (NYSE:MS.PP) as ticker symbol) are currently trading around par (the closing price was $25.03 on Tuesday) for a current yield which is approximately 6.5% as well, payable in four quarterly preferred dividends of $0.40625 per share. The securities can be called from October 15, 2027 on.

When I look at preferred shares, I care about two things: The preferred dividend coverage level and the asset coverage level.

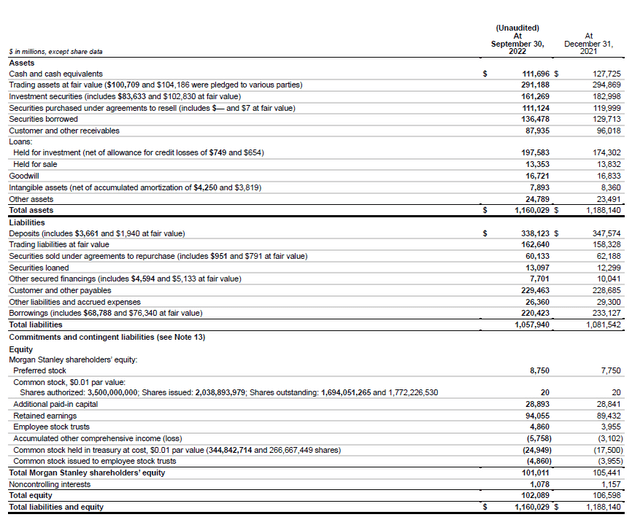

The dividend coverage level is easy to deduct from the income statement. During the third quarter, Morgan Stanley paid $138M in preferred dividends from a $2.63B attributable net income. This means the company only required just over 5% of its income to be spent on preferred dividends. And looking at the 9M 2022 results, the $366M paid in preferred dividends represented less than 4.2% of the attributable income. So I’m pretty satisfied with that, especially knowing Morgan Stanley remained profitable during the COVID crisis as well, with a reported EPS of $6.55 in 2020. While an Armageddon scenario is always possible, it does look like Morgan Stanley’s profits should be pretty resilient, and I don’t think making the preferred dividend payments will be an issue going forward.

A second element I focus on is the asset coverage level. Looking at Morgan Stanley’s balance sheet, approximately $102B of the $1.16B in assets was represented by equity of which $101B was contributed by Morgan Stanley’s shareholders (with $1.1B contributed by non-controlling interests). The total value of the preferred shares is just $8.75B.

Morgan Stanley Investor Relations

This means that in excess of $92B of the equity is ranking junior to the preferred shares.

Investment thesis

Of course, the P-Series aren’t the only preferred security issued by Morgan Stanley, but I’m attracted due to the high fixed preferred dividend and the fact the securities cannot be called before Q4 2027. Investors looking for fix-to-float preferred shares could perhaps consider the K-series, trading with (MS.PK) as ticker symbol. Those preferreds have a $1.4625 annual preferred dividend until April 2027 when the preferred dividend will be reset to 3M LIBOR (which will likely be replaced by the SOFR) plus 349.1 basis points. Those could potentially be interesting as well because although the current yield is lower than the P-series, if the 3M SOFR continues to exceed 4%, these K-series are quite likely to be called in 2027 which would equal a yield to call of just over 7%.

Both are valid ideas, and it’s up to an investor’s personal preference to decide which security is the best fit.

I currently have no exposure to Morgan Stanley other than some put options I have written on the common shares but which are out of the money now. But I would like to pick up some of the P-series of the preferred shares, preferably around par.

Be the first to comment