Kameleon007

Last week I interviewed Joey Agree, CEO of Agree Realty (ADC) and I asked him this question:

“I used to ask you why you’re not paying monthly dividends, but you checked that box, and we appreciate it. But I do want to ask you, is there a reason not to pay a monthly dividend?”

Joey replied,

“It’s a great question we did a deep dive into it.

So first of all, there are very de minimis frictional costs. It’s literally several thousand dollars with a transfer.

We looked into it and we finally came to the conclusion that we believe that the decentralization of Wall Street is going to be a consistent theme. Active investors moving into ETFs, individual investors moving into buying shares individually or even partial shares.

And in context of our business where we get monthly rent checks with a weighted average lease term of over nine years with 70% investment grade retailers, we think it makes a lot of sense to pay out those dividends period, passing frankly with those rent checks.

And we haven’t got any pushback from institutional investors. I think individual investors, including myself and the shareholders, love receiving it monthly. The costs both frictional and actual are extremely de minimis.

So if you have that certainty of cash flows at the end of the day, and I think it makes a lot of sense for REITs to continue to move to a monthly dividend.

Now, historically, a lot of REITs thought it was gimmicky to reframe. They think it made sense, because most companies pay on a quarterly basis. Well, we get rent checks monthly, right? I mean this isn’t a manufacturing business.

We’re not an IT company. We get predictable cash flows on a monthly basis and shareholders are our most important constituent.

And so we think it makes sense to change those distributions to continue it up to a monthly basis as well.”

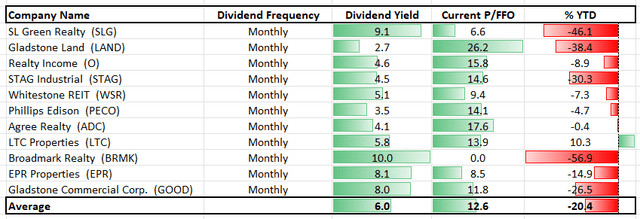

We sorted our list of monthly-paying REITs within our iREIT Tracker, we found that there we just 11 REITs (out of 150) that pay monthly.

The highest yielder is Broadmark Realty (BRMK) – that now yields 10% (even after a 50% dividend cut) and the lowest yielder is Gladstone Land (LAND) at 2.7%.

iREIT

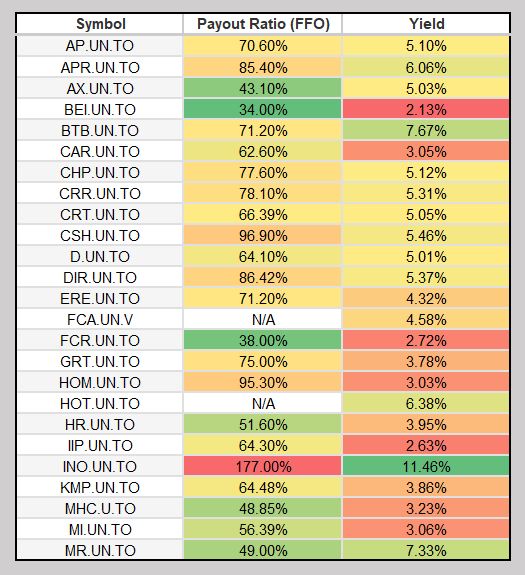

It seems that in Canada, most REITs pay monthly dividends. On this www.stocktrades.ca website, I found a list of 25 REITs that pay monthly dividends:

Source: stocktrades.ca/canadas-best-monthly-dividend-stocks-reits

Personally, I would like to see more U.S. REITs paying out monthly dividends, and when I attended REITworld in San Francisco I asked several CEOs why they didn’t consider distributing monthly mailbox money. Here’s a list of REITs that I approached:

- National Storage (NSA)

- Omega Healthcare Investors (OHI)

- Postal Realty (PSTL)

- Netstreit (NTST)

- Alpine Net Lease (PINE)

In my view, all of these REITs should be monthly payers, and perhaps a few other like…

So, while some of you may not care about monthly dividend-paying stocks, I certainly do. And based upon the number of comments that I get on my monthly-paying articles, it seems that the monthly dividend army is growing rapidly.

Most importantly, as Joey Agree reminds us,

“…individual investors, including myself and the shareholders, love receiving it monthly. The costs both frictional and actual are extremely de minimis.”

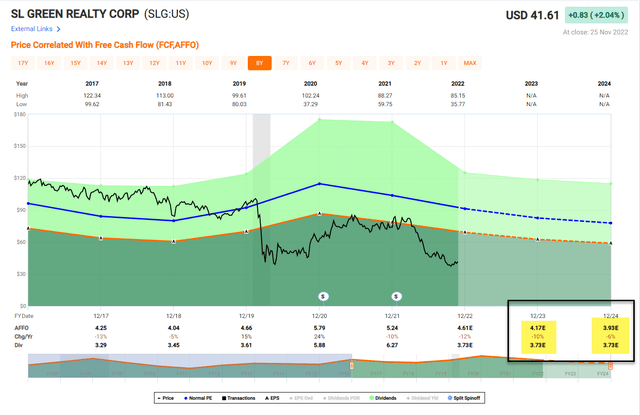

S.L. Green (SLG)

As you can see below, SLG shares have returned -42% YTD, and the dividend yield is around 9.0%. Shares are trading at 8.9x P/AFFO vs. the normal range of 19.8x. The payout ratio is 81%, however, analysts are forecasting negative growth of -10% in 2023 and -6% in 2024, which puts the payout ratio at 95% (in 2024). We consider SLG speculative given the continued pressure on the NYC office portfolio, and this elevated risk rating is reflected in the above average dividend yield.

FAST Graphs

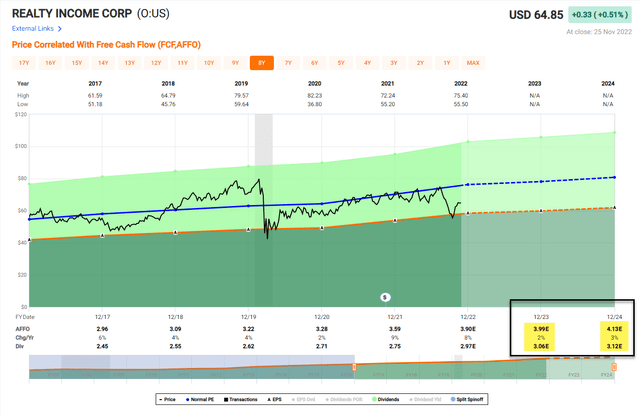

Realty Income (O)

As you can see below, O shares have returned -6.0% YTD, and the dividend yield is around 4.6%. Shares are trading at 16.7x P/AFFO vs. the normal range of 19.6x. The payout ratio is 76% which is in-line with normal ranges for net lease REITs. Analysts are forecasting growth of +2% in 2023 and +3% in 2024. We have a Buy rating on O with a 12-month total return forecast of 15% to 20%.

FAST Graphs

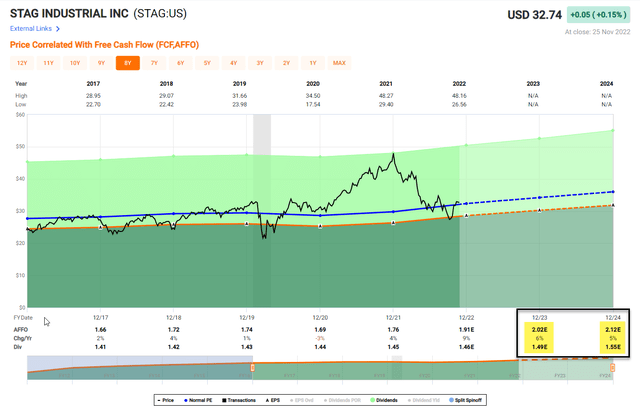

STAG Industrial (STAG)

As you can see below, STAG shares have returned -31% YTD, and the dividend yield is around 4.5%. Shares are trading at 17.3x P/AFFO vs. the normal range of 17.0x. The payout ratio is 76% which is in-line with normal ranges for Industrial REITs. Analysts are forecasting growth of +6% in 2023 and +5% in 2024. We have a Buy rating on STAG with a 12-month total return forecast of 10% to 15%.

FAST Graphs

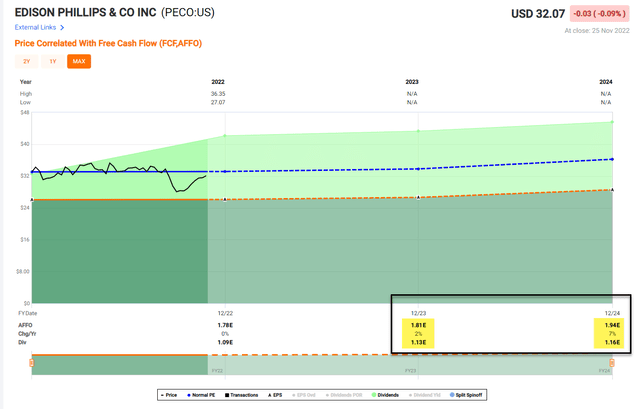

Phillips Edison (PECO)

As you can see below, PECO shares have returned +5% YTD, and the dividend yield is around 3.5%. Shares are trading at 18.1x P/AFFO vs. the normal range of 18.7x. The payout ratio is 61% which is in-line with normal ranges for Shopping Center REITs. Analysts are forecasting growth of +2% in 2023 and +7% in 2024. We have a Buy rating on PECO with a 12-month total return forecast of 10% to 15%.

FAST Graphs

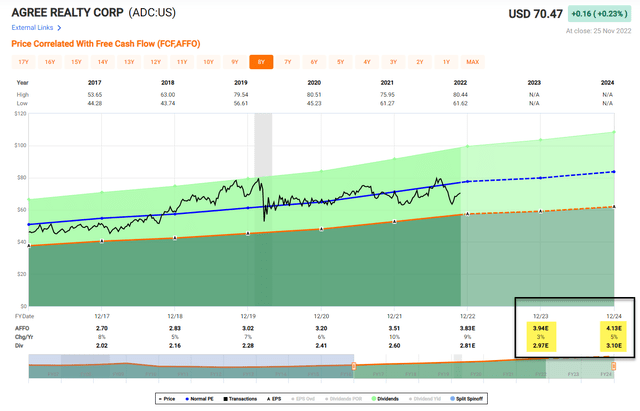

Agree Realty

As you can see below, ADC shares have returned +2.5% YTD, and the dividend yield is around 4.1%. Shares are trading at 18.6x P/AFFO vs. the normal range of 20.3x. The payout ratio is 73% which is in-line with normal ranges for Net Lease REITs. Analysts are forecasting growth of +3% in 2023 and +5% in 2024. We have a Buy rating on ADC with a 12-month total return forecast of 15% to 20%.

FAST Graphs

It’s Not All About Instant Gratification Folks

I want to be clear. I love getting paid monthly, but just like I tell the dozens of CEOs that I speak with regularly,

“The safest dividend is the one that’s just been raised.”

I much prefer to see dividend growth versus a dividend that’s paid monthly.

Joey Agree is right, monthly distributions can seem “gimmicky,” yet it’s hard to disguise an unsafe dividend when you closely examine the payout ratio and the history of the dividend.

Three of the REITs on my Monthly Mailbox Money list – O, STAG, and ADC – have a record of increasing their dividend each and every year.

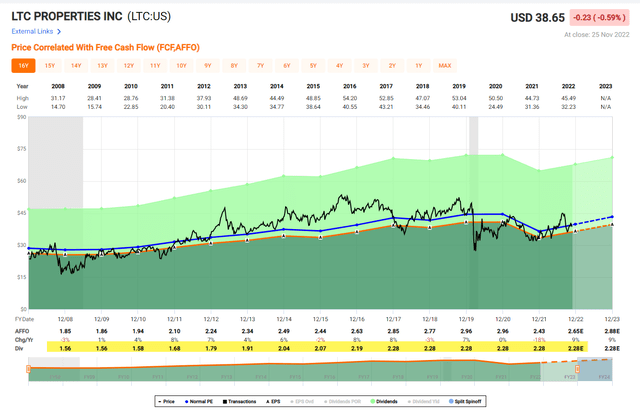

And by the way, LTC Properties (LTC) is not on the list simply due to valuation (we rate shares as a HOLD), but as you can see below, the healthcare landlord has never cut its dividend – even during the pandemic.

FAST Graphs

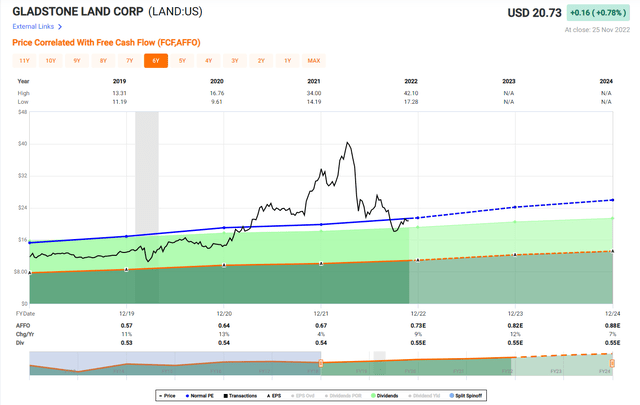

Gladstone Land (LAND) is on our Buy list too, as shares have finally hit “pay dirt” ranges. Although the yield is puny (2.7%) analysts are forecasting double digit growth in 2023, which translates into an iREIT 12-month total return forecast of 15% to 20%.

FAST Graphs

I plan to buy a few shares of O, ADC, and STAG this week as stocking stuffers, so I can show them how the concept of compounding works. Here’s an excerpt from the book The Elements of Investing: (written by Burton Malkeil and Charles Ellis)

“Benjamin Franklin provides us with an actual rather than a hypothetical case. When Franklin died in 1790, he left a gift of $5,000 to each of his two favorite cities, Boston and Philadelphia.

He stipulated that the money was to be invested and could be paid out at two specific dates, the first 100 years and the second 200 years after the date of the gift.

After 100 years, each city was allowed to withdraw $500,000 for public works projects. After 200 years, in 1991, they received the balance—which had compounded to approximately $20 million for each city.

Franklin’s example teaches all of us, in a dramatic way, the power of compounding. As Franklin himself liked to describe the benefits of compounding, “Money makes money. And the money that money makes, makes money.”

As always, thank you for reading and commenting.

Happy Holidays!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment