Khosrork

Author’s note: This article was originally published on Dividend Kings on Monday, November 28th.

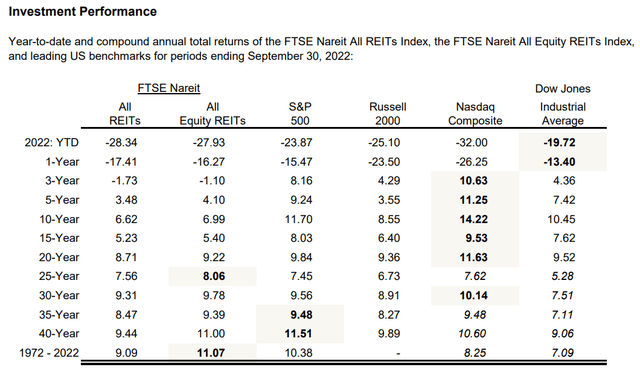

If you’re anything like me you love high-yield blue-chips, and REITs are one of the best high-yield sectors long-term investors can own. Why?

REITs are a time-tested way to earn superior returns to the market, while enjoying generous, safe and growing income. REITs are like the infrastructure of the overall economy, representing a great way to profit from steady rental growth in every sector.

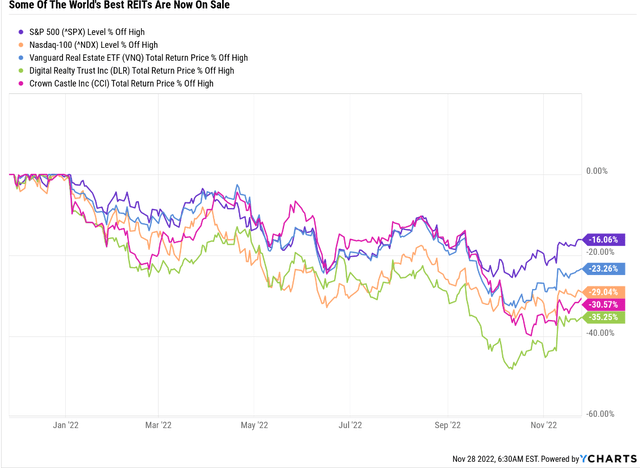

Thanks to the Pandemic “free money” bubble, many of the best REIT sectors, such as data centers and telecom towers, became overvalued. But then came the 2022 stagflation bear market and REITs took it on the chin.

That includes world-beater blue-chip REITs like Digital Realty (DLR) and Crown Castle (CCI), which fell into 40% to 50% bear markets.

Let me show you why DLR and CCI represent two sweet high-yield REIT bargains whose fundamentals remain fully intact, and why now might be a great time to buy them at their best valuations in years.

Digital Realty: A Dominant Name In Data Centers

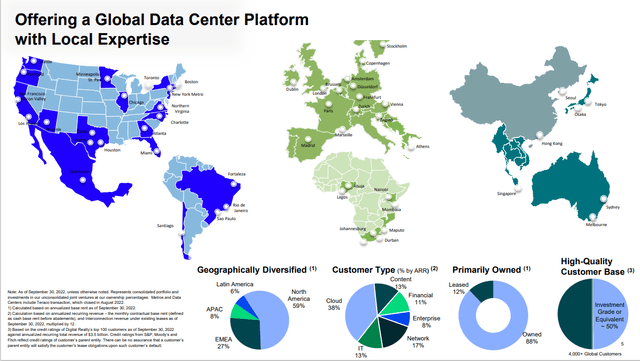

DLR isn’t just the 2nd largest data center REIT in America, it’s the 8th largest REIT period.

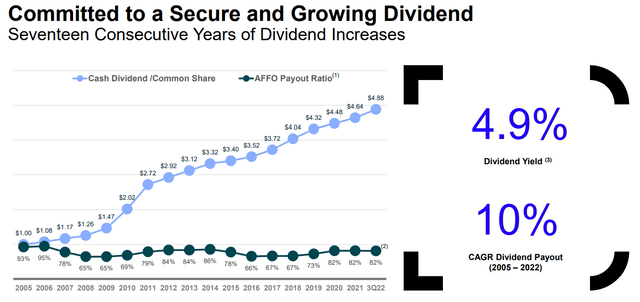

One that has a 17-year dividend growth streak that’s expected to reach 22-years by 2027.

For context, just 13 REITs in the country avoided cutting their dividends during the Great Recession, and DLR was one of them.

DLR stands out among data center REITs thanks to global scale, including over 300 data centers, in 54 of the world’s largest cities, on six continents.

“Digital Realty has transformed its business from one that merely provided large companies vast amounts of space and power (a typical wholesale data center) to one that can offer customers of all sizes the full spectrum of space, power, and connection needs. With a sizable presence across nearly every continent, it is primed to accommodate the needs of global enterprises that want a fluid solution across their data center footprint. Along with Equinix, we think this makes Digital Realty one of only two data center providers that can offer this breadth and set itself apart from the pack.” – Morningstar

DLR is a one-stop-shop for companies trying to source their data center needs, and those needs are massive and rapidly growing.

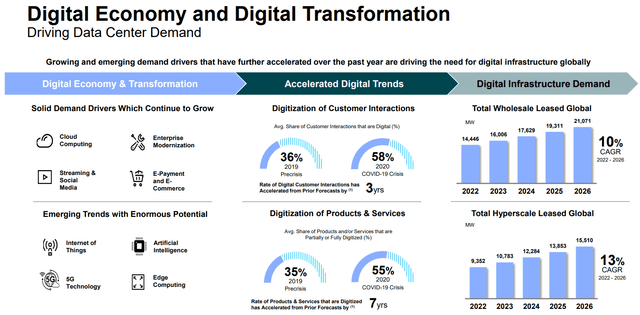

Data center demand is expected to grow at 10% through 2026 and hyperscale data demand (what DLR specializes in) at 13%.

- about 3X faster than the global economy

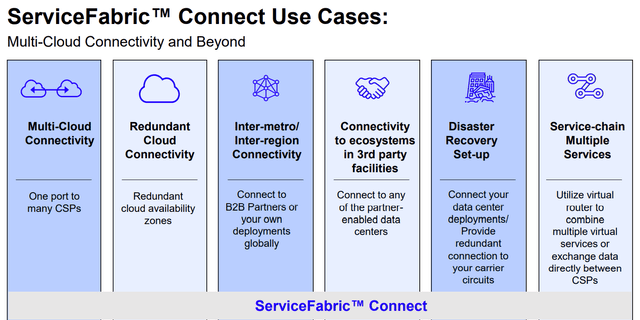

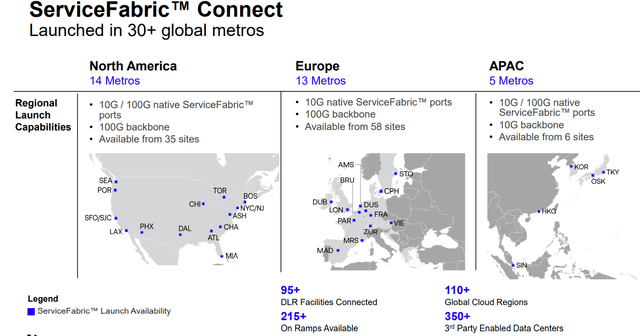

DLR’s ServiceFabric Connect is an example of the one-stop-shopping experience DLR offers its more than 4,000 clients. It allows companies to connect their data systems to any cloud computing company and backs up data creating a safe, redundant system that avoids catastrophic data interruptions.

ServiceFabric Connect is now live in over half of DLR’s cities and is being rapidly rolled out to the rest.

“In our view, Digital Realty was smart to get into the more attractive co-location and interconnection business, and we think its ability to provide those services in conjunction with the capacity to offer wholesale space to the largest cloud providers leaves it well positioned to win in an evolving technological landscape, where huge cloud providers drive the industry but need to connect to virtually all other enterprises.” – Morningstar

DLR has great management that is able to skate to where the industry puck is going, including the most lucrative and least commoditized parts of the business.

- interconnect fees now make up 10% of revenue up from 0% in 2015

- large enterprise clients make up 50% of revenue (up from 5% in 2015)

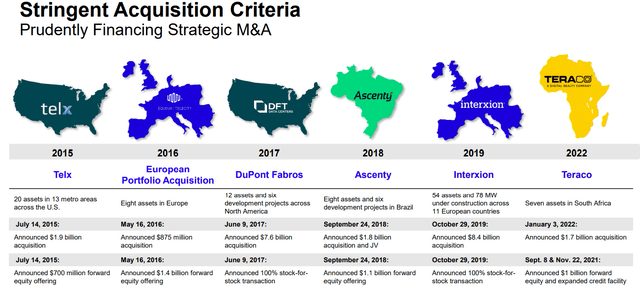

DLR’s empire has been built on the back of smart acquisitions, including the $1.9 billion Telx deal which is what launched DLR into the global inter-connect market.

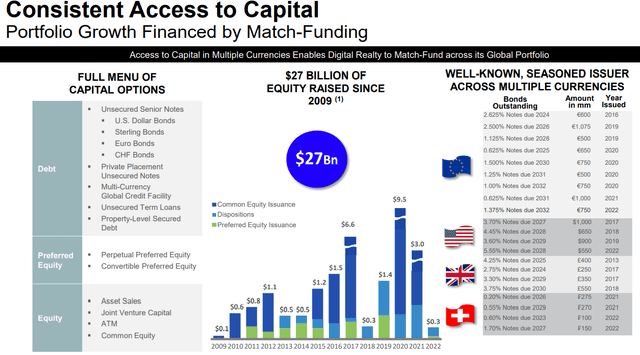

DLR has successfully leveraged its global scale to access the some of the cheapest capital on earth with which to grow. That includes $27 billion in equity financing and borrowing in four currencies including at interest rates as low as 0.2%.

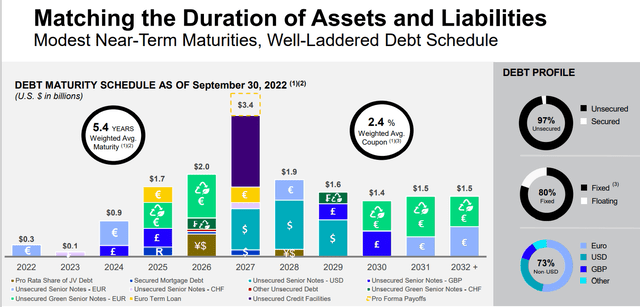

- average borrowing cost 2.4%

DLR has just $100 million in bonds maturing in 2023, the recession year, and just $1 billion maturing through 2024. The 2nd best credit rating in the industry means it should have no problem refinancing at reasonable rates

DLR’s very safe 4.4% yield is well covered by cash flow, including an 82% AFFO payout ratio in the most recent quarter.

90% or less AFFO payout ratio is safe for data center REITs according to rating agencies

The last time DLR’s payout ratio was above safety guidelines was in 2006.

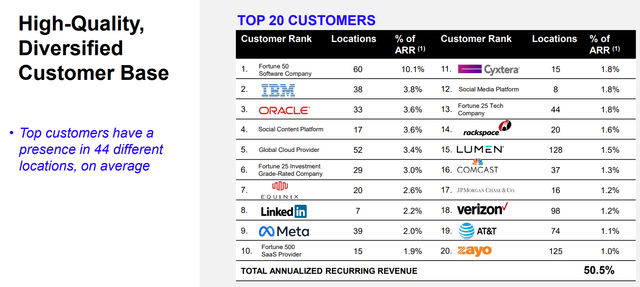

51% of its revenue is from its 20 largest corporate clients, which includes AAA-rated Microsoft (MSFT), AA-rated Meta (META), and A-rated Comcast (CMCSA).

On average, those top 20 clients lease space in 44 of its centers around the globe.

Risk Profile: Why Digital Realty Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Digital Realty’s Risk Summary Includes

- Credit market risk: capex heavy business model means in another financial crisis it could see significantly slower growth

- Industry disruption risk: the world’s largest cloud giants are increasingly taking their cloud needs in-house (like AWS, Azure and Google Cloud) – the reason interconnect is so valuable

Big cloud providers’ accumulating power in the market is a moderate risk for Digital Realty. We expect cloud providers’ importance to continue growing, leaving Digital Realty more susceptible to these companies playing hardball.” – Morningstar

- Cyber-security risk: hackers

- Energy transition risk: DLR is committed to 100% green energy (a potential risk to reliability and margins)

- Economic cyclicality risk (short-term risk to growth prospects, but not a major risk to the secular growth story)

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

See the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

DLR Scores 91st Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Digital Realty | 91 |

Exceptional |

Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Essex Property Trust | 66 | Above-Average | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

DLR’s long-term risk-management is exceptional according to S&P, better than all but 9% of companies on earth.

How We Monitor DLR’s Risk Profile

- 24 analysts

- three credit rating agencies

- 27 experts who collectively know this business better than anyone other than management

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

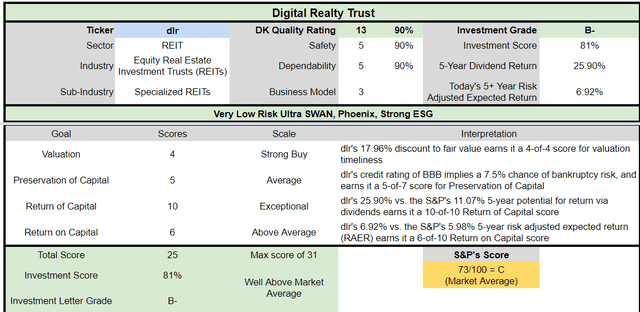

Valuation: A Potentially Strong Buy

- fair value: $133.35

- current price: $111.27

- discount: 18%

- quality: 90% 13/13 Ultra SWAN REIT

- DK rating: Potentially strong buy

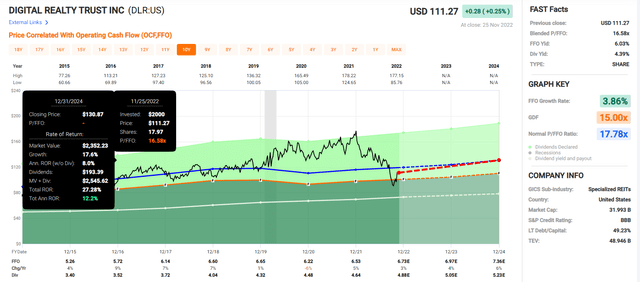

Digital Realty 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If DLR grows as expected and returns to historical fair value it could deliver 12% annual returns, with over 33% of that from dividends.

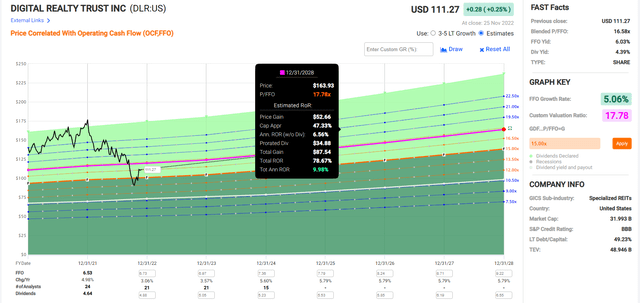

Digital Realty 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

If DLR grows as expected over the next five years, it could deliver 10% annual returns.

- 50% more than the S&P 500 consensus

- with almost 3X the very safe yield

DLR Investment Decision Tool

DK (Source: DK automated investment decision tool)

DLR is a potentially reasonable and prudent high-yield REIT opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 18% discount to fair value vs. 4% premium S&P = 22% better valuation

- 4.4% safe yield vs. 1.7% (3X higher and much safer)

- 11.2% CAGR long-term return potential vs 10.2% CAGR S&P 500 and 10% REITs

- 2.5X higher income potential over five years

Crown Castle: A Great Way To Earn 4.4% Safe Yield While Profiting From 5G

The best way to profit from the rise of telecom data isn’t with Verizon (VZ) or AT&T (T), it’s with telecom tower REITs like CCI. Why?

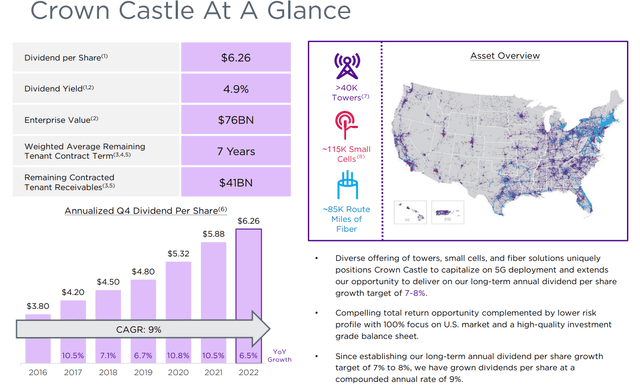

CCI is a telecom infrastructure titan with over 40,000 US telecom towers, 115,000 small cell sites, and 85,000 miles of fiber optic lines.

It has $41 billion in contracted revenue coming in the next seven years. Management has a long-term growth target of 7% to 8% and analysts think they can easily achieve that.

- 8.4% CAGR median growth consensus from all 20 analysts covering it

That means a 12.8% CAGR long-term return potential for CCI, which is stupendous for a REIT.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Crown Castle International | 4.4% | 8.4% | 12.8% | 9.0% | 6.6% | 10.9 | 1.90 |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% | 4.7% | 15.4 | 1.58 |

| Schwab US Dividend Equity ETF | 3.6% | 8.5% | 12.1% | 8.4% | 6.1% | 11.8 | 1.81 |

| Dividend Aristocrats | 2.6% | 8.5% | 11.1% | 7.8% | 5.4% | 13.2 | 1.70 |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% | 4.9% | 14.8 | 1.61 |

| Nasdaq | 0.8% | 11.8% | 12.6% | 8.8% | 6.5% | 11.0 | 1.88 |

(Sources: DK Research Terminal, FactSet, Morningstar, Ycharts)

In the future, analysts thinks CCI won’t just outperform the REIT sector, but also the aristocrats, S&P, and possibly even the Nasdaq.

- but with 5.5X the safe yield

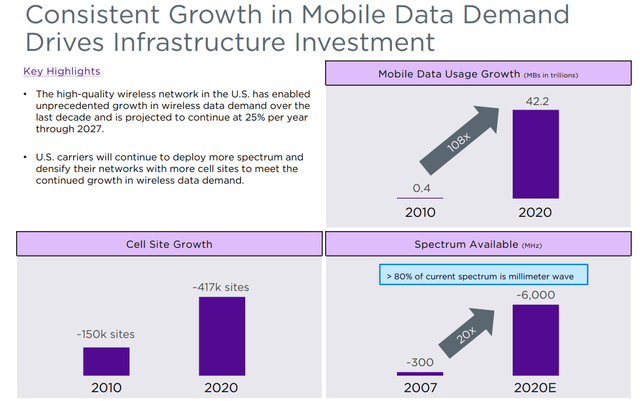

CCI has been an industry leader in telecom towers, which have benefitted from 108X data usage growth in the last decade.

5G, which is video heavy, and the basis for connected-car tech, is the next major growth catalyst that will drive the need for even more cell sites, but especially fiber optic cables and small cells.

- what CCI is now focused on

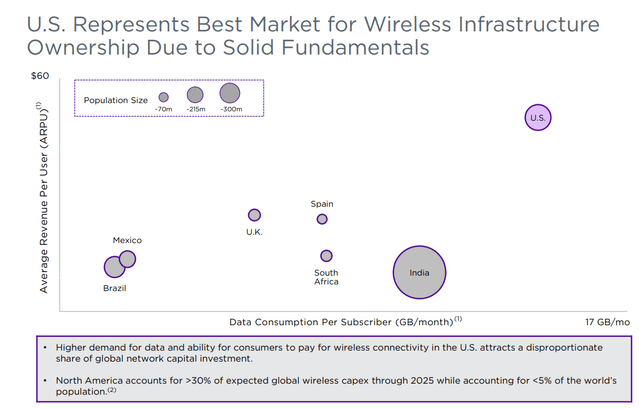

Don’t let the name throw you, CCI is actually 100% US focused and American Tower (AMT) is the globally focused telecom tower REIT.

CCI is sticking to the US because this is the market with the most data usage and highest average revenue per user in global telecom.

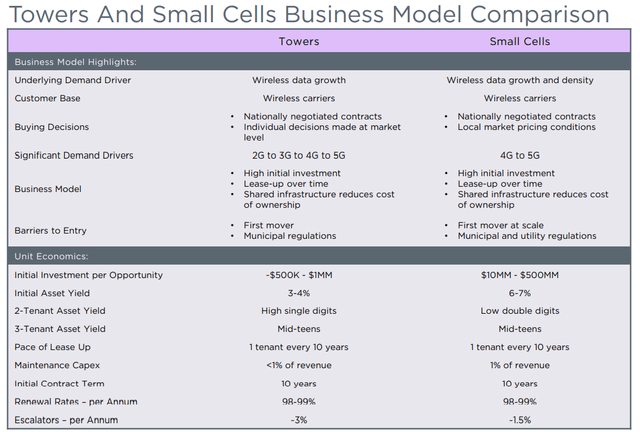

That’s why CCI enjoys 98.5% annual retention rates on its towers and small cell sites, with the average initial contract for 10 years.

By the time a tower or small-cell is fully leased up with 3 tenants it’s generating around 15% cash flow yields.

- the average cash yield for REITs is 6% to 8%

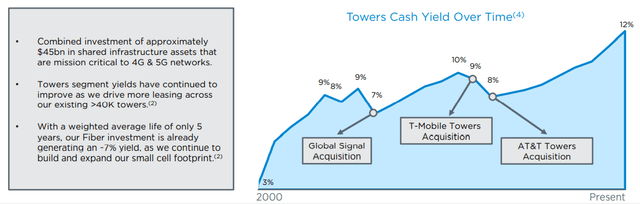

CCI has invested $45 billion so far in towers and fiber and its tower cash yields has been rising relatively steadily (factoring in acquisitions) for 20 years. It’s now 12%, about 50% higher than the REIT sector.

- management expects tower cash yields to rise another 25% by the time it’s fully leased up

- 15% cash yields with assets that cost almost nothing to maintain

CCI’s FCF margins are already 24% and expected to keep rising as its scales up its existing infrastructure.

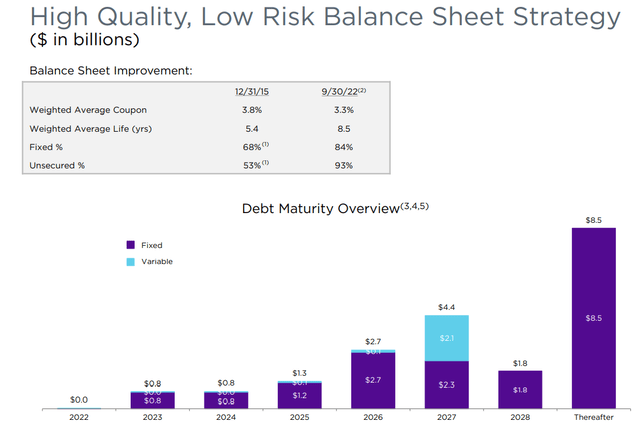

CCI has a BBB stable credit rating, the best in its industry.

- 7.5% 30-year default risk

It’s spent the last seven years during the low rate era steadily extending the duration of its bonds to 8.5 years and reducing its average borrowing cost to 3.3%.

CCI has $800 million in debt maturing in the 2023 recession, and 84% of its debt is fixed rate.

Risk Profile: Why Digital Realty Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Crown Castle’s Risk Summary Includes

- Credit market risk: highly capital intensive industry, if financial markets seize up CCI could have trouble raising low cost capital to refinance maturing bonds or keep growing as management plans

- Business model pivot risk: CCI has pivoted to fiber (spending $10 billion in recent years), fiber is a new industry and so far cash yields have been far below tower yields (though that’s expected to improve in the future)

- Business disruption risk: small cells could prove less profitable per tenant than traditional towers

- Land renewal lease risk: CCI leases rather than owns the land its towers sit on (very long-term leases) land owners could significant increase rents unless it buys the land (which the contracts allow) but could require a lot more debt funded financing in the future

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

See the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

CCI Scores 45th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- customer relationship management

- climate strategy adaptation

- corporate governance

- brand management

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Essex Property Trust | 66 | Above-Average | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Crown Castle | 45 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

CCI’s long-term risk-management is average according to S&P, better than 45% of all companies it rates.

How We Monitor CCI’s Risk Profile

- 20 analysts

- three credit rating agencies

- 23 experts who collectively know this business better than anyone other than management

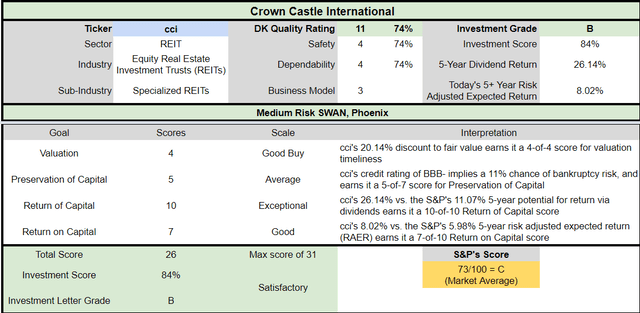

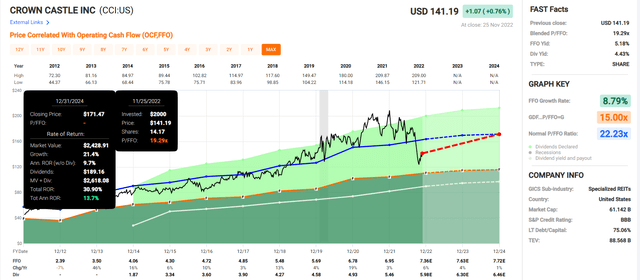

Valuation: A Potentially Strong Buy

- fair value: $176.80

- current price: $141.19

- discount: 20%

- quality: 74% 11/13 SWAN Telecom Tower REIT

- DK rating: Potentially good buy

Crown Castle 2024 Consensus Total Return Potential

If CCI grows as expected and returns to historical fair value, it could deliver 14% annual returns over the next two years.

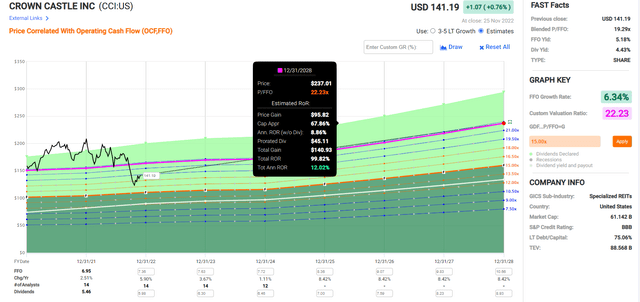

Crown Castle 2028 Consensus Total Return Potential

If CCI grows as expected over the next five years, it could deliver 12% annual returns and double in value.

- 2X more than the S&P 500 consensus

- with almost 3X the very safe yield

CCI Investment Decision Tool

DK Dividend Kings Automated Investment Decision Tool

CCI is a potentially reasonable and prudent high-yield REIT opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 20% discount to fair value vs. 4% premium S&P = 24% better valuation

- 4.4% safe yield vs. 1.7% (3X higher and much safer)

- 12.8% CAGR long-term return potential vs 10.2% CAGR S&P 500 and 10% REITs

- 2.5X higher income potential over five years

Bottom Line: Digital Realty And Crown Castle Are Sweet High-Yield REIT Bargains

Let me be clear: I’m NOT calling the bottom in DLR or CCI (I’m not a market-timer).

Sleep Well At Night quality does NOT mean “can’t fall hard and fast in a bear market”.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

But here is what I can tell you about DLR and CCI’s fundamentals.

DLR is the 2nd largest data center REIT in the world, and along with EQIX, well positioned to benefit from decades of secular growth in this industry.

CCI is America’s largest telecom tower REIT and is well positioned in fiber and small cells to continue riding the exponential growth in telecom data that’s coming thanks to:

- 5G and 6G (in the 2030s)

- the internet of things

- connected-autos

After several years when both CCI and DLR were overvalued, this bear market has presented an attractive buying opportunity in both REITs.

So if you find the prospect of a safe or very safe 4.4% yield and solid growth prospects driving double-digit total returns for decades to come attractive, consider buying these two sweet high-yield REITs today.

Be the first to comment