Talaj

People are hurting financially these days.

I know we keep hearing about the strength of the U.S. consumer. And I’m not trying to completely downplay or disagree with those assessments.

What I do want to do, however, is put them in perspective.

In my blog post on Monday, July 19, I wrote:

“In the last couple of weeks, we’ve witnessed a whirlwind in terms of economic data.

“Inflation metrics have quickly outpaced predictions from top economists. And earnings season has shed light on some of the challenges our banking institutions face.

“Throughout all of this though, the American consumer has remained surprisingly strong, all things considered. Even though discretionary spending waned from its pandemic levels, Americans are still driving up demand for homes, cars, and other big purchases.

“But how much longer can that last? Or, to ask another relevant question, how is this even possible?”

I went on to quote The Wall Street Journal as saying:

“Over the past year, wage increases have continued to exceed pre-pandemic levels, with year-over-year growth topping 4% each month.

“But those steady gains have been wiped out by high prices. When taking inflation into account, there hasn’t been a single month with year-over-year earnings growth since March 2021.

“Spending also rose over the past year, and like with wages, it was outpaced by inflation. Americans are spending more because of high prices, but adjusted for inflation, they are usually consuming less.”

Let me explain…

Inflation Is Hurting Everyone More Than You’re Hearing (You’re Hardly Alone)

Here’s a bit more of the blog:

“This [Wall Street Journal analysis] is a telling bit of information – especially since many of the most optimistic economists cite strong consumer activity as the reason why they’re expecting a mere mild recession.

“When adjusted for inflation though, it appears that spending isn’t actually as strong as we once thought. Actual American consumption appears to be leveling off instead of increasing.

“Take retail, for example. Sales appear to be up 30% from pre-pandemic numbers. But when you adjust for inflation, they’ve only risen 15%.”

Moreover, that number is bound to decline from here since inflation isn’t fading. In fact, a new CNN poll shows that 75% of American families consider inflation their “biggest economic problem.”

Some of the participants’ feedback included:

- “Prices on everything just [keep] getting higher and higher. Is it going to stop?”

- “I work 40+ hours and can barely afford to survive. With the price of gas and price of food so high, I don’t see how anyone can have extra money to do anything other than work.”

- “Inflation causes so much pain with everything we buy and everything we do.”

Yet Fox News suggests that families might not end up being in the “biggest loser” category (emphasis added):

“Scorching-hot inflation is inflicting financial pain on millions of U.S. households. But the rising price of everyday necessities has squeezed one group in particular: retirees living on a fixed income.

“Although Social Security recipients receive a cost-of-living adjustment… the amount of benefits exempted from tax has remained unchanged for decades. Since 1984, retirees have owed taxes on their benefits if their income – including their Social Security payments – is more than $25,000 if they are single or $32,000 if they are a married couple.”

See where is this going?

Retirees Should Rely on REITs – Especially the Monthly Dividend-Paying Kind

My readers are smart cookies, but everyone has their moments – especially when they’re stressed. So let’s follow Fox for a few more paragraphs:

“Now experts say the hottest inflation in a generation could ultimately push more seniors into higher tax brackets as a result of what’s likely to be a record-high cost-of-living increase.

“The Senior Citizens League… estimated last week the COLA [cost-of-living adjustment] could be as high as 10.5% after June inflation data showed consumer prices soared 9.1% from the previous year, the fastest year-over-year jump since 1981. An increase of that magnitude would raise the average retiree benefit of $1,668 by about $175.10 per month, the group said.”

Incidentally, sorry about all the quotes. There’s just a lot of information to acknowledge, and I still want proper time to devote to potential solutions…

Particularly certain real estate investment trusts (“REITs”) that pay monthly dividends. These REITs could be retirees’ – and other households’ – saving grace.

Social Security checks, of course, come every month. But with their power dwindling every day, it seems, those on fixed income need another monthly source to rely on.

The REITs I’m reviewing below have done exactly that for years. And while we all know the past doesn’t guarantee the future, I’m going to fall back on another quote. This time, it’s from Winston Churchill:

“Those who fail to learn from history are doomed to repeat it.”

History isn’t filled with all negatives though. As the following monthly dividend-paying companies show, history can be chock-full of profits. In which case, I’m going to have to modify that statement:

“Those who fail to learn from history are far less likely to enjoy the future.”

Keep that in mind as you read on.

Welcome to the Monthly-Paying List

Let’s start with the following list of monthly paying REITs…

iREIT

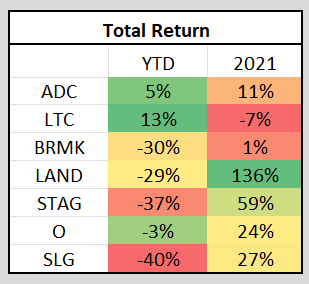

These seven stocks have generated varied results year-to-date and in 2021. The best-performers so far in 2021 are LTC Properties (LTC), Agree Realty (ADC), and Realty Income (O).

The worst are SL Green (SLG), STAG Industrial (STAG), and Broadmark Realty (BRMK). Gladstone Land (LAND) was also down.

Then again, LAND can afford it a bit better considering how shares grew by a whopping 136% in 2021.

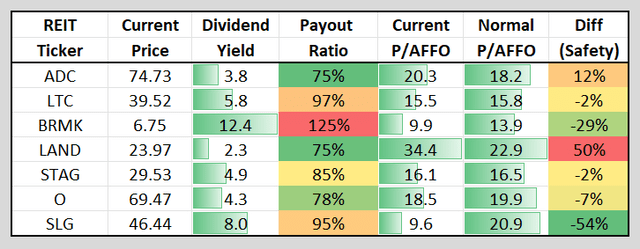

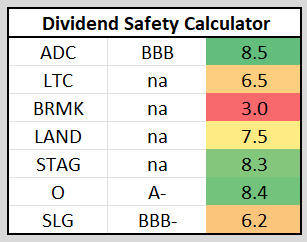

Concerning the entire list – and beyond – we always stress the importance of dividend safety. So just because a company pays out a monthly dividend doesn’t necessarily make it safe.

As shown in the middle column below, we can determine one way or the other by inspecting payout ratios.

iREIT

Notably, BRMK – a commercial mortgage REIT (mREIT) that invests in residential housing builders – has a payout ratio of 125% using earnings per share (EPS) since this is an mREIT. That’s the primary reason shares have underperformed YTD, down 30%.

Its dividend yield is now over 12%, suggesting that it’s in “sucker yield” territory.

SLG also has a seemingly high payout ratio at 95%. That’s also calculated using AFFO per share, which is the best way to determine the safety of the dividend.

We’ve been watching STAG’s payout ratio closely, too. The company has been able to reduce it, though, which obviously makes the dividend safer.

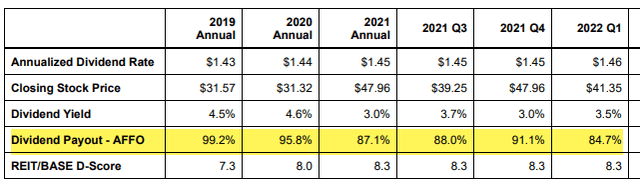

iREIT / REIT Base

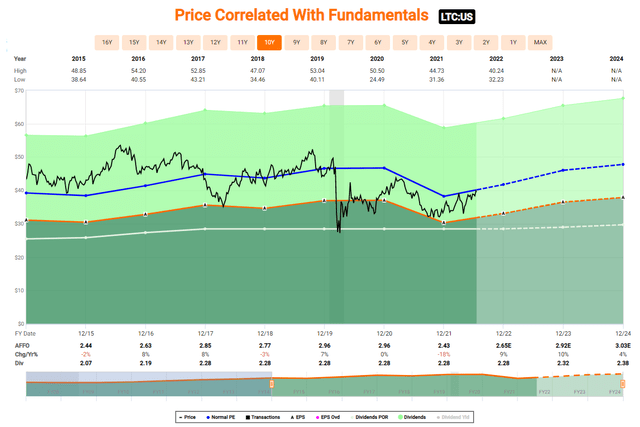

Moving right along, LTC – a healthcare REIT with skilled nursing exposure – did struggle during Covid-19. However, the company appears to be “out of the woods” since its payout ratio has decreased substantially.

iREIT / REIT Base

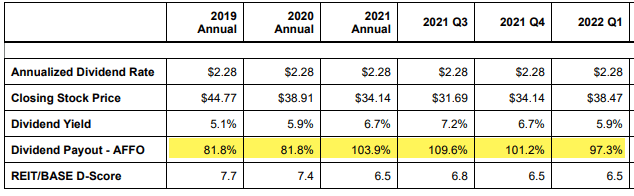

And then the two net-lease REITs – ADC and O – have held up remarkably well during Covid-19 thanks in large part to their mostly investment-grade tenants. Their payout ratios are 75%-78%.

Dividend Safety Acknowledged Again

One of the ways to determine a dividend’s safety is to assign a dividend safety score to each REIT. So that’s what we’ve done below.

Note that STAG doesn’t have an S&P rating. Yet it does have investment-grade ratings from Moody’s (Baa3) and Fitch (BBB).

iREIT

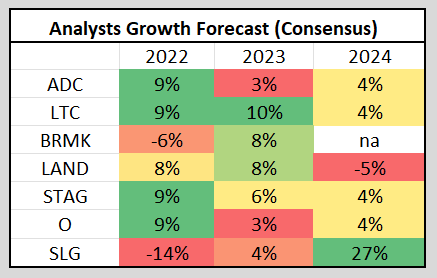

One other metric to consider when evaluating REITs is their growth potential. That’s why this next chart displays analyst consensus estimates.

As you can see, SLG and BRMK are forecasted to generate negative growth in 2022 – which is very good to know.

iREIT

Four of the REITs – ADC, LTC, STAG, and O – are forecasted to grow by around 9% this year. The only REIT forecasted to grow by double-digits in 2023 is LTC.

In terms of valuation, our favorite REITs to buy right now are STAG and LTC. ADC is a tad rich now, and O is trading at a slight discount to our Buy Below target.

Moreover, SLG and BRMK are considered “speculative” given their elevated payout ratios. And LAND remains expensive after the 2021 run-up.

2 Monthly Paying Buys

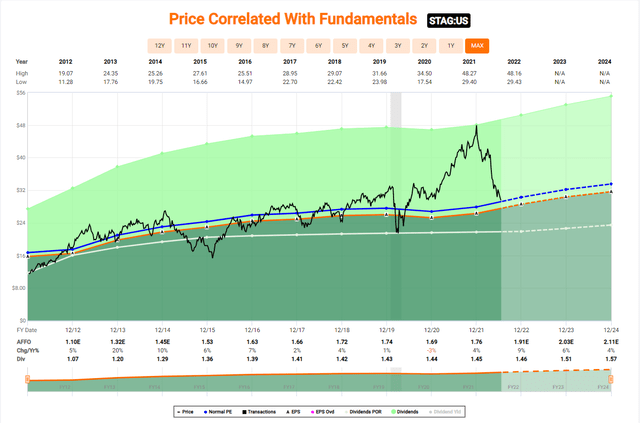

STAG is now trading at $29.53 with a P/AFFO of 16.1x. That’s slightly below its normal 16.5x.

As already mentioned, STAG’s dividend – which is now yielding 4.9% – is getting safer. We can thank its wider payout ratio for that.

I wouldn’t consider this company a screaming buy, mind you. “Fair value” appears to be the logical adjective to describe the industrial REIT.

FAST Graphs

But that can be good enough sometimes.

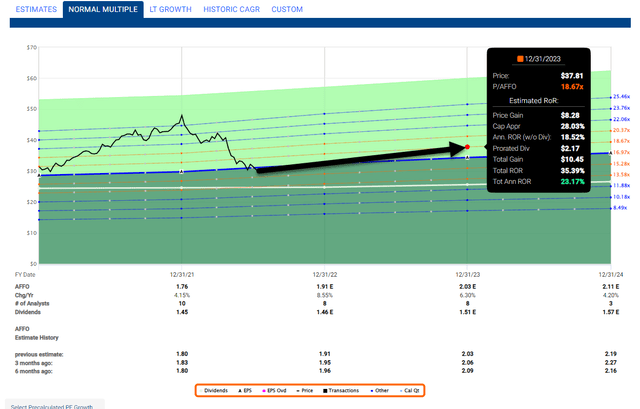

As shown below, we’re forecasting STAG to return around 20% annually. This should provide monthly income investors with a steady paycheck and some solid price appreciation.

FAST Graphs

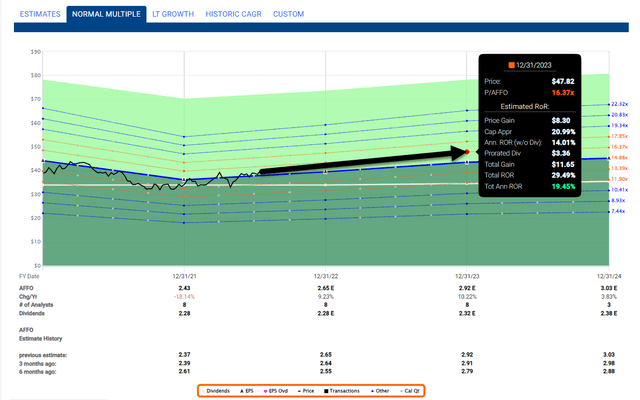

Next up, we believe LTC has the potential to return 15% or so over the next 12 months. For starters, management’s discipline during the global pandemic impressed us significantly.

Considering those insanely unexpected circumstances, that display gives us confidence going forward too.

FAST Graphs

LTC is now trading at $39.52 with a P/AFFO multiple of 15.5x – just under its normal 15.8x. And, as noted above, its payout ratio is improving every quarter.

Its dividend yield is 5.8%, and we expect solid numbers from Q2-22.

FAST Graphs

As for the others? We continue to hold overweight positions in ADC, STAG, and O, with speculative ratings on SLG and BRMK.

Thank you for reading “Monthly Mailbox Money.” I look forward to your comments below.

Be the first to comment