Marcus Lindstrom

Investment Thesis

Marten Transport, Ltd. (NASDAQ:MRTN), a trucking company that offers time, temperature and dry transport and distribution services throughout the States, Canada, and Mexico, is a sturdy and affordable small cap stock at $1.656 billion. It has no long term debt, decades of positive cashflow that is reinvested in the company, a five-year dividend growth of almost 43% and has been growing its top and bottom line for the last nine consecutive quarters. This excludes fuel surcharge revenue, which has risen significantly over the last few months. Since releasing its Q2 2022 financial report this week, the stock price has risen by 17.84%.

As uncertainty in the general economy increases and the stock market is on the down, we want to be on the lookout for companies that have remained profitable irrespective of the economic conditions. MRTN has been consistently profitable and organically growing since its IPO in 1986. Although there are much larger players in the field, MRTN keeps its position and competitive advantage, especially in delivering goods that are time and temperature sensitive because of its strong and well-established reputation in this segment. Whilst we should be wary of the company’s reliance on revenue from a small number of large customers, the industry-wide shortage of drivers and the impact of the unstable economic and political environment, MRTN has a proven track record for delivering irrespective of market conditions. For this reason, I believe that investors may consider taking a bullish stance on this company.

Introduction

In 1946 MRTN was established by the founder, Roger Martin, at the young age of 17 as a small dairy product delivery service in his hometown, Wisconsin. The focus has always been on time and temperature sensitive delivery, initially to Wisconsin and surrounding areas and over the years it grew into a long-haul business covering Canada, USA, and Mexico. It remains family run with son, Randy Marten, as chairman and chief executive, and it has been public since 1986 on Nasdaq stock exchange market. The family has seen the company grow from a one-man show to one that is now employing over 4000 workers.

Where the journey began (Investor Presentation 2022)

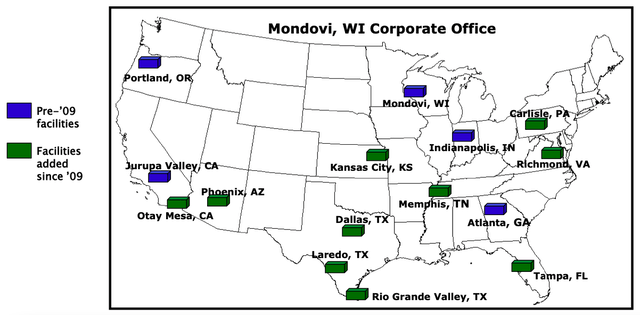

The business model is based around 5 main operational platforms. In order of financial size, they are as follows; firstly, “Truckload”, which are USA road-based, full and large load, trucking fleets that operate out of fifteen different regional services centres as indicated on the map below.

Service Centres throughout the USA (Investor Presentation 2022)

The second platform is “Dedicated”, these are customised transport solutions for customers and suppliers that require specialised equipment to deliver goods. The third platform is “Intermodal”, this is when the company is relying on multiple means of transport, in this case the use of containers for long haul rail transport in which there is door to door truck support provided. As a fourth solution there is “Brokerage”, this is a transport offering by working together with third party carriers. The last platform is MRTN de Mexico which is a partner in Mexico that provides door to door services from Mexico all the way through to Canada.

An important part of the trucking business are the fuel prices, as these often fluctuate within the business. Hence, fuel is brought forward as part of the cost to consumers in the form of fuel surcharge. Companies separate these revenues to give a better indication of operating performance.

MRTN has always been an industry leader in profitability, innovation, and growth. It has been recognised in the past by Forbes as one of the “Top small companies” and “Top most trusted USA companies.” As the digital world not only benefits but also creates challenges in traditional services, MRTN is staying ahead with an integrated in-house information system that provides real time visibility, following the company’s data driven mentality. The company has a CRM department focused on customer satisfaction, a strong brand portfolio, a track record in product innovation, a strong dealer community and is focused on growing its revenue stream and diversifying economic risk. Creating its unique five platform business model has given the company a long-term competitive advantage.

Financials and Valuation

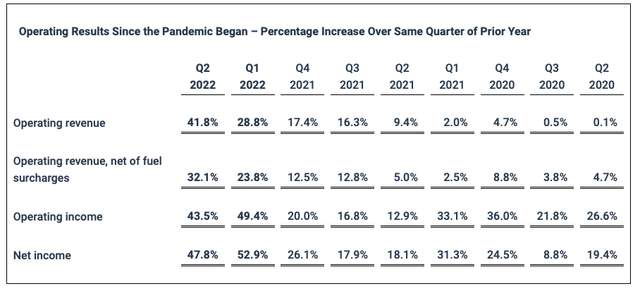

“You can’t build a reputation on what you were going to do,” a quote by Henry Ford in the investor presentation of Q2 2022. MRTN has just released its Q2 2022 financial report, and the numbers are above expectations and add further confidence in its reputation. The top line performance is the highest it has been in its operating history.

Operating Results over 9 Quarters (Investor Presentation 2022)

MRTN’s net income increased yoy to $31.7 million, an increase of 47.8%, as seen in the table above. Furthermore, the Q2 2022 earnings grew by 15.0% from the prior quarter. If we break up the revenue into the different business platforms, we can see that majority of the revenue is from “Truckload”, at 39%, followed by “Dedicated” with 33% revenue, next with “Brokerage” at 17% revenue and lastly with “Intermodal” at 11%. MRTN de Mexico has also grown yoy by 31% to $72.7 million. Noteworthy, the top 10 customers account for 50% of the revenue.

The top and bottom line performance improved over the last nine quarters. Return on Equity (ROE) is 15%, telling us that for each dollar of shareholder capital, the company made $0.15 in profit. EPS was 1.13, with a one-year price target of $22.50. The company has a low P/E ratio of 15.34.

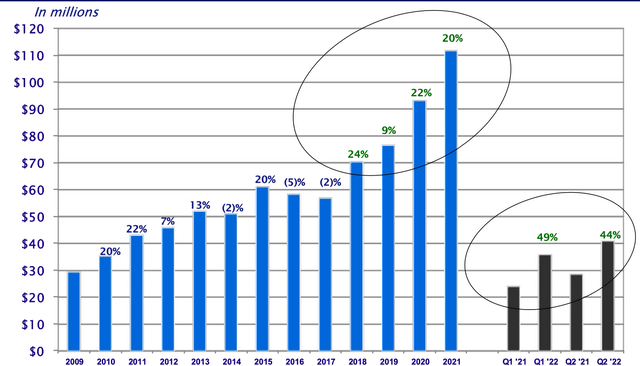

Operating Income (Investor Presentation 2022)

Q1 2022 saw the company repurchase 1.3 million common stock for $25 million and increase quarterly cash dividends by 50%. On top of that, the company repurchased another 963,000 shares in Q2 2022 for $16.8 million. This shows the management’s belief in the financial situation of the company and its commitment to its shareholders.

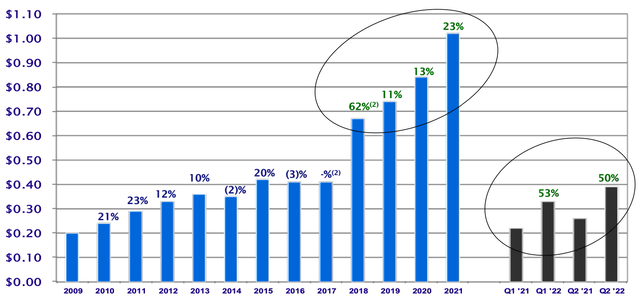

In line with the last four quarters, MRTN’s Q2 2022 results have surpassed the expectation of analysts by 21.88%. This quarterly report represents an earnings surprise of 21.88%. A quarter ago, it was expected that this company would post earnings of $0.26 per share when it actually produced earnings of $0.33, delivering a surprise of 26.92%. We can see the earnings per share over the years on the graph below.

Earnings per Share over the years (Investor Presentation Q2 2022)

Analysts are positive about this company. Wall Street has recommended this stock as a ‘Buy’ and Seeking Alpha’s Quant Rating at 4.87 is a ‘Strong Buy’. It has a 1-year target price estimate of $23.50 and rated as a 2.2 ‘Strong Buy’ on Yahoo Finance. In addition to the stable financials, these are very promising signs for the company.

Risks

One of the main risks that the company faces is that a small number of customers account for the majority of its revenue. The top 10% of its consumers account for 50% of the revenue. Many of these customers have been clients for over ten years, and MRTN is often the main or dominant choice of transport for these companies. However, if large customers were to move to competitors, it would have big implications on the performance of the company. The company is focused on diversifying its consumer base, and dependency has slightly reduced this number over the last few years.

The company has limited success outside of its core business. It has a limited product range, and in this way cannot always offer everything the potential customer requires. In a highly competitive market, alternative companies may better address the needs of similar customers. The barrier to entry is not very large, and the options for potential customers are diverse and customised.

Furthermore, the shortage of drivers is an issue throughout the industry. This is partly due to COVID-19 and variants and also the impact lockdowns and pandemics have had on the shift in consumer purchasing process to online and remote with the expectation of receiving goods at their door. The company prides itself on its family focus and applies this way of thinking to its drivers, for instance paying wages above the industry average and providing non-financial benefits such as trainings and holiday perks. Furthermore, backend automation and tracking systems are leading to more efficient and lean means of transporting goods.

Future and Final Thoughts

Fuel is highly fluctuating and sensitive to consumer and suppliers’ availability and demand. Although fuel surcharge is put forward to the customer, to reduce costs, as a company highly dependent on fuel it has agreements to buy in bulk from Mondovi. Additionally, since 2007, it has invested in auxiliary power units since 2007 to reduce fuel consumption and to reduce energy consumption there are now satellite tracking systems in place to control temperature units.

MRTN has the automation power to scale up and downward dependent on the demand. It has a strong cashflow that it can use to continue expanding through new companies and projects. As an established company, it has managed to create long term relationships with its suppliers, which helps to overcome supply chain bottlenecks through good communication and agreements. The company has a very strong brand portfolio. Not only has it been recognised as an excellent company through various well-known establishments, but it has also delivered years and years of high customer satisfaction through the work the company has put in. Off the back of another excellent quarter, investors may want to take a bullish stance on this company.

Be the first to comment