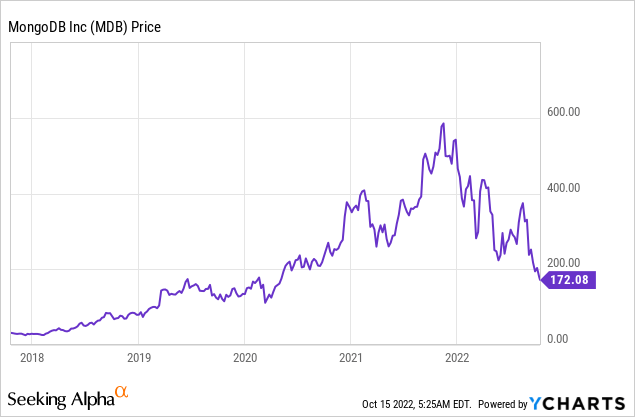

The big data industry was valued at $162.6 billion in 2021 and is forecasted to grow at a rapid 11% compounded annual growth rate [CAGR] up until 2026. All this “big data” needs storing somewhere and traditional databases just aren’t very scalable. That is where MongoDB (NASDAQ:MDB) can help, as it provides a fast and flexible modern database service. The company serves a variety of elite customers which include; Verizon, Coinbase, eBay, Forbes and many more. The high inflation and rising interest rate environment has butchered growth stocks, and MongoDB’s share price has slid down by over 68% since November 2021. Despite this the company has continued to grow its revenue at over a 50% rate. In addition, they are poised to benefit from other secular trends such as Digital transformation as organizations move their workloads to the cloud. In this post I’m going to breakdown the company’s business model, financials and valuation, let’s dive in.

Sundry Photography

Evolving Business Model

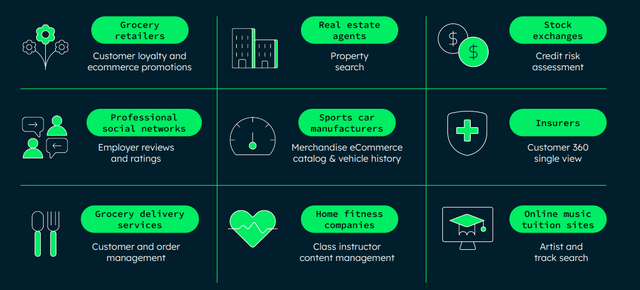

MongoDB provides a non-relational or “non-SQL” database service and is rated number one on Gartner by customer reviews and ratings. Its platform is ideal for many applications from financial services to customer personalization, Localization marketing and the Internet of Things [IoT].

MongoDB has open-source code that has created a cult following globally. The platform has been downloaded over 240 million times across its 37,000 global customer base, you can see a few example use cases on the image below.

MongoDB use cases (Product Presentation 2022)

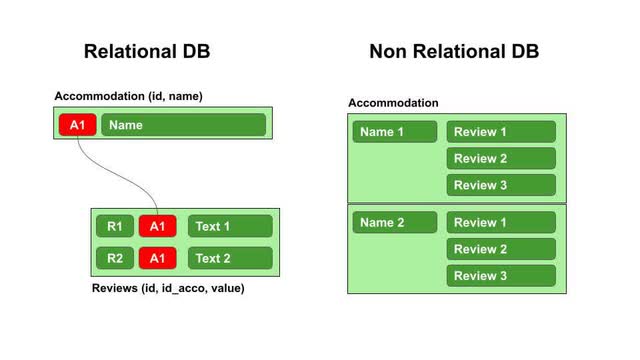

In a traditional “relational” or SQL database, data is structured in a rigid schema which means each column or row has an assigned value type (number, letter etc). This is great for doing structured queries such as, “SELECT” the top 5 apartments with the highest price in a property database, using querying language like MySQL. However, the issue with “SQL” (structured query language) databases is they can have challenges scaling and often be slow to perform queries. Whereas “Non-Relational databases” have a “flexible schema”. This means data can be stored of different types as key, value pairs, it is also more scalable and often faster, which means it’s great for real time data.

Relational vs Non Relational Databases (Toward Data Science)

The company offers a cloud-native “Database as a Service” [DBaaS] which scales with demand as a user needs more storage and offers high performance. MongoDB offers the only multi-cloud database which gives access to 95 regions across AWS, Azure and Google Cloud. This means super “high availability” of the database as even if AWS goes down (which is unlikely), you still have the other two major cloud providers.

The organization has focused on building a community for developers to make their life easier. These software engineers can waste less time creating databases and use that time more effectively. The MongoDB university course is testament to this community and has had over 1.5 million registrations.

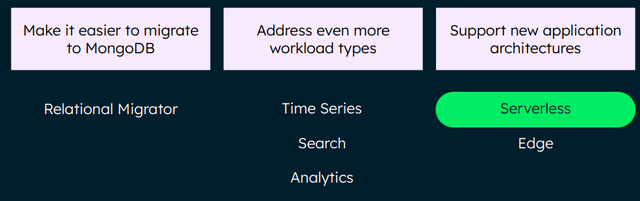

New Product Features

MongoDB is continuously innovating and have recently announced new product features. The first is its “Relational Migrator” which makes it easier for customers to move their legacy “relational database” to the MongoDB “non-relational database”. The feature does virtually the same as Amazon’s [AWS] Database Migration Service. However, it uses a graphical user interface (display) which makes the process a lot more intuitive than legacy solutions.

New Product features (MongoDB product presentation)

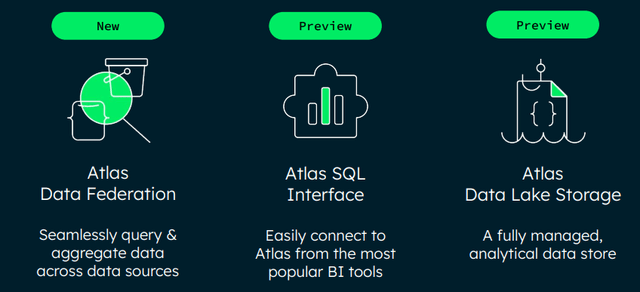

The company has also announced native support for time series data which was already commonly used with the platform by customers. In addition, the company has announced “In-app analytics” and improved search capabilities. Atlas is the company’s “Serverless” database which outsources all the underlying compute and scaling requirements to the cloud. This enables customers to scale both performance and cost.

The company makes its revenue from a variety of options. It entices customers and the community in with free shared plans to get familiar with the tools and systems. Then after a customer can move to a monthly subscription service or even a fully managed service where customers are charged based on the number of database reads. This “pay as you use” model is the same pricing strategy AWS uses for its customers. This offers customers greater flexibility to scale with demand. For example, let’s say an e-commerce company is going through the holiday season, they will have more website traffic, more sales, and more database reads. However, in a season of lower demand, they will be charged less.

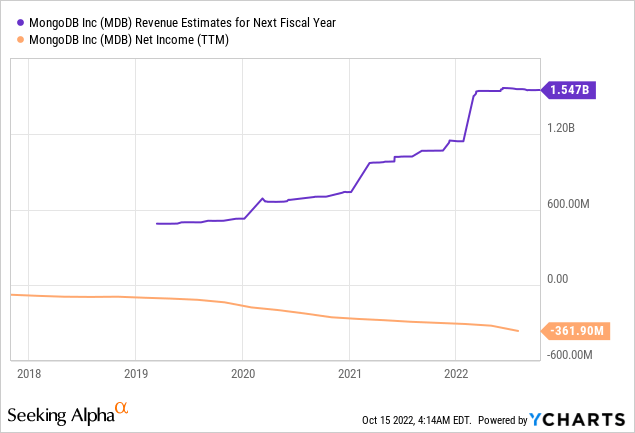

Growing Financials

MongoDB generated solid financial results for the second quarter of fiscal year 2023. Revenue was $303.7 million which increased by a blistering 53% year over year and beat analyst estimates by $21.35 million. Subscription revenue made up the bulk of total revenue with $291.6 million generated up 52% year over year. Services revenue was $12.1 million which increased by 64% year over year.

Its fully managed service Atlas has proven to be immensely popular and has seen its revenue expand by a rapid 73% year over year. Customers continued to grow strong and increased from 33,000 at the start of 2022 to 37,000 by the second quarter.

Management showed confidence in its earnings call and reported “no change” in sale cycles. The fact that the business hasn’t noticed customers delaying spending and lengthening deal cycles is a positive sign. This means the platform is likely to be “non-discretionary” and thus would hold up well during a recessionary environment. I don’t imagine customers migrating their database to another provider during a recessionary, which means the platform has high “stickiness”. However, the customers of MongoDB’s customers may reduce spending which could lead to lower demand in the short term (more on that in the Risks segment).

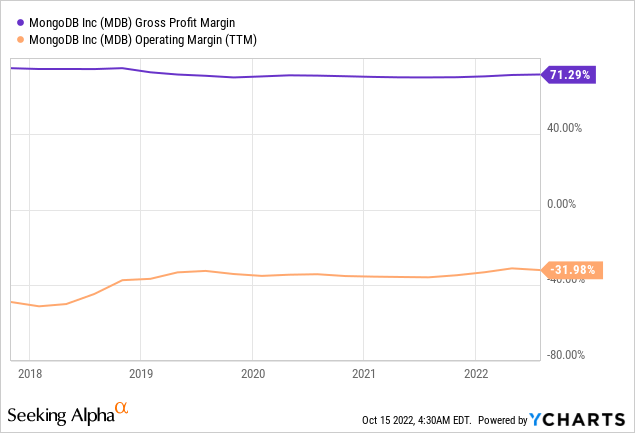

MongoDB generated solid Gross Profit of $215.4 million which was the result of a slight increase in gross margin from 69% to 71% which was a positive sign. This improvement in gross margin was driven by efficiency improvements from its Atlas platform.

The company did generate a small loss from operations of $12.4 million at a minus 4% margin. This was slightly worse than the -2% operating margin generated in the equivalent quarter last year. This was not a major worry as the business ramped up its Sales and Marketing spend for the MongoDB world event which broke attendance records with over 3,000 developers visiting.

The company generated operating cash flow of minus $44.7 million, and free cash flow of minus $48.6 million. Its free cash flow was more negative than the minus $22.7 million produced in the equivalent quarter of last year. Management brushed over the reasons for this decline in their earnings call, but they did allude to $3.9 million in extra Capex and debt repayments.

MongoDB has a robust balance sheet with $1.8 billion in cash, cash equivalents, and short-term investments. The company does have total debt of just over $1.2 billion but the majority of this looks to be long-term debt.

Moving forward, management is forecasting revenue of between $1.196 and $1.206 billion for the full fiscal year 2023. With a non-GAAP loss from operating of between $13 million and $8 million.

Advanced Valuation

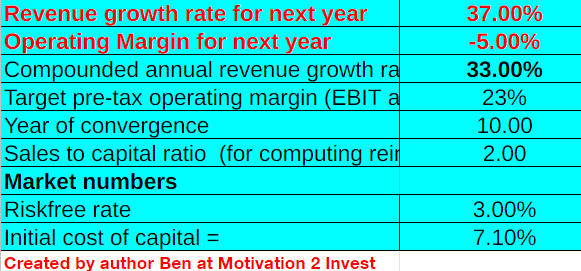

In order to value MongoDB, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 37% revenue growth rate for next year and 33% over the next 2 to 5 years. This is driven by my own estimates combined with analyst and management forecasts.

MongoDB stock valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted the business to steadily increase its operating margin of the next 10 years to 23% which is the average of the software industry. I expect this to be driven by high operating leverage and greater economies of scale from its managed services platform. This operating margin also includes an uplift adjustment I have made by capitalizing R&D expenses.

MongoDB stock valuation (created by author Ben at Motivation 2 Invest)

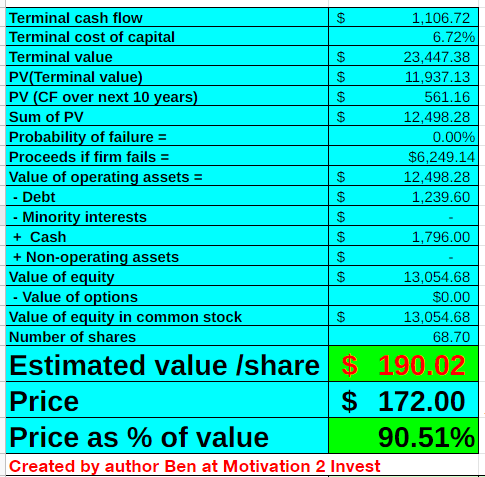

Given these factors, I get a fair value of $190 per share, the stock is trading at $172 per share at the time of writing and thus is approximately 9.5% undervalued.

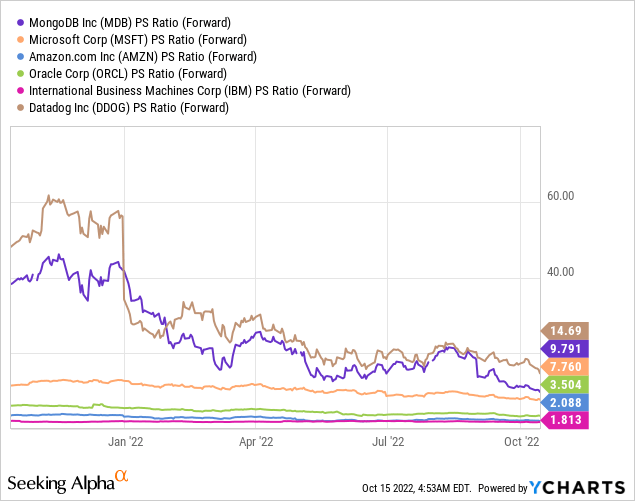

As an extra datapoint, MongoDB trades at a Price to Sales ratio = 10.71 which is 53.17% cheaper than its 5-year average. Relative to industry peers it is quite difficult to value as MongoDB is a pure database provider whereas at a company like Microsoft or Amazon, it is a microscopic part of their business. Therefore, I think it makes more sense to look at companies such as Oracle (ORCL) which trades at a PS ratio = 3.5 and IBM which trades at a PS ratio = 1.8. Both of these stocks are cheaper than MongoDB which trades at a PS ratio = 9.8. However, MongoDB is a much more modern company and thus a comparison with a cloud-native platform like Datadog (DDOG) (PS = 14.7) makes sense, even though they do different functions.

Risks

Competition

The database industry is competitive and there is a giant named Amazon breathing down MongoDB’s neck. The world’s largest cloud infrastructure provider Amazon Web Services has a service for pretty much everything and databases are no different. Amazon’s Dynamo DB is a Non-Relational, Non-SQL database that offers rapid scalability and performance. This is a fully managed service the same as MongoDB and is the backbone of major customers such as Disney+, Zoom, Dropbox, and even Snapchat. MongoDB is an AWS partner and thus it is not fully a competition. But for organizations moving to the AWS cloud, Amazon’s native offering is very tempting.

Recession/Lower Consumption

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. As mentioned prior, lower usage by the customers of MongoDB’s customers will directly impact revenue for its managed pay-as-you-use service. The good news is I expect this to only be a short-term issue as by in large a database is non-discretionary.

Final Thoughts

MongoDB is a market-leading database provider which has a vibrant community and is continually innovating. The company is poised to ride multiple secular trends and the stock is slightly undervalued due to economic uncertainty. I do expect some short-term headwinds as consumer demand slows usage, but long term I forecast this company to continue to thrive.

Be the first to comment