Sundry Photography

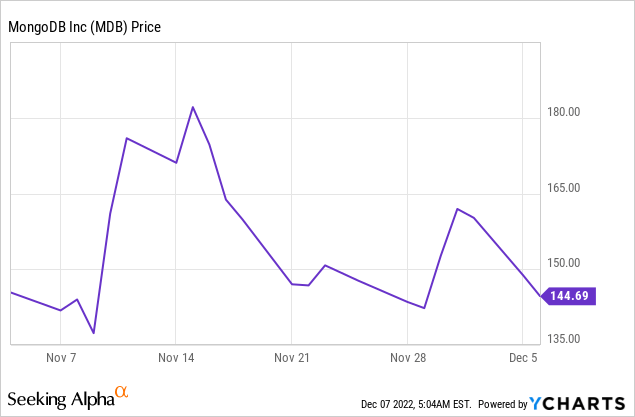

In my previous post on MongoDB (NASDAQ:MDB), I highlighted that the company was “poised to benefit” from secular trends such as “Big Data” and “Digital transformation” as organizations move their databases to the scalable cloud. Now it looks as though my thesis has continued to play out as the company reported super financial results for Q3,FY23, beating both revenue and earnings estimates. These results caused the stock price to surge by 27% in premarket trading on the back of huge momentum.

MongoDB is a Gartner magic quadrant leader in “Non-SQL” or nonrelational databases. This is a flexible database type that is popular for storing nonstandardized data for many applications from financial services to customer personalization. As MongoDB offers a cloud-based “database as a service” it can automatically scale with usage and charge customers in a flexible manner. I covered the technology behind this and MongoDB’s business model in extensive detail in my prior post. In this post I’m going to break down its financial results and valuation in granular detail, let’s dive in.

Growing Financials

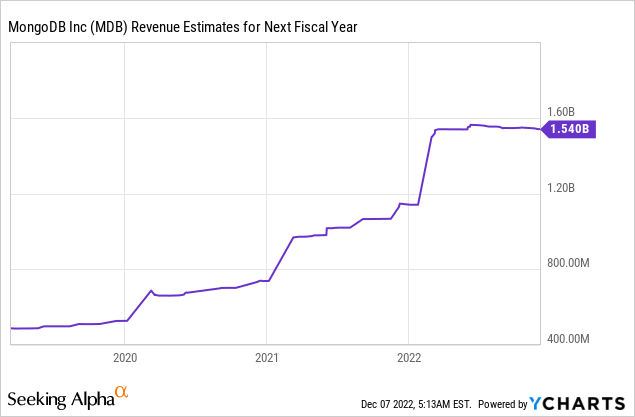

MongoDB reported strong financial results for the third quarter of fiscal year 2023. Revenue was $334 million which increased by a rapid 47% year over year and beat analyst estimates by 9.84% [Google Finance data].

This was driven by strong growth in its core Atlas platform, which increased revenue by 61% year over year and contributed to 63% of total revenue. Atlas is MongoDB’s “fully managed” database as a service [DaaS] solution. The fact it is fully managed means that customers don’t have to worry about setting up new storage as it will automatically scale up and down using the cloud.

Atlas charges its customers with a “consumption” model similar to Amazon Web Services [AWS]. This is great for customer flexibility but can also mean revenue can be impacted by macroeconomic factors. The business noted an uptick in consumption vs the prior quarter but consumption rates are still below “historic levels”. Area’s below consumption expectations include its mid-market segment internationally and enterprise segment in Europe.

Despite the macroeconomic challenges, Atlas added over 500 direct sales customers in the third quarter alone and 39,100 total customers were reported for MongoDB as a whole. Its solution has proven to be very popular with a range of company sizes from startups to Fortune 500 companies. The company effectively runs a product-led “freemium” strategy which allows developers to sign up for the free tier and get started building databases. This has resulted in a huge open-source community developing around the product. Its open-source software has been downloaded over 115 million times from its website, in the trailing 12 months alone. Over 300,000 people have signed up for the Atlas free tier program in the third quarter alone, up a staggering 15X in five years. This is a brilliant go-to-market strategy as it effectively means getting started with MongoDB has zero friction. The company grows with its customer, only charging them as they expand usage.

Popular customers of MongoDB include Toyota Financial Services, Ulta Beauty (ULTA), Vodafone (VOD) and more. Vodafone is an interesting case study as this is a leading telecoms provider which is using MongoDB’s Atlas as the backbone for its Internet of Things [IoT] ecosystem which consists of over 140 million devices. The international IoT industry was valued at $300 billion in 2021 and is forecasted to grow at a 16.7% compounded annual growth rate, reaching $650.5 billion by 2026. Therefore MongoDB is poised to benefit from growth in this industry as developers look for an easy-to-use and scalable backend database solution.

Companies such as the Washington Post, Cisco (CSCO), and Cybersecurity company Okta (OKTA) are also using MongoDB as the database platform for the development of applications.

MongoDB has continued to “grow up market” as the business reported 1,545 customers with at least $100,000 in ARR, up from 1,201 customers in the equivalent quarter last year.

Huge Growth in “Adjusted” Profitability

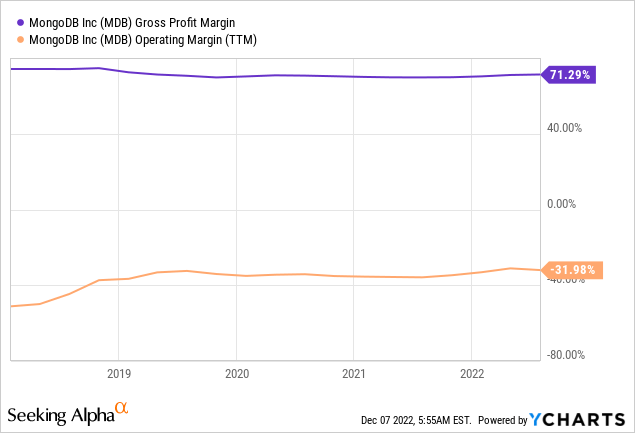

In Q3,FY23 MongoDB reported Gross Profit of $247.8 million which represented a gross margin of 74%, up from 73% in the prior year. This was driven by efficiency improvements across its Atlas platform.

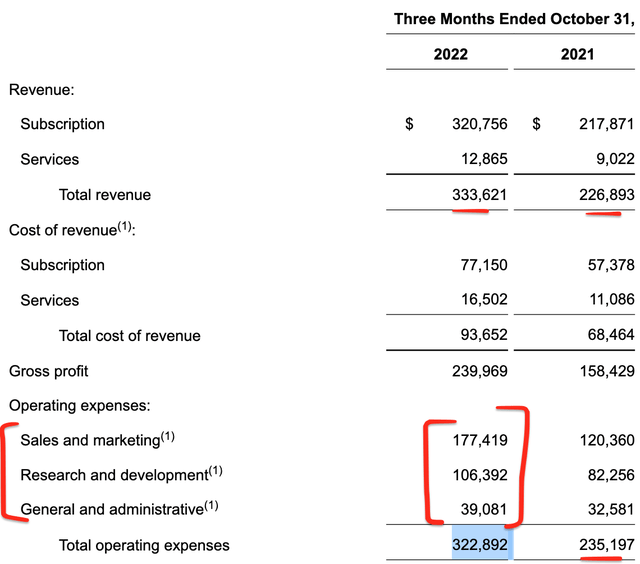

Adjusted Earnings per share was a standout metric as it increased to $0.23 per share which represented a 237% surprise over the negative $0.17 expected by analysts, [Google Finance data]. This was driven by top-line growth and expense moderation, according to management on the Q3 earnings call. However, it should be noted that on a GAAP basis, Operating expenses were $322.89 million in Q3, FY23 which increased by an eye-watering 37% year over year. Total expenses made up 96% of revenue which was a slight improvement over the 101% expense level in Q3,FY22. This is a positive trend and demonstrates operating leverage in the business but it still has a long way to go.

MongoDB financials (Q3,FY23 report)

A positive in the expense line items is the majority of expenses is being invested into growth via $117 million in Sales and Marketing spend. This is followed by $106 million in R&D expenses (which I consider more of an investment).

In Q3,FY23 Free Cash flow was negative $8.4 million which was a slight improvement over the negative $9.2 million reported in Q3,FY22.

MongoDB has a robust balance sheet with $1.8 billion in cash, cash equivalents, short-term investments, and restricted cash. In addition, the company has $1.1 billion in convertible senior note debt.

Advanced Valuation

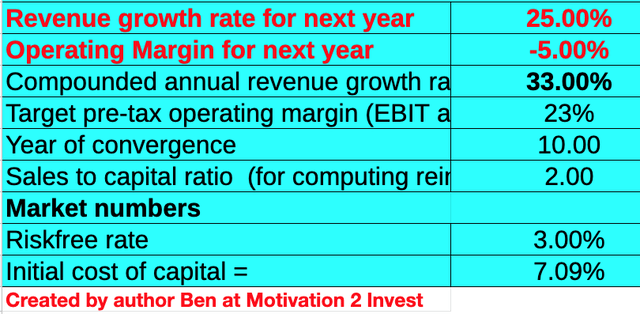

In order to value MongoDB, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method in valuation. I have forecasted 25% revenue growth for next year, based on a conservative extrapolation of management guidance and a tough economic backdrop. In years 2 to 5, I have forecasted revenue growth to increase as economic conditions are likely to improve and greater consumption occurs.

MongoDB stock valuation 1 (created by author Ben at Motivation 2 Invest)

To improve the accuracy of the valuation, I have capitalized R&D expenses which has lifted net income. I have also forecasted the business will grow its pre-tax operating margin to 23% over the next 10 years.

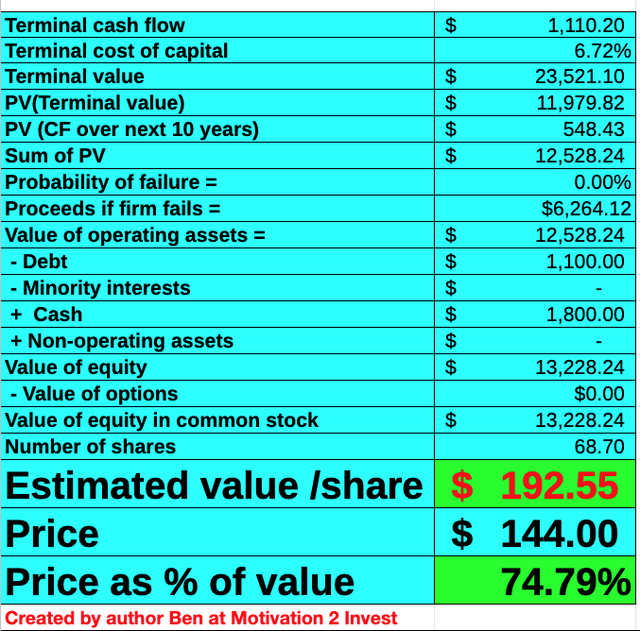

MongoDB stock valuation 2 (created by author Ben at Motivation 2 Invest )

Given these factors I get a fair value of $193 per share, the stock is trading at $144 per share at the time of writing and is thus ~25% undervalued. As the stock price has popped by ~27% in premarket trading, at the time of writing, this valuation gap will likely close therefore I deem it to be “fairly valued”.

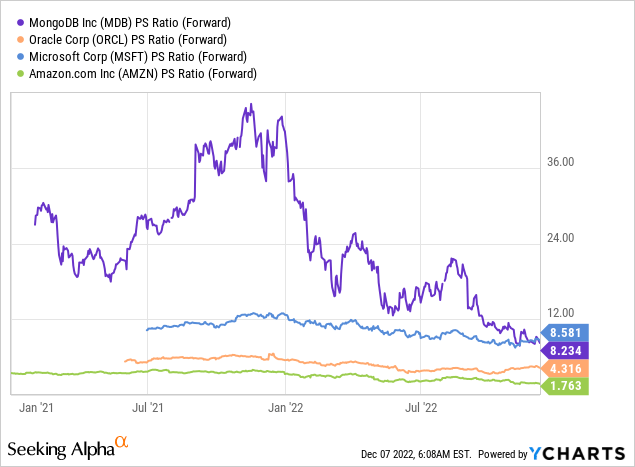

As an extra data point MongoDB has a price-to-sales ratio = 9 which is 61% cheaper than its 5-year average. Relative to industry peers, MongoDB trades at a fairly high price to sales ratio. However, this is an unfair comparison given large technology companies such as Amazon (AMZN) have a diverse business model. Amazon Web Services (cloud business) has a product called “DynamoDB” which is a Non-SQL database that competes directly with MongoDB.

Risks

Lower Consumption/Recession

The high inflation and rising interest rate environment mean a recession has been forecasted. As MongoDB makes its revenue via a “consumption-based” model, lower economic activity generally results in lower consumption. This will likely impact growth for at least the next year.

Final Thoughts

MongoDB is a best-in-class database provider which has built a substantial community around its product. The company has partnerships with the major cloud providers including AWS, Microsoft Azure and Google Cloud. Therefore the business is poised to benefit from the growth in hybrid cloud and database applications. The stock looks to be “fairly valued” after the recent spike in share price following the stock’s results.

Be the first to comment