We Are/DigitalVision via Getty Images

For many investors in the growth sphere, the last few months have been catastrophic. For those who had pumped their portfolio with extreme leverage, it has been an extinction-level event. MoneyLion (NYSE:ML) is now down 37.6% since my last article on the company written just at the start of this year. At this point, the end of the pandemic was seemingly at hand and investors were looking towards 2022 with a deep hope that the nearly year-long collapse of growth stocks would come to an end.

The company’s financials have been strong and its long-term macro case was shaping up to be healthy on the back of the continued rise in demand for digital financial services. This would see the company experience a boost in overall revenue growth, ensuring it met its upwardly revised revenue estimates for the coming fiscal years. MoneyLion initially guided for revenue for 2021 to be $155 million, rising to $285 million in 2022, then $525 million in 2023. Hence, against a current market cap of $581 million, the company is trading at a lowly 1.10x price to 2023 revenue multiple. For some clarity 2023 is next year, not an extremely faraway point in the future.

We have now moved to a new world where fast-growing companies that once traded at the 8x to 10x revenue multiple range now trade at less than 1x. This is a result of the torrid investment atmosphere, a very rapid switch that has taken many investors by surprise and forced brutal adjustments to their portfolios. Will this previous sentiment ever return? If yes, then MoneyLion likely presents a favourable risk to reward ratio.

What Is The Bull Case For Investing In MoneyLion?

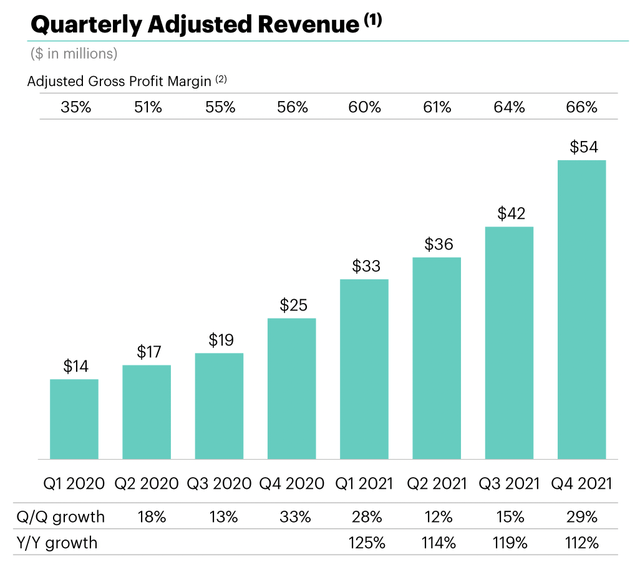

MoneyLion’s last reported earnings were for its fiscal 2021 fourth quarter which saw revenue come in at $55.56 million, a 146% increase from the year-ago quarter. Further, total revenue for fiscal 2021 came in at $171 million, a $16 million beat on an already upwardly revised revenue estimate, and a 115% from the previous fiscal year.

The triple-digit revenue growth meant a strong finish to a breakout year for MoneyLion. Whilst some of this spectacular has been driven by recent acquisitions, the company has quickly established itself as an important platform to serve the needs of its fast-expanding customer base.

MoneyLion Q4 & 2021 Full Year 2021 Earnings Presentation

The quarter meant a continuation of the trend of uninterrupted quarter over quarter growth in adjusted revenues with subsequent growth in adjusted gross profit margins. The latter reached a new high of 66% during the last reported quarter.

Momentum during 2021 was clear, customers and originations grew by triple digits with MoneyLion closing out the year with 3.3 million customers, up 129% year over year and $1.1 billion in originations, up 165% year over year. Further, a record 8 million total products were used by their customers, up 79% versus the prior year. The stock price reacted tepidly to the results as adjusted EBITDA for the year increased markedly. This was negative at $32 million versus a loss of $13.2 million in the comparable period.

However, the company still has a substantial cash and equivalents position at just over $200 million, giving it ample liquidity to fund itself to adjusted EBITDA breakeven at the end of fiscal 2022. MoneyLion is forecasting adjusted revenue of between $325 to $335 million for fiscal 2022 with an adjusted gross profit margin of between 60% to 65% and an adjusted EBITDA loss of no higher than $50 million. Hence, the company expects revenue to at minimum grow by 90% in fiscal 2022 with an adjusted EBITDA loss that is set to move positive in 2023.

The Future Of Finance Remains Digital

MoneyLion longs are straight-up not having a great time. The company’s shares seem to be allergic to any type of good fundamental news, seemingly stuck in a time loop characterised by rampant capital destruction and disappointment. But the bears have had their fun. The company has been a victim of timing as it went public at a time when the valuation of growth stocks and public fintech firms started to take a dive. Then inflation started to creep up to combine with a war in Europe.

In spite of all these, the company has continued to deliver and outperform its financial targets, setting the background for likely outperformance in the longer term. However, this analysis could be wrong. The company’s shares could continue to experience material near term weakness if inflation continues to creep up and the FED is forced to be even more hawkish towards rate hikes than it currently is. But as long as MoneyLion continues to deliver on its financial targets its bulls’ time in the sun will come once again.

Be the first to comment