Eoneren

Investment thesis

monday.com (NASDAQ:MNDY) operates in the fiercely competitive project and work management software space. Although there are several companies in the sector growing revenues above 30-40-50% year-over-year, the time will come when most ‘greenfield’ opportunities cease to exist, and head-to-head competition will be more typical. Due to its efforts to differentiate itself from competitors and its strong adoption trends among larger enterprise customers I think monday is well positioned to stand its ground even under those circumstances. This, coupled with a strong growth momentum even in a weakening macroeconomic environment and an attractive valuation make the company’s shares a good long-term investment at current levels.

Business Overview

monday.com operates a cloud-based Work Operating System (or more traditionally spoken a project and work management software) with headquarters in Tel Aviv, Israel, which enables organizations of all sizes to manage their people and workloads in a transparent and efficient way. This is done through visual collaboration tools, with a high degree of customization and automation options. As part of its core Work OS platform monday offers a low-code, no-code framework of modular building blocks, which enables even non-tech employees a limitless customization and extension of the core platform. The company operates a marketplace, where external developers or even existing customers can market their different apps and extensions to the platform they developed themselves.

Why is monday.com different?

Although today monday is still identified as a classic project and work management (PWM) platform in my opinion, the company pushes hard to distinguish itself from the numerous other competitors in the space. This has been the core theme of their Work Without Limits ad campaign this year, centered around that particular Super Bowl ad. But are they really different from other companies in the PWM space?

I think they are in the sense, that they try to provide everything within one solution. They developed an easy-to-use, universal PWM platform, which makes PWM related tasks more efficient for many people within an organization. This concept is similar to Smartsheet’s (SMAR), Asana’s (ASAN) or Trello’s (owned by Atlassian (TEAM)) solution. However, monday’s solution provides a wide range of low-code, no-code extension and customization options, which distinguishes its platform from those of other competitors mentioned above. This aspect of the business is further strengthened by monday’s marketplace, which tries to lure developers to come up with unique extensions to the platform and develop specific apps that meet different customer-specific needs. Low-code/no-code software development is projected to be one of the main themes in the software space in the upcoming years, this should strengthen the companies’ competitive position in my opinion.

It is important to add, that the low-code, no-code approach in software development is not new, companies like Airtable, ClickUp (both highly anticipated IPOs) or Appian (APPN) have been pioneers in this space. Compared to these companies I think monday has the advantage of simplicity on the one hand, because it also offers the concept of the basic, pre-built PWM platform, which is easier to sell. However, on the other hand software developers don’t seem to be very satisfied with monday’s low-code, no-code customization possibilities, at least based on several comments I came across on Hackernews. Airtable seemed to be a better fit for them, which has the concept of customization built in its core. Nevertheless, monday doesn’t target tech-savvy software developers in the first place, they try to be a platform for everyone.

The question arises at this point, whether it’s not counterproductive for monday to do everything in one time instead of focusing only on one thing. I think the steady growth of the company shows that this is not the case and building your business on several pillars could be a great advantage if one of the pillars begins to shake in the future. Furthermore, this philosophy of monday results in a high degree of flexibility, which is a very important trait in the rapidly changing, highly competitive SaaS space. Being able to adopt to customer needs as soon as possible will be a key to surviving in the long run in my opinion.

Besides these core differences to other business models monday decided this year to introduce four distinctively marketed services (mostly through re-packaging of solutions available thus far) based on four key verticals they serve: project management (Monday Projects), sales CRM (Monday Sales CRM), marketing (Monday Marketer) and software development (Monday Dev). Built on the top of their universal Work OS platform I think these services will help the company to target specific segments of the crowded PWM market more efficiently. These core products are supplemented by Canvas, a digital whiteboard with real-time collaboration and WorkForms, that’s designed to capture data and collect feedback.

Finally, regarding the core platform monday seems to be comparatively strong in customization features, and their quality of support is also rated quite high, if needed at all (based on a deep dive in trustradius comments from relevant experts). Looking at criticism, users often lack specific integrations with other software and automations are limited in several areas. This shows there is still ample room to improve.

Based on the above I think monday is a strong competitor in the crowded PWM space as they constantly thrive for innovation and flexibly react on customers needs. Furthermore, they managed in recent years to establish strong roots in the enterprise segment unlocking large cross-sell and upsell potential. Currently the PWM market seems to be large enough for several players, but if everyone grows at such a rapid pace the number of greenfield opportunities will shrink quickly. When it comes to the moment of truth, I think monday will be among those who succeed in the long run.

Strong growth momentum amid early signs of slowdown in Europe

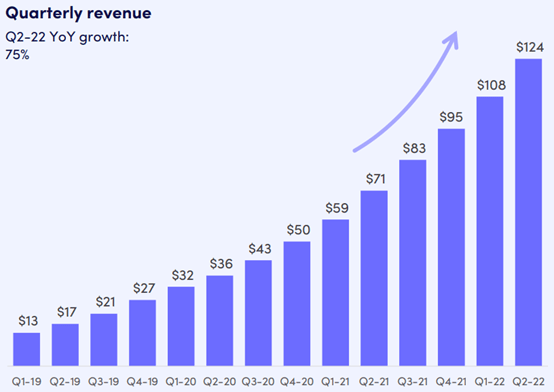

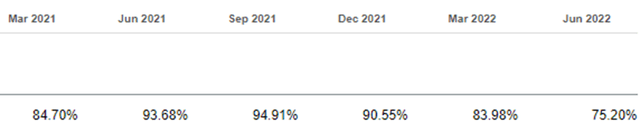

Top line growth at monday continued to be exceptionally strong as revenues increased 75% YoY in the Q2 2022 quarter:

monday.com Q2 2022 earnings presentation

This has marked a further slowdown in the annual revenue growth rate of ~9%-points QoQ, although 2%-points were the result of the strengthening dollar:

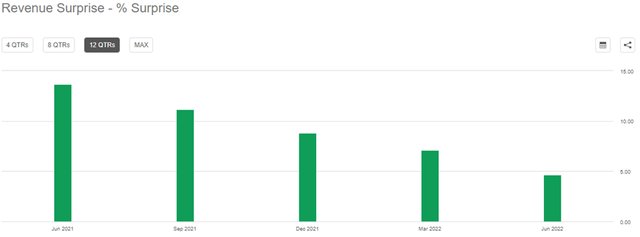

The company was among the few SaaS companies who managed to accomplish a beat-and-raise quarter within the significantly worsening macro environment, but this was partly due to their extremely low bar set at the beginning of the year, for which shares have been strongly punished that time. Although revenue beat was smaller than usual, around 5%, in my opinion it was better than feared by many investors:

The company increased it’s 2022 YoY revenue growth forecast from previous quarter’s 58-60% to 62-63%, which seems still conservative after posting growth of 84% and 75% for the first two quarters in 2022.

Management highlighted on the Q2 2022 earnings call that they saw some softening in the business in Europe in June, that continued into July as well. This was in line with comments from other SaaS companies. monday’s guidance for 2022 incorporates that this slowdown will last into the whole year. However, even in the light of this, Q3 guidance of 57-58% YoY growth and the implied Q4 guidance of ~44% YoY growth seem still quite conservative, leaving comfortable room for beat-and-raise again.

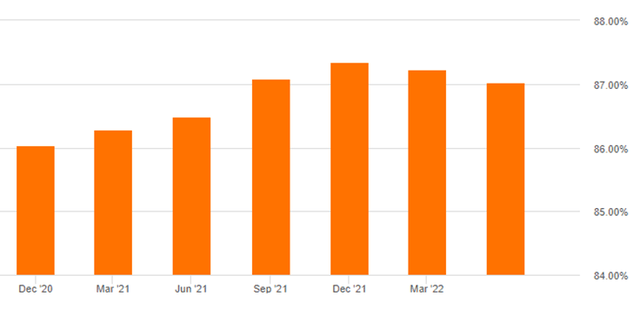

GAAP gross profit margin stayed around 87% in the quarter, which management expects to maintain in the medium- and long-term:

According to datasets of Damodaran the average gross margin for the system and application software sector was around 71.6% at the beginning of the year, so monday’s 87% is exceptional from that point of view.

The secret source of strong revenue growth

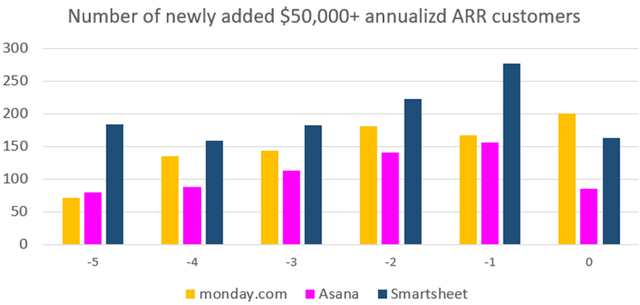

Behind the strong revenue growth momentum of Smartsheet there is one important factor, which stands out among competitors: especially strong growth in the number of enterprise customers, defined by monday as customers above $50,000 annualized ARR.

In Q2 2022 Monday grew the number of these customers by a record of 200, representing 147% YoY growth. This was much higher than the same metric for Asana, and even higher than the same metric for Smartsheet for its recently closed FY Q1 2023 quarter, although they have more than twice as many such customers in total:

(as reporting periods for the companies don’t exactly overlap, “0” indicates their most recently closed fiscal quarter as a starting point, with negative numbers showing how many quarters we go back from the most recently closed quarter)

Created by author based on company filings

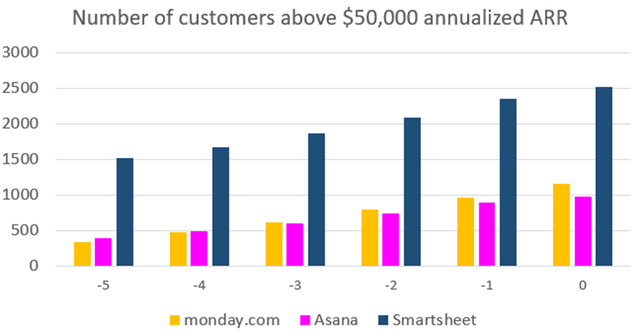

With this, Monday is closing the gap in the number of total enterprise customers served (defined by $50,000+ ARR customers) compared to Smartsheet and has already left Asana behind a few quarters ago:

Created by author based on company filings

It will be an important question whether this trend could continue, but looking at monday’s current momentum there are good chances for that in my opinion. According to Eran Zinman, Co-Founder and Co-CEO the success of monday within the enterprise customer cohort is driven by larger initial deal sizes, the company’s new product strategy and also the consolidation effort seen at customers, who realize that they can do many things with monday’s flexible Work OS platform.

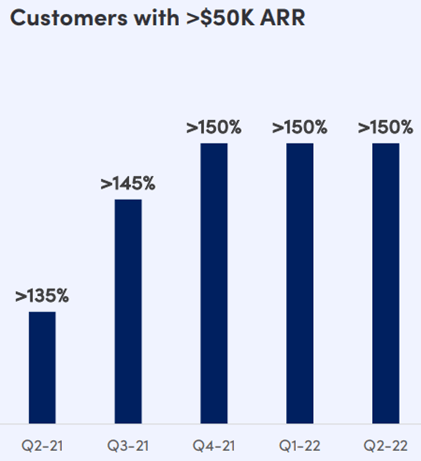

Regarding future growth prospects the dynamic growth of the enterprise segment is a key, because this cohort tends to make up the bulk of a SaaS companies’ ARR over time. monday doesn’t disclose the share of this segment of total ARR, but for comparison at Smartsheet it stood at 57% as of the end of April. monday’s net retention rate (NRR) among enterprise customers seemed to stabilize somewhat above 150% in recent quarters that management expects to prevail:

monday.com Q2 2022 earnings presentation

This counts as an exceptionally strong figure, which could support further strong topline growth in the quarters to come.

Strong hiring resulted in deteriorating bottom line in H1

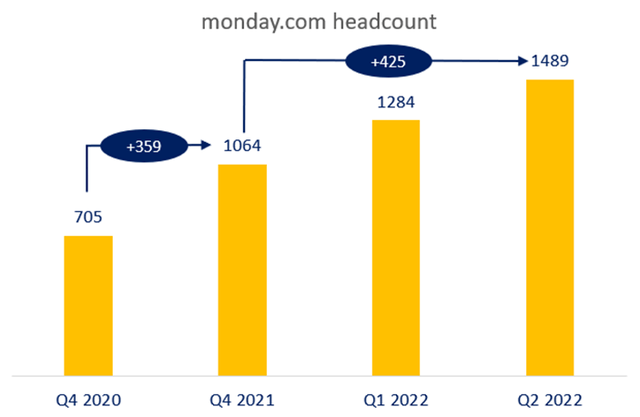

Like in the case of many other SaaS companies, monday’s operating and free cash flow margins are still deeply in the red. The past two quarters were characterized by heavy spending to capture the large market opportunity in front of the company. After growing by 359 employees in 2021 the company grew its headcount by 425 just in the past two quarters, effectively doubling it within 1.5 years:

Created by author based on company filings

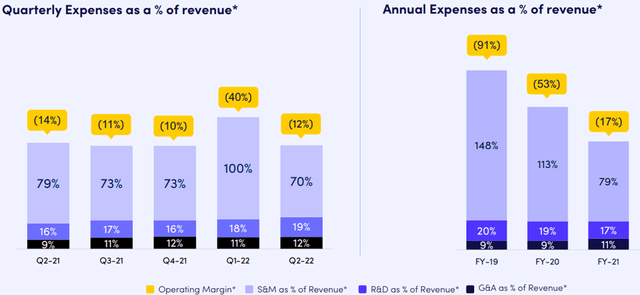

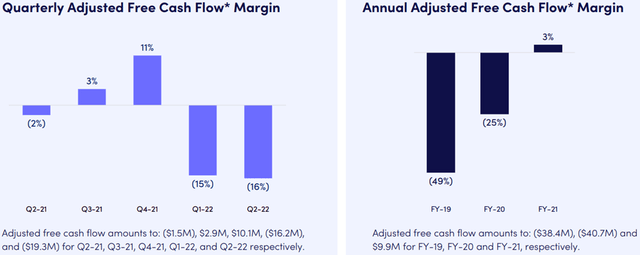

I think this sets the stage for further strong growth, especially as more than 60% of the most recent hires landed in customer facing roles. monday plans to slow the pace of hiring in H2 and focus more on the successful onboarding of new employees. This will have a beneficial effect on operating and free cash flow margins, which showed improvement in recent years, but declined meaningfully in the first half:

monday.com Q2 2022 earnings presentation monday.com Q2 2022 earnings presentation

Currently, it seems possible that we saw the bottom from both an operating and free cash flow margin perspective as after an improving H2 this year management expects to reach breakeven free cash flow margin somewhere in H2 2023. This could be followed after a few quarters by reaching breakeven in operating margin as well.

Looking at monday’s balance sheet we see ~$800 million of cash. This comfortably supports the companies’ spending needs until they reach breakeven free cash flow margin, as they typically burn cash of ~$10-20 million per quarter.

Finally, from an expense perspective I think a big question for monday will be, how can they maintain strong topline growth after scaling back S&M spending as a percentage of revenues? Based on the company’s strong total NRR of above 125% (and above 150% in the enterprise segment) I am optimistic that they will succeed. It seems to me that with heavy H1 spending (including strong hiring and the “Work Without Limits” ad campaign) the seeds have been planted, and the fruits will be harvested in the upcoming quarters/years.

monday is undervalued within the PWM sector

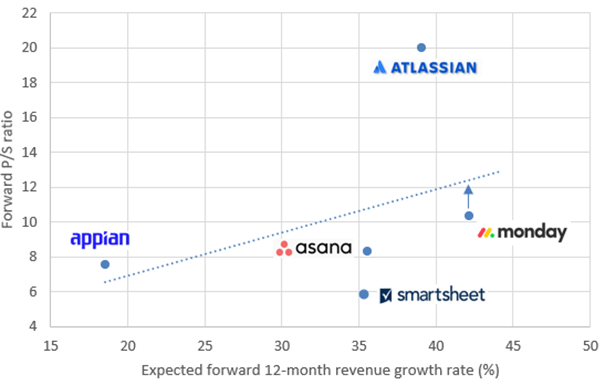

Looking at monday’s relative valuation within the PWM space we can see the following: The company has the highest expected revenue growth rate among publicly traded, closer competitors, which is it not proportionally reflected in its current forward P/S valuation multiple:

Created by author based on company filings

Atlassian stands out with its quite aggressive valuation of 20x forward sales, which can be partly explained by its stronger cash flow generating ability in my opinion. Although its flagship product, Jira is the top pick for software developers among these companies, I think in most of the other segments of the market monday provides at least the same quality of service. Furthermore, as discussed before monday is not that far from reaching breakeven free cash flow margin (unlike Asana), which makes me question the large valuation discount compared to Atlassian.

Based on the valuation matrix presented above monday’s shares should trade 20% higher in order to be fairly valued, not to mention, that the highest growers trade usually at a premium. And that’s just the valuation discount within the PWM sector.

If we look out to the broader market, I think many SaaS companies are undervalued in general as shares have been punished due to heavy investments in recent quarters leading to deteriorating margins. However, strong gross margin profiles and increasing focus on improving operating and free cash flow margins suggest to me, that in the upcoming quarters/years many of these companies will show, that they can generate significant profits, which will lead to more elevated valuations on medium-term.

Risk factors

An important risk factor to look out for the short run is the softening macroeconomic environment, which has already caused some decline in monday’s sales momentum in Europe. It’s worth to look out for the earnings of competitors, what they will have to say about this issue. Among the closest competitors Smartsheet and Asana will be the next ones to report earnings at the beginning of September, but we have many other SaaS companies reporting next week. Currently, a typical publicly traded SaaS company has baked in some conservativism into its calendar year 2022 guidance due to this macro backdrop, but steep revenue guidance cuts haven’t been typical. If we would experience a wave of these, this could pressure share prices significantly on the short run in my opinion.

An important risk factor for the longer run is the strong competition within the PWM space. Currently, based on management comments from the sector, most of the new business is still made up of greenfield opportunities, and replacing other non-legacy vendors is not so typical. With the market maturing this could become an important issue in the upcoming years. As I have shown above, I think monday is well positioned to stand its ground even under those circumstances.

Conclusion

Even in a somewhat uncertain macroeconomic environment monday is still able to maintain its strong topline growth. The engine behind this, is its strong adoption trend within the enterprise customer cohort, which seems to stand out among competitors. The company’s efforts to differentiate its business model within a strongly competitive market could bear fruit in the medium and long run, which is supported by heavy investments made in the first half of 2022. These position monday for further strong growth, which coupled with improving margins will lead to a significant expansion of its valuation multiple in my opinion.

Be the first to comment