HJBC

Investment Thesis

I have covered US Pharmaceutical companies frequently for Seeking Alpha, and generally speaking, the sector has been a rewarding one for investors.

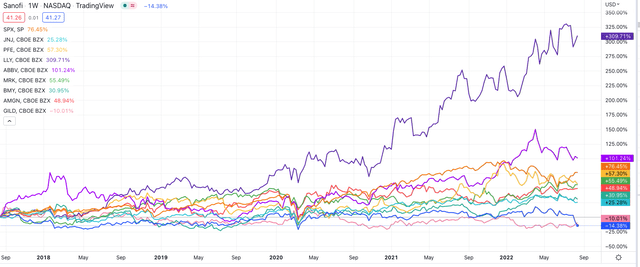

Of the “Big 8” US Pharmas – in order of market cap, Johnson & Johnson (JNJ), Eli Lilly (LLY), AbbVie (ABBV), Merck (MRK), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD), only Gilead stock has fallen in value across the past five years, whilst the sector average gain has been 76%, almost exactly matching the rise in value of the S&P across the same period. Across the past three years, the average gain has been 61%, versus the S&P’s gain of 46%.

As such, you might expect that Pharmas headquartered outside of the US would have experienced similar good fortune, but in the case of Sanofi (NASDAQ:SNY), that has not been the case.

Sanofi shares traded on the Nasdaq haven fallen in by 14.5% over the past five years – worse than Gilead’s 9% drop – and over the past year, the stock price has fallen by 22%, comfortably worse than Gilead – again the worst performer of the US “Big 8”, down 10%.

Share price performance of “Big 8” US Pharmas + Sanofi – past 5 years. (TradingView)

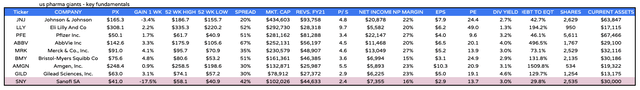

When we compare Sanofi’s fundamental business performance against the “Big 8”, we can see that the France headquartered Pharma holds up well against its US counterparts.

Sanofi vs US Big Pharma sector – business and performance fundamentals compared. (my table)

Sanofi’s market cap is admittedly the smallest apart from Gilead, but even factoring in this week’s sell-off, which I will discuss later, Sanofi is a $100bn market cap company. Sanofi generates significantly more revenues than Gilead, Amgen, or Eli Lilly (whose market cap is nearly 3x Sanofi’s), and its price to sales ratio is lower than any US Pharma – a low P/S often indicates a company is undervalued.

In terms of profitability, Sanofi earned net income of $7.4bn in FY21 – higher than Gilead, Amgen, BMY, and Eli Lilly, and its price to earnings (“PE”) ratio of 14x is lower than all of the other Pharmas barring Pfizer – a company that has grown revenues from $42bn to $81bn between 2020 and 2021, and is forecasting for ~$100bn revenues this year.

To summarise, fundamentally speaking, Sanofi stock looks undervalued, which suggests that there may be other issues at the company undermining its valuation. One issue that has dragged down Sanofi’s price this month was the US Senate’s signing of the Inflation Reduction Act on August 8th.

The Act has introduced a cap on the prices of insulin for Medicare patients of $35, and although the ruling does not extend to the non-insured, Sanofi recently dropped the price of insulin it sells to non-insured patients to match the cap of $35. Alongside Eli Lilly and Novo Nordisk (NVO), Sanofi is one of the world’s largest providers of insulin to diabetics.

Another issue is Sanofi’s pausing recruitment for Phase 3 clinical trials of its Multiple Sclerosis (“MS”) and Myasthenia Gravis (“MG”) therapy Tolebrutinib, which the company announced on August 9th, in response to the FDA placing a clinical hold on certain trials due to after cases of liver damage were observed.

The Pharma still hopes to have the clinical hold lifted before the end of the year, and put data in front of the FDA by 2024, but the market tends to respond negatively to such news.

Investment Bank UBS downgraded Sanofi from “Buy” to “Neutral” recently, citing a lack of catalysts, and to complete a dreadful week for the company, on 11th August, the company became embroiled in the row over Zantac, a heartburn drug withdrawn from the market in 2020 after the FDA became aware of unacceptable levels of potential human carcinogen, N-nitrosodimethylamine in patients.

Sanofi markets a generic version of the drug, and is likely to face litigation, which could involve damage payouts of anything between $10bn – $45bn, one analyst has suggested, shared between Sanofi, GlaxoSmithKline, and others.

All of these negative headwinds have dragged Sanofi’s price to its lowest ebb since the pandemic induced market sell-off of March 2020, the only time Sanofi stock has dropped <$42 since May 2018. Sanofi stock is not particularly volatile historically, typically trading ~$45-$50, so is it worth buying this dip in the hope that short term headwinds can be overcome, in anticipation of 15-25% upside, and a reasonably attractive dividend of $0.83 per quarter, that currently yields ~3%?

In the rest of this post, I will try to answer that question, starting by taking a closer look at the product portfolio and pipeline.

Sanofi Product Portfolio Overview

Sanofi breaks down its drug product portfolio into four separate sections – Specialty Care GBU, General Medicine GBU, Vaccines, and Consumer Health, which respectively accounted for 32%, 36%, 16%, and 11% of total revenues in FY21.

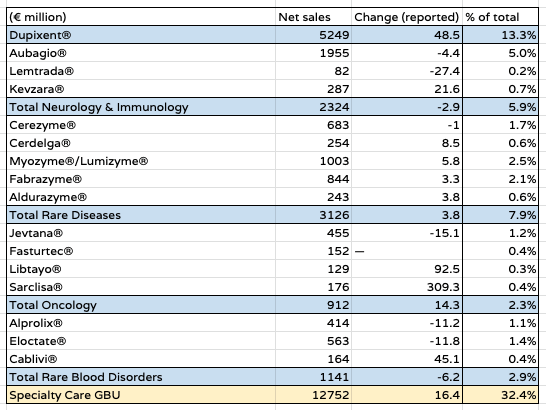

Sanofi Specialty Care revenue breakdown 2021. (Sanofi)

Beginning with Specialty Care, we can see this segment is dominated by Dupixent, a hugely important drug for Sanofi which is co-marketed with Regeneron (REGN), a US Pharma that sits just outside the “Big 8”, with whom Sanofi enjoys, or more accurately enjoyed, a close relationship. Sanofi and Regeneron split profits equally in the US, whilst Sanofi takes the lion’s share of profits ex-US.

Sanofi management has previously suggested Dupixent could deliver $13bn sales per annum at its peak, and is targeting 11 new indications by 2025. The drug – an interleukin-4 receptor alpha antagonist – is already approved to treat Atopic Dermatitis, Asthma, Chronic Rhinosinusitis, and eosinophilic esophagitis. Sales were up nearly 50% year-on-year in 2021, to $5.2bn, and were $1.96bn – up 43% year-on-year – in Q2’22.

Dupixent is the current class leader in Atopic Dermatitis – a huge market – having achieved 75% skin clearance in 44% to 69% of patients across three Phase 3 clinical trials, although Eli Lilly’s Lebrikizumab will likely emerge as a challenger, with early trials suggesting it may have a slight efficacy edge. AbbVie’s Rinvoq is another challenger in a fiercely contested market.

Besides Dupixent, in Speciality care there are two other blockbuster (>$1bn per annum sales) drugs. Aubagio, an MS drug, saw sales fall last year, however, to just under $2bn, and apparently loses its patent exclusivity next year, with a host of generics set to flood the market, reducing Aubagio’s price point and sales volumes substantially.

Sanofi’s rare diseases division generated >$3bn in sales last year led by Myozyme, an enzyme replacement therapy (“ERT”) indicated for Pompe disease, while another ERT, Fabrazyme, indicated for Fabry Disease, drove >$800m in revenues.

Sanofi’s oncology division is minor, generating <$1bn of revenues in 2021, but Sarclisa, indicated for multiple myeloma and used in a combo with Amgen’s Kyprolis and the steroid dexamethasone (“KD”), is challenging Genmab’s $6bn per annum selling Darzalex, and sales are growing fast – blockbuster sales may be in reach. Meanwhile, the rare blood disorder division’s revenues were down 6% year-on-year, despite a 45% rise in revenues for Cablivi.

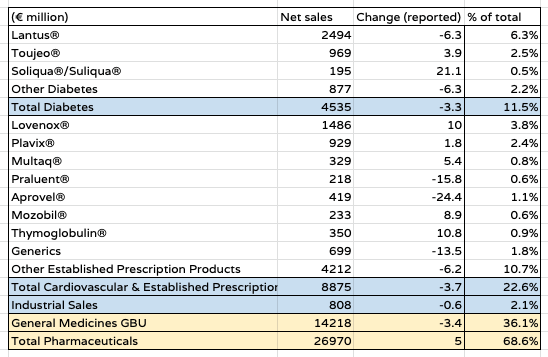

Sanofi general medicines sales performance in 2021. (Sanofi)

Diabetes has been a cash cow for Sandoz and Lantus has generated $2.4bn of sales last year, although the drug has been around for some time and its peak sales year was back in 2014. Toujeu, indicated for Type 2 diabetes patients with moderate to severe kidney damage, is a likely blockbuster, but Eli Lilly’s Tirzepatide is arriving on the Type 2 diabetes scene and is expected to dominate the space, alongside Novo Nordisk’s Ozempic.

Lovenox enjoyed strong sales growth in the anti-thrombotic market, but the drug was a one-time $2.7bn selling asset that is now competing against generics, and the rest of the division appears to be aging also – witness Plavix, the blood thinner, once one the world’s biggest selling drugs, earning $10bn in 2011, and now generating <$1bn in sales.

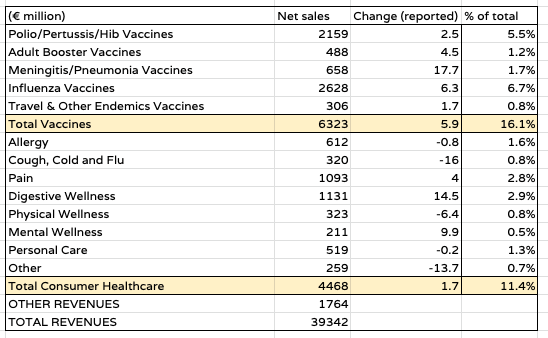

Sanofi Vaccine and Consumer Health sales 2021. (Sanofi)

Sanofi’s vaccines division is a traditional strength, generating $6.3bn in 2021, although the company’s failure to bring a COVID vaccine to market, despite being one of the largest global players, can be considered a disappointment, and possibly even disastrous, given the likes of Pfizer and Moderna have earned ~$50bn from their messenger-RNA COVID vaccines Comirnaty and SpikeVax.

Consumer Healthcare is yet another division that appears to be meandering slightly, driving 2% annual growth.

Recent Performance and Drugs To Look Out For

Despite its poor share price performance in recent weeks, Sanofi’s Q2’22 earnings results were actually encouraging, with Dupixent helping the company drive 8.1% annual growth. The vaccine division was up 9% year-on-year thanks to people travelling more and a revival in the booster market.

Net sales were $10.12bn, and net income $2.17bn, with EPS $1.73. All of these figures were released by Sanofi in euros, but since the exchange rate between euro and dollar is practically 1:1, I am quoting in dollars. The H122 EPS figure is $3.7, implying a forward PE ratio of 11x, reiterating Sanofi’s fundamental strength.

In terms of the late stage drug development pipeline efanesoctocog alfa (BIVV001) for the treatment of people with hemophilia A has been granted a Breakthrough Therapy designation by the FDA on the back of data from its pivotal study – which could act as a boon for a company that initiated the $11.6 billion buyout of hemophilia-focused Bioverativ in 2018, in order to gain access to Eloctate – although it is not expected to generate >$1.5bn in peak sales.

Two late stage studies of Venglustat – in Fabry Disease and Gaucher Disease – have been initiated, whilst nirsevimab, a monoclonal antibody directed against respiratory syncytial virus (“RSV”) is expected by some researchers to generate peak sales of $3bn, although it is being co-developed with GSK.

In its Q222 earnings release, Sanofi also discusses:

Positive data from the Sanofi-GSK next-generation vaccine candidate, a bivalent vaccine containing D614 and Beta (B.1.351) strains, demonstrated an efficacy of 64.7% against symptomatic COVID-19 and 72% efficacy in Omicron-confirmed symptomatic cases in an environment of high Omicron variant circulation.

It isn’t too late for Sanofi to come to the fore in a COVID market that may be privatised by the time its vaccine candidate arrives, and there is a booster candidate in development too.

Conclusion – Some Tough Headwinds For Creaky Sanofi But The Price Point Is Attractive

Sanofi isn’t a company I have looked at in great depth until researching this note, but my first impressions are of a company that was in need of a revamp, and may just be getting one.

Many of Sanofi’s products enjoyed their best days a long time ago, it seems, but with Dupixent performing as well as it has been, the Pharma seems to have cracked it in several autoimmune markets, which are extremely lucrative and ought to help the company enormously as it looks to revamp its vaccines division.

The failure to deliver a COVID vaccine means Sanofi doesn’t have $20-$30bn of cash to spend on M&A like e.g. Pfizer does, or ~$20bn in the case of Moderna (MRNA) and BioNTech (BNTX), two companies that consider themselves and their MRNA approach the future of vaccines.

Sanofi’s pipeline is not especially inspiring either, and its diabetes division may be under threat from Eli Lilly and Novo Nordisk. Consumer Health does not generate much excitement either, despite a recent corporate branding.

To conclude, I do not necessarily think Sanofi stock is a bad buy. Pharma’s tend to be profitable and Sanofi is no exception. It is not heavily indebted, with current assets of $28.3bn, versus current liabilities of $22bn and long term debt of $15bn – much better than e.g. AbbVie, or Bristol Myers Squibb, or Amgen.

Sanofi stock has fallen to 2.5 year lows on the threat of litigation in relation to Zantac, trial halts of Tolebrutinib, a hit to its insulin pricing, and a sparse pipeline. Investors need to decide if these are dangerous long-term headwinds, or chimeric issues that the company can navigate through or sidestep without too much damage.

If you believe the former, it would be best to wait and see what the litigation will look like, whether the trial holds are resolved etc. You may end up buying Sanofi at a higher price, but it will be a much less risky investment.

If you believe the latter, you may find that this is the best chance you will have to buy Sanofi stock at a 20% discount to its normal trading range. At present I am sitting on the fence. Dupixent is clearly an exceptional drug but I am not sure it can lift an entire Pharma out of its slump alone, and it’s not clear when the rest of the cavalry will arrive. The Zantac issue also looks problematic.

Be the first to comment