Kar-Tr/iStock via Getty Images

Thesis

Molson Coors Beverage Company (NYSE:TAP) is a stock that should be of interest to investors looking for a stable dividend investment that can perform well in an economic downturn. The beverage company has strong old and new brands that provide strong moats, and the company’s stock can benefit from dividend raises to pre-pandemic levels and share buyback programs. In addition, given that the company operates in the alcoholic beverage industry, they should be well-protected from current macroeconomic risks.

Company Overview

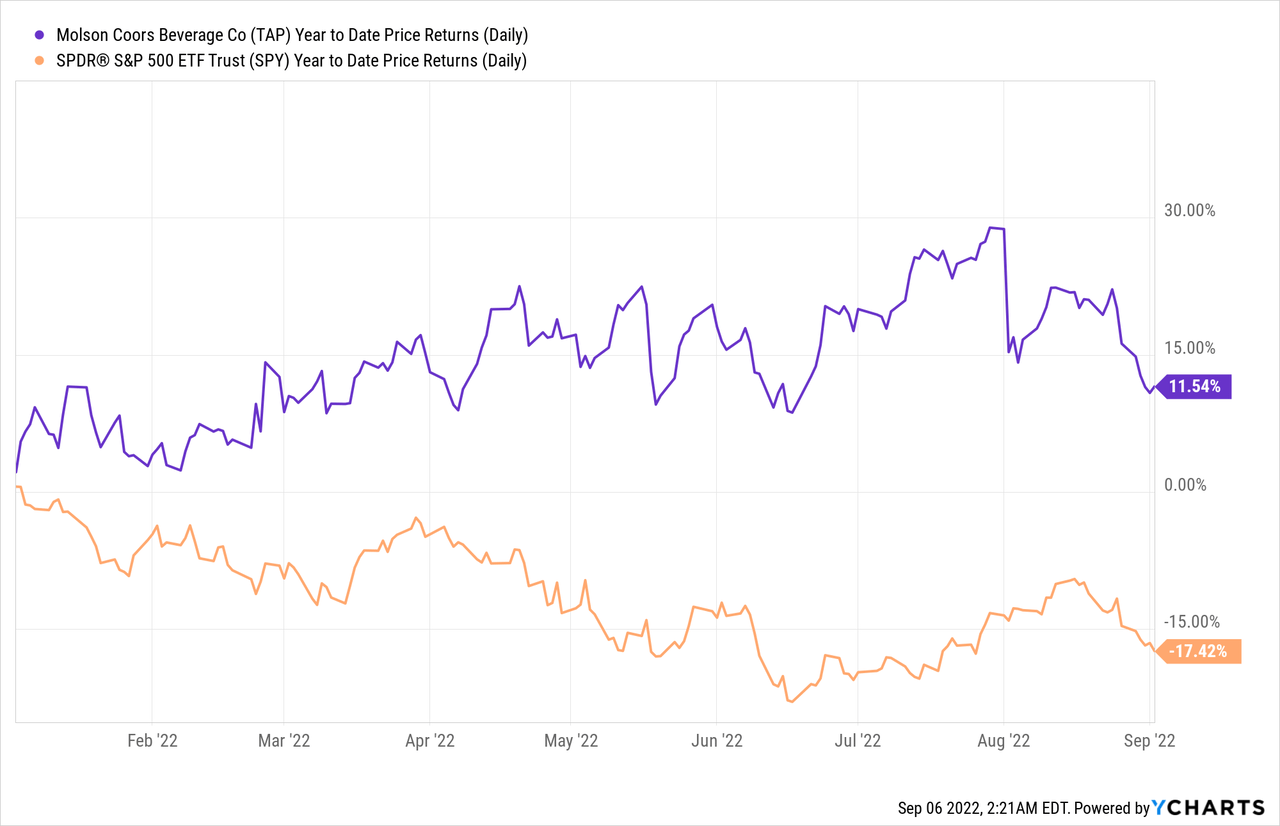

Molson Coors Beverage Company is a U.S. based beverage company that sells numerous recognizable brands, including but not limited to Coors Light, Miller Lite, Blue Moon, Vizzy, Hop Valley, and more. The company is the 5th largest beer company in the world by size and operates 15 brands with $100 million+ in net sales. Molson Coors has had a strong stock price performance year-to-date, returning 11.54% compared to S&P 500’s return of -17.47% in the same time frame. The current market capitalization of the company is $11.24 billion.

Great Product Portfolio

Molson Coors has great old and new product franchises that have good brand perception and have exposure to various age segments. Strong brands should serve as natural moats against competitors, as consumer brands are fairly sticky with consumers. The namesake Coors Light, Miller Lite, and Blue Moon are globally recognizable beer brands that are the company’s core business products. According to YouGov Research, Blue Moon, Coors, and Miller all make the top 10 most popular beer brands in America, with other similar brand subsidiaries making it to the top 20 list. In addition to these beer brands, Molson Coors has also heavily invested in new product offerings that appeal to the younger generation, such as Vizzy (hard seltzer) and Simply Spiked Lemonade (Partnership with Coca-Cola). Despite the dominance of White Claw in the hard seltzer market, Vizzy has meaningfully expanded its market share despite its late entry, as Vizzy had the strongest growth in sales among hard seltzer brands in the United States in 2021. The strength of its product brands can be seen in financial results, as the company reported 5% YoY revenue growth from $5.82 billion in 1H 2021 to $6.14 billion revenue in 1H 2022. We believe that strong brand perception of its core brands and continued growth in new product segments will allow for top-line and bottom-line expansion.

Shareholder Value Upsides

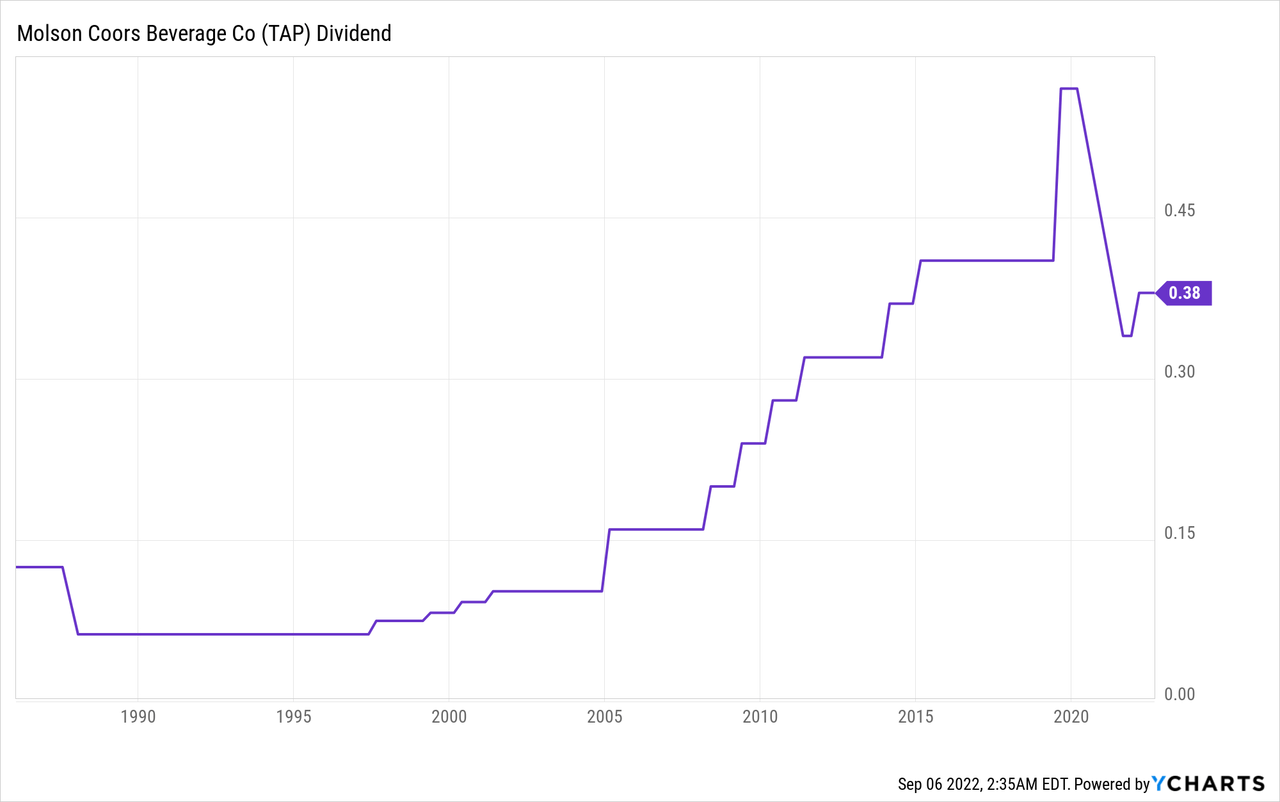

Molson Coors has a long history of paying dividends, and the company has had a history of substantially growing its dividends until a recent dividend cut in 2020 as a result of the pandemic. Since the dividend cut, Molson Coors now pays $0.38 per share in quarterly dividend, which is an increase from $0.34 per share in 2021. We believe that in the near-term, the company will resume to pay a quarterly dividend per share up to $0.57 per share, which was the quarterly dividend in 2019 before the cut in 2020 due to the impact of the pandemic. Our belief comes from management stating that they will increase dividends as “business performance improves“. As the company’s financial results improve, we find it likely that dividend will return to pre-pandemic levels given that the current TTM revenue already is similar to FY 2019 revenue. That represents a near ~50% dividend increase from its current levels, and given the current ~3% dividend yield, a return to 2019 quarterly dividend level would mean that the near-term dividend yield will be ~4.5%. In addition, the company also has a decent 4-year share buyback program valued at $200 million. Overall, we believe that the company presents a dividend growth opportunity and capital appreciation opportunity from its buyback programs.

Macroeconomic Risks

As a beverage company, Molson Coors sees major risks to its business prospects from a decline in U.S. consumer sentiment and consumption. If the Federal Reserve were to over-tighten and cause a steep recession and dampen consumer demand, Molson Coors will see its sales and profits decline. Thankfully, unlike other companies in the consumer discretionary industry, alcohol beverages tend to be fairly recession resistant. Furthermore, we believe the stock is attractive due to its potential for dividend hikes as the company aims to return back to distributions prior to the pandemic. With a ~40% payout ratio, we believe that even in a tougher economic scenario, the company will be more than capable of paying out its current dividends and still have ample earnings to hike dividends in the near term. We do not believe that management will cut dividends in a recessionary environment like they have done during the pandemic as the company has a history of paying out and increasing dividends during the years following the financial crisis. That should provide a better benchmark for investors as to the business resiliency of Molson Coors during a recession rather than the deep panic brought about by the pandemic. As a result, we believe that this company is a perfect dividend stock that is recession resistant.

Conclusion

We believe that Molson Coors Beverage Company is a great stock for investors looking for stable dividend distributions during a time of economic uncertainty. The company has a wide arrangement of strong beverage brands that should provide a moat to its business model and continue to drive growth. In addition, the company has a well-defined dividend and share buyback program that should continue to propel the stock price forward.

Be the first to comment