FG Trade/E+ via Getty Images

Lamb Weston Holdings, Inc. (NYSE:LW) is a leading producer of frozen potato products like French fries, hash browns, tater tots, and mashed potatoes serving both the restaurant industry and retail markets. The company notes that demand has been proven to be resilient in the current inflationary environment, with potatoes representing a relatively affordable food staple compared to other grocery items that have become even more expensive. Indeed, LW has been a big winner this year, up over 22% through a trend of steady growth and impressive earnings.

That being said, that challenge here comes down to valuation which, in our opinion, has likely gotten a bit too hot with the market likely focusing on LW’s consumer defensive profile. While macro conditions remain volatile, signs inflation is cooling off may end up reversing the sentiment toward the stock. Fundamentals are fine, and the company maintains a positive long-term outlook, but we see a correction lower as shares lose momentum.

LW Key Metrics

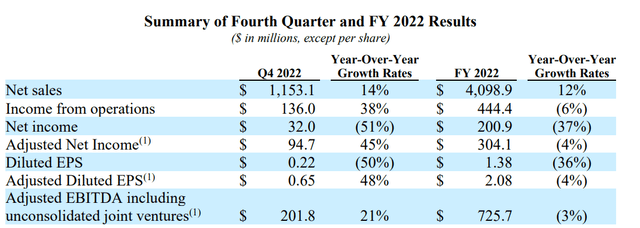

The company last reported its fiscal Q4 earnings in early July, highlighted by EPS of $0.65, which was $0.14 ahead of estimates. Revenue of $1.2 billion, up 14% year-over-year, also beat the consensus by $79 million. The result was even more impressive considering volumes were down 1% compared to Q4 2021 reflecting lower exports amid limited availability of container ships, a continuation of supply chain disruptions that were a bigger issue at the start of the year. Q4 adjusted EBITDA at $202 million was up 21% y/y.

The company has been able to leverage higher pricing and a more favorable sales mix with cost savings to end the year on a high note. On this point, even with the record quarter, a weaker first half of the year that was defined by cost pressures and softer margins meant that the full-year adjusted EPS of $2.08, was still down 4% compared to 2021.

Operationally, the “global” segment of the company representing nearly 50% of the business related to the top 100 North American quick-service restaurant (QSR) chains and full-service restaurant customers generated 10% growth, again based on higher pricing. The trend was more positive in the food service segment capturing channels like lodging, entertainment, and hospitality customers, with a 21% increase in sales in the context of a weaker comparison period last year. The smaller “retail” group, which includes sales to branded and private labels for grocery channels, was also strong with a 20% y/y revenue increase over Q4 2021.

As it relates to the balance sheet, LW ended the year with $525 million in cash against $2.7 billion in long-term financial debt. Considering adjusted EBITDA over the past year at $726 million, the leverage ratio of around 3x is otherwise stable and consistent with the sector. The company pays a quarterly dividend of $0.245 which yields 1.8% on a forward basis. Stock buybacks totaling $151 million last year added approximately 1.3% to the total shareholder return.

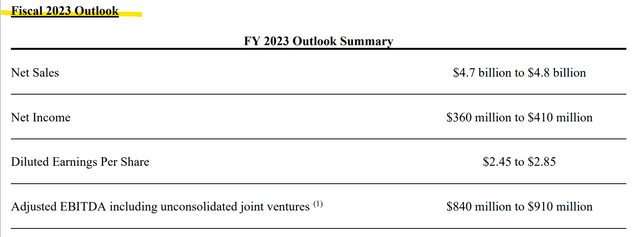

The expectation from management is for the financial trends to continue. In terms of guidance, the company is targeting fiscal 2023 net sales between $4.7 and $4.8 billion, representing a 16% increase at the midpoint over 2022. A forecast for EPS between $2.45 and $2.85, if confirmed, would be approximately 27% higher at the midpoint compared to the $2.08 last year. Again, the expectation is for easing supply chain disruptions to support firming margins while normalization of export markets adds to growth opportunities.

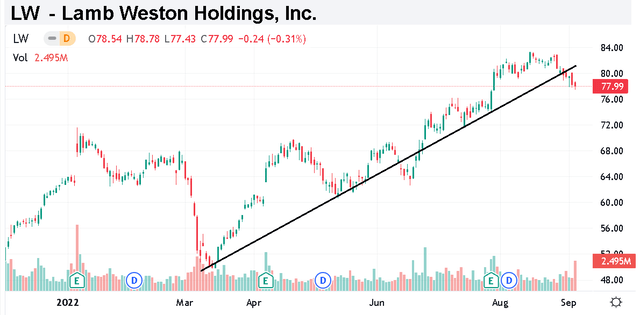

LW Stock Price Chart

There’s a lot to like about Lamb Weston which delivered a blowout quarter in terms of financial execution. The attraction of potato products is the understanding that demand could get a boost from strengthening economic conditions as consumers dine out more, while there is also a counter-cyclical component, meaning the downside to demand is likely limited even in a deeper recession. Anecdotally, diners are more likely to cut back on steak and seafood than to give up on French fries when facing budgetary constraints. These factors support a positive long-term outlook for the company.

On the other hand, the question we pose is how much of that bullish thesis is already priced into the stock, considering its outperformance in 2022. What we can say with some certainty is that expectations are high for the year ahead given the lofty sales and earnings guidance, which ends up leaving little room for the company to materially exceed estimates.

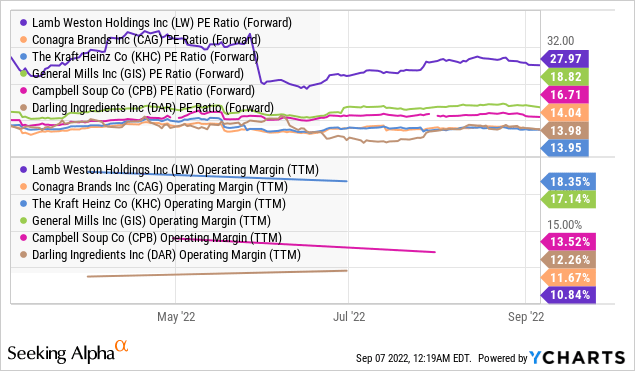

When looking at LW, the positives in its growth story are hardly a secret, evident in what has become a high premium for the stock. Shares are trading at a forward P/E of 28x, which is a large spread to the rest of the consumer staples sector and even packaged food leaders. Among comparables that we include names like Conagra Brands, Inc. (CAG), The Kraft Heinz Co. (KHC), General Mills, Inc. (GIS), Campbell Soup Co. (CPB), and Darling Ingredients Inc. (DAR); LW stands out as the most expensive in the group compared to an average P/E closer to 15x.

Each company here has also generated a higher operating margin compared to LW over the past year at just 10.8%. Even recognizing LW has some stronger earnings growth momentum this year as its supply chain conditions normalize, our take is that the stock is overvalued with the market a bit too enthusiast regarding its runway.

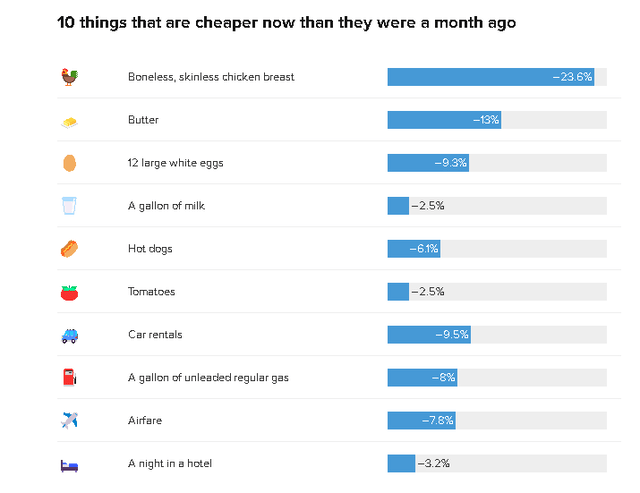

The other dynamic we highlight is indications that inflation is set to trend lower, following what was already a softer than expected July CPI. Data suggest that food prices have peaked including a sharp decline in items like poultry and dairy just over the past month. The connection we make with LW is that if the stock gained this year based on the idea of potatoes being an “inflation winner”, a reversal going forward sort of makes it lose its shine. The broader consumer staples sector could face the same headwind.

Final Thoughts

From the stock price chart, the first point is that LW shares appear to have hit some resistance above $80 which corresponds to a high going back to 2021. The more recent pullback has also broken a long-running uptrend that was in place since March. While we’re not expecting the stock to crash lower or collapse from here, our call is that any upside will be more difficult. We officially rate LW as a hold, representing a neutral view over the near term.

What’s more likely to happen is a return of volatility through some profit taking and a consolidation in shares a bit lower towards the $70.00 or $65.00 level, which would help to reset valuation a bit lower. Over the next few quarters, the operating margin and potato volumes will be key monitoring points. Any further supply chain disruption including a weak potato crop could open the door for a deeper selloff as the main risk to watch.

Be the first to comment