Liudmila Chernetska/iStock via Getty Images

Introduction

The share price of Mohawk Industries (NYSE:MHK) has, like the market, traded down in recent months. It has underperformed the market by a wide margin and is down -60% since its peak in 2021. With fundamentals remaining solid and management being proactive in buying back shares, I believe value investors should consider taking a closer look at Mohawk Industries.

Mohawk Industries is the world’s leading flooring company. The company offers a comprehensive range of soft and hard surface products for commercial and residential spaces. They employ 43,000 people with activities spread over several countries.

Fundamentals

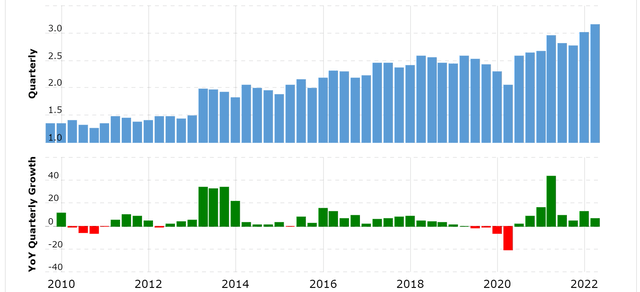

Mohawk Industries has been growing revenue by ~7% per year, which seems reasonable given the industry and the size of the company. The growth is a result of various acquisitions combined with organic growth. Although acquisitions are not preferred due to risks of potential merger complications, the sizes of the acquired companies have so far been manageable

Analysts expect the revenue to slightly decline next year.

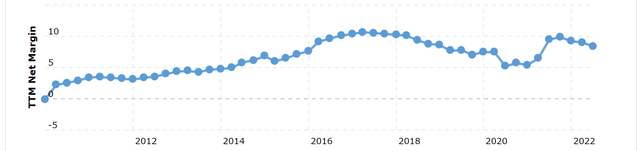

With revenue growing by single digits per year, it is a pleasant surprise to see, that the net profit margin has improved. After returning to profitability in 2010 following the effects of the financial crisis, profit margins continued to improve until 2017, when a new high was set. The increase in profitability led to years of high growth and perhaps to unrealistic future expectations, that profitability at such a level would be sustained.

As profitability fell to a profit margin of 7.4% and began to show signs of stabilization, the shutdowns, following a sharp increase in interest in the company’s products, caused profitability to rise again. However, they are showing signs of weakening, as demand has slowed.

To avoid overestimating the company’s profitability, I would not assume that the current net profit margin is sustainable. A margin of ~7.4% seems more realistic in the long run.

Net profit margin (Macrotrends.com)

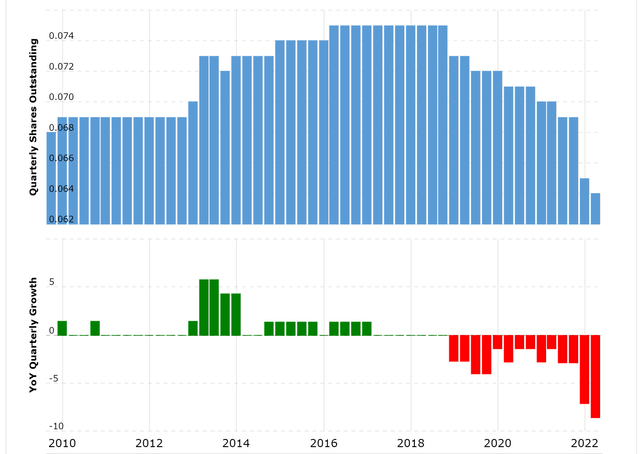

As the company has struggled with below-average valuations in recent years, share buybacks have begun to be pursued. The company used ~25% of earnings from 2017-2020 to fund buybacks, with the rest going toward acquisitions and reducing net debt.

In the past few months, the company has spent all of its earnings on share buybacks, and management says that the buybacks will continue going forward.

Shares outstanding (Macrotrends.com)

Capital allocation

The company has never paid a dividend and has just recently started buying back shares. This has been a prudent allocation choice, as potential dividend payments and share buybacks in recent years would not have outweighed the benefits of the company reinvesting earnings.

The company has often been valued at a multiple of >20, which would have resulted in poor performance from share buybacks and dividend payments. Them reinvesting earnings at a rate of ~12%, has been far more beneficial.

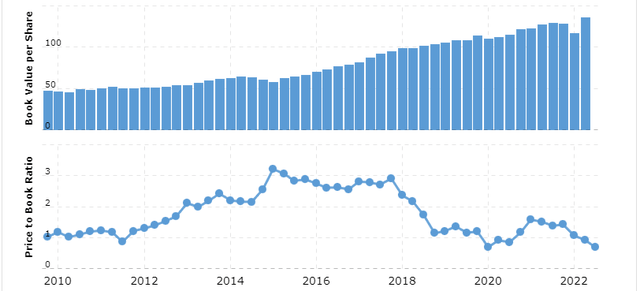

With their book value currently at 0.68, it certainly seems low for a company growing in the double digits.

As can be seen in the picture below, the growth in book value per share has been consistent and predictable. Since all earnings prior to 2019 were reinvested at a rate of ~10%, it comes as no surprise, that the book value per share has also grown by that percentage.

How much is an appropriate price for that growth is not an exact science. However, I find it hard to justify paying much above book value. On the contrary, its current valuation well below book value seems very exciting. Not only is that a low valuation, but it’s a valuation that management is taking advantage of. The share buybacks they do, are currently yielding ~3% more than what reinvesting earnings would have.

Valuation

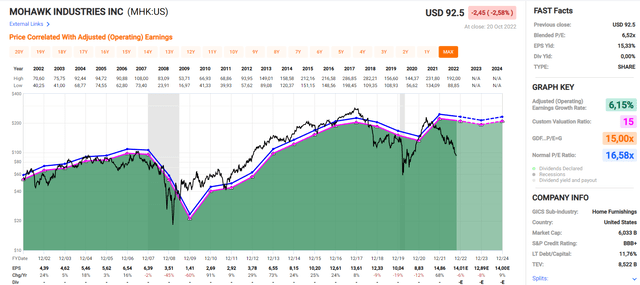

Mohawk Industries has averaged an earnings multiple slightly above the standard multiple of 15, which is a common multiple of profitable and mid-growth companies. A return to its average p/e of 16.58 would show a gain of 150%. A return to a 15 earnings multiple, which I believe is a more justified multiple, would show gains of 130%.

Given that the company doesn’t carry any significant amount of net debt, I don’t see it unreasonable, that the stock should eventually return to such multiples again. In the meanwhile, the share buybacks that are currently being made, are contributing a lot to the intrinsic growth of the investment.

A return to a ~15 multiple would also put the price to book value at ~1.5, which seems like a fair price to pay, for a company with the ability to make 12% ROE, where all earnings are being reinvested.

Stock chart

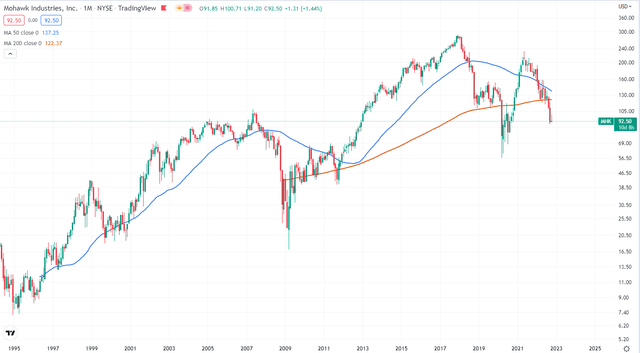

Quick disclaimer. A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

As with most consistent and profitable growing businesses, the 50- moving average has proven to be a decent guideline. Accumulating shares below the moving average in itself, would have given decent returns. However, accumulating shares below the 200-month moving average, which is usually only touched during market crashes, would have produced excellent results.

It now again gives investors such an opportunity.

Final thoughts

I believe Mohawk Industries should be considered, if you are a value investor. We have seen that the company is able to reinvest earnings at ~12%. This reinvestment rate in itself seems too high to justify its current book value. The company has never traded at such a book value in the last 2 decades. Given that the fundamentals remain intact and that the company uses capital very efficiently by buying back shares, the low valuation does not seem sustainable.

With an estimated growth rate in the low single digits, a multiple close to 15, which has previously been the norm, does not seem unrealistic either. This would show capital gains of 120% + the annual intrinsic growth of low single digits.

Be the first to comment