naphtalina/iStock via Getty Images

Thesis and Company Overview

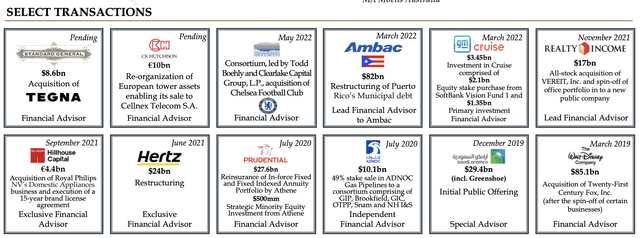

We believe Moelis & Company (NYSE:MC) is a perfect stock to collect dividend income while waiting for increased banking activity in the next economic cycle to propel the stock price higher. To provide a quick overview of the business, Moelis & Company is a global boutique investment bank that provides investment banking services to international corporations. The investment bank provides M&A and Strategic Advisory services, Capital Structure Advisory services, Capital Markets and Private Funds Advisory services across major industries. As seen below, in the past few years, Moelis & Company recently advised on major acquisitions like the acquisition of Twenty-First Century Fox, Inc. and advised companies like Hertz on restructuring.

Moelis & Company Select Transactions

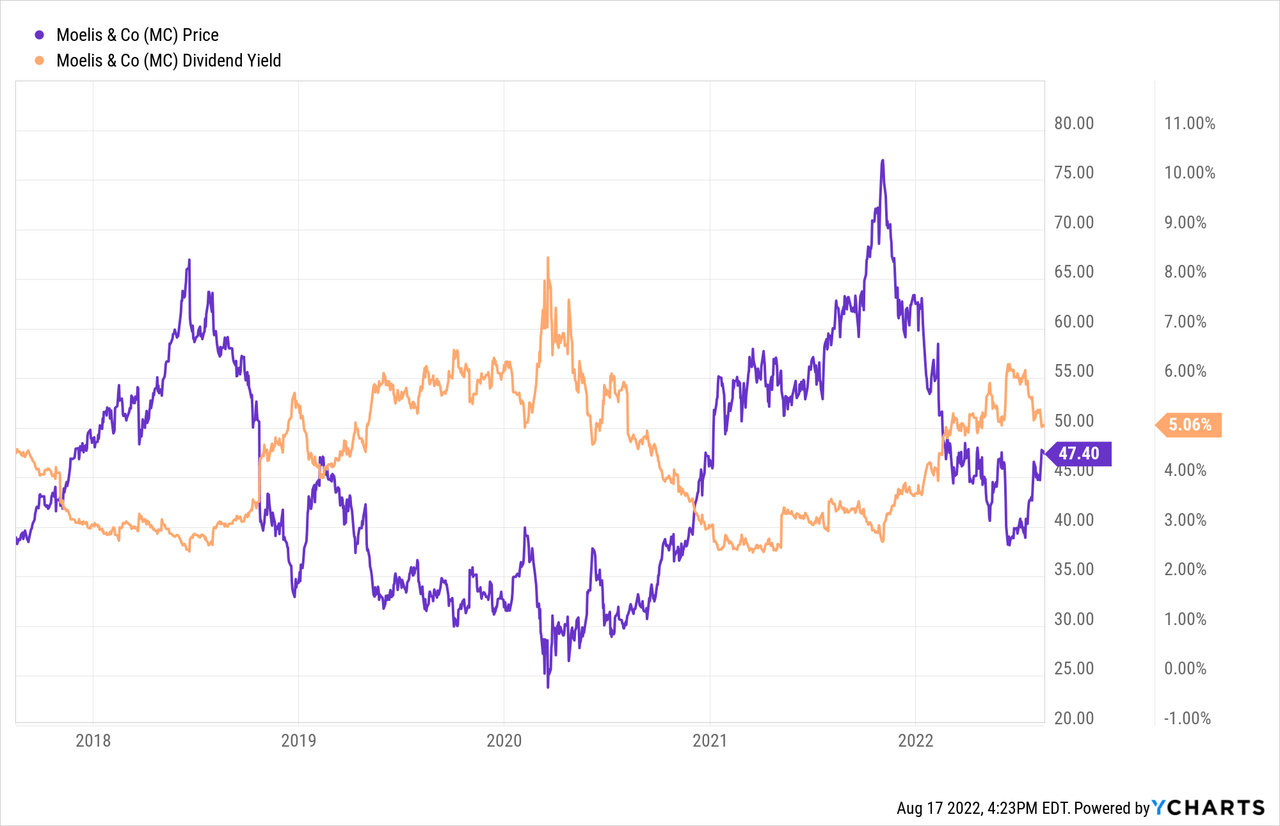

Volatile Stock, Consistent Dividend

Similar to many boutique investment banks, the company’s financial performance is highly dependent on macroeconomic conditions. When economic activity is high and monetary policy is accommodative, companies engage in numerous M&A transactions and require advisory services in debt and equity capital markets. As a consequence, Moelis & Company has seen considerable drawdowns and growth in its stock price, and as recently as March 2020, the stock touched below $25 before rallying to above $75 in late 2021. Now, the stock price hovers below $50, which is ~40% below the highs of last year. However, despite the volatility in the stock price, Moelis & Company has consistently paid out dividends each quarter and has generally had a dividend yield between 3% to 6%. Regardless of the range of stock price and yield, one thing is certain: Moelis & Company has consistently paid out dividends. We find this to be a good indicator of the company’s commitment to shareholder value regardless of the economic circumstances. Currently, the dividend yield is 5.06%, and we believe this presents an attractive yield proposition as the yield is nearly 3x of the S&P 500.

Return to Normalcy After Record 2021

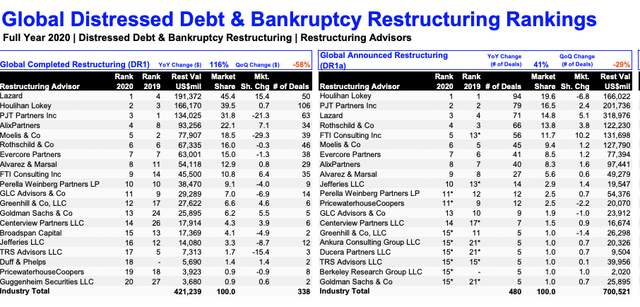

2021 was a record year for investment banks, and it is no surprise that recent financial performance shows a material decline in investment banking fees. Moelis reported a 14% decline in revenue in 1H 2022 compared to 1H 2021 and reported nearly a 30% drop in diluted EPS in the same time period. However, the deterioration in performance is to be expected given the economic slowdown and interest rate hikes, which have weighed on business sentiment and therefore financing activity among businesses. If anything, Moelis performed much better than data seems to suggest, as global investment banking fees dropped by 38% in the first half of 2022, according to data provider Dealogic. This outperformance compared to the overall industry is likely due to Moelis & Company’s strong restructuring business, which can provide a hedge against poor macroeconomic conditions. As the economy slows down or begins to deteriorate, more businesses will file for bankruptcy or need to restructure, which would require restructuring advisory services from investment banks like Moelis & Company. Moelis & Company is consistently ranked as one of the top Distressed Debt & Bankruptcy Restructuring advisors, and this will help provide some protection to investors against a prolonged slowdown in economic activity.

Refinitiv – Distressed Debt & Bankruptcy Restructuring Review

Nevertheless, it is important for investors to recognize that Moelis & Company is currently operating in a less ideal part of the investment banking business cycle and that the growth of the business may be stalled until economic and monetary conditions improve.

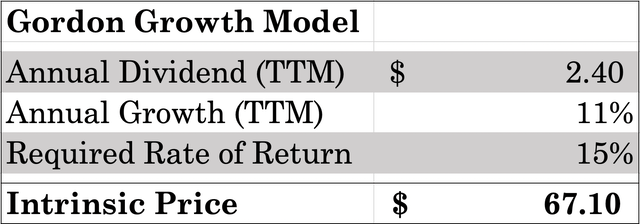

Valuation Model

We used the Gordon Growth Model to determine a current valuation based on our assumptions on dividend growth and the required rate of return. We use the ~11.69% 3-year CAGR of Moelis & Company’s dividend growth as the assumption for dividend growth, and we borrow the ~15% ROE of a financial sector from a paper from the Federal Reserve (p. 48) as the assumption for the required rate of return. Based on the TTM annual dividend of $2.40, we find that the intrinsic value of the share based on our model is $67.10, a 41.6% upside from the current price. This model should provide support to our thesis that based on the dividend alone, the stock price is undervalued.

Sweet Minute Capital Valuation Model

Better Days Will Come

Business cycles are natural, and a new business cycle will begin at some point once this cycle ends. Though it is an open question as to when and how the current business cycle will end, when it eventually does, a new expansionary part of the business cycle will drive Moelis & Company’s earnings higher, and so will the stock price. And based on dividends alone, we believe the stock price is undervalued, as our model presents an intrinsic value of $67.10 per share. So in all, we would recommend investors to add Moelis & Company to the portfolio and enjoy the stream of dividend income while waiting for meaningful stock price appreciation in the next economic cycle.

Be the first to comment