Capuski/E+ via Getty Images

Modine Manufacturing Company (NYSE:MOD) provides innovative and environmentally responsible thermal management solutions with the vision to provide cleaner, healthier and eco-friendly products.

Intending to provide energy-efficient and innovative products, the company offers its thermal Management products to commercial, industrial, building heating, ventilation, and refrigeration markets. Also, the company is a leading provider of high-quality heat transfer systems to the OEM vehicular manufacturer.

Furthermore, with consistent technology development and innovation, the company focuses on developing more efficient, durable, and low-fuel-consuming devices. In the fiscal year 2022, with the entry of the second leader on the board, Modine has seen significant progress in the last few quarters.

Although the management has been trying to diversify the customer base, a significant percentage of revenue comes from its top five customers.

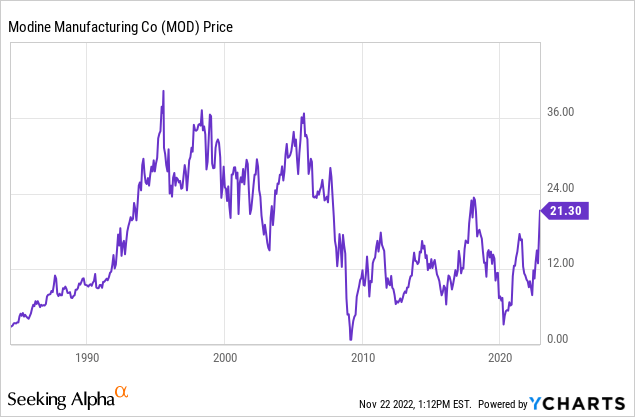

Also, due to significant fluctuations in business operations, the stock price has seen huge ups and downs, ranging from $24 per share to $3.4 per share. Currently, due to the higher demand, profitability has increased significantly, and the stock has reached significantly higher levels to about $20.8 per share although due to increasing profit margins stock can appreciate considerably, in my view, the stock has increased to higher valuations and from this point, it may not produce desirable returns. Whereas the cyclical nature of operations might bring substantial risk which can lead to a sharp drop in the margins.

Historical performance

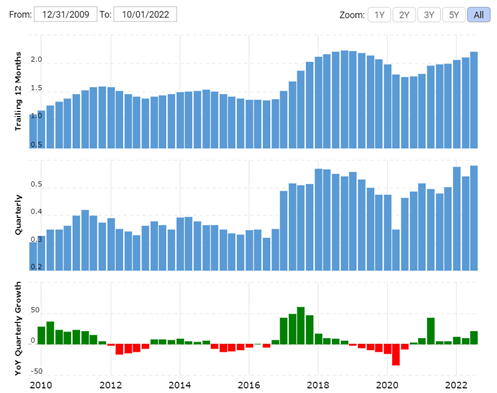

Revenue growth (macrotrends.net)

Due to significant cyclicality in the business model, over the last ten years, the revenue remained very much volatile and couldn’t see any desirable growth; rather, the growth was considerably subdued, which led revenue from $1.57 billion in 2012 to about $2 billion by 2021.

Also, profit margins have fluctuated dramatically over the period, leading to significant losses during 2013 and 2020, but due to increased demand in 2021, the company could post earnings of $86 million. Such huge fluctuations show that the business model is very much cyclical and might not have pricing power over its customers. Therefore, it becomes difficult to predict the profitability of the business in the upcoming years.

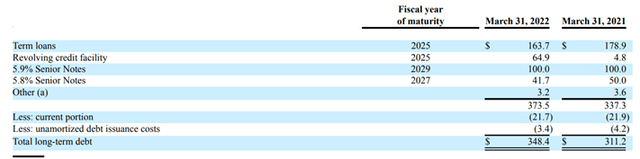

Also, over the period, debt levels have been managed at considerably moderate levels, and the liquid assets seem much higher, providing significant financial stability to the business. The business requires significantly high working capital, as a result, the company requires to rely on debt and equity dilution; therefore, if the company desires to grow further, the long-term debt might increase in the upcoming years.

Share price (YCharts)

Furthermore, despite significant losses produced by the company, the cash flow from operations has remained significantly attractive, resulting from higher depreciation costs and properly managed working capital. However, due to current supply chain issues, working capital levels have increased slightly, leading to subdued cash flows.

In 2016, the company acquired Luvata Heat Transfer Solutions for about $418 million, which was funded through debt leading to a significant rise in long-term debt.

Finally, the historical business performance doesn’t seem attractive due to the substantial cyclicality. But the Management’s focus on growth and innovation might bring significant value to the company.

Strength in the business model

A portfolio of advanced and innovative products gives the company an edge over its competitors.

Energy-efficient products

As the management has been focusing on developing energy-efficient and eco-friendly products, as the environmental regulations increase to reduce global warming caused by refrigerants, the consumers’ preference might shift to HAVAC equipment which is a more efficient and environmentally friendly alternative. In such cases, revenue from companies’ HAVAC equipment and efficient product might increase significantly.

Although the heating market has seen modest growth in the last year, increased demand for energy efficiency and decarbonizing initiatives might drive considerable growth in the upcoming years.

Consistent innovation

Innovation plays a big role in driving profitability in the cyclical thermal management industry. Over the period, management invested a significant amount of money in research and development, strengthening the business. And as a result, the company has about 500 active patents, which brings a strong moat around the business castle.

For the last few quarters, the management has been focusing on driving operational efficiency to drive profit margins and has come up with various initiatives, such as building high-performance teams and disciplined management, which will significantly improve operating margins.

Risk factors

High customer concentration

in the last year, about 39% of the total revenue came from its top five customers, which puts the business model at significant risk; in my view, high customer concentration might be the reason for dramatic fluctuations in the margins because large customers put significant pressure on the company. As a result, the company could not enjoy the pricing power; such conditions might persist in the upcoming years, affecting the overall margins.

Increased competition

As the use of heat transfer systems has been growing, various companies such as Gentherm (THRM) have been investing in developing innovative products that might lead to significantly increased competitive pressure, affecting profitability.

Higher stock prices led by the cyclical uptrend

In my view, current stock prices seem considerably high, and if the profit margins couldn’t sustain at this level, the stock price might see significant corrections and might not appreciate for a longer time, which brings massive risk to the stock.

Recent development

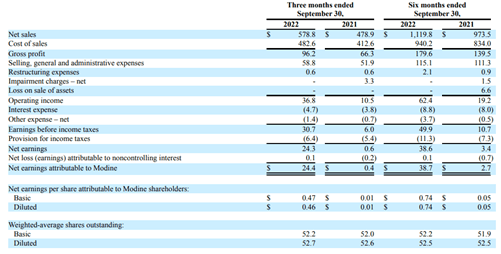

quarterly results (quarterly reports)

The company recently posted another strong quarter, with an over 21% increase in sales compared to last year and a significant improvement in the EBITDA margins. Contributed to a strong gain in climate solutions, performance technology, and favorable pricing.

As per the management, revenue growth for the full year of fiscal 2023 might range from 6% to 12%, with the EBITDA expected to reach above $190 million. But the current growth in sales might be attributed to an industry-wide increase in sales and higher pricing, such growth might not last for a long duration.

Currently, the company is trading for about $1 billion. In contrast, it produced about $86 million last year, which seems that the company has been trading for about 12 times its last year’s earnings. Still, the investors must consider that profit margins might not sustain for long, and historically the company’s profitability has been significantly low. Therefore, I assign a sell rating by considering the high share price and cyclical nature of the business.

Be the first to comment