asbe/iStock via Getty Images

Investment Thesis

It might seem a stretch to assume that Moderna’s (NASDAQ:MRNA) mRNA-4157 (or any other oncology pipelines) would achieve the same success as Merck & Co’s (NYSE:MRK) Keytruda. However, we reckon the same might be said of the latter during its early FDA approval in 2014 for melanoma. The therapy had an annual sales contribution of $55M in 2014, accounting for 0.13% of its total revenues, and an original patent expiry of 2028.

By 2021, Keytruda has recorded a tremendous $17.18B in sales, accounting for 35.31% of MRK’s total revenues, as opposed to 28.32% in FY2019. The company is already reporting an impressive $15.5B in revenue from the therapy within the first three quarters of 2022. Assuming a similar FQ4’22 cadence, it is not ambitious to surmise a $20.9B sales contribution for the whole year, indeed. Thereby, potentially accounting for a significant 35.38% of FY2022 revenues.

Furthermore, Keytruda has already been approved for more than twenty applications by FQ3’22, with more clinical trials underway in expanding its treatment use across multiple oncology applications. The most recent partnership with MRNA has also proved highly successful in the treatment of patients with stage 3/4 melanoma. With the iron-clad patent protection in the US through November 2035 and in the EU through June 2028, Keytruda will likely continue outperforming as MRK’s primary revenue driver.

On the same note, we reckon that MRNA’s oncology pipeline may possess a similar bright prospect through the next decade, significantly aided by the promising preliminary results in a clinical trial for head and neck cancer, amongst others. With the mRNA-4157 already in the clinical phase 2 stage and both flu/ RSV vaccines in the phase 3 stage, we may expect to see successful FDA approvals and commercializations by sometime mid-decade.

The potential is limitless, since the global oncology therapeutic market is expected to grow tremendously from $135.49B in 2020 to $274.4B by 2030 at a CAGR of 7.5%, with the influenza and RSV market separately expected to hit ~$10B at a CAGR of 7.2% at the same time. As a result, being top and bottom-line accretive to MRNA and MRK’s financial performance through this decade, if not the next, depending on the performance of their competing biosimilars once the patent expires. AbbVie’s (ABBV) Humira is expected to experience a tragic -50% biosimilar headwinds in the US by 2023, though we reckon the windfall of $188.69B since 2011 is already more than impressive.

So, How Are MRNA & MRK Expected To Perform Moving Forward?

MRNA has obviously benefited from the hyper-necessity of the COVID-19 vaccine, due to the valuable impact on its financial performance thus far. By FY2021, the company reported revenues of $18.47B and EPS of $28.29 from its breakthrough Spikevax mRNA vaccine, indicating an impressive YoY growth of 2,200.2% and 1,542.9%, respectively. By 2022 YTD, the vaccine has further contributed revenues of $14.16B and EPS of $16.35 (including other grant and collaboration revenues). Impressive indeed, since the management also guided FY2022 revenues of up to $19B and market analysts’ EPS projections of $21.48, respectively.

No doubt, MRNA’s balance sheet has also profitably expanded by FQ3’22, with cash/investments of $8.34B and total receivables of $2.69B. Combined with practically zero debt, the company remains well-poised for the deceleration of COVID-19 vaccine demand, while further investing in its clinical pipelines over the next few years, prior to the successful commercialization of its pipelines.

MRNA Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, FCF %, and Net Debt

From FY2023 onwards, MRNA’s top and bottom line growth is expected to normalize toward living with COVID, due to the drastic -54.79% and -74.95% YoY decline, respectively. However, we are not concerned at all, given the projected strength of its balance sheet, with -$37.41B of net debts by FY2025.

Furthermore, assuming a similar pricing strategy as Keytruda at $21.36K per dose every six weeks or $185.12K annually, MRNA will likely eventually experience a surge in sales from speculatively FY2025 onwards. Some analysts are already bullishly projecting $10.06B of revenues and $8.05 of EPS by FY2026, indicating MRNA’s long runway for growth indeed.

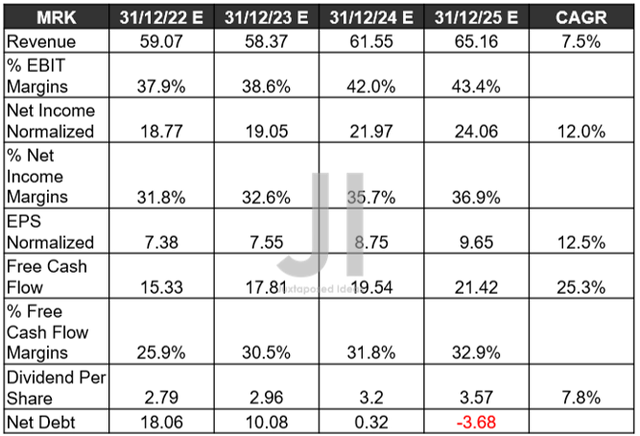

MRK Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, FCF %, Dividend, and Net Debt

In this vein, market analysts are also confidently projecting MRK’s accelerated top and bottom-line growth through FY2025 at a CAGR of 7.5% and 12.5%, compared to pre-pandemic levels of 5.6%/11.1% and pandemic levels of 2%/7.7%. Impressive indeed, since the company is expected to deliver expanded EBIT/ net income/FCF margins to 43.4%/36.9%/32.9% by FY2025, against 34%/28.6%/21.3% in FY2019 and 36.3%/31.4%/17.8% in FY2021. Thereby, also contributing to the rapid deleveraging of its balance sheet to -$3.86B of net debts at the same time.

MRK’s annual dividends of $3.57 by FY2025 are not too bad as well, though the recent stock rally of 31.2% from the September bottom has also, unfortunately, triggered a lower forward dividend yield of 3.21% against previous levels of 4.22%. In the meantime, we encourage you to read our previous articles, which would help you better understand its position and market opportunities.

- Pfizer Vs. Merck: Battle Between The Giants During Pandemic And Beyond

- Recovery Is Possible As Moderna Races Its Children Vaccine

So, Are MRNA & MRK Stock Buy, Sell, or Hold?

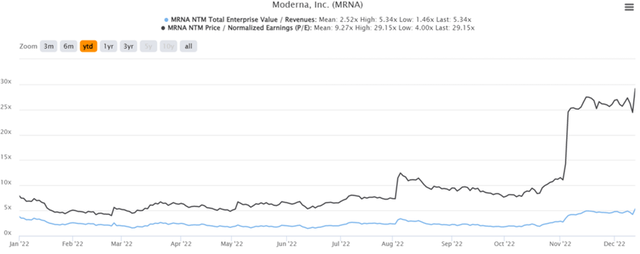

MRNA YTD EV/Revenue and P/E Valuations

MRNA is obviously trading at elevated optimism levels, due to the recent positive results on the mRNA and Keytruda combo. The stock is currently trading at an EV/NTM Revenue of 5.34x and NTM P/E of 29.15x, hyper-inflated from its YTD mean of 2.52x and 9.27x, respectively. Based on its FY2025 EPS of $5.73 and previous P/E median of 8x, we are looking at a moderate price target of $45.84.

Naturally, based on MRNA’s current stock price of $208.95, we are looking at a very frothy P/E valuation of 36.46x, though still a distance from its hyper-pandemic mean of -233.56x during FY2020. Due to the recent 76.50% rally from October bottom, the stock has also exceeded its near and long-term prospects, based on the consensus estimates of $189.86. Thereby, indicating its massive baked-in premium for those who choose to add at current levels.

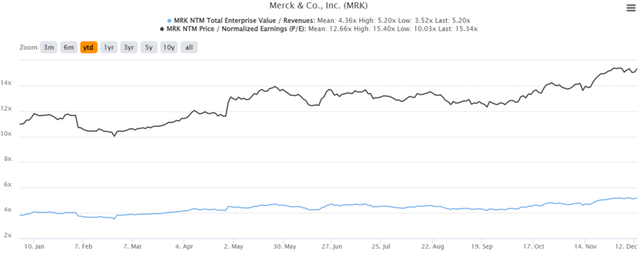

MRK YTD EV/Revenue and P/E Valuations

Likewise, MRK is also trading above its YTD EV/Revenue mean of 4.36x and P/E mean of 12.66x, higher than its pre-pandemic 3Y mean of 4.66x and 15.90x, respectively. The consensus price target of $108.70 also implies a minimal margin of safety for long-term portfolio growth and investing. As a result, we encourage investors to wait for a deeper retracement before adding MRNA and MRK to their portfolios.

The time will come soon enough, once these optimistic sentiments are digested, with the upbeat November CPI and the Fed’s 50 basis points hike also furiously lifting most boats up over the past few days. China’s unexpected reopening cadence will likely throw a wrench in Powell’s dovish stance, pointing to the possibility of raised terminal rates to over 6%. Therefore, triggering more load-up opportunities through 2023 as the rising inflationary pain puts more volatility in the short term.

Be the first to comment