Khosrork

Investment Thesis

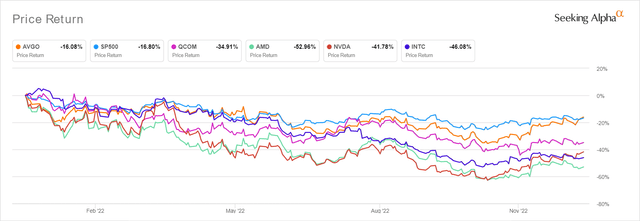

AVGO YTD Stock Price

Broadcom (NASDAQ:AVGO) has proved itself as the king of the semiconductor chips stocks, due to the excellent financial performance it reported in its recent FQ4’22 call. Thereby, triggering the excellent recovery in its stock valuations at -16.08% YTD against the S&P 500 Index at -16.80%, Qualcomm (QCOM) at -34.91%, Nvidia (NVDA) at -41.78%, Intel (INTC) at -46.08%, and Advanced Micro Devices (AMD) at -52.96%.

Now, the critical question is whether AVGO is able to sustain its current rally, since the stock has previously failed to sustain its resistance level at ~$580 in August 2022. However, we choose to remain optimistic, due to the excellent November CPI report at 7.1% versus estimates of 7.3%. With the Feds also walking the 50 basis point talk, we will likely witness a more dovish stance and moderate terminal rates ahead. Thereby, suggesting that the stock market has already bottomed by now, with a bullish outlook for sustained recovery through 2023.

AVGO’s Execution & Margins Continues To Impress

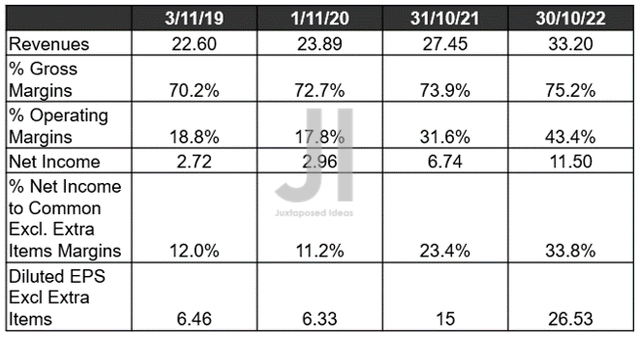

AVGO Revenue, Gross %, EBIT %, Net Income ( in billion $ ) %, and EPS

By FY2022, AVGO reported an excellent expansion in margins across the board, tremendously improving its profitability by 34.38% YoY to adj EPS of $37.64. It is apparent that the management has been aggressively improving its operating efficiencies. This is due to the notable decline in its operating expenses by -9.05% YoY and -19.58% from FY2020 levels, while sustaining its leading R&D efforts at ~$4.9B annually over the past three years. Thereby, leading to the expansion of its GAAP operating margins by 11.8 percentage points YoY.

Furthermore, AVGO has been keeping the lid on its Stock-Based Compensation at $1.53B in FY2022, representing a notable decline of -10% YoY or -29.81% from FY2019 levels of $2.18B. As a result, tremendously improving its GAAP profitability by 76.86% YoY to EPS of $26.53 as well.

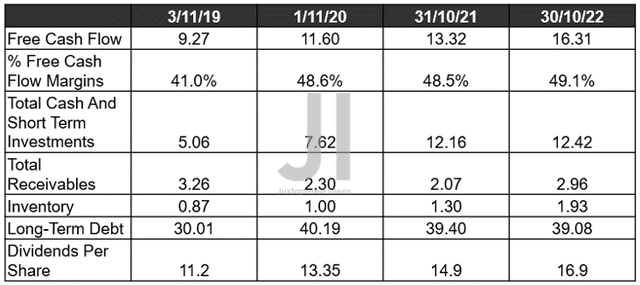

AVGO FCF ( in billion $ ) % and Balance Sheet

Meanwhile, AVGO has also outperformed expectations, due to the rapid expansion in its FCF margins and improvement in its balance sheet over the past three years. By FY2022, the company reported an excellent immediate liquidity of $15.38B while keeping its inventory levels manageable at $1.93B compared to INTC at $12.83B, AMD at $3.36B, and NVDA at $4.45B over the last twelve months.

The AVGO management also focused on shareholder returns against early deleveraging, with $7.03B of annual dividends paid and $8.45B of shares repurchased in the last fiscal year, as opposed to a nominal $0.33B debt repaid. However, we are not overly concerned about this strategy, since the company is expected to report an impressive annual FCF generation of ~$18B over the next few years compared to FY2019 levels of $9.27B and FY2022 levels of $16.31B.

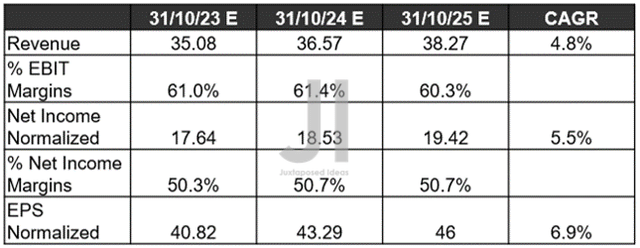

AVGO Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

Since our previous article in October 2022, AVGO’s top and bottom line growth through FY2025 has been largely intact, indicating Mr. Market’s confidence in the management’s forward execution. Furthermore, with China’s unexpected reopening cadence, we expect to see a massive boost in demand, due to the projected flurry of ‘revenge’ spending and 300B Yuan from the government stimulus package. The country accounted for a significant 29.66% or $9.75B of AVGO’s revenues in FY2021, with the first three quarters of 2022 bringing the sum even higher for the Asia region at 67.31% and $16.33B.

Thereby, indicating the immense potential for AVGO’s upward rerating through 2023. Market analysts already expect China to fully reopen by H1’23, with its GDP recovering tremendously to 5% by 2023, compared to the projected 3% in 2022 and the previous 6% in 2019. Naturally, this may also spark off prolonged inflationary pain through 2024, since Powell may have to raise terminal rates to over 6% to combat the country’s elevated spending and demand. Only time will tell.

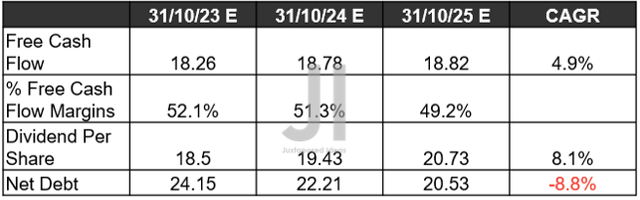

AVGO Projected FCF ( in billion $ ) %, Dividends, and Debt

There is no doubt about AVGO’s FCF generation as well, since market analysts expect the company to steadily continue its deleveraging efforts through FY2025 to $20.53B of net debts against the FY2022 levels of $27.09B. Impressive indeed, with the projection of $575M in annual capital expenditure and $7.91B of annual dividends over the next three years.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Buy Broadcom As A Gift To Yourself During This Deep Pullback

So, Is AVGO Stock A Buy, Sell, or Hold?

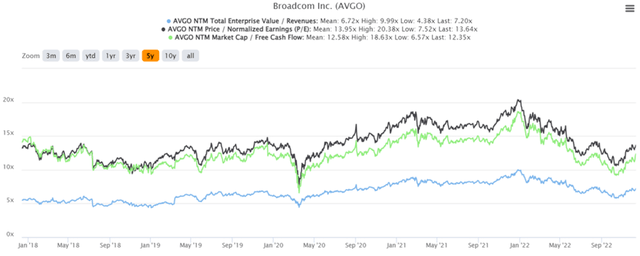

AVGO 5Y EV/Revenue and P/E Valuations

AVGO is currently trading at an EV/NTM Revenue of 7.20x, NTM P/E of 13.64x, and NTM Market Cap/ FCF of 12.35x, relatively in line with its 5Y mean of 6.72x, 13.95x, and 12.58x, respectively. Otherwise, somewhat attractive based on its YTD mean of 7.49x, 14.41x, and 12.79x, respectively. However, there is a minimal margin of safety now, due to the recent 38.39% rally from the October bottom. Based on FY2025 adj EPS of $46.0 and current P/E valuations, we are looking at an aggressive price target of $627.44 with a nominal 9.22% upside. Otherwise, the consensus estimate of $653.70 also indicates a minimal 13.79% prospect.

Therefore, we prefer to rerate the AVGO stock as a Hold for now, significantly worsened by the VMware (NYSE:VMW) overhang from the EU regulators. Another Big Tech company, Microsoft (MSFT) is already facing insurmountable challenges in getting its Activision (ATVI) deal approved in all 16 countries, due to the vehemence of the FTC saga, China’s refusal for a simplified approval, and the EU’s in-depth investigation. Thereby, indicating a potential downside from current levels, with VMware already reporting some internal issues as three top executives exit the company during this uncertain period.

Investors should wait for a deeper retracement and clarity on the deal before adding this excellent stock to their portfolios. There will be more chances through 2023, once this tsunami of optimism has been moderately digested. On the other hand, opportunistic investors may still take advantage of the potential upside. However, one should also beware of getting burned while trying to execute in an extremely volatile macroeconomic environment.

Be the first to comment