yongyuan

MUFG logo (MUFG website)

Investment thesis

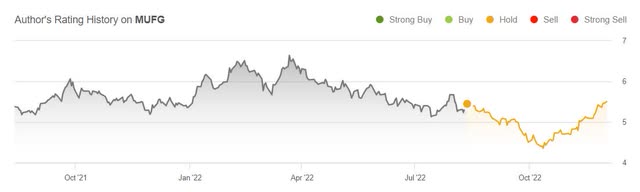

In our last article on Mitsubishi UFJ Financial Group (NYSE:MUFG) from August this year, we had a hold stance as we felt that it delivered too low ROE over many years, but there were some positive changes taking place.

Since then, the share price first dropped but has recovered to a similar level.

MUFG share price development (SA)

With MUFG’s first half of 2022 financial results being presented to shareholders and investors on November 15th this year, it is a good time to revisit the thesis.

Let us look at the numbers.

Latest Financial Results

MUFG set a new record this interim period with a net operating profit of ¥895.2 billion.

That was 40% higher than the corresponding period of last year.

The improvements came mainly from higher profits from increases in loan and deposit income due to higher overseas interest rates and the risk-return improvement. It was also a result of an increase in foreign exchange gains and trading income captured from opportunities that arose as a result of high market fluctuations.

Ordinary profits were ¥591 billion as a result of credit costs of ¥243.8 billion, which reflects valuation losses associated with accounting treatment in connection with their decision to sell their shares in MUFG Union Bank.

In September this year, MUFG came to an agreement to sell its subsidiary MUFG Union Bank (‘MUB’) to U.S. Bancorp (USB). It was noted all regulatory approvals should be cleared by the 5th of December.

As part of the consideration for the share transfer, MUFG will receive 2.9% of USB’s outstanding shares and will engage in discussions with them on further business alliances. USB’s rationale for the deal was that it will gain access to more than one million consumer customers and about 190,000 small business customers on the U.S. West Coast.

The total gain on the sale is about ¥120 billion, which includes amounts recorded in the previous fiscal year and the following fiscal years.

The two main drivers for a bank’s income are their net interest income, which largely depends on volume and its net interest rate margin. The other large income generator is its income from various fees.

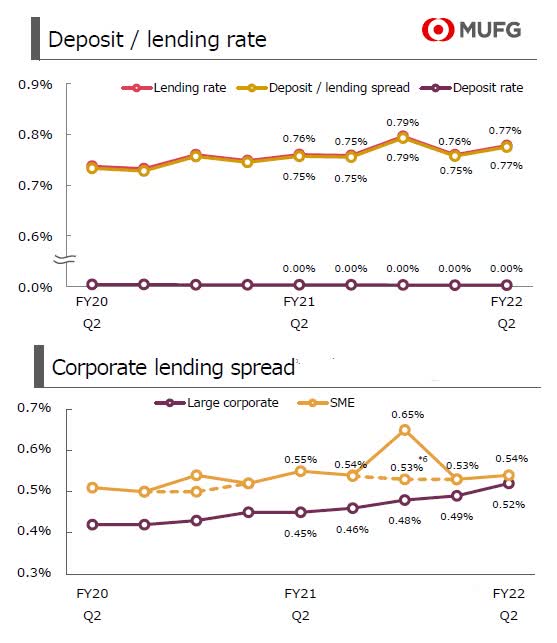

When we look at MUFG’s NIM, or net interest rate margin, we can see that it lags most banks.

MUFG’s NIM is low (MUFG’s FY2022FH Presentation)

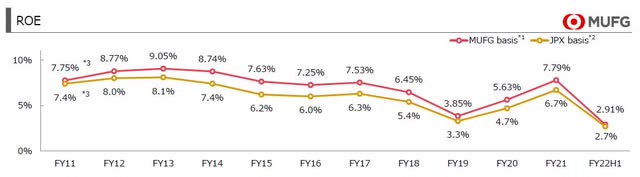

This low NIM explains to some degree the reason why their ROE has been so low for many years.

MUFG’s low ROE (MUFG’s FY2022FH Presentation)

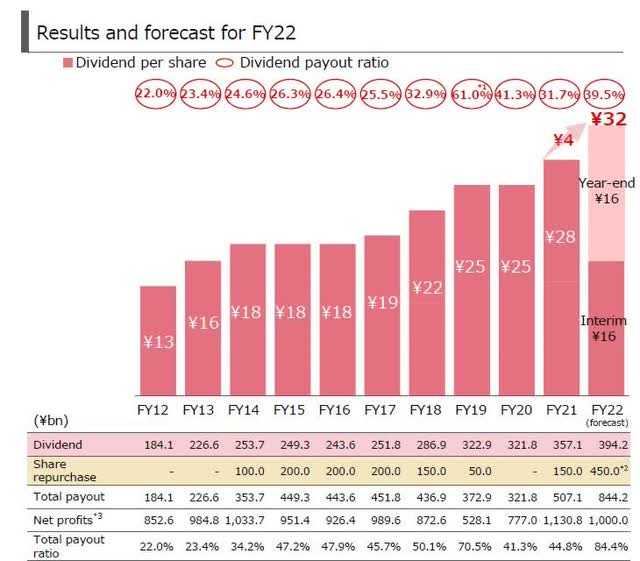

In terms of returning capital to shareholders, we should expect it to improve based on their improved profit level.

They have decided to pay an interim dividend of ¥16 per share. For the full year, it is estimated to be ¥32. This would be an increase of 14% from the previous year.

MUFG’s dividend history (MUFG’s FY2022FH Presentation)

Their target is to maintain a sustainable payout ratio of 40% from their earnings.

Based on a share price of ¥755 we get a yield of 4.24%. This is in line with most large banks these days.

In addition to the dividend, management said that they have “resolved” a share buyback of up to ¥150 billion. This comes on top of a buyback plan announced in May of ¥300 billion.

However, it is not clear how much they have actually bought back.

They have done a good job in reducing their non-performing loans over the last 10 years. It has come down from 2.2% to 1.1% of their total loans.

To make a judgment on how safe a bank is, we generally look at how much capital they hold.

This is measured in the Common Equity Tier 1 ratio. After the financial crisis of 2008, banks were required to hold more capital buffers and banks in Europe and the U.S. now have a CET-1 ratio in the low to middle teens.

But MUFG’s CET-1 ratio is on the low side. It now stands at just 9.9% down from 10.4% six months ago. As a comparison, DBS Group (OTCPK:DBSDY) here in Singapore has a CET-1 ratio of 13.8%.

In view of their low CET-1 ratio, we should expect MUFG to deliver a higher ROE. After all, the more capital a bank holds, the more difficult it is to deliver a high ROE. If we look at DBSDY they still manage to deliver an ROE of 14.3% for the first 9 months of this year. That is 5.9% higher than that of MUFG.

Conclusion

It seems that MUFG is improving where they can improve things.

Nevertheless, there is still more work to do in order to get us interested in investing in MUFG.

The legendary investor Warren Buffett, and Berkshire Hathaway (BRK.A) (BRK.B) which has always held many bank holdings, always looks at ROE to see whether a company has consistently performed well compared to other companies in the same industry.

So do we.

As such, MUFG is still a hold for us.

We would instead deploy more capital into our present bank holdings such as HSBC (HSBC), Swedbank (OTCPK:SWDBF), and DBS, until MUFG can deliver a better return on their equity.

Be the first to comment